|

市場調查報告書

商品編碼

1687173

歐洲發泡聚苯乙烯(EPS):市場佔有率分析、產業趨勢與成長預測(2025-2030年)Europe Expanded Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

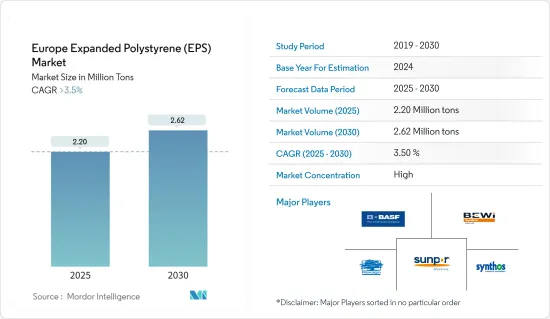

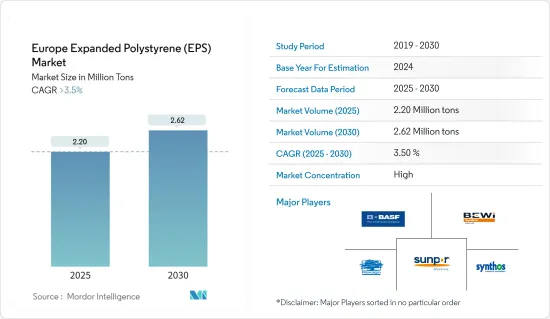

歐洲發泡聚苯乙烯市場規模預計在 2025 年為 220 萬噸,預計在 2030 年達到 262 萬噸,預測期(2025-2030 年)的複合年成長率將超過 3.5%。

關鍵亮點

- 從中期來看,食品包裝和建築領域的需求成長預計將推動 EPS 市場的成長。

- 然而,嚴格的政府法規和綠色替代品預計將阻礙市場成長。

- 預計預測期內發泡聚苯乙烯產業的回收將成為機會。

歐洲發泡聚苯乙烯(EPS)市場趨勢

建築業預計將主導市場

- 發泡聚苯乙烯因其重量輕、耐用、熱效率高、減震、防潮和易於使用等特性而用於建築領域。它用於屋頂、牆壁、地板隔熱材料、封閉空腔牆、道路建設等。

- EPS 是一種惰性材料,不會腐爛或為害蟲提供營養。這可以防止老鼠和白蟻等害蟲。由於其強度高、耐用且重量輕,EPS 成為一種用途廣泛且受歡迎的建築產品。

- 它用於住宅和商業建築的外牆、牆壁、屋頂和地板的絕緣板系統。此外,它還可用作公路和鐵路建設中的輕質路堤、計劃中的成腔路堤材料以及碼頭和浮橋建設中的浮體材料。

- 據 Eumeps 稱,歐洲生產的 EPS 約 75% 用於建築業。使用 EPS 作為隔熱材料的住宅正在進行重建,以提高能源效率。

- 根據歐盟統計局的數據,與 2022 年相比,2023 年歐洲年均建築產量增加 0.2%,歐盟成長 0.1%。年建築產量增幅最大的是羅馬尼亞(成長 30.7%)、波蘭(成長 18.9%)和比利時(成長 10.7%)。降幅最大的是斯洛伐克(-10.4%)、奧地利(-8.7%)和瑞典(-6.1%)。此外,由於歐盟復甦基金的新投資,2022年歐洲建築業成長了2.5%。據歐盟委員會和歐盟統計局稱,勞動力短缺是歐盟(歐盟27國)建築業最大的問題。

