|

市場調查報告書

商品編碼

1801808

農業手動工具市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Agriculture Hand Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

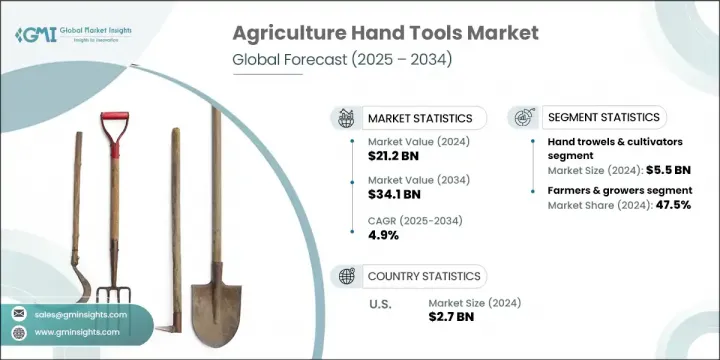

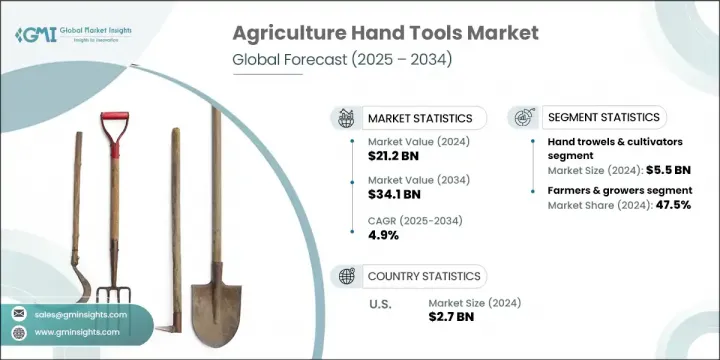

2024年,全球農業手動工具市場規模達212億美元,預計2034年將以4.9%的複合年成長率成長,達到341億美元。持續的糧食增產需求以及對經濟實惠的農業解決方案的需求,持續推動市場成長。手動工具仍然是全球小農戶和農業社區生產營運的重要組成部分,協助完成種植、除草和收割等核心任務。隨著永續農業實踐的興起,人們越來越青睞採用可回收或低影響材料製成的耐用、環保的工具。同時,人體工學手把和多用途設計等技術升級正在提升工具的易用性和勞動效率,使手排工具在各個用戶群中更具吸引力。

該市場的主要公司正致力於增強產品組合、建立區域合作夥伴關係並進行全球擴張以擴大其影響力。開發方便用戶使用、輕巧且符合人體工學設計的工具,以減輕壓力並提高準確性,已成為新產品發布的核心。製造商也優先考慮環保選項,以滿足日益成長的客戶期望。分銷管道的變化,例如數位平台的興起和對農村供應鏈的拓展,有助於提高這些工具的可及性。在價格敏感的行業中,產品的耐用性、功能性和品牌認知度會顯著影響購買行為。市場需求很大一部分來自依賴可靠工具進行日常運作的農民和種植者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 212億美元 |

| 預測值 | 341億美元 |

| 複合年成長率 | 4.9% |

2024年,手鏟和耕耘機市場產值達55億美元,憑藉其在種植、移植、土壤通氣和小空間施肥等作業中的重要性,成為該領域領軍產品。這些工具的應用範圍廣泛,從家庭園藝到大規模農業和景觀美化,無所不包。其緊湊的外形和精準的操控性使其成為容器花園、菜床和觀賞地等狹小環境的理想選擇,尤其是在空間有限的城市和郊區環境中。

2024年,農民和種植者群體佔了47.5%的市場。由於該使用者群體每天都參與核心作物生產,從整地到收穫,他們是工具需求的中堅力量。鋤頭、修枝工具、鐵鍬和手動耕耘機等手動設備在中小型農場的工作流程中發揮關鍵作用,尤其是在那些採用有機和永續耕作方法的農場。

2024年,美國農業手動工具市場產值達27億美元。美國農業產業規模龐大,將傳統方法與先進的農業技術結合,在全球農業經濟中發揮關鍵作用。作為全球最大的農作物和牲畜生產國和出口國之一,美國整合了自動化、智慧農業和即時資料監控等現代技術。消費者對有機農產品和環保實踐的興趣日益濃厚,這持續影響著農業趨勢,而政策支持和研發投入則進一步影響設備的普及。

影響全球農業手動工具市場的知名公司包括 Stanley Black & Decker、Corona Tools、GARDENA、Fiskars Group、WOLF-Garten、AM Leonard、Ames True Temper、Truper、Bahco、Griffon、Husqvarna、Lowell Corporation、JCB Tools、Walter Stern Inc. 和 Vaughan &nell。農業手動工具市場的領導者正專注於創新、在地化和永續性,以鞏固其市場地位。許多製造商正在投資研發,以生產具有改進的人體工學和耐用性的工具,同時保持材料輕巧且對環境負責。與區域分銷商和農業合作社的合作使產品能夠更深入地滲透到農村地區並擴大其可及性。公司正在擴展線上零售管道,以接觸精通技術的農民和城市園丁,同時利用資料來改善產品供應。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 採用永續農業

