|

市場調查報告書

商品編碼

1797680

生物基黏合劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bio-based binder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

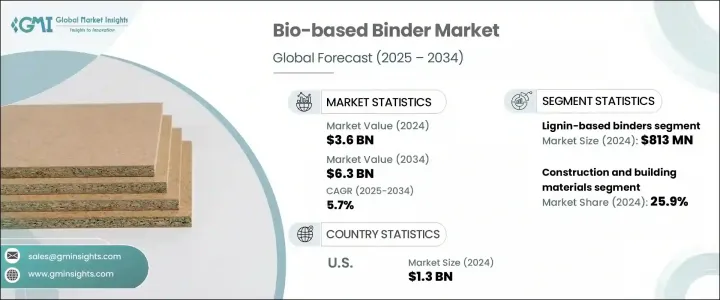

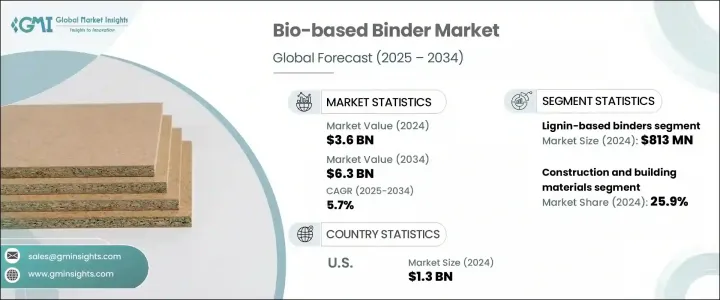

2024年,全球生物基黏合劑市場規模達36億美元,預計年複合成長率將達5.7%,到2034年將達到63億美元。由木質素、澱粉和植物油等可再生資源開發的生物基黏合劑,正日益取代建築、複合材料和包裝等領域的合成黏合劑。隨著永續性成為行業實踐的核心,企業和消費者正在尋求環保的替代品,以減少對環境的影響。對綠色材料日益成長的需求與不斷發展的全球政策和環保法規相契合。

促進低排放和使用再生資源的法規(尤其是來自北美和歐洲監管機構的法規)正在鼓勵製造商擴大其生物基產品組合併加速創新。這些監管框架日益嚴格,推動各行各業從石化產品轉向環保替代方案。稅收抵免、政府補助和永續材料使用補貼等激勵措施進一步激勵企業開發符合生態標籤和環境認證的生物基黏合劑。碳減排目標和揮發性有機化合物(VOC)排放限制等規定正迫使製造商投資於更清潔的技術、重新設計生產線並改進現有的黏合劑配方。這種監管勢頭不僅促進了低影響材料的開發,也為汽車、包裝、建築和紡織等行業的廣泛應用奠定了基礎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 63億美元 |

| 複合年成長率 | 5.7% |

永續發展目標正在推動各行各業的採用,其中建築和建築材料領域到 2024 年將佔 25.9% 的佔有率。向綠色基礎設施和環保建築認證的轉變正在鼓勵製造商將生物基黏合劑整合到混凝土混合物、絕緣材料和其他基礎材料中,以最大限度地減少開發項目中的碳排放。

2024年,木質原料領域引領全球市場,這得益於其強大的供應鏈、經濟高效的採購方式以及易於加工成生物聚合物黏合劑的優勢。強勁的林業產業確保了穩定的原料供應,使製造商更容易獲得木質原料。與此同時,農業廢棄物正逐漸受到關注。這些廢棄物包括秸稈等剩餘材料,它們不僅可以減少浪費,還能增加農業副產品的價值,有助於平衡經濟和環境優先事項。

2024年,美國生物基黏合劑市場產值達13億美元。憑藉著發達的製造業基礎以及對綠色建築和永續消費品日益成長的需求,美國仍然是關鍵的成長動力。美國為減少碳足跡所做的不懈努力,加強了包裝、建築和家具等關鍵產業對環保黏合劑的追求。隨著消費者環保意識的增強和工業永續發展目標的推進,對生物基黏合劑的需求持續成長。

