|

市場調查報告書

商品編碼

1801798

支氣管內超音波切片設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Endobronchial Ultrasound Biopsy Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

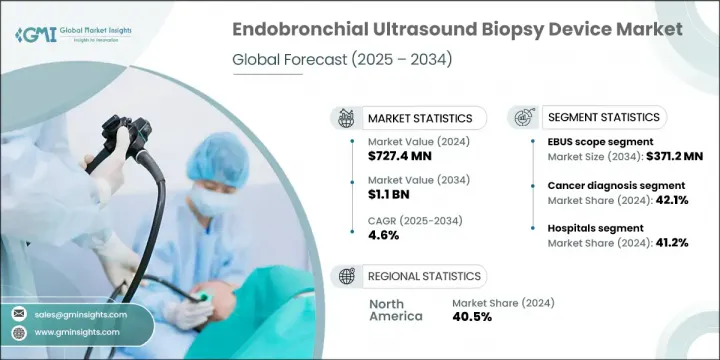

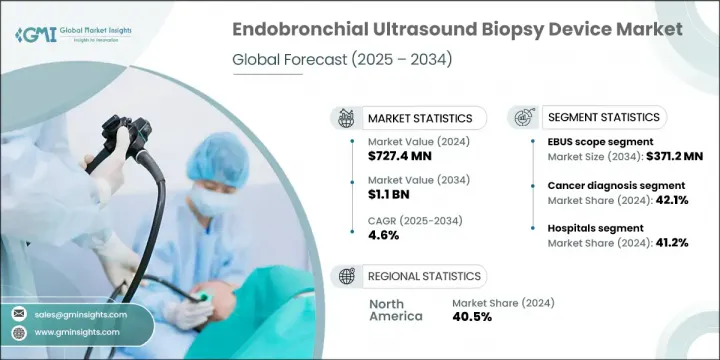

2024 年全球支氣管內超音波活體組織切片設備市場價值為 7.274 億美元,預計到 2034 年將以 4.6% 的複合年成長率成長至 11 億美元。人口老化加劇、呼吸系統疾病發病率上升、對微創診斷技術的需求不斷成長以及活體組織切片設備的技術進步,推動了該市場的成長。這些設備旨在幫助臨床醫生以高精度和最小患者不適的方式從肺部和周圍淋巴結採集組織樣本。隨著向微創診斷的轉變,醫院、診斷實驗室和癌症護理中心擴大採用這些超音波導引解決方案來診斷和分期肺癌和其他胸部疾病等疾病。對早期疾病檢測和高效臨床程序的不斷成長的需求也促使 EBUS 工具在常規醫療實踐中的使用日益增多。

活體組織切片平台的技術突破正在改變診斷程序的模式。現代解決方案如今包含彈性成像、人工智慧導航和混合成像等功能,這些功能可提高準確性和手術效率。這些創新有助於降低併發症風險、簡化工作流程並改善患者體驗。此外,隨著醫療保健系統強調早期和準確的診斷,人們越來越依賴這些系統來減少對侵入性手術的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.274億美元 |

| 預測值 | 11億美元 |

| 複合年成長率 | 4.6% |

EBUS 針頭市場在 2024 年的市場規模為 2.043 億美元,預計到 2034 年將達到 3.365 億美元,複合年成長率為 5.2%。該市場的成長得益於多樣化的針頭規格選擇和迴聲針尖技術,這些技術提高了手術過程中的可視性。 EBUS 內視鏡將超音波探頭與支氣管鏡結合,能夠即時成像氣道附近的組織和淋巴結。這些內視鏡對於實施經支氣管針吸活體組織切片 (TBNA) 至關重要,TBNA 是一種使臨床醫生無需進行開放性手術即可獲取診斷樣本的檢查方法。此技術不僅可以最大限度地減少不適,還能確保患者更快康復,並降低接受肺部或胸部評估的風險。

2024年,癌症診斷應用領域佔42.1%的市佔率。胸部癌症發生率的上升大幅提升了對精準即時診斷工具的需求。 EBUS內視鏡、TBNA設備和配備彈性成像的探頭對於癌症分期和早期檢測至關重要,它們能夠為臨床醫生提供設計個人化治療方案所需的資料。隨著癌症病例的持續成長,醫療保健機構正在加速採用先進的超音波導引活體組織切片設備,以滿足日益成長的診斷需求。

2024年,美國支氣管內超音波切片設備市場規模達2.694億美元。這一成長趨勢歸因於慢性阻塞性肺病(COPD)、結核病和癌症等肺部疾病的高發生率。此外,完善的監管框架、民眾日益增強的認知度以及強大的研發投入,推動了先進的EBUS技術在全美各地臨床實踐中的廣泛應用。

全球支氣管內超音波活體組織切片設備市場的知名公司包括西門子醫療、貝朗、庫克醫療、Argon Medical Devices、富士膠片控股、Praxis Medical、Hobbs Medical、奧林匹克醫療、Argon Medical Devices、富士膠片控股、Praxis Medical、Hobbs Medical、奧林匹克醫療、Argon Medical Devices、富士膠片控股、通用電氣醫療、荷蘭皇家飛利浦、Clinodevice、Medi-Globe 和美敦力。支氣管內超音波活體組織切片設備市場的主要參與者正在部署一系列策略,以增強其市場影響力。

許多公司正在大力投資研發,以開發人工智慧輔助導航系統、增強型視覺化工具以及更符合人體工學的活體組織切片儀器。一些公司正在透過推出診斷準確性更高、患者安全功能更強的設備來擴展其產品組合。與醫院和診斷中心的策略合作也有助於公司加速技術應用。臨床試驗和醫生培訓計畫的合作支持真實世界驗證,並拓展使用者能力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 老年人口不斷增加

