|

市場調查報告書

商品編碼

1721574

切片設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biopsy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

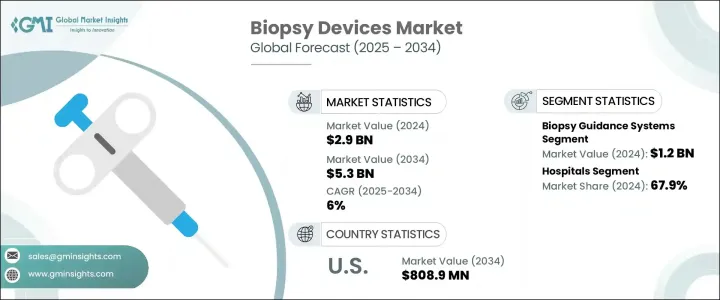

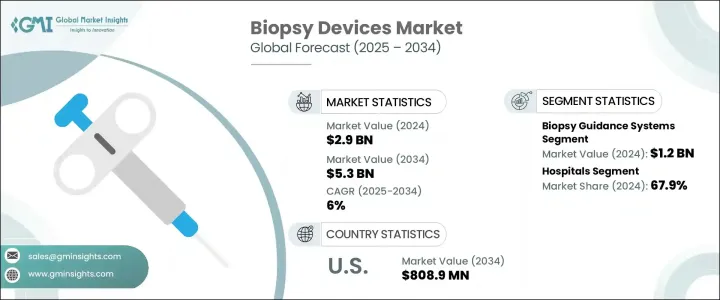

2024 年全球切片設備市場價值為 29 億美元,預計到 2034 年將以 6% 的複合年成長率成長,達到 53 億美元。活體組織切片設備在現代醫療保健中發揮關鍵作用,因為它可以提取組織樣本進行診斷評估。這些工具可支援識別和分析各種醫療狀況,通常有助於檢測和確認惡性腫瘤。全球慢性疾病(尤其是癌症)負擔的不斷加重,推動了對先進診斷解決方案的需求。隨著對早期發現、準確診斷和及時治療計劃的重視程度不斷提高,活體組織切片設備的作用變得比以往任何時候都更加重要。人們對影像導引和微創手術的日益青睞推動了活體組織切片技術的不斷創新,進一步提高了準確性並縮短了患者的恢復時間。

現在,越來越多的醫療保健專業人員開始轉向提供精確性、易用性和即時監控的設備。醫院和診斷中心也在迅速適應這種轉變,這有助於簡化工作流程並改善結果。全球意識的增強和獲得先進診斷護理的機會正在推動已開發經濟體和新興經濟體採用活體組織切片設備。政府致力於改善癌症診斷的措施和醫療改革也促進了市場擴張。此外,隨著手術量的不斷增加,醫療服務提供者正在投資高效、以患者為中心的活體組織切片解決方案,以滿足現代臨床需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 6% |

市場按產品類型細分為針基活體組織切片槍、活體組織切片引導系統、活體組織切片鉗、活體組織切片針和其他相關設備。其中,活體組織切片引導系統佔最大佔有率,2024 年的收入價值為 12 億美元。其使用率的上升很大程度上歸功於其提供即時成像和精確定位的能力,使其成為需要精確度和微創性的手術的理想選擇。這些系統現在被視為臨床工作流程不可或缺的一部分,其中有效的可視化對於定位和採樣小的或難以到達的組織至關重要。透過增強不同影像模式之間的相容性,活體組織切片引導系統正在幫助醫療保健專業人員減少手術錯誤並提高病患安全性。這些工具擴大被整合到醫院和診斷中心環境中,它們的多功能性正在提高吞吐量並最佳化整體結果。