- 小規模農業和城市農業的興起

- 成本效益和應用的多功能性

- 產業陷阱與挑戰

- 來自機械化和電動工具的競爭

- 市場分化和假冒偽劣

- 機會

- 技術和設計創新

- 商業景觀和園藝

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 手鏟和耕耘機

- 修剪和剪切工具

- 挖掘和鏟地工具

- 鋤頭和除草機

- 噴霧器和塗抹器

- 其他

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 作物種植

- 土壤準備

- 種植和移植

- 除草和病蟲害防治

- 收穫

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 農民和種植者

- 園藝師

- 庭園設計師與園丁

- 農業機構

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 離線

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AM Leonard

- Ames True Temper

- Bahco

- Corona Tools

- Fiskars Group

- GARDENA

- Griffon

- Husqvarna

- JCB Tools

- Lowell Corporation

- Stanley Black & Decker

- Truper

- Vaughan & Bushnell

- Walter Stern Inc

- WOLF-Garten

The Global Agriculture Hand Tools Market was valued at USD 21.2 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 34.1 billion by 2034. The ongoing demand for higher food production and the need for affordable farming solutions continue to fuel market growth. Manual tools remain a critical part of operations for smallholder farmers and agricultural communities worldwide, assisting in core tasks such as planting, weeding, and harvesting. As sustainable farming practices gain momentum, there's an increasing preference for durable, eco-conscious tools made using recycled or low-impact materials. At the same time, technological upgrades-like ergonomic handles and multi-use designs-are improving ease of use and labor efficiency, making hand tools more appealing across user segments.

Key companies in this market are focusing on enhancing their product portfolios, entering regional partnerships, and expanding globally to improve their footprint. The development of user-friendly, lightweight, and ergonomically designed tools that reduce strain and improve accuracy has become central to new launches. Manufacturers are also prioritizing environmentally friendly options to meet growing customer expectations. Changes in distribution, such as the rise of digital platforms and outreach to rural supply chains, help improve access to these tools. In a price-sensitive sector, product durability, functionality, and brand perception significantly influence purchasing behavior. A substantial portion of market demand stems from farmers and growers who rely on reliable tools for daily operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.2 Billion |

| Forecast Value | $34.1 Billion |

| CAGR | 4.9% |

The Hand trowels and cultivators segment generated USD 5.5 billion in 2024, leading the product category due to their importance in tasks like planting, transplanting, aerating soil, and fertilizing in small spaces. These tools are adopted in applications ranging from home gardening to large-scale agriculture and landscaping. Their compact form and precision make them ideal for confined environments such as container gardens, vegetable beds, and ornamental patches-especially in urban and suburban settings where space is limited.

The farmers and growers segment held a 47.5% share in 2024. This user group forms the backbone of tool demand due to their daily involvement in core crop production, from soil preparation to harvesting. Manual equipment such as hoes, pruning tools, spades, and hand cultivators play a key role in the workflows of small- to mid-sized farms, particularly those embracing organic and sustainable farming methods.

U.S. Agriculture Hand Tools Market generated USD 2.7 billion in 2024. The country's expansive farming industry, which merges traditional methods with advanced agri-tech, plays a pivotal role in the global agricultural economy. As one of the top producers and exporters of crops and livestock, the U.S. integrates modern techniques like automation, smart farming, and real-time data monitoring. Growing consumer interest in organic produce and eco-conscious practices continues to shape farming trends, while policy support and R&D investments further influence equipment adoption.

Notable companies shaping the Global Agriculture Hand Tools Market include Stanley Black & Decker, Corona Tools, GARDENA, Fiskars Group, WOLF-Garten, A.M. Leonard, Ames True Temper, Truper, Bahco, Griffon, Husqvarna, Lowell Corporation, JCB Tools, Walter Stern Inc., and Vaughan & Bushnell. Leading players in the agriculture hand tools market are focusing on innovation, localization, and sustainability to strengthen their market standing. Many manufacturers are investing in R&D to produce tools with improved ergonomics and durability while keeping materials lightweight and environmentally responsible. Partnerships with regional distributors and agricultural cooperatives are enabling deeper rural penetration and wider product accessibility. Companies are expanding online retail channels to reach tech-savvy farmers and urban gardeners, while also leveraging data to refine product offerings.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Adoption of sustainable farming

- 3.2.1.2 Rising small-scale and urban farming

- 3.2.1.3 Cost-effectiveness and versatility of applications

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition from mechanized and power tools

- 3.2.2.2 Market fragmentation and counterfeiting

- 3.2.3 Opportunities

- 3.2.3.1 Technological and design innovations

- 3.2.3.2 Commercial landscaping and horticulture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Hand trowels & cultivators

- 5.3 Pruning & sheering tools

- 5.4 Digging & spading tools

- 5.5 Hoes & weeders

- 5.6 Sprayers & applicators

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Crop cultivation

- 6.3 Soil preparation

- 6.4 Planting & transplanting

- 6.5 Weeding & pest control

- 6.6 Harvesting

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Farmers & growers

- 7.3 Horticulturists

- 7.4 Landscapers & gardeners

- 7.5 Agricultural institutions

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 A.M. Leonard

- 10.2 Ames True Temper

- 10.3 Bahco

- 10.4 Corona Tools

- 10.5 Fiskars Group

- 10.6 GARDENA

- 10.7 Griffon

- 10.8 Husqvarna

- 10.9 JCB Tools

- 10.10 Lowell Corporation

- 10.11 Stanley Black & Decker

- 10.12 Truper

- 10.13 Vaughan & Bushnell

- 10.14 Walter Stern Inc

- 10.15 WOLF-Garten