|

市場調查報告書

商品編碼

1797784

高壓 BCD 電源 IC 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High-Voltage BCD Power IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

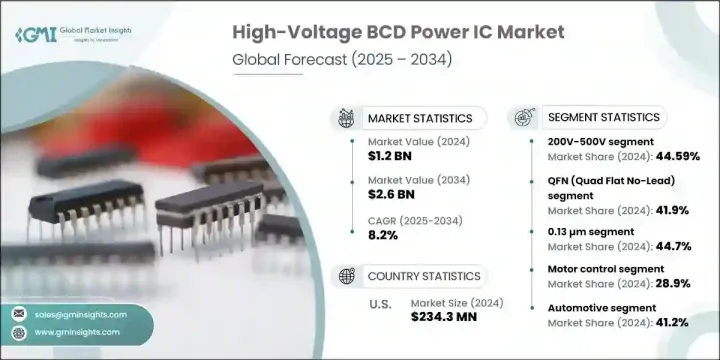

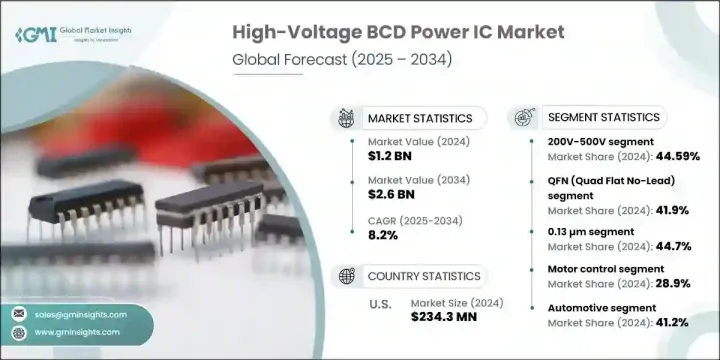

2024年,全球高壓BCD電源IC市場規模達12億美元,預計2034年將以8.2%的複合年成長率成長,達到26億美元。這一成長主要得益於市場對緊湊型節能電源管理系統日益成長的需求。各行各業正轉向基於BCD的電源IC,這種IC將高壓DMOS、類比雙極型和CMOS邏輯元件整合到單一晶片上。這種配置顯著節省空間,減少元件數量,並提高能源效率。這些整合解決方案對於電動和混合動力汽車、電信基礎設施和工業自動化尤其重要,因為它們能夠提高電源控制精度、熱性能和運行永續性,同時降低碳足跡。

功能豐富的智慧電源IC的發展正在改變關鍵產業的應用。先進的BCD裝置現已具備可程式設定、故障監控、軟開關和熱保護等功能。這些功能降低了維護需求,簡化了系統架構,並提高了可靠性,使其成為汽車ECU、醫療設備、機器人和物聯網系統的理想選擇。它們與SoC和數位控制系統的整合在終端市場持續成長。汽車和工業OEM廠商正在推動BCD的採用,以提高安全性、效率和即時系統反應。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 8.2% |

2024年,200V-500V電壓段以5.351億美元的市場規模領先市場。這些IC廣泛應用於電動車電源模組、工業控制器和電信設備。它們的吸引力在於能夠在高性能、易整合性和成本效益之間取得平衡,使其適用於各種高壓應用。由於該段與全球日益成長的電氣化運動、工廠現代化和智慧基礎設施部署息息相關,其發展前景廣闊。

0.13 µm 製程節點市場在 2024 年的市場規模為 5.3589 億美元。由於其穩健性、較低的生產成本以及在單晶片上整合類比、數位和高壓 DMOS 技術的能力,該節點仍佔據主導地位。由於其在極端工作條件下的可靠性以及對功率密度要求的滿足,該節點已成為汽車系統、工業驅動和耐用消費性電子產品中關鍵任務應用的標準。

美國高壓BCD功率IC市場在2024年創收2.343億美元,預計2034年複合年成長率將達到7.9%。美國受益於強大的半導體生產基礎、不斷擴張的電動車基礎設施以及工業領域的自動化程度提高。其他成長動力包括下一代電信服務的推出、國防系統的投資、清潔能源的推廣。聯邦政府計劃下的公共資金以及支持國內晶片製造的激勵措施,正在進一步增強美國市場的地位。

