|

市場調查報告書

商品編碼

1782127

人工智慧硬體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AI Hardware Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

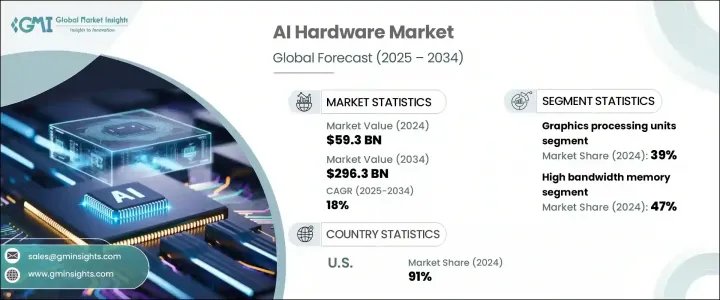

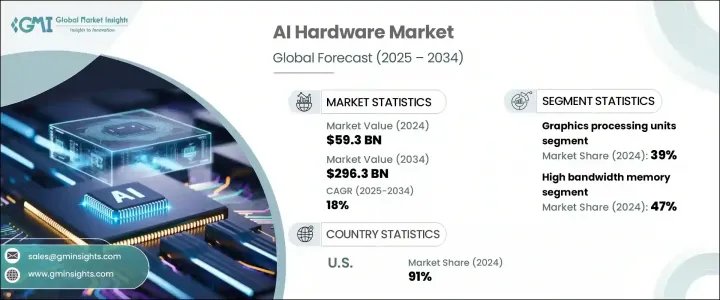

2024年,全球人工智慧硬體市場規模達593億美元,預計到2034年將以18%的複合年成長率成長,達到2,963億美元。這一強勁的成長勢頭源於人工智慧在各行各業的廣泛應用,這顯著增加了對高效能運算基礎設施的需求。隨著企業擴大部署具有複雜運算需求的人工智慧模型,企業對能夠處理大規模處理任務的專用人工智慧硬體的依賴也日益增加。

企業正在向硬體轉型,這些硬體不僅能夠支援更快的資料吞吐量,還能支援更低的延遲和更高的能源效率。這種趨勢不僅限於雲端環境;人工智慧也正在邊緣運算環境中得到應用,為工業系統、行動裝置和嵌入式解決方案中的即時決策提供支援。邊緣人工智慧的普及進一步推動了對能夠獨立運作而無需持續依賴雲端服務的處理器和記憶體單元的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 593億美元 |

| 預測值 | 2963億美元 |

| 複合年成長率 | 18% |

綜觀處理器領域,AI 硬體市場細分為圖形處理單元 (GPU)、中央處理單元 (CPU)、張量處理單元 (TPU)、專用積體電路 (ASIC)、現場可程式閘陣列 (FPGA) 和神經處理單元 (NPU)。其中,GPU 在 2024 年佔據市場主導地位,約佔總營收的 39%。從 2025 年到 2034 年,預計這一領域的複合年成長率將超過 18%。 GPU 的主導地位可歸因於其在平行運算、記憶體處理以及訓練和運行推理模型方面的高效能力。這些特性使得 GPU 對企業級 AI 平台和需要可擴展效能以進行複雜模型開發的研究機構都至關重要。

從記憶體和儲存的角度來看,AI 硬體市場包括高頻寬記憶體 (HBM)、AI 最佳化 DRAM、非揮發性記憶體以及新興記憶體技術。 2024 年,高頻寬記憶體領域佔據最大佔有率,佔整個市場的 47%。預計該領域在預測期內的複合年成長率將超過 19%。這種需求激增很大程度上受到 AI 系統對速度和頻寬日益成長的需求的影響。隨著 AI 模型變得越來越複雜且資料量越來越大,高頻寬記憶體能夠實現近乎即時的資料檢索,這對於實現無縫效能至關重要,尤其是在即時應用中。此功能使企業能夠最大限度地減少延遲、提高回應速度並更好地管理工作負載處理。

從應用角度來看,資料中心和雲端運算仍然是市場收入的最大貢獻者。隨著對可擴展、高效能基礎設施的需求日益成長,該領域持續快速擴張。大量需要進行大規模訓練和推理的人工智慧模型的激增,促使企業建立專門用於支援人工智慧工作負載的資料中心。這些中心配備了尖端的加速器和專為高效執行人工智慧而量身定做的組件。企業正在優先投資專用基礎設施,這些基礎設施不僅能滿足當前的人工智慧需求,還能預測未來模型的需求。

從區域來看,美國在北美人工智慧硬體市場佔據領先地位,佔據了該地區近91%的收入佔有率,2024年市場規模約為198億美元。這一優勢得益於美國在技術創新方面的領先地位、強大的供應鏈以及先進的半導體製造能力。美國仍然是全球人工智慧硬體開發的中心,並擁有由硬體公司、研究機構和雲端服務供應商組成的豐富生態系統。

