|

市場調查報告書

商品編碼

1801863

細胞凋亡檢測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

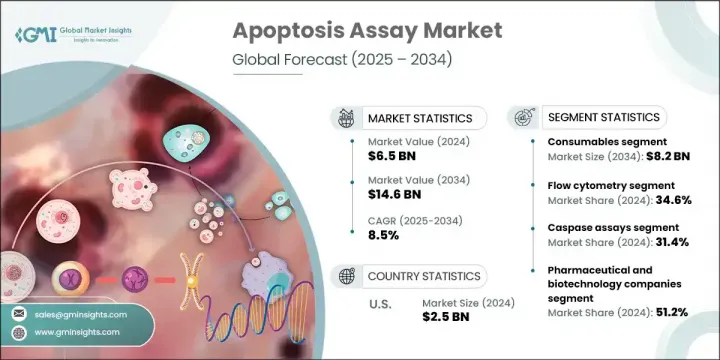

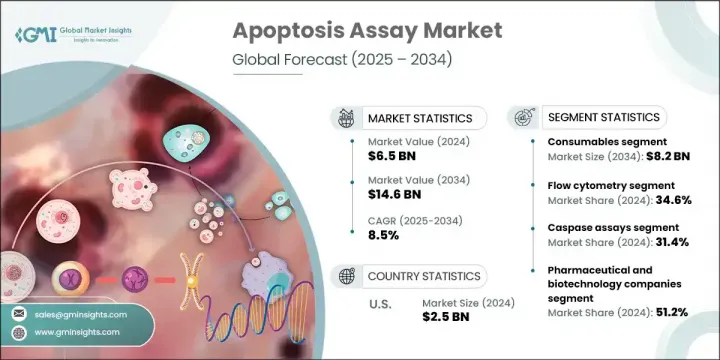

2024 年全球細胞凋亡檢測市場規模為 65 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長至 146 億美元。慢性病發病率上升和個人化治療方案需求不斷成長推動著該市場穩步擴張。細胞分析工具的創新,包括先進的影像檢測和高通量流式細胞儀,顯著提高了研究過程的準確性和效率。此外,生命科學領域的資金投入增加以及細胞凋亡檢測在藥物研發中的更廣泛應用,正在推動該檢測在全球已開發地區和發展中地區的應用。細胞凋亡檢測對於識別和測量程序性細胞死亡至關重要,在推動疾病研究和藥物創新方面發揮關鍵作用。隨著醫療保健系統優先考慮標靶治療和早期診斷,細胞凋亡檢測在多個醫療領域的相關性持續成長。

個人化醫療日益受到關注,這成為細胞凋亡檢測市場強勁的成長引擎。根據個別基因組成和特定疾病特徵量身訂做醫療方案需要能夠進行精確細胞層級分析的先進工具。細胞凋亡檢測使研究人員能夠評估細胞對治療的反應,尤其是在神經退化性疾病、癌症和自體免疫疾病等領域。這種細胞反應追蹤對於確定治療效果、最佳化給藥策略和最大程度減少不良反應至關重要。透過讓臨床醫生監測治療誘導的細胞凋亡,這些檢測有助於改進治療方案,以獲得更好的療效。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 146億美元 |

| 複合年成長率 | 8.5% |

2024年,流式細胞儀市佔率為34.6%。流式細胞儀因其速度快、準確性高以及在單細胞層級進行多參數分析的能力而備受青睞。它具有高通量功能,並擅長同時識別各種凋亡指標。其先進的雷射檢測、自動門控機制和即時資料監控等功能使其能夠與現代實驗室整合,使其成為大規模臨床和研究的理想選擇。

2024年,胱天蛋白酶(caspase)檢測細分市場佔31.4%的市佔率。這類檢測透過測量胱天蛋白酶(caspase)的活性來追蹤程序性細胞死亡,而胱天蛋白酶在細胞凋亡中起著核心作用。它們廣泛應用於免疫學、腫瘤學和藥物篩選等領域,以評估治療藥物如何影響細胞活力。胱天蛋白酶檢測專為高通量篩選環境而設計,相容於自動化系統,並支援發光和螢光檢測,從而實現靈活、靈敏的性能。

美國細胞凋亡檢測市場規模預計在2024年達到25億美元。這一成長反映了美國在研發方面的強勁投入、良好的監管框架以及對先進診斷工具的高度認知。美國市場受益於生物醫學研究領域對可擴展自動化解決方案日益成長的需求,尤其是在免疫療法和腫瘤學等領域。持續的公共衛生努力和私人創新持續增強了市場的發展勢頭,確保了細胞凋亡檢測技術的長期應用。

全球細胞凋亡檢測市場的關鍵公司包括賽默飛世爾科技、普洛麥格、珀金埃爾默、碧迪、迪金森公司、GeneCopoeia、Takara Bio、安捷倫科技、丹納赫、賽多利斯、艾博抗姆、G Biosciences、默克、Biotium、Bio-Rad Laboratories 和 Bio-Techne。這些公司正積極塑造全球市場格局。為了鞏固市場地位,細胞凋亡檢測產業的領導者正強調檢測靈敏度、速度和多參數能力的創新。各公司正在利用自動化平台增強產品組合,並整合人工智慧驅動的分析以獲得更精確的結果。與製藥公司和學術機構的策略合作支持個人化醫療和藥物發現的新應用。同時,各公司正在透過區域合作夥伴關係、在地化生產和針對新興市場客製化產品來擴大其地理覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 個人化醫療需求日益成長