- 根據歐洲建築協會的數據,預計2023年歐洲住宅裝修費用將達到4,568億歐元。 2019年,這一數字為4,485億歐元。

- 此外,近年來非住宅建築的整體投資大幅增加,並且在研究期間可能會持續增加,這將影響產品需求。

- 因此,預計歐洲 EPS 市場在預測期內將蓬勃發展。

預計德國將主導市場

- 德國擁有歐洲最大的建築業。該國的建築業正在以溫和的速度成長,主要受到新住宅建設活動增加的推動。建築業的高需求使其成為發泡聚苯乙烯的主要市場之一。發泡聚苯乙烯因其形態形成特性、易於成型和其他多種優勢而在該行業中廣泛應用。

- 近年來,德國對發泡聚苯乙烯在綠建築設計應用中的需求日益增加,因為它具有卓越的環境效益、增強的耐用性、最大化的能源效率和改善的室內環境。

- 根據德國聯邦統計局(Destatis)公佈的統計數據,聯邦政府設定了每年在德國建造40萬套新住宅的目標。 2023年3月,德國獲準興建24,500住宅。

- 德國聯邦統計局 (Destatis) 的數據顯示,2023 年 3 月,德國批准建造 24,500住宅。這意味著自 2022 年 3 月以來,建築許可證數量減少了 10,300 份(29.6%)。 2023年1-3月總合發放住宅建築許可證6.87萬份,較去年同期下降25.7%(2022年1-3月:9.25萬份)。計劃的減少可能是由於建材成本上升和財務狀況惡化所造成的。

- 預測期內,德國的飯店建築預計也將激增。截至2021年,總合飯店建築。 2022年預計將有89家新飯店推出,共15,780間客房。 2023 年計劃再開設 78 家飯店,共 13,073 間客房。預計 2024 年後飯店籌備情況仍將保持強勁,目前已有 153 個計劃和 22,769 間客房正在籌備中。

- 德國政府已開始在德國黑森州法蘭克福-費興海姆建設費興海姆數位園區,該園區佔地10.7公頃,占地面積10萬平方公尺,投資額為11.79億美元。預計建設將於 2021 年第三季開始,並於 2028 年第四季完工。

- 2021年第三季度,該國開始在巴登-符騰堡州羅拉赫建造一座耗資4.18億美元的中心醫院。預計於2025年完工,該計劃旨在打造一個設有心理健康中心和停車區的醫療百貨商店。

- 根據聯邦統計局的數據,德國建設業的 GDP 從 2022 年第四季的 620.1 億歐元下降到 2023 年第一季的 516.1 億歐元。

- 此外,在德國,包裝解決方案擴大被用於開發客製化產品和創新。因此,德國對 EPS 的採用正在增加,有助於德國發泡聚苯乙烯市場在未來幾年進一步成長。全國各地對包裝食品和個人護理產品的小包裝尺寸有需求。根據德國聯邦統計局發布的資料,2022年德國包裝產業的銷售額將達到350.4億歐元,而2021年為295.9億歐元。

- 德國 EPS 市場的主要企業正專注於開發和推出創新產品,以進一步支持市場成長。例如,2022 年 3 月,BASF擴大了其石墨基可發性聚苯乙烯 (EPS) 顆粒產品組合。 Neopor F5 Mcycled 含有 10% 的再生材料,適用於許多建築應用,尤其是建築幕牆隔熱材料。這種新原料採用擠壓生產,具有與 Neopor F 5200 Plus 相同的成熟機械性能和最佳化的隔熱性能。

- 上述趨勢可能會影響預測期內德國的整體 EPS 消費。

歐洲發泡聚苯乙烯 (EPS) 產業概況

歐洲發泡聚苯乙烯市場集中度較高,主要企業佔據歐洲生產能力的很大佔有率。市場排名前五的公司(不分先後順序)分別是 Synthos Group、 BASF SE、Ravago、SUNPOR 和 BEWiSynbra Group。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築和建築業的需求增加

