|

市場調查報告書

商品編碼

1797701

矽基生物刺激素市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Silicon Based Biostimulants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

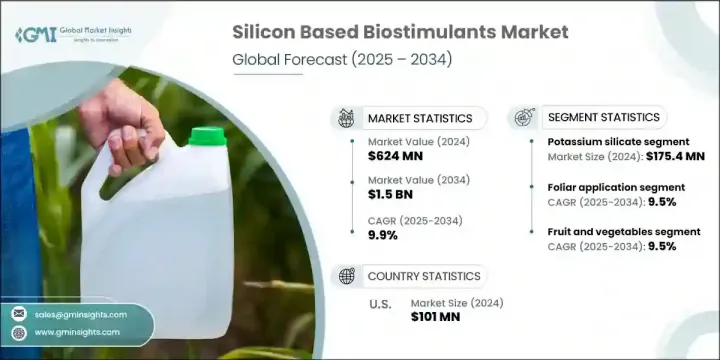

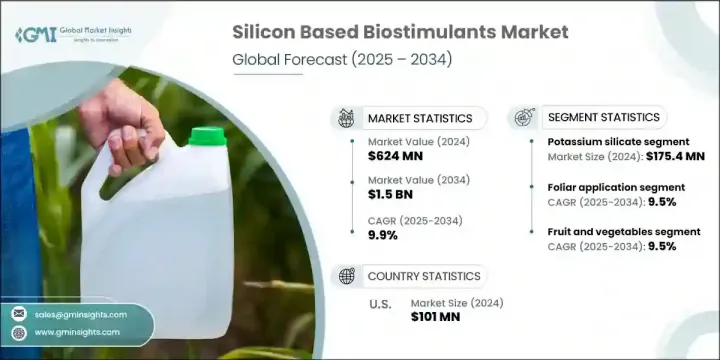

2024年,全球矽基生物刺激素市場規模達6.24億美元,預計2034年將以9.9%的複合年成長率成長,達到15億美元。隨著農業持續優先發展永續且富有韌性的耕作方式,該市場的發展勢頭強勁。農業生產正朝著注重生態和高效的種植方式轉變,這推動了各種農業體系對矽基投入品的需求。隨著農業越來越重視減輕生物和非生物脅迫的影響,這些生物刺激素因其能夠促進植物健康、提高產量穩定性並抵抗環境壓力而被廣泛採用。

該行業的擴張得益於不斷成長的研究、產品創新以及人們對智慧農業技術日益成長的興趣。隨著農場轉向減少對化學物質的依賴並提高作物產量的種植方式,矽強化配方正受到全球種植者的青睞。強勁的產品性能進一步推動了市場的活力,尤其是在提高作物抗逆性和最佳化植物在逆境下代謝方面。世界各地先進的農業實踐為此類專業產品的興起創造了有利條件,體現了人們對再生農業和永續農業的更廣泛投入。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.24億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 9.9% |

市場上一個顯著的發展是奈米矽生物刺激素的出現。這些先進的配方利用矽奈米顆粒來提高生物利用度,並帶來針對性的益處,例如改善植物吸收和增強抗逆性。此類創新對高價值作物和精準農業的吸引力日益增強。隨著研究的深入和商業化的加速,新的機會正在湧現,而越來越多的科學發現支持奈米矽在複雜農業系統中的優勢。這一趨勢預計將為技術先進的農業地區開闢新的成長途徑。

在全球對氣候變遷和土壤健康惡化的擔憂中,農民和農業企業都在探索更聰明的解決方案。事實證明,矽基生物刺激素有助於增強農業抵禦重金屬暴露、乾旱和土壤鹽化等環境挑戰的能力。這些解決方案與全球對永續農業投入的追求相契合,永續農業投入正成為氣候意識型糧食生產體系的重要組成部分。隨著種植者尋求在不損害生態平衡的情況下有效提升植物健康的途徑,這些產品在農業領域的應用正在日益廣泛。

就產品類型而言,矽酸鉀細分市場在2024年創造了1.754億美元的銷售額,佔28.1%的市場佔有率,這得益於其在增強多種作物強度和應對逆境方面的有效性。矽酸鉀在各種農業環境中的穩定表現,使其成為尋求可靠生物刺激素的種植者的首選。