- 流式細胞儀的技術進步

- 毒理學和藥物安全評估中的應用日益增多

- 產業陷阱與挑戰

- 先進技術成本高昂

- 監管和道德挑戰

- 市場機會

- 癌症和神經退化性疾病研究日益受到關注

- 成長動力

- 成長潛力分析

- 監管格局

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 儀器

- 耗材

- 試劑盒和試劑

- 微孔板

- 其他耗材

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 流式細胞儀

- 細胞成像與分析系統

- 分光光度法

- 其他檢測技術

第7章:市場估計與預測:按檢測類型,2021 - 2034 年

- 主要趨勢

- 胱天蛋白酶檢測

- DNA碎片化分析

- 粒線體檢測

- 膜聯蛋白V

- 細胞通透性測定

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 醫院和診斷實驗室

- 學術和研究機構

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Abcam

- Agilent Technologies

- Becton, Dickinson and Company

- Bio-Rad Laboratories

- Bio-Techne

- Biotium

- Danaher

- G Biosciences

- GeneCopoeia

- Merck

- PerkinElmer

- Promega

- Sartorius

- Takara Bio

- Thermo Fisher Scientific

The Global Apoptosis Assay Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 14.6 billion by 2034. The steady expansion of this market is being driven by the rising prevalence of chronic conditions and the growing demand for personalized therapeutic solutions. Innovations in cell analysis tools, including advanced imaging-based assays and high-throughput flow cytometry, are significantly enhancing the accuracy and efficiency of research processes. Additionally, increased funding for life sciences and broader use of apoptosis assays in drug development are fueling global adoption across both developed and developing regions. Apoptosis assays are essential for identifying and measuring programmed cell death and play a key role in advancing disease research and pharmaceutical innovations. As healthcare systems prioritize targeted treatment and early diagnostics, the relevance of apoptosis assays continues to grow across multiple medical fields.

The increasing focus on personalized medicine is acting as a powerful growth engine for the apoptosis assay market. Tailoring medical treatments to an individual's genetic makeup and specific disease characteristics demands advanced tools capable of precise cellular-level analysis. Apoptosis assays enable researchers to evaluate how cells respond to therapies, particularly in fields like neurodegenerative disease, cancer, and autoimmune disorders. This type of cellular response tracking is essential for determining the effectiveness of treatments, optimizing dosing strategies, and minimizing adverse effects. By allowing clinicians to monitor therapy-induced apoptosis, these assays help refine treatment protocols for better outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 8.5% |

In 2024, the flow cytometry segment held a 34.6% share. Flow cytometry is favored for its speed, accuracy, and capacity to perform multi-parameter analysis at the single-cell level. It offers high-throughput functionality and excels in identifying various apoptotic indicators simultaneously. Its integration into modern laboratories is supported by cutting-edge features such as laser-based detection, automated gating mechanisms, and live data monitoring, making it ideal for large-scale clinical and research settings.

The caspase assays segment held a 31.4% share in 2024. These assays are instrumental in tracking programmed cell death by measuring the activity of caspase enzymes, which play a central role in apoptosis. They are extensively used in areas like immunology, oncology, and drug screening to assess how therapeutic agents affect cell viability. Designed for use in high-volume screening environments, caspase assays feature compatibility with automated systems and support luminescent and fluorescent detection for flexible, sensitive performance.

United States Apoptosis Assay Market USD 2.5 billion in 2024. This growth reflects the country's strong investment in R&D, favorable regulatory framework, and high level of awareness around advanced diagnostic tools. The U.S. market benefits from increasing demand for scalable, automated solutions in biomedical research, especially in fields like immunotherapy and oncology. Ongoing public health efforts and private innovation continue to strengthen the market's momentum, ensuring long-term adoption of apoptosis assay technologies.

Key companies in the Global Apoptosis Assay Market include Thermo Fisher Scientific, Promega, PerkinElmer, Becton, Dickinson and Company, GeneCopoeia, Takara Bio, Agilent Technologies, Danaher, Sartorius, Abcam, G Biosciences, Merck, Biotium, Bio-Rad Laboratories, and Bio-Techne. These firms are actively shaping the global market landscape. To reinforce their market position, leading players in the apoptosis assay industry are emphasizing innovation in assay sensitivity, speed, and multi-parameter capabilities. Companies are enhancing product portfolios with automation-ready platforms and integrating AI-driven analytics for more precise results. Strategic collaborations with pharmaceutical firms and academic institutions support new applications in personalized medicine and drug discovery. In parallel, firms are expanding their geographic reach through regional partnerships, localized manufacturing, and tailored product offerings for emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Assay type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Bio-Rad Laboratories

- 10.5 Bio-Techne

- 10.6 Biotium

- 10.7 Danaher

- 10.8 G Biosciences

- 10.9 GeneCopoeia

- 10.10 Merck

- 10.11 PerkinElmer

- 10.12 Promega

- 10.13 Sartorius

- 10.14 Takara Bio

- 10.15 Thermo Fisher Scientific