|

市場調查報告書

商品編碼

1773398

消化性潰瘍治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Peptic Ulcers Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

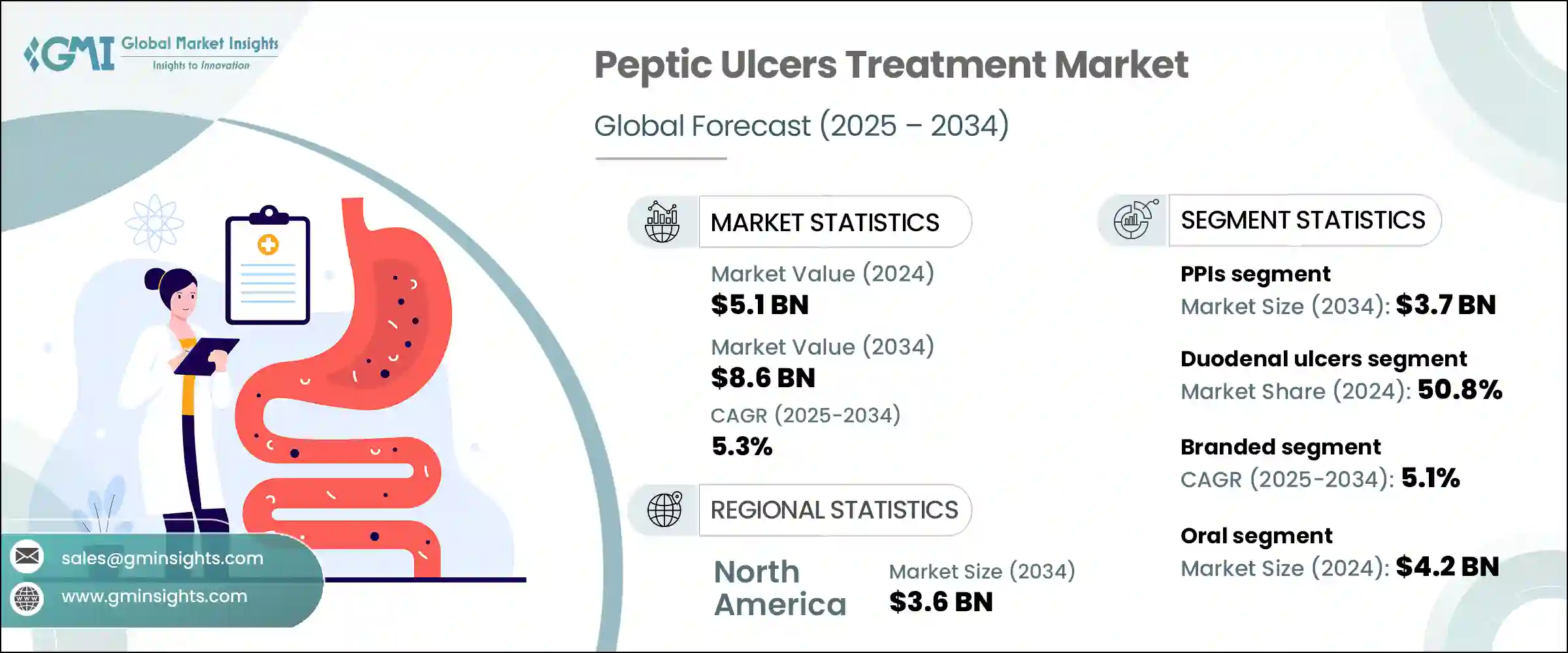

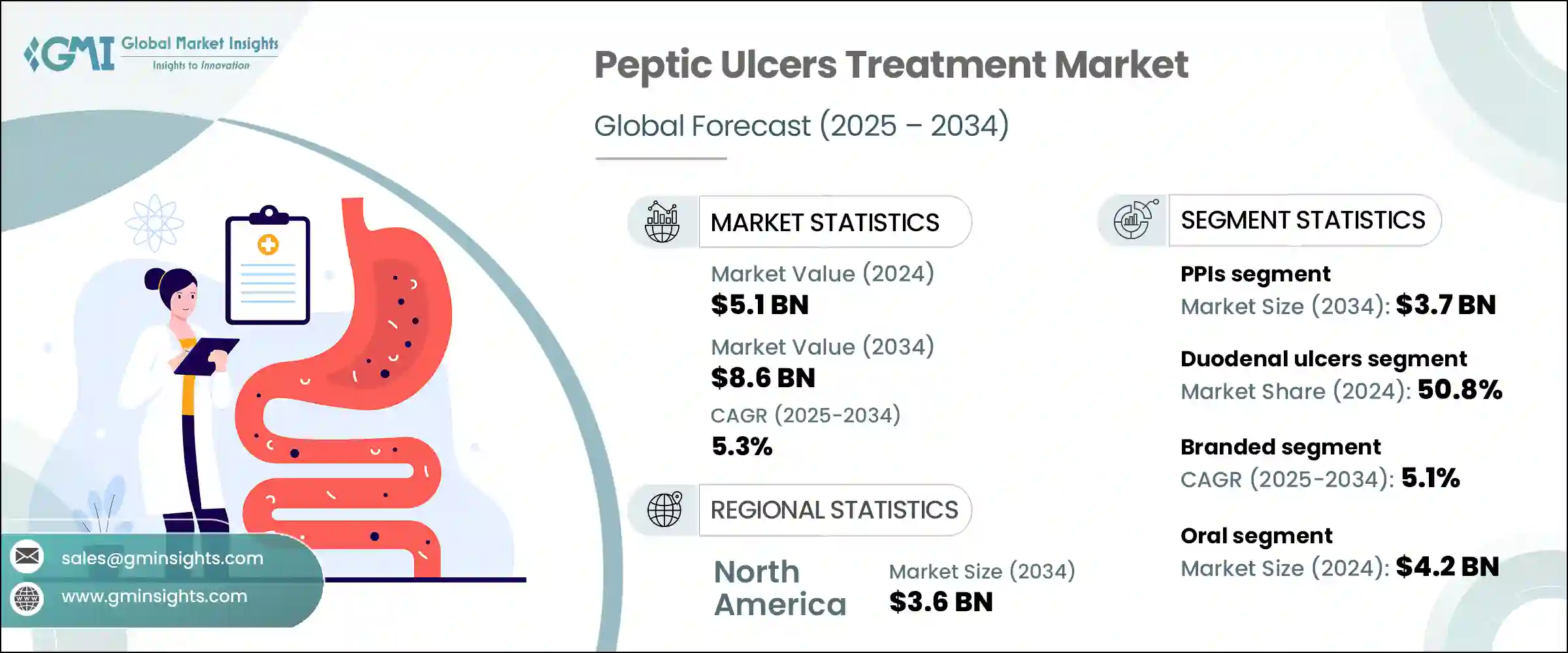

2024年,全球消化性潰瘍治療市場規模達51億美元,預計2034年將以5.3%的複合年成長率成長至86億美元。市場成長主要源自於成人胃腸道疾病發病率的上升以及創新藥物解決方案的持續發展。幽門螺旋桿菌感染的廣泛流行是推動這一需求成長的關鍵因素,該感染仍然是全球消化性潰瘍的主要原因。全球衛生機構指出,幽門螺旋桿菌感染影響全球一半以上的人口,尤其是在中低收入地區。這種令人擔憂的感染率預計將加速對更有效的治療方案的需求,以控制和根除疾病。

推動市場擴張的另一個因素是非類固醇類抗發炎藥物濫用的日益嚴重,這類藥物往往會損害胃黏膜並導致潰瘍形成。此外,診斷技術的進步以及創新治療方案(包括二聯療法和三聯療法)的日益普及,正在提高患者的康復率並最大限度地降低潰瘍復發率。這些因素,加上已開發國家和新興國家對消化性潰瘍的認知度不斷提高以及醫療保健可近性的不斷提升,預計將在未來幾年維持對消化性潰瘍治療方案的穩定需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 51億美元 |

| 預測值 | 86億美元 |

| 複合年成長率 | 5.3% |

質子幫浦抑制劑 (PPI) 市場在 2024 年的銷售額為 23 億美元,預計到 2034 年將達到 37 億美元,複合年成長率為 5.1%。 PPI 因其在降低胃酸水平、加速癒合和緩解疼痛方面的有效性,已成為潰瘍治療的基石。其可靠的療效和極低的副作用使其成為治療方案的廣泛首選。 PPI 對根除幽門螺旋桿菌的多藥療法的貢獻進一步鞏固了其市場主導地位。臨床上一直報告較高的治癒成功率,尤其是在 4 至 8 週的治療窗口期內使用 PPI 的情況下。