硬體市場的領先公司包括英偉達 (NVIDIA)、英特爾 (Intel)、高通 (Qualcomm Technologies)、超微半導體 (AMD)、蘋果 (Apple)、Google (Google)、亞馬遜網路服務 (AWS)、微軟 (Microsoft)、IBM、三星電子 (Samsung Electronics) 等。這些公司持續投資開發客製化晶片、高效能處理器和下一代加速器,以滿足人工智慧系統不斷變化的需求。他們的努力對於塑造全球人工智慧硬體格局的下一階段至關重要。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 生成式人工智慧應用的激增

- 邊緣AI部署快速擴張

- 雲端和資料中心採用

- 醫療保健和生命科學領域的人工智慧

- 政府人工智慧投資

- 產業陷阱與挑戰

- 高功耗和冷卻需求

- 全球晶片供應限制

- 市場機會

- 設備端 AI 需求不斷成長

- 政府半導體激勵措施

- AI超級運算與超大規模擴展

- 產業特定人工智慧應用的成長

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 先進製程節點開發(3nm、2nm)

- 高頻寬記憶體(HBM)的演進

- Chiplet 架構和模組化設計

- 新興技術

- 用於人工智慧的量子運算硬體

- 光子運算和光學人工智慧硬體

- 神經形態運算架構

- 先進的記憶體技術

- 當前的技術趨勢

- 案例研究

- 用例

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按處理器,2021 - 2034 年

- 主要趨勢

- 圖形處理單元 (GPU)

- 訓練

- 推理

- 邊緣

- 資料中心

- 中央處理器 (CPU)

- AI最佳化

- 具有 AI 加速的伺服器 CPU

- 邊緣運算

- 張量處理單元 (TPU)

- 雲

- 邊緣

- 客製化設計

- 專用積體電路(ASIC)

- 人工智慧訓練

- 人工智慧推理

- 自訂人工智慧

- 現場可程式閘陣列(FPGA)

- AI最佳化

- 邊緣人工智慧

- 可重構運算平台

- 神經處理單元(NPU)

- 智慧型手機

- 邊緣人工智慧

- 物聯網

第6章:市場預估與預測:按內存和存儲,2021 - 2034 年

- 主要趨勢

- 高頻寬記憶體 (HBM)

- AI 最佳化的 DRAM

- 非揮發性記憶體

- 新興記憶體技術

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 資料中心和雲端運算

- 汽車和運輸

- 醫療保健和生命科學

- 消費性電子產品

- 工業和製造業

- 金融服務

- 電信

第8章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 基於雲端

- 本地

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 越南

- 菲律賓

- 澳新銀行

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Advanced Micro Devices

- Amazon Web Services (AWS)

- Apple

- ARM

- Broadcom

- Cerebra's Systems

- Fujitsu

- Graph core

- IBM

- Intel

- Marvell Technology

- Micron Technology

- Microsoft

- NVIDIA

- Qualcomm Technologies

- Samsung Electronics

- SiPearl

- SK Hynix

- Tenstorrent

The Global AI Hardware Market was valued at USD 59.3 billion in 2024 and is estimated to grow at a CAGR of 18% to reach USD 296.3 billion by 2034. This strong growth trajectory is driven by the widespread adoption of artificial intelligence across diverse sectors, which has significantly amplified the need for high-performance computing infrastructure. As organizations increasingly deploy AI models with complex computational demands, there is a growing reliance on dedicated AI hardware capable of handling large-scale processing tasks.

Businesses are transitioning toward hardware that can support not only faster data throughput but also lower latency and greater energy efficiency. This trend is not limited to cloud environments alone; AI is also being implemented across edge computing environments, powering real-time decision-making in industrial systems, mobile devices, and embedded solutions. The proliferation of edge AI is further boosting demand for processors and memory units capable of operating independently without constant reliance on cloud services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $59.3 Billion |

| Forecast Value | $296.3 Billion |

| CAGR | 18% |

Across the processor landscape, the AI hardware market is segmented into graphics processing units (GPUs), central processing units (CPUs), tensor processing units (TPUs), application-specific integrated circuits (ASICs), field-programmable gate arrays (FPGAs), and neural processing units (NPUs). Among these, GPUs held the dominant share of the market in 2024, accounting for approximately 39% of total revenue. From 2025 to 2034, this segment is expected to grow at a CAGR exceeding 18%. The dominance of GPUs can be attributed to their unmatched capabilities in parallel computing, memory handling, and their efficiency in training and running inference models. These features have made GPUs essential to both enterprise-grade AI platforms and research institutions that require scalable performance for complex model development.

When viewed through the lens of memory and storage, the AI hardware market includes high bandwidth memory (HBM), AI-optimized DRAM, non-volatile memory, and emerging memory technologies. In 2024, the high bandwidth memory segment captured the largest share, contributing 47% of the total market. The segment is forecasted to expand at a CAGR of over 19% during the forecast period. This surge in demand is largely influenced by the growing need for speed and bandwidth in AI systems. As AI models become more sophisticated and data-heavy, high bandwidth memory enables near-instant data retrieval, which is critical for achieving seamless performance, particularly in real-time applications. This capability allows enterprises to minimize latency, enhance responsiveness, and better manage workload processing.