從最終用戶的角度來看,活體組織切片設備市場分為醫院、門診手術中心和其他環境。醫院成為主要的使用者群體,佔 2024 年整體市場收入的 67.9%,預計到 2034 年價值將達到 36 億美元。醫院由於能夠使用高階成像設備和能夠執行先進活體組織切片技術的技術人員,在採用方面繼續保持領先地位。在複雜的診斷病例中,對準確、即時組織採樣的需求日益增加,這使得醫院成為進行這些程序的首選場所。與慢性病和先進診斷相關的入院人數的增加促使醫院投資更複雜的活體組織切片系統。此外,在這些環境中,機器人輔助和微創手術的使用也顯著成長,提高了效率和患者滿意度。醫院也正在成為多學科治療方法的中心樞紐,其中精確的診斷發揮基礎性的作用。

從區域來看,北美仍然是全球活體組織切片設備市場的主要貢獻者。尤其是美國,其市場成長強勁,活體組織切片設備收入預計將從 2023 年的 4.519 億美元增至 2034 年的 8.089 億美元。這一成長可歸因於完善的醫療保健基礎設施、高手術量以及支持先進診斷干預措施的優惠保險覆蓋範圍。積極的報銷環境使住院和門診設施能夠採用最新的活體組織切片技術,而不會遇到重大的財務障礙,從而促進在多個護理環境中的廣泛使用。

競爭格局中存在著幾家全球領先企業,它們透過持續投資於技術、產品創新和策略性收購來保持優勢地位。老牌企業憑藉其強大的產品組合和對綜合診斷解決方案的承諾,佔據了相當大的市場佔有率。同時,新進業者和中端製造商正透過專注於滿足目標臨床應用的具成本效益專業設備而獲得發展。隨著人們對精確引導、微創診斷工具的興趣日益濃厚,活體組織切片設備產業有望不斷進步,以滿足現代醫療保健不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球癌症發生率上升

- 切片設備的技術進步

- 有利的報銷方案

- 提高對乳癌的認知

- 產業陷阱與挑戰

- 活體組織切片後併發症的風險

- 缺乏熟練的醫療保健專業人員

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 切片引導系統

- 手動的

- 機器人

- 針基切片槍

- 真空輔助切片(VAB)設備

- 細針抽吸活體組織切片 (FNAB) 設備

- 芯針切片(CNB)設備

- 切片針

- 一次性的

- 可重複使用的

- 切片鉗

- 普通活體組織切片鉗

- 熱活體組織切片鉗

- 其他產品類型

- 刷子

- 刮匙

- 沖孔

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Argon Medical Devices

- B. Braun Melsungen

- Becton, Dickinson, and Company

- Boston Scientific

- Cardinal Health

- Cook Group

- Devicor Medical Products

- FUJIFILM

- Hologic

- INRAD

- Medtronic

- Olympus Corporation

- Stryker Corporation

The Global Biopsy Devices Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 5.3 billion by 2034. Biopsy devices serve a critical role in modern healthcare by allowing the extraction of tissue samples for diagnostic evaluation. These tools support the identification and analysis of a wide range of medical conditions, often being instrumental in detecting and confirming malignancies. The increasing global burden of chronic diseases, particularly cancer, is pushing the demand for advanced diagnostic solutions. With rising emphasis on early detection, accurate diagnosis, and timely treatment planning, the role of biopsy devices has become more important than ever. The growing preference for image-guided and minimally invasive procedures has led to continuous innovation in biopsy technologies, further improving accuracy and reducing patient recovery time.

More healthcare professionals are now shifting toward devices that offer precision, ease of use, and real-time monitoring. Hospitals and diagnostic centers are also adapting quickly to this shift, which is helping streamline workflows and improve outcomes. Increasing global awareness and access to advanced diagnostic care are fueling the adoption of biopsy equipment across developed and emerging economies. Government initiatives and healthcare reforms focused on improving cancer diagnostics are also contributing to market expansion. Moreover, as procedural volumes continue to rise, providers are investing in efficient, patient-centric biopsy solutions that align with modern clinical demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6% |

The market is segmented by product type into needle-based biopsy guns, biopsy guidance systems, biopsy forceps, biopsy needles, and other associated devices. Among these, biopsy guidance systems held the largest share, generating revenue worth USD 1.2 billion in 2024. Their rising use is largely due to their ability to deliver real-time imaging and precise targeting, making them ideal for procedures requiring accuracy and minimal invasiveness. These systems are now seen as integral to clinical workflows where effective visualization is essential for locating and sampling tissues that are small or difficult to reach. With enhanced compatibility across different imaging modalities, biopsy guidance systems are helping healthcare professionals reduce procedural errors and boost patient safety. These tools are increasingly being integrated into hospital and diagnostic center environments, where their multi-functional capabilities are improving throughput and optimizing overall outcomes.