全球高壓 BCD 電源 IC 市場的知名參與者包括 Vishay Intertechnology、Power Integrations、Renesas Electronics、Maxim Integrated、安森美半導體 (onsemi)、Dialog Semiconductor、意法半導體、羅姆半導體、Diodes Incorporated、儀器、Alalpha & Omquira) Technology、英飛凌科技、ADI、Presto Engineering、恩智浦半導體、GlobalFoundries、台積電、聯華電子和 Magnachip Semiconductor。為了加強市場定位,領先的參與者正在大力投資下一代 BCD 架構的研發,以支援更高的電壓範圍、增強的熱處理和數位整合。一些公司正在擴大其代工合作夥伴關係,以確保獲得可擴展且具有成本效益的製造能力。汽車級認證被高度重視,以符合嚴格的安全和可靠性標準。本公司也專注於滿足特定應用功率配置的模組化晶片設計。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 汽車和工業領域電氣化程度不斷提高

- 對節能和緊湊設計的需求不斷成長

- 5G基礎設施和資料中心的擴展

- 政府對電動車充電和電力基礎設施的獎勵措施

- 智慧型電源 IC 功能的進步(SoC 整合、診斷、保護)

- 產業陷阱與挑戰

- 先進BCD製程開發的複雜性與成本

- 高壓下的熱管理和功耗問題

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各區域市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按電壓等級類型,2021 - 2034 年

- 主要趨勢

- 60伏-100伏

- 100伏-200伏

- 200伏-500伏

- 500V以上

第6章:市場估計與預測:按工藝節點,2021 - 2034 年

- 主要趨勢

- 0.35 微米

- 0.18 微米

- 0.13 微米

- 90奈米以下

第7章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- QFN(四方扁平無引線)

- WLCSP(晶圓級晶片尺寸封裝)

- BGA(球柵陣列)

- 晶片/板上晶片(用於整合模組)

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 汽車(EV/HEV動力系統、ADAS、照明)

- 消費性電子產品(電源供應器、電池管理、快速充電器)

- 工業(馬達驅動器、自動化設備、機器人)

- 電信(5G基礎設施、功率放大器)

- 醫療器材(攜帶式診斷和治療設備)

- 航太與國防(雷達系統、通訊設備)

- 資料中心和雲端基礎設施(伺服器電源、DC-DC轉換器)

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 電源管理

- 馬達控制

- 電池管理系統(BMS)

- LED照明驅動器

- 電壓調節與轉換

- 訊號調理與保護

- 音訊放大器

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- STMicroelectronics

- Texas Instruments

- Infineon Technologies

- Infineon Technologies

- NXP Semiconductors

- Renesas Electronics

- Rohm Semiconductor

- Analog Devices (ADI)

- Diodes Incorporated

- Microchip Technology

- TSMC

- GlobalFoundries

- UMC

- Vishay Intertechnology

- Dialog Semiconductor

- Maxim Integrated

- Power Integrations

- Alpha & Omega Semiconductor (AOS)

- Magnachip Semiconductor

- Presto Engineering

The Global High-Voltage BCD Power IC Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 2.6 billion by 2034. This growth is largely fueled by the increasing demand for compact and energy-efficient power management systems. Industries are moving toward BCD-based power ICs that integrate high-voltage DMOS, analog Bipolar, and CMOS logic components onto a single chip. This configuration offers notable space savings, reduces the number of components, and improves energy efficiency. These integrated solutions are particularly essential for use in electric and hybrid vehicles, telecom infrastructure, and industrial automation, as they improve power control precision, thermal performance, and operational sustainability while lowering the carbon footprint.

The development of intelligent, feature-rich power ICs is transforming applications across key sectors. Advanced BCD devices now include features such as programmable settings, fault monitoring, soft-switching, and thermal safeguards. These capabilities make them ideal for automotive ECUs, medical devices, robotics, and IoT systems by lowering maintenance needs, simplifying system architecture, and improving reliability. Their integration with SoCs and digital control systems continues to gain momentum across end-use markets. Automotive and industrial OEMs are driving adoption to enhance safety, efficiency, and real-time system response.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 8.2% |

In 2024, the 200V-500V voltage segment led the market with USD 535.1 million. These ICs are widely used in EV power modules, industrial controllers, and telecom equipment. Their appeal lies in their ability to deliver a balance of high performance, integration ease, and cost-effectiveness, making them suitable across a wide array of high-voltage applications. This segment is gaining traction due to its relevance in the growing electrification movement, factory modernization, and smart infrastructure deployments worldwide.

The 0.13 µm process node segment accounted for USD 535.89 million in 2024. It remains dominant due to its robustness, lower production costs, and ability to support integration of analog, digital, and high-voltage DMOS technologies on a single chip. This node has become a standard for mission-critical applications in automotive systems, industrial drives, and durable consumer electronics due to its reliability under extreme operating conditions and compliance with power density demands.