On the basis of application, data center and cloud computing remain the largest contributors to market revenue. The segment continues to expand rapidly as the need for scalable, high-performance infrastructure intensifies. The proliferation of AI models with massive training and inference requirements is driving companies to build data centers specifically designed to support AI workloads. These centers are equipped with cutting-edge accelerators and components tailored for efficient AI execution. Organizations are prioritizing investment in purpose-built infrastructure that not only meets current AI needs but also anticipates the demands of future models.

In regional terms, the United States led the AI hardware market in North America, accounting for nearly 91% of the regional revenue share and generating around USD 19.8 billion in 2024. This stronghold is driven by the country's leadership in technology innovation, a robust supply chain, and access to advanced semiconductor manufacturing capabilities. The U.S. remains a global hub for AI hardware development, supported by a rich ecosystem of hardware companies, research institutions, and cloud service providers.

Leading companies in the AI hardware market include NVIDIA, Intel, Qualcomm Technologies, Advanced Micro Devices (AMD), Apple, Google, Amazon Web Services (AWS), Microsoft, IBM, Samsung Electronics, and others. These firms are consistently investing in the development of custom chips, high-performance processors, and next-generation accelerators to support the evolving needs of AI-powered systems. Their efforts are crucial in shaping the next phase of the global AI hardware landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Processor

- 2.2.3 Memory and storage

- 2.2.4 Application

- 2.2.5 Deployment

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of generative AI applications

- 3.2.1.2 Rapid expansion of edge AI deployment

- 3.2.1.3 Cloud & data center adoption

- 3.2.1.4 AI in healthcare & life sciences

- 3.2.1.5 Government AI investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High power consumption & cooling needs

- 3.2.2.2 Global chip supply constraints

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for on-device AI

- 3.2.3.2 Government semiconductor incentives

- 3.2.3.3 AI supercomputing & hyperscale expansion

- 3.2.3.4 Growth of industry-specific AI applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Advanced process node development (3nm, 2nm)

- 3.7.1.2 High bandwidth memory (HBM) evolution

- 3.7.1.3 Chiplet architecture and modular design

- 3.7.2 Emerging technologies

- 3.7.2.1 Quantum computing hardware for AI

- 3.7.2.2 Photonic computing and optical AI hardware

- 3.7.2.3 Neuromorphic computing architectures

- 3.7.2.4 Advanced memory technologies

- 3.7.1 Current technological trends

- 3.8 Case studies

- 3.9 Use cases

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Processor, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Graphics processing unit (GPU)

- 5.2.1 Training

- 5.2.2 Inference

- 5.2.3 Edge

- 5.2.4 Data center

- 5.3 Central processing unit (CPU)

- 5.3.1 AI-optimized

- 5.3.2 Server CPU with AI acceleration

- 5.3.3 Edge computing

- 5.4 Tensor processing unit (TPU)

- 5.4.1 Cloud

- 5.4.2 Edge

- 5.4.3 Custom designs

- 5.5 Application-specific integrated circuit (ASIC)

- 5.5.1 AI training

- 5.5.2 AI inference

- 5.5.3 Custom AI

- 5.6 Field-programmable gate arrays (FPGA)

- 5.6.1 AI-optimized

- 5.6.2 Edge AI

- 5.6.3 Reconfigurable computing platforms

- 5.7 Neural processing units (NPU)

- 5.7.1 Smartphone

- 5.7.2 Edge AI

- 5.7.3 IoT

Chapter 6 Market Estimates & Forecast, By Memory & Storage, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 High bandwidth memory (HBM)

- 6.3 AI-optimized DRAM

- 6.4 Non-volatile memory

- 6.5 Emerging memory technologies

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Data center and cloud computing

- 7.3 Automotive and transportation

- 7.4 Healthcare and life sciences

- 7.5 Consumer electronics

- 7.6 Industrial and manufacturing

- 7.7 Financial services

- 7.8 Telecommunications

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Cloud-Based

- 8.3 On-Premises

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Vietnam

- 9.4.6 Philippines

- 9.4.7 ANZ

- 9.4.8 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Advanced Micro Devices

- 10.2 Amazon Web Services (AWS)

- 10.3 Apple

- 10.4 ARM

- 10.5 Broadcom

- 10.6 Cerebra’s Systems

- 10.7 Fujitsu

- 10.8 Google

- 10.9 Graph core

- 10.10 IBM

- 10.11 Intel

- 10.12 Marvell Technology

- 10.13 Micron Technology

- 10.14 Microsoft

- 10.15 NVIDIA

- 10.16 Qualcomm Technologies

- 10.17 Samsung Electronics

- 10.18 SiPearl

- 10.19 SK Hynix

- 10.20 Tenstorrent