- 食品包裝產業的需求不斷成長

- 限制因素

- 政府法規

- 發泡聚苯乙烯的替代品

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

第5章市場區隔

- 產品類型

- 白色EPS

- 灰色和銀色 EPS

- 最終用戶產業

- 包裝

- 建築與施工

- 其他

- 地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 挪威

- 瑞典

- 丹麥

- 芬蘭

- 其他歐洲國家

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Alpek SAB de CV

- BASF SE

- BEWiSynbra Group

- Epsilyte LLC

- KANEKA Belgium NV

- Ravago

- SABIC

- SIBUR International GmbH

- Sundolitt Ltd

- SUNPOR

- Synthos Group

- Unipol Holland BV

- Versalis SpA

第7章 市場機會與未來趨勢

- 日益重視發泡聚苯乙烯的回收利用

簡介目錄

Product Code: 55956

The Europe Expanded Polystyrene Market size is estimated at 2.20 million tons in 2025, and is expected to reach 2.62 million tons by 2030, at a CAGR of greater than 3.5% during the forecast period (2025-2030).

Key Highlights

- In the medium term, increasing demand from the food packaging and construction sectors is expected to drive the growth of the EPS market.

- However, stringent government regulations and green alternatives are expected to hinder the market's growth.

- Recycling in the expanded polystyrene industry is likely to act as an opportunity during the forecast period.

Europe Expanded Polystyrene (EPS) Market Trends

The Building and Construction Segment is Expected to Dominate the Market

- Expanded polystyrene, owing to its properties like low weight, durability, thermal efficiency, shock absorption, moisture resistance, usability, etc., is used in the building and construction sector. It is used in making roofs, walls, floor insulation, closed cavity walls, road construction, etc.

- EPS is an inert material that does not rot and provides no nutritional benefits to vermin. Therefore, it does not attract pests, such as rats or termites. Its strength, durability, and lightweight nature make it a versatile and popular building product.

- It is used in insulated panel systems for both residential and commercial building fronts, as well as walls, roofs, and floors. Moreover, it is utilized as a lightweight fill in the construction of roads and railways, as a void-forming fill material in civil engineering projects, and as a floatation material in the construction of marinas and pontoons.

- As per the Eumeps, approximately 75% of the EPS produced in Europe is used in the construction sector. Houses are renovated using EPS as insulation to improve their energy efficiency.

- As per the Eurostat, the annual average production in construction for the year 2023, compared with 2022, increased by 0.2% in Europe and by 0.1% in the European Union. The highest annual increases in construction production were recorded in Romania (+30.7%), Poland (+18.9%), and Belgium (+10.7%). The largest decreases were observed in Slovakia (-10.4%), Austria (-8.7%) and Sweden (-6.1%). Moreover, in 2022, Europe's construction sector grew by 2.5% because of new investments from the EU Recovery Fund. As per the European Commission and Eurostat, the biggest concern in the European Union's construction sector (EU-27) was the shortage of labor.

- According to Euroconstruct, the volume of residential renovation in Europe was projected at EUR 456.8 billion in 2023. In 2019, the value stood at EUR 448.5 billion.

- Moreover, overall investment in non-residential construction has increased significantly in recent times and is likely to continue over the study period, which will influence the product demand.

- Therefore, the European EPS market is expected to flourish over the forecast period.

Germany is Expected to Dominate the Market

- Germany has the most significant construction industry in Europe. The construction industry in the country has been growing at a slow pace, majorly driven by increasing new residential construction activities. It is one of the leading markets for expanded polystyrene owing to high demand from the building and construction sector. Expanded polystyrene finds applications in this industry due to its shape formation properties, easy molding, and other versatile benefits.

- In recent years, Germany witnessed a rising demand for expanded polystyrene use in green building design applications owing to its excellent environmental advantages, enhanced durability, maximized energy efficiency, and improved indoor environment.

- As per the stats released by Statistisches Bundesamt (Destatis), the Federal Government has set the goal of constructing 400,000 new dwellings in Germany every year. In March 2023, the construction of 24,500 dwellings was permitted in Germany.