全球生物基黏合劑市場的主要公司包括阿科瑪 (Arkema)、Sappi Limited、Ashland Global Holdings、巴斯夫 SE、BioBond Adhesives、Borregaard ASA、陶氏化學公司 (The Dow Chemical Company)、斯道拉恩索公司 (Stora Enso Oyj)、宜瑞安公司 (Ingredion Incorporated) 和嘉吉公司。為了鞏固在生物基黏合劑市場的立足點,各公司專注於透過持續研發和合作來擴展其產品線,以提高性能和可擴展性。與原料供應商和終端用戶產業建立策略合作夥伴關係有助於建立可靠的供應鏈並為新的應用打開大門。許多參與者也正在投資符合嚴格的全球永續發展標準的下一代黏合劑技術。企業正在進行併購,以增強生產能力並進入尚未開發的市場。企業正在針對建築和包裝等高需求產業客製化產品創新,同時透過流程自動化和再生能源整合來提高生產效率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 木質素基黏合劑

- 牛皮紙木質素黏合劑

- 木質素磺酸鹽黏合劑

- 有機溶劑型木質素黏合劑

- 酵素木質素黏合劑

- 澱粉基黏合劑

- 天然澱粉黏合劑

- 改性澱粉黏合劑

- 澱粉衍生物

- 纖維素基黏合劑

- 微晶纖維素

- 奈米纖維素黏合劑

- 纖維素衍生物

- 蛋白質基黏合劑

- 大豆蛋白黏合劑

- 小麥蛋白黏合劑

- 其他植物性蛋白質黏合劑

- 天然樹膠和樹脂黏合劑

- 生物基聚氨酯黏合劑

- 其他生物基黏合劑

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 建築和建築材料

- 木質複合材料和塑合板

- 絕緣材料

- 混凝土添加劑

- 地板應用

- 油漆和塗料

- 建築塗料

- 工業塗料

- 防護塗層

- 黏合劑和密封劑

- 結構膠合劑

- 包裝黏合劑

- 消費性黏合劑

- 紙張和包裝

- 造紙

- 瓦楞包裝

- 軟包裝

- 汽車

- 內裝部件

- 複合材料

- 聲學材料

- 儲能(電池黏合劑)

- 鋰離子電池黏合劑

- 其他電池技術

- 食品和飲料

- 紡織品和不織布

- 其他

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 建造

- 汽車

- 包裝

- 電子和儲能

- 食品和飲料

- 紡織品

- 家具和家居裝飾

- 航太和國防

- 其他

第8章:市場估計與預測:依原料來源,2021-2034

- 主要趨勢

- 木質原料

- 硬木來源

- 軟木來源

- 木材加工殘留物

- 農業殘留物

- 農作物殘茬

- 加工副產品

- 專用能源作物

- 藻類和海洋資源

- 都市固體廢棄物

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Arkema

- Ashland Global Holdings

- BASF SE

- BioBond Adhesives

- Borregaard ASA

- Cargill

- Ingredion Incorporated

- Sappi Limited

- Stora Enso Oyj

- The Dow Chemical Company

The Global Bio-based Binder Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 6.3 billion by 2034. Bio-based binders, developed from renewable sources like lignin, starches, and plant oils, are increasingly replacing synthetic adhesives in sectors such as construction, composites, and packaging. As sustainability becomes central to industry practices, companies and consumers are pushing for eco-conscious alternatives that reduce environmental impact. This growing demand for greener materials aligns with evolving global policies and environmental mandates.

Regulations promoting lower emissions and the use of renewable resources-particularly from governing bodies in North America and Europe-are encouraging manufacturers to expand their bio-based portfolios and accelerate innovation. These regulatory frameworks are becoming increasingly stringent, pushing industries to shift from petrochemical-based products to environmentally responsible alternatives. Incentives such as tax credits, government grants, and subsidies for using sustainable materials are further motivating companies to develop bio-based binders that comply with eco-labeling and environmental certifications. Mandates like carbon reduction targets and restrictions on VOC (volatile organic compound) emissions are compelling manufacturers to invest in cleaner technologies, reengineer production lines, and reformulate existing adhesives. This regulatory momentum not only fosters the development of low-impact materials but also sets the stage for widespread adoption across sectors like automotive, packaging, construction, and textiles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.3 billion |

| CAGR | 5.7% |

The sustainability goal is driving adoption across various industries, with construction and building materials segment holding 25.9% share in 2024. The shift toward green infrastructure and eco-friendly building certifications is encouraging manufacturers to integrate bio-based binders into concrete mixtures, insulation, and other foundational materials to minimize carbon emissions in development projects.

