|

市場調查報告書

商品編碼

1782126

十二指腸潰瘍治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Duodenal Ulcer Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

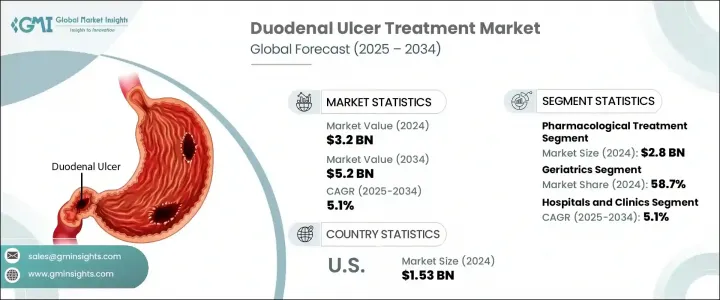

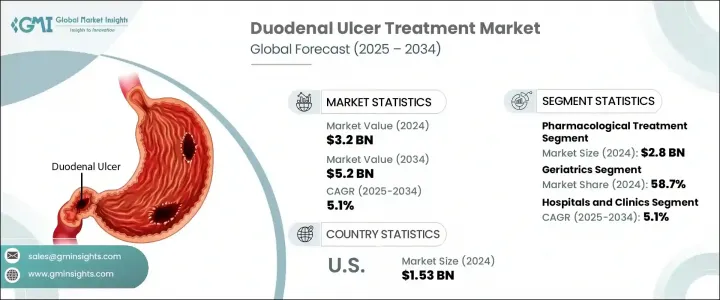

2024年,全球十二指腸潰瘍治療市場規模達32億美元,預計2034年將以5.1%的複合年成長率成長,達到52億美元。這一成長主要源於全球十二指腸潰瘍病例的不斷增加,而這些病例通常與營養不良、飲酒和吸煙習慣有關。人口老化也加劇了對治療方案的需求,因為老年人更容易出現胃腸道併發症。 H2受體阻斷劑和質子幫浦抑制劑(PPI)等藥物因其可靠的抑酸能力和良好的安全性而得到越來越廣泛的應用。

在許多治療方案中,這些藥物如今與針對幽門螺旋桿菌感染(十二指腸潰瘍的主要病因)的抗生素合併使用。此外,硫糖鋁和米索前列醇等藥物因其對胃黏膜的保護作用而日益受到關注。人工智慧診斷、行動醫療工具和遠距醫療的融合正在重塑潰瘍治療的提供方式,重點在於可及性和以患者為中心的治療。隨著越來越多的醫療保健系統採用數位健康模式和預防策略,各地區對可靠的十二指腸潰瘍治療的需求持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 52億美元 |

| 複合年成長率 | 5.1% |

2024年,藥物治療領域收入達28億美元。這一主導地位源於PPI和H2受體阻斷劑等藥物類別在快速緩解症狀和持續控制酸度方面的有效性。這些藥物因其易用性、口服給藥和整體便利性而廣受青睞,有助於居家照護和患者長期堅持用藥。它們無需侵入性操作即可有效控制症狀,使其成為醫療保健提供者和患者的首選,推動了該治療類別的成長。

老年病學領域在2024年的市佔率為58.7%。隨著年齡成長,胃腸道保護功能下降,老年人更容易患潰瘍,因此他們成為治療方案的主要消費群體。此外,長期使用非類固醇類抗發炎藥物 (NSAID) 治療其他與年齡相關的疾病,會顯著增加該族群罹患十二指腸潰瘍的風險。由於長期接觸潰瘍誘因,需要針對老年患者制定長期預防性照護計畫。

2025年,美國十二指腸潰瘍治療市場規模達15.3億美元。由於幽門螺旋桿菌感染率不斷上升、非類固醇抗發炎藥物(NSAID)的頻繁使用以及飲食風險因素的影響,美國市場持續成長。美國重視早期發現和完善的治療方案,有助於及時診斷和介入。強大的醫療基礎設施、廣泛的宣傳活動以及尖端診斷服務的可近性,確保了較高的治療採用率。持續的治療研究和創新投入也增強了美國在全球十二指腸潰瘍治療格局中的地位。

市場的主要參與者包括武田製藥、雅培實驗室、勃林格殷格翰、西普拉、衛材、葛蘭素史克、輝瑞、默克、魯賓、諾華、費羅茲森實驗室、太陽製藥、賽諾菲和阿斯特捷利康。為了鞏固市場地位,十二指腸潰瘍治療領域的公司正在採取各種策略措施。專注於針對症狀管理和根本病因(例如幽門螺旋桿菌)的先進藥物研發。

許多公司正在透過合作夥伴關係、本地生產和區域行銷策略來增強其全球影響力。數位化醫療整合,例如智慧監測和遠距醫療治療,正在被探索,以提高患者的參與度和依從性。此外,各公司正在多元化產品組合,納入聯合療法,旨在提高療效和依從性。策略定價、病患援助計畫和醫生教育活動也支持更廣泛的市場滲透。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 幽門螺旋桿菌感染盛行率上升