葉面肥在2024年佔據34.1%的市場佔有率,預計到2034年將以9.5%的複合年成長率成長。這項技術之所以受歡迎,是因為它能夠透過植物葉片快速吸收矽元素,並帶來即時的效果。植物狀況、抗逆性和產量品質的顯著改善是其在追求快速、可衡量效益的種植者和園藝師中被廣泛採用的關鍵原因。

2024年,美國矽基生物刺激素市產值達1.01億美元,佔80.1%的市佔率。美國在該領域的領先地位得益於其強大的監管框架、農業技術的快速發展以及對環境管理的廣泛重視。矽基生物刺激素已成為作物生產策略中不可或缺的一部分,尤其是在穀物和農產品種植中,提高產量和抗逆性是重中之重。隨著農民應對日益難以預測的氣候條件,這些產品與作物管理方案的整合正在穩步擴大。

塑造矽基生物刺激素市場的關鍵參與者包括先正達公司、UPL有限公司、科迪華公司、拜耳公司和巴斯夫。矽基生物刺激素領域的領先公司正透過創新、合作和全球擴張等方式鞏固其市場地位。各公司正大力投資研發,以創造先進的配方,尤其是能夠精準輸送和提高藥效的奈米矽技術。與農業研究機構和技術提供者的策略合作正在加速產品開發和商業化。許多參與者也透過收購和合資企業進入新興市場,以擴大其地理覆蓋範圍。客製化產品以滿足區域作物需求和監管標準已成為關鍵關注點。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對永續農業的需求不斷成長

- 增強作物抗逆性和產量

- 生物刺激素使用的監管支持

- 產品配方和奈米技術的進步

- 產業陷阱與挑戰

- 農民意識和教育有限

- 與傳統投入相比成本較高

- 市場機會

- 新興市場的擴張

- 與精準農業和數位農業的融合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 矽酸鉀

- 矽酸鈉

- 穩定化矽酸

- 矽奈米粒子

- 其他矽化合物

第6章:市場估計與預測:依應用方法,2021 - 2034 年

- 主要趨勢

- 葉面施肥

- 土壤應用

- 種子處理

- 水肥一體化和水耕

第7章:市場估計與預測:依作物類型,2021 - 2034 年

- 主要趨勢

- 穀物和穀類

- 水果和蔬菜

- 經濟作物

- 草坪和觀賞植物

- 其他特色作物

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- BASF SE

- Eutrema

- Haifa Group

- Intermag

- Nuvia Technologies

- Orion Future Technology Ltd

- Plant Food Company Inc

- PlantoSys Nederland BV

- Roam Technology

- Shield Lifesciences and Resins Pvt Ltd

- Sustainable Agro Solutions SA

- Syngenta AG

The Global Silicon Based Biostimulants Market was valued at USD 624 million in 2024 and is estimated to grow at a CAGR of 9.9% to reach USD 1.5 billion by 2034. This market is gaining traction as agriculture continues to prioritize sustainable and resilient farming methods. The ongoing shift toward eco-conscious and efficient cultivation practices is driving the demand for silicon-based inputs across various farming systems. With agriculture's increasing focus on mitigating the effects of biotic and abiotic stress, these biostimulants are being adopted for their ability to support plant health, yield stability, and resistance to environmental pressures.

The expansion of the industry is backed by rising research, product innovation, and growing interest in smart agriculture technologies. As farms transition to methods that reduce chemical reliance and improve crop outcomes, silicon-enhanced formulations are finding favor among producers globally. The dynamic nature of the market is further propelled by strong product performance, particularly in improving crop resilience and optimizing plant metabolism under stress. Sophisticated agricultural practices in several parts of the world are creating favorable conditions for the rise of specialized products in this category, reflecting a wider commitment to regenerative and sustainable farming.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $624 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 9.9% |

A notable development in the market is the emergence of nano-silicon biostimulants. These advanced formulations use silicon nanoparticles to enhance bioavailability and deliver targeted benefits, such as improved plant uptake and increased resistance to stress. Such innovations are becoming increasingly attractive for high-value crops and precision agriculture. As research deepens and commercialization gains speed, new opportunities are surfacing, driven by a rise in scientific findings that support the advantages of nano-silicon across complex farming systems. This trend is expected to open fresh pathways for growth in technologically advanced agricultural regions.