The wood-based feedstock segment led the global market in 2024, supported by a strong supply chain, cost-effective sourcing, and its ease of processing into biopolymer adhesives. A robust forestry industry ensures steady raw material availability, making wood-based inputs more accessible for manufacturers. Meanwhile, agricultural residues are steadily gaining attention. These include leftover materials like straw and stalks, which not only reduce waste but also add value to farming by-products, helping balance economic and environmental priorities.

U.S. Bio-based binder Market generated USD 1.3 billion in 2024. With its developed manufacturing base and increasing demand for green construction and sustainable consumer products, the U.S. remains a key growth driver. Growing efforts to reduce the nation's carbon footprint have strengthened the push toward environmentally friendly adhesives across key sectors such as packaging, construction, and furniture. Demand for bio-based binders continues to rise in response to eco-conscious consumer trends and industrial sustainability goals.

Key companies in the Global Bio-based binder Market include Arkema, Sappi Limited, Ashland Global Holdings, BASF SE, BioBond Adhesives, Borregaard ASA, The Dow Chemical Company, Stora Enso Oyj, Ingredion Incorporated, and Cargill. To strengthen their foothold in the bio-based binder market, companies are focused on expanding their product lines through continuous R&D and collaborations aimed at improving performance and scalability. Strategic partnerships with raw material suppliers and end-use industries help create reliable supply chains and open doors to new applications. Many players are also investing in next-gen binder technologies that meet stringent global sustainability standards. Mergers and acquisitions are being pursued to enhance production capabilities and access untapped markets. Companies are tailoring product innovations for high-demand sectors like construction and packaging, while increasing production efficiency through process automation and renewable energy integration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 End use industry trends

- 2.2.4 Feedstock source trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Lignin-based binders

- 5.2.1 Kraft lignin binders

- 5.2.2 Lignosulfonate binders

- 5.2.3 Organosolv lignin binders

- 5.2.4 Enzymatic lignin binders

- 5.3 Starch-based binders

- 5.3.1 Native starch binders

- 5.3.2 Modified starch binders

- 5.3.3 Starch derivatives

- 5.4 Cellulose-based binders

- 5.4.1 Microcrystalline cellulose

- 5.4.2 Nanocellulose binders

- 5.4.3 Cellulose derivatives

- 5.5 Protein-based binders

- 5.5.1 Soy protein binders

- 5.5.2 Wheat protein binders

- 5.5.3 Other plant protein binders

- 5.6 Natural gum and resin binders

- 5.7 Bio-based polyurethane binders

- 5.8 Other bio-based binders

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Construction and building materials

- 6.2.1 Wood composites and particleboard

- 6.2.2 Insulation materials

- 6.2.3 Concrete additives

- 6.2.4 Flooring applications

- 6.3 Paints and coatings

- 6.3.1 Architectural coatings

- 6.3.2 Industrial coatings

- 6.3.3 Protective coatings

- 6.4 Adhesives and sealants

- 6.4.1 Structural adhesives

- 6.4.2 Packaging adhesives

- 6.4.3 Consumer adhesives

- 6.5 Paper and packaging

- 6.5.1 Paper manufacturing

- 6.5.2 Corrugated packaging

- 6.5.3 Flexible packaging

- 6.6 Automotive

- 6.6.1 Interior components

- 6.6.2 Composite materials

- 6.6.3 Acoustic materials

- 6.7 Energy storage (battery binders)

- 6.7.1 Lithium-ion battery binders

- 6.7.2 Other battery technologies

- 6.8 Food and beverages

- 6.9 Textile and non-woven

- 6.10 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automotive

- 7.4 Packaging

- 7.5 Electronics and energy storage

- 7.6 Food and beverages

- 7.7 Textile

- 7.8 Furniture and home furnishing

- 7.9 Aerospace and defense

- 7.10 Others

Chapter 8 Market Estimates and Forecast, By Feedstock Source, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Wood-based feedstock

- 8.2.1 Hardwood sources

- 8.2.1 Softwood sources

- 8.2.1 Wood processing residues

- 8.3 Agricultural residues

- 8.3.1 Crop residues

- 8.3.1 Processing by-products

- 8.4 Dedicated energy crops

- 8.5 Algae and marine sources

- 8.6 Municipal solid waste

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arkema

- 10.2 Ashland Global Holdings

- 10.3 BASF SE

- 10.4 BioBond Adhesives

- 10.5 Borregaard ASA

- 10.6 Cargill

- 10.7 Ingredion Incorporated

- 10.8 Sappi Limited

- 10.9 Stora Enso Oyj

- 10.10 The Dow Chemical Company