From the end-user perspective, the biopsy devices market is categorized into hospitals, ambulatory surgical centers, and other settings. Hospitals emerged as the dominant user segment, accounting for 67.9% of the overall market revenue in 2024, with projections estimating the value to reach USD 3.6 billion by 2034. Hospitals continue to lead in terms of adoption due to their access to high-end imaging equipment and skilled personnel capable of performing advanced biopsy techniques. The increasing need for accurate, real-time tissue sampling in complex diagnostic cases makes hospitals a preferred setting for these procedures. The rise in admissions related to chronic diseases and advanced diagnostics is pushing hospitals to invest in more sophisticated biopsy systems. Additionally, there has been significant growth in the use of robotic-assisted and minimally invasive procedures within these environments, improving both efficiency and patient satisfaction. Hospitals are also becoming central hubs for multidisciplinary treatment approaches, where precise diagnostics play a foundational role.

In regional terms, North America remains a leading contributor to the global biopsy devices market. The United States, in particular, has demonstrated strong market growth, with biopsy device revenue expected to rise from USD 451.9 million in 2023 to USD 808.9 million by 2034. This growth can be attributed to a well-established healthcare infrastructure, high procedural volumes, and favorable insurance coverage that supports advanced diagnostic interventions. Positive reimbursement environments enable both in-patient and out-patient facilities to adopt the latest biopsy technologies without significant financial barriers, promoting widespread use across multiple care settings.

The competitive landscape features several global leaders who maintain a stronghold through continued investments in technology, product innovation, and strategic acquisitions. Established players hold a considerable portion of the market thanks to their robust portfolios and commitment to integrated diagnostic solutions. At the same time, newer entrants and mid-tier manufacturers are gaining ground by focusing on cost-effective, specialized devices catering to targeted clinical applications. With growing interest in precision-guided, less invasive diagnostic tools, the biopsy devices industry is expected to see ongoing advancements tailored to the evolving demands of modern healthcare.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cancer across the globe

- 3.2.1.2 Technological advancements in biopsy devices

- 3.2.1.3 Favorable reimbursement scenario

- 3.2.1.4 Increasing awareness regarding breast cancer

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of complications after biopsy

- 3.2.2.2 Dearth of skilled healthcare professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Biopsy guidance systems

- 5.2.1 Manual

- 5.2.2 Robotic

- 5.3 Needle based biopsy guns

- 5.3.1 Vacuum-assisted biopsy (VAB) devices

- 5.3.2 Fine needle aspiration biopsy (FNAB) devices

- 5.3.3 Core needle biopsy (CNB) devices

- 5.4 Biopsy needles

- 5.4.1 Disposable

- 5.4.2 Reusable

- 5.5 Biopsy forceps

- 5.5.1 General biopsy forceps

- 5.5.2 Hot biopsy forceps

- 5.6 Other product types

- 5.6.1 Brushes

- 5.6.2 Curettes

- 5.6.3 Punches

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Argon Medical Devices

- 8.2 B. Braun Melsungen

- 8.3 Becton, Dickinson, and Company

- 8.4 Boston Scientific

- 8.5 Cardinal Health

- 8.6 Cook Group

- 8.7 Devicor Medical Products

- 8.8 FUJIFILM

- 8.9 Hologic

- 8.10 INRAD

- 8.11 Medtronic

- 8.12 Olympus Corporation

- 8.13 Stryker Corporation