Amid global concerns about climate shifts and deteriorating soil health, both farmers and agribusinesses are exploring smarter solutions. Silicon-based biostimulants are proving instrumental in boosting agricultural resilience to environmental challenges, including heavy metal exposure, drought, and soil salinity. These solutions align with the global momentum toward sustainable agricultural inputs, which are becoming an essential part of climate-conscious food production systems. The adoption of these products is increasing across the farming spectrum as growers seek effective ways to enhance plant health without compromising ecological balance.

In terms of product type, the potassium silicate segment generated USD 175.4 million and held 28.1% share in 2024 due to its proven effectiveness in boosting plant strength and stress response across multiple crop types. Its consistent performance in diverse agricultural environments continues to make it a top choice among growers looking for reliable biostimulant options.

The foliar segment held a 34.1% share in 2024 and will grow at a 9.5% CAGR through 2034. This technique is popular because it enables rapid absorption of silicon through plant foliage and delivers immediate benefits. Visible improvements in plant condition, stress resistance, and yield quality are key reasons for its widespread adoption among growers and horticulturists aiming for fast, measurable outcomes.

United States Silicon Based Biostimulants Market generated USD 101 million in 2024 and held an 80.1% share. The country's leadership in the sector is supported by a strong regulatory framework, rapid advancements in agri-tech, and widespread emphasis on environmental stewardship. Silicon-based biostimulants have become integral in crop production strategies, particularly in grain and produce farming, where enhancing yield and stress tolerance are top priorities. The integration of these products into crop management programs is steadily expanding as farmers respond to increasingly unpredictable climate conditions.

Key players shaping the Silicon Based Biostimulants Market include Syngenta AG, UPL Limited, Corteva Inc., Bayer AG, and BASF SE. Leading firms in the silicon-based biostimulants sector are reinforcing their market positions through a combination of innovation, partnerships, and global expansion. Companies are heavily investing in R&D to create advanced formulations, particularly nano-silicon technologies that offer precision delivery and improved efficacy. Strategic collaborations with agricultural research institutions and tech providers are accelerating product development and commercialization. Many players are also entering emerging markets through acquisitions and joint ventures to expand their geographic footprint. Customization of product offerings to meet regional crop requirements and regulatory standards has become a critical focus.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application method

- 2.2.4 Crop type

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable agriculture

- 3.2.1.2 Enhanced crop stress tolerance and yield

- 3.2.1.3 Regulatory support for biostimulants use

- 3.2.1.4 Advancements in product formulations and nanotechnology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited farmer awareness and education

- 3.2.2.2 Higher cost compared to conventional inputs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Integration with precision and digital agriculture

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million, Tons)

- 5.1 Key trends

- 5.2 Potassium silicate

- 5.3 Sodium silicate

- 5.4 Stabilized silicic acid

- 5.5 Silicon nanoparticles

- 5.6 Other silicon compounds

Chapter 6 Market Estimates & Forecast, By Application Method, 2021 - 2034 (USD Million, Tons)

- 6.1 Key trends

- 6.2 Foliar application

- 6.3 Soil application

- 6.4 Seed treatment

- 6.5 Fertigation and hydroponic

Chapter 7 Market Estimates & Forecast, By Crop Type, 2021 - 2034 (USD Million, Tons)

- 7.1 Key trends

- 7.2 Cereals and grains

- 7.3 Fruits and vegetables

- 7.4 Industrial crops

- 7.5 Turf and ornamentals

- 7.6 Other specialty crops

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Italy

- 8.3.4 Spain

- 8.3.5 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Eutrema

- 9.3 Haifa Group

- 9.4 Intermag

- 9.5 Nuvia Technologies

- 9.6 Orion Future Technology Ltd

- 9.7 Plant Food Company Inc

- 9.8 PlantoSys Nederland B.V.

- 9.9 Roam Technology

- 9.10 Shield Lifesciences and Resins Pvt Ltd

- 9.11 Sustainable Agro Solutions S.A

- 9.12 Syngenta AG