|

市場調查報告書

商品編碼

1801802

生活用紙市場機會、成長動力、產業趨勢分析及2025-2034年預測Household Paper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

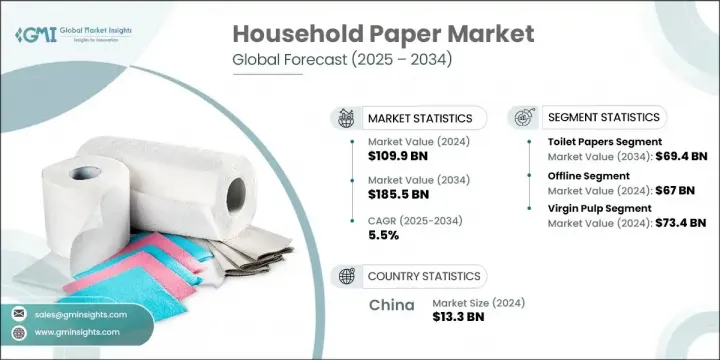

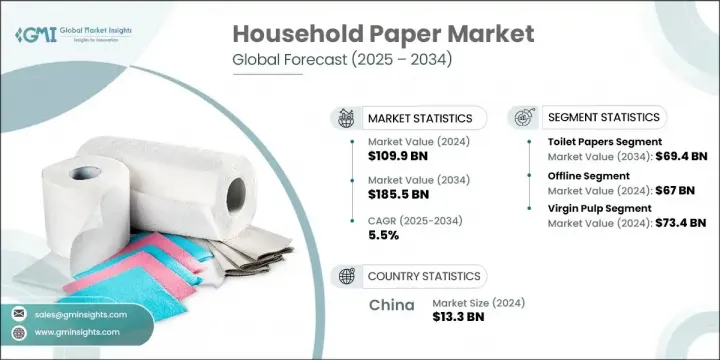

2024年,全球生活用紙市場規模達1,099億美元,預計到2034年將以5.5%的複合年成長率成長,達到1,855億美元。隨著生活方式的轉變、城市人口的擴張以及可支配收入的提高,消費者習慣正在改變,這一上升趨勢仍在持續。隨著越來越多的人遷入城市,對便利和衛生相關紙製品的需求也日益成長。城市生活不僅帶來了更繁忙的日常生活,還帶來了諸如用水短缺等挑戰,從而增加了對一次性衛生用品的需求。相較之下,低收入家庭取得此類產品的機會有限,由此產生的差距至今仍在影響著全球市場的發展軌跡。

可支配收入較高的消費者往往更青睞柔軟度、耐用性和品牌品質更高的高階紙製品。這些消費者更有可能在紙巾、廚房紙巾和衛生紙等必需品中尋求附加價值。此外,全球衛生標準意識的不斷提高也推動了對一次性紙製品的需求不斷擴大。由於創新,市場也正在發生動態變化——環保材料、超柔軟質地和多層結構等新功能正在幫助品牌迎合現代消費者不斷變化的偏好,他們注重舒適性和永續性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1099億美元 |

| 預測值 | 1855億美元 |

| 複合年成長率 | 5.5% |

2024年,衛生紙市場規模達396億美元,預計2034年將增加至694億美元。衛生紙一直是最主要的家用紙類別。其實用性、廣泛的接受度以及人們對柔軟、芳香和高品質衛生紙日益成長的偏好,推動了其在已開發經濟體和新興經濟體的強勁表現。隨著收入水準的提高和都市化進程的擴大,衛生紙作為全球家庭日常用品的地位持續鞏固。

2024年,線下零售通路市場規模達670億美元,預計2025-2034年複合年成長率將達5.3%。由於便利的取得、即時的商品供應以及消費者對實體零售環境的信任等因素,離線銷售仍佔據全球最大佔有率。該領域包括超市、便利商店和大賣場等零售連鎖店,它們讓顧客能夠親自評估產品,這通常比線上通路更有效地影響購買行為。

2024年,中國生活用紙市場規模達133億美元,預計2025年至2034年期間將以6.2%的複合年成長率強勁成長。由於衛生意識的增強、中產階級的壯大以及消費者支出能力的提升,中國的生活用紙市場正在快速擴張。現代零售體系和數位平台正在提升產品的覆蓋範圍和可及性,公眾對健康的日益關注——尤其是在全球衛生事件之後——將繼續推動人們轉向日常使用生活紙。

影響全球生活用紙市場的知名公司包括金佰利、愛生雅、恆安國際集團、喬治亞太平洋、索菲德爾集團、亞洲漿紙、WEPA 集團、愛生雅集團/瑞典纖維素股份公司、日本製紙、王子控股、寶潔、克魯格產品、美莎紙業集團、維達國際控股和 Cascades。為了在不斷發展變化的生活用紙市場中保持競爭力,領導企業已專注於幾項關鍵策略。一個主要領域是投資於產品創新,例如環保材料和多功能設計,以吸引注重健康和環保的消費者。各公司也透過擴大零售業務和利用全通路策略來加強其分銷網路,尤其是在新興經濟體。策略合作夥伴關係和合併正在幫助公司擴大其地域足跡。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 衛生紙