- 呼吸系統疾病盛行率不斷上升

- 微創手術需求不斷成長

- 切片設備的技術進步

- 產業陷阱與挑戰

- 設備成本高

- 發展中國家缺乏報銷政策

- 市場機會

- 專科診所擴大採用標靶活體組織切片

- 成長動力

- 成長潛力分析

- 監管格局

- 技術進步

- 當前的技術趨勢

- 新興技術

- 供應鏈分析

- 2024年定價分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- EBUS示波器

- EBUS針頭

- 超音波處理器和成像系統

- 配件

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 癌症診斷

- 感染診斷

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心(ASC)

- 專科診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Argon Medical Devices

- ACE Medical Devices

- B. Braun

- Boston Scientific

- Cook Medical

- Clinodevice

- Fujifilm Holdings

- GE Healthcare

- Hobbs Medical

- Koninklijke Philips

- Medtronic

- Medi-Globe

- Olympus Corporation

- Praxis Medical

- Siemens Healthineers

The Global Endobronchial Ultrasound Biopsy Device Market was valued at USD 727.4 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 1.1 billion by 2034. Growth in this market is driven by the increasing aging population, a growing incidence of respiratory diseases, rising demand for minimally invasive diagnostic techniques, and ongoing technological advancements in biopsy equipment. These devices are designed to assist clinicians in collecting tissue samples from the lungs and surrounding lymph nodes with high accuracy and minimal patient discomfort. With a shift toward less invasive diagnostics, hospitals, diagnostic labs, and cancer care centers are increasingly adopting these ultrasound-guided solutions to diagnose and stage diseases such as lung cancer and other thoracic conditions. The rising demand for early disease detection and efficient clinical procedures is also contributing to the growing utilization of EBUS tools in routine medical practice.

Technological breakthroughs in biopsy platforms are transforming the landscape of diagnostic procedures. Modern solutions now include features like elastography, AI-enabled navigation, and hybrid imaging, which offer enhanced accuracy and procedural efficiency. These innovations help reduce complication risks, streamline workflow, and contribute to improved patient experiences. Additionally, as healthcare systems emphasize early and accurate diagnosis, there's a higher reliance on these systems for their ability to reduce the need for more invasive surgeries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $727.4 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 4.6% |

The EBUS needle segment generated USD 204.3 million in 2024 and is forecast to reach USD 336.5 million by 2034, growing at a CAGR of 5.2%. The growth of this segment is supported by diverse needle gauge options and echogenic tip technology, which improve visibility during procedures. EBUS scopes, which incorporate ultrasound probes with bronchoscopy, enable real-time imaging of tissues and lymph nodes near the airways. These scopes are essential for performing transbronchial needle aspiration (TBNA), a method that allows clinicians to obtain diagnostic samples without resorting to open procedures. This technique not only minimizes discomfort but also ensures faster recovery and lower risks for patients undergoing lung or thoracic evaluations.

In 2024, the cancer diagnosis application segment held 42.1% share. The increasing incidence of thoracic cancers has sharply raised the need for precise, real-time diagnostic tools. EBUS scopes, TBNA devices, and elastography-equipped probes are vital for staging and early detection, offering clinicians the data necessary to design personalized treatment plans. As cases of cancer continue to rise, healthcare providers are accelerating the adoption of advanced ultrasound-guided biopsy equipment to meet growing diagnostic demands.

United States Endobronchial Ultrasound Biopsy Device Market was valued at USD 269.4 million in 2024. This upward trajectory is attributed to the high prevalence of lung conditions like COPD, tuberculosis, and cancer. Additionally, a well-structured regulatory framework, growing awareness among the population, and strong investments in R&D have supported the widespread integration of advanced EBUS technology in clinical practices across the country.

Notable companies involved in the Global Endobronchial Ultrasound Biopsy Device Market include Siemens Healthineers, B. Braun, Cook Medical, Argon Medical Devices, Fujifilm Holdings, Praxis Medical, Hobbs Medical, Olympus Corporation, Boston Scientific, ACE Medical Devices, GE Healthcare, Koninklijke Philips, Clinodevice, Medi-Globe, and Medtronic. Key players in the endobronchial ultrasound biopsy device market are deploying a range of strategies to strengthen their market presence.

Many are heavily investing in R&D to develop AI-assisted navigation systems, enhanced visualization tools, and more ergonomic biopsy instruments. Several companies are expanding their product portfolios through the launch of devices with improved diagnostic accuracy and patient safety features. Strategic collaborations with hospitals and diagnostic centers are also helping firms to accelerate technology adoption. Partnerships for clinical trials and physician training programs support real-world validation and broaden user competence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising geriatric population

- 3.2.1.2 Increasing prevalence of respiratory disorders

- 3.2.1.3 Rising demand for minimally invasive procedures

- 3.2.1.4 Technological advancements in biopsy devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of equipment

- 3.2.2.2 Lack reimbursement policies in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in specialty clinics for targeted biopsies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 EBUS scopes

- 5.3 EBUS needles

- 5.4 Ultrasound processors and imaging systems

- 5.5 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer diagnosis

- 6.3 Infection diagnosis

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Specialty clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Argon Medical Devices

- 9.2 ACE Medical Devices

- 9.3 B. Braun

- 9.4 Boston Scientific

- 9.5 Cook Medical

- 9.6 Clinodevice

- 9.7 Fujifilm Holdings

- 9.8 GE Healthcare

- 9.9 Hobbs Medical

- 9.10 Koninklijke Philips

- 9.11 Medtronic

- 9.12 Medi-Globe

- 9.13 Olympus Corporation

- 9.14 Praxis Medical

- 9.15 Siemens Healthineers