U.S. High-Voltage BCD Power IC Market generated USD 234.3 million in 2024 and is expected to register a CAGR of 7.9% through 2034. The country benefits from a robust base in semiconductor production, expanding EV infrastructure, and increasing automation in industrial sectors. Additional growth drivers include the rollout of next-generation telecom services, investment in defense systems, and a push toward clean energy adoption. Public funding under federal initiatives and incentives supporting domestic chip manufacturing is further strengthening the U.S. market presence.

Notable players in the Global High-Voltage BCD Power IC Market include Vishay Intertechnology, Power Integrations, Renesas Electronics, Maxim Integrated, ON Semiconductor (onsemi), Dialog Semiconductor, STMicroelectronics, Rohm Semiconductor, Diodes Incorporated, Texas Instruments, Alpha & Omega Semiconductor (AOS), Microchip Technology, Infineon Technologies, Analog Devices (ADI), Presto Engineering, NXP Semiconductors, GlobalFoundries, TSMC, UMC, and Magnachip Semiconductor. To strengthen market positioning, leading players are heavily investing in R&D for next-generation BCD architectures that support higher voltage ranges, enhanced thermal handling, and digital integration. Several companies are expanding their foundry partnerships to secure access to scalable and cost-effective fabrication capabilities. A strong emphasis is placed on automotive-grade qualification, enabling compliance with stringent safety and reliability standards. Firms are also focusing on modular chip designs that cater to application-specific power profiles.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing electrification in automotive & industrial sectors

- 3.2.1.2 Rising demand for energy-efficient and compact designs

- 3.2.1.3 Expansion of 5G infrastructure and data centers

- 3.2.1.4 Government incentives for EV charging and power infrastructure

- 3.2.1.5 Advances in smart power IC features (SoC integration, diagnostics, protection)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity and cost of advanced BCD process development

- 3.2.2.2 Thermal management and power dissipation issues at high voltages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.10.1 Sustainable materials assessment

- 3.10.2 Carbon footprint analysis

- 3.10.3 Circular economy implementation

- 3.10.4 Sustainability certifications and standards

- 3.10.5 Sustainability ROI analysis

- 3.11 Global consumer sentiment analysis

- 3.12 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Voltage Rating Type, 2021 - 2034 (USD Billion and Units)

- 5.1 Key trends

- 5.2 60V - 100V

- 5.3 100V - 200V

- 5.4 200V-500V

- 5.5 Above 500V

Chapter 6 Market Estimates and Forecast, By Process Node, 2021 - 2034 (USD Billion and Units)

- 6.1 Key trends

- 6.2 0.35 µm

- 6.3 0.18 µm

- 6.4 0.13 µm

- 6.5 Below 90 nm

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion and Units)

- 7.1 Key trends

- 7.2 QFN (Quad Flat No-Lead)

- 7.3 WLCSP (Wafer-Level Chip-Scale Package)

- 7.4 BGA (Ball Grid Array)

- 7.5 Die/Chip-on-Board (for integrated modules)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion and Units)

- 8.1 Key trends

- 8.2 Automotive (EV/HEV powertrain, ADAS, lighting)

- 8.3 Consumer Electronics (power adapters, battery management, fast chargers)

- 8.4 Industrial (motor drives, automation equipment, robotics)

- 8.5 Telecommunications (5G infrastructure, power amplifiers)

- 8.6 Medical Devices (portable diagnostic and therapeutic devices)

- 8.7 Aerospace & Defense (radar systems, communication equipment)

- 8.8 Data Centers & Cloud Infrastructure (server power supplies, DC-DC converters)

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion and Units)

- 9.1 Key trends

- 9.2 Power Management

- 9.3 Motor Control

- 9.4 Battery Management Systems (BMS)

- 9.5 LED Lighting Drivers

- 9.6 Voltage Regulation and Conversion

- 9.7 Signal Conditioning & Protection

- 9.8 Audio Amplifiers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion and Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 STMicroelectronics

- 11.2 Texas Instruments

- 11.3 Infineon Technologies

- 11.4 Infineon Technologies

- 11.5 NXP Semiconductors

- 11.6 Renesas Electronics

- 11.7 Rohm Semiconductor

- 11.8 Analog Devices (ADI)

- 11.9 Diodes Incorporated

- 11.10 Microchip Technology

- 11.11 TSMC

- 11.12 GlobalFoundries

- 11.13 UMC

- 11.14 Vishay Intertechnology

- 11.15 Dialog Semiconductor

- 11.16 Maxim Integrated

- 11.17 Power Integrations

- 11.18 Alpha & Omega Semiconductor (AOS)

- 11.19 Magnachip Semiconductor

- 11.20 Presto Engineering