- 衛生紙

- 廚房用紙

- 面紙

- 其他

第6章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 原生紙漿

- 再生紙漿

第7章:市場估計與預測:依定價,2021-2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司擁有的網站

- 離線

- 大賣場/超市

- 百貨公司

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- Asia Pulp & Paper

- Cascades

- Essity

- Georgia-Pacific

- Hengan International Group

- Kimberly-Clark

- Kruger Products

- Metsa Tissue - Metsa Group

- Nippon Paper Industries

- Oji Holdings

- Procter & Gamble

- SCA Group / Svenska Cellulosa Aktiebolaget

- Sofidel Group

- Vinda International Holdings

- WEPA Group

The Global Household Paper Market was valued at USD 109.9 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 185.5 billion by 2034. This upward trend continues as shifting lifestyles, expanding urban populations, and rising disposable incomes reshape consumer habits. As more people move into cities, the demand for convenience and hygiene-related paper products has intensified. Urban living not only leads to busier routines but also brings challenges like limited access to water, increasing the need for disposable hygiene products. In contrast, households in lower-income brackets face restricted access to such products, creating disparities that still influence the global market's trajectory.

Consumers with higher disposable incomes tend to gravitate toward premium paper products that offer better softness, durability, and branded quality. These consumers are more likely to seek added value in essentials such as tissues, paper towels, and toilet paper. Furthermore, growing awareness around hygiene standards worldwide is driving broader demand for disposable paper items. The market is also witnessing dynamic shifts thanks to innovation-new features such as eco-friendly materials, ultra-soft textures, and multi-ply construction are helping brands cater to the evolving preferences of modern buyers focused on comfort and sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $109.9 Billion |

| Forecast Value | $185.5 Billion |

| CAGR | 5.5% |

The toilet paper segment generated USD 39.6 billion in 2024 and is forecast to rise to USD 69.4 billion by 2034. It has maintained its lead as the most dominant household paper category. Its practical nature, widespread acceptance, and growing preference for soft, fragranced, and high-quality variants have driven strong performance across both developed and emerging economies. As income levels rise and urbanization expands, toilet paper continues to solidify its role as a daily-use product within homes worldwide.

In 2024, the offline retail channels segment generated USD 67 billion and is expected to grow at a CAGR of 5.3% during 2025-2034. Offline sales still hold the largest share globally due to factors like easy accessibility, immediate product availability, and consumer trust in physical retail environments. This segment includes retail chains such as supermarkets, convenience stores, and hypermarkets, which offer customers the ability to assess products in person-often influencing purchasing behavior more effectively than online channels.

China Household Paper Market generated USD 13.3 billion in 2024 and is poised for strong growth at a CAGR of 6.2% between 2025 and 2034. China is seeing rapid expansion in this sector due to increasing hygiene consciousness, a swelling middle class, and higher consumer spending power. Modern retail systems and digital platforms are improving product reach and availability, and growing public concern about health-particularly after global health events-continues to reinforce the shift toward regular use of household paper goods.

Prominent companies shaping the Global Household Paper Market include Kimberly-Clark, Essity, Hengan International Group, Georgia-Pacific, Sofidel Group, Asia Pulp & Paper, WEPA Group, SCA Group / Svenska Cellulosa Aktiebolaget, Nippon Paper Industries, Oji Holdings, Procter & Gamble, Kruger Products, Metsa Tissue - Metsa Group, Vinda International Holdings, and Cascades. To remain competitive in the evolving household paper market, leading players have focused on several key strategies. One major area has been investment in product innovation, such as eco-conscious materials and multi-functional designs that appeal to health- and environment-conscious consumers. Companies are also strengthening their distribution networks-particularly in emerging economies-by expanding retail presence and leveraging omnichannel strategies. Strategic partnerships and mergers are helping firms broaden their geographic footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 ($Bn, Tons)

- 5.1 Key trends

- 5.2 Toilet papers

- 5.3 Bathroom tissues

- 5.4 Kitchen papers

- 5.5 Facial tissues

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 ($Bn, Tons)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled pulp

Chapter 7 Market Estimates & Forecast, By Pricing, 2021-2034 ($Bn, Tons)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Tons)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce website

- 8.2.2 Company owned website

- 8.3 Offline

- 8.3.1 Hypermarket/Supermarket

- 8.3.2 Departmental stores

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Asia Pulp & Paper

- 10.2 Cascades

- 10.3 Essity

- 10.4 Georgia-Pacific

- 10.5 Hengan International Group

- 10.6 Kimberly-Clark

- 10.7 Kruger Products

- 10.8 Metsa Tissue - Metsa Group

- 10.9 Nippon Paper Industries

- 10.10 Oji Holdings

- 10.11 Procter & Gamble

- 10.12 SCA Group / Svenska Cellulosa Aktiebolaget

- 10.13 Sofidel Group

- 10.14 Vinda International Holdings

- 10.15 WEPA Group