- Germany granted permission for 24,500 homes to be built in March 2023. According to the Federal Statistical Office (Destatis), this represents a drop in building permits of 10,300, or 29.6%, from March 2022. A total of 68,700 residential building licenses were issued from January to March 2023, a decrease of 25.7% from the same period in the previous year (January to March 2022: 92,500 building permits). The drop in construction projects is most likely being caused by the high cost of building materials and the worsening financial situation.

- The construction of hotels in Germany is also expected to witness a sharp rise during the forecast period. As of 2021, a total of 360 new hotels with 56.565 rooms had been in the pipeline. The year 2022 was projected to witness the launch of 89 new hotels and 15,780 rooms. 78 more projects with 13,073 keys were mooted for 2023. The pipeline of hotels is anticipated to stay strong for 2024 and beyond, with 153 projects and 22,769 rooms already in the works.

- The German government initiated the construction of the Digital Park Fechenheim on a 10.7-ha area, with a gross floor area of 100,000 sq. m in Frankfurt-Fechenheim, Hesse, Germany, with an investment of USD 1,179 million. The construction work started in Q3 2021 and is expected to be completed by Q4 2028.

- In the third quarter of 2021, the country started the construction of the Central Hospital in Lorrach, Baden-Wuerttemberg, with an investment of USD 418 million. It is expected to be completed by 2025. The project aims to build a center for mental health and a medical department store with a parking garage.

- According to the Federal Statistical Office, Germany's GDP from construction declined from 62.01 EUR billion in the fourth quarter of 2022 to 51.61 EUR billion in the first quarter of 2023.

- Additionally, in Germany, packaging solutions are progressively being used for customized products and developing innovation. Therefore, there has been increased adoption of EPS in the nation, aiding the German expanded polystyrene market to grow further in the coming years. Smaller pack sizes are in demand across the county in the packaged food and personal care sectors. As per the data published by Statistisches Bundesamt, the revenue of the packaging industry in Germany in 2022 accounted for EUR 35.04 billion compared to EUR 29.59 billion in 2021.

- The key companies operating in the German EPS market are focusing on developing and launching innovative products that will further support the market's growth. For instance, in March 2022, BASF expanded its graphitic expandable polystyrene (EPS) granulate portfolio. Neopor F5 Mcycled contains 10% recycled material and is suitable for numerous building applications, particularly facade insulation. The new raw material is produced using the extrusion process and offers the same proven mechanical properties and optimized insulation performance as Neopor F 5200 Plus.

- The aforementioned trends are likely to influence the overall consumption of EPS in Germany during the forecast period.

Europe Expanded Polystyrene (EPS) Industry Overview

The European expanded polystyrene market is partially concentrated, with the top five players accounting for a considerable share of the production capacity in Europe. The five key players in the market (in no particular order) are Synthos Group, BASF SE, Ravago, SUNPOR, and BEWiSynbra Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand From the Building and Construction Industry

- 4.1.2 Growing Demand From Food Packaging Industry

- 4.2 Restraints

- 4.2.1 Government Regulations

- 4.2.2 Alternative Materials For Expanded Polystyrene

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-Export Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 White EPS

- 5.1.2 Grey and Silver EPS

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Other End-user Industries

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Norway

- 5.3.7 Sweden

- 5.3.8 Denmark

- 5.3.9 Finland

- 5.3.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpek SAB de CV

- 6.4.2 BASF SE

- 6.4.3 BEWiSynbra Group

- 6.4.4 Epsilyte LLC

- 6.4.5 KANEKA Belgium NV

- 6.4.6 Ravago

- 6.4.7 SABIC

- 6.4.8 SIBUR International GmbH

- 6.4.9 Sundolitt Ltd

- 6.4.10 SUNPOR

- 6.4.11 Synthos Group

- 6.4.12 Unipol Holland BV

- 6.4.13 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Emphasis on Expanded Polystyrene Recycling

02-2729-4219

+886-2-2729-4219