- 遠距醫療和數位診斷的擴展

- 人們對胃腸道健康的認知不斷提高

- 抑酸療法的技術進步

- 產業陷阱與挑戰

- 內視鏡和pH監測程序成本高昂

- 不良反應

- 市場機會

- 擴大發展中地區的醫療保健

- 加強公私合作,促進可負擔藥品供應

- 成長動力

- 成長潛力分析

- 管道分析

- 未來市場趨勢

- 技術和創新格局

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按治療類型,2021 - 2034 年

- 主要趨勢

- 藥物治療

- 藥品類別

- 質子幫浦抑制劑

- H2拮抗劑

- 抗生素

- 其他藥物類別

- 藥物類型

- 品牌治療

- 泛型

- 給藥途徑

- 口服

- 腸外

- 藥品類別

- 手術

第6章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 成年人

- 老年病學

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 居家照護環境

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- AstraZeneca

- Boehringer Ingelheim

- Cipla

- Eisai

- Ferozsons Laboratories

- GlaxoSmithKline

- Lupin

- Merck

- Novartis

- Pfizer

- Sanofi

- Sun Pharma

- Takeda Pharmaceutical

The Global Duodenal Ulcer Treatment Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 5.2 billion by 2034. This growth is largely fueled by rising cases of duodenal ulcers worldwide, often linked to poor nutrition, alcohol intake, and smoking habits. An aging population also contributes to increased demand for treatment solutions, as older individuals are more susceptible to gastrointestinal complications. Medications such as H2 receptor blockers and proton pump inhibitors (PPIs) are seeing heightened usage due to their reliable acid-suppressing abilities and favorable safety profiles.

In many treatment plans, these are now used in conjunction with antibiotics that target Helicobacter pylori infections- a leading cause of duodenal ulcers. Additionally, agents like sucralfate and misoprostol are gaining traction for their protective effects on the gastric lining. The integration of AI diagnostics, mobile health tools, and telemedicine is reshaping how ulcer care is delivered, with a focus on accessibility and patient-centered treatment. As more healthcare systems adopt digital health models and preventive strategies, the demand for reliable duodenal ulcer treatments continues to grow across all regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 5.1% |

The pharmacological therapies segment generated USD 2.8 billion in 2024. This dominance stems from the effectiveness of drug classes like PPIs and H2 blockers in providing quick symptom relief and consistent acid control. These medications are widely preferred for their ease of use, oral delivery, and overall convenience, which support home-based care and long-term patient adherence. Their ability to manage symptoms effectively without invasive procedures makes them the first choice for both healthcare providers and patients, pushing growth in this treatment category.

The geriatrics segment held a 58.7% share in 2024. Age-related declines in gastrointestinal protection increase vulnerability to ulcer formation among older adults, making them the primary consumer group for treatment options. Additionally, chronic use of non-steroidal anti-inflammatory drugs (NSAIDs) to manage other age-related conditions significantly raises the risk of duodenal ulcers in this demographic. This persistent exposure to ulcerogenic triggers calls for long-term and preventive care approaches tailored to senior patients.

United States Duodenal Ulcer Treatment Market was valued at USD 1.53 billion in 2025. The American market continues to grow due to the increasing prevalence of Helicobacter pylori infections, frequent NSAID use, and dietary risk factors. The country's emphasis on early detection and robust treatment protocols supports timely diagnosis and intervention. Strong infrastructure in healthcare delivery, along with extensive awareness campaigns and access to cutting-edge diagnostic services, ensures high treatment adoption. Ongoing investments in therapeutic research and innovation also bolster the country's role in shaping the global duodenal ulcer treatment landscape.

Key industry players in this market include Takeda Pharmaceutical, Abbott Laboratories, Boehringer Ingelheim, Cipla, Eisai, GlaxoSmithKline, Pfizer, Merck, Lupin, Novartis, Ferozsons Laboratories, Sun Pharma, Sanofi, and AstraZeneca. To strengthen their market position, companies operating in the duodenal ulcer treatment space are embracing various strategic initiatives. Investment in advanced drug development targeting both symptom management and root causes, such as Helicobacter pylori, is a key focus.

Many firms are enhancing their global reach through partnerships, local manufacturing, and regional marketing strategies. Digital health integration, such as smart monitoring and telehealth-enabled treatment, is being explored to boost patient engagement and adherence. Additionally, firms are diversifying portfolios to include combination therapies, aiming to improve efficacy and compliance. Strategic pricing, patient assistance programs, and physician education campaigns also support broader market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Treatment type

- 2.2.3 Age group

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of helicobacter pylori infections

- 3.2.1.2 Expansion of telemedicine and digital diagnostics

- 3.2.1.3 Growing awareness of gastrointestinal health

- 3.2.1.4 Technological advancements in acid-suppressing therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of endoscopic and pH monitoring procedures

- 3.2.2.2 Adverse effects

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding healthcare in developing regions

- 3.2.3.2 Growing public-private partnerships for affordable drug access

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Technology and innovation landscape

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmacological treatment

- 5.2.1 Drug class

- 5.2.1.1 Proton pump inhibitors

- 5.2.1.2 H2 antagonists

- 5.2.1.3 Antibiotics

- 5.2.1.4 Other drug classes

- 5.2.2 Medication type

- 5.2.2.1 Branded Treatment

- 5.2.2.2 Generics

- 5.2.3 Route of administration

- 5.2.3.1 Oral

- 5.2.3.2 Parenteral

- 5.2.1 Drug class

- 5.3 Surgery

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adults

- 6.3 Geriatrics

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Homecare settings

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 AstraZeneca

- 9.3 Boehringer Ingelheim

- 9.4 Cipla

- 9.5 Eisai

- 9.6 Ferozsons Laboratories

- 9.7 GlaxoSmithKline

- 9.8 Lupin

- 9.9 Merck

- 9.10 Novartis

- 9.11 Pfizer

- 9.12 Sanofi

- 9.13 Sun Pharma

- 9.14 Takeda Pharmaceutical