十二指腸潰瘍在2024年佔據50.8%的市場佔有率,預計在整個預測期內將經歷顯著成長。這類潰瘍通常發生在小腸上部,主要由細菌感染和長期使用非類固醇抗發炎藥(NSAID)引發。這類潰瘍在廣泛人群中普遍存在,且常伴隨獨特的症狀,便於更快診斷和更及時的干涉,從而提高治療率。

北美消化性潰瘍治療市場在2024年達到21億美元,預計2034年將達到36億美元,複合年成長率為5.5%。該地區的主導地位可歸因於非類固醇抗發炎藥物相關併發症和幽門螺旋桿菌感染的高負擔。完善的醫療保健體系、更便捷的先進藥物取得途徑以及日益提升的胃腸道護理和預防保健意識,都有助於該地區保持強勁的市場地位。此外,領先製藥公司的積極佈局也將繼續支撐該地區的成長。

全球消化性潰瘍治療產業的主要參與者包括武田、葛蘭素史克、卡迪拉醫療保健、奧羅賓度製藥、蘭伯西實驗室、輝瑞、雷迪博士實驗室、Strides Pharma、Phathom Pharmaceuticals、Granules India、阿斯利康、太陽製藥、衛材和 Azurity Pharmaceuticals。為了鞏固市場地位,消化性潰瘍治療領域的主要參與者正專注於各種策略性措施。許多公司正大力投資研發,以開發療效更高、副作用更小的新療法。配方改進,尤其是聯合用藥方案的改進,旨在提高治療依從性並最大限度地減少復發。

企業也正在擴大生產能力,強化全球供應鏈,以確保更廣泛的治療可及性。此外,企業正在建立策略合作夥伴關係,並進行併購活動,以擴大產品組合和地理覆蓋範圍。有針對性的宣傳活動和醫生教育計畫進一步提升了產品知名度和品牌信譽,尤其是在診斷和治療率穩步攀升的新興醫療保健市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 幽門螺旋桿菌感染盛行率上升

- 老年人口不斷增加

- 擴大研發經費和活動

- 產業陷阱與挑戰

- 長期使用PPI的副作用

- 市場機會

- 新療法和藥物輸送創新

- 網路藥局的擴張

- 成長動力

- 成長潛力分析

- 管道分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 擴張計劃

第5章:市場估計與預測:按藥物類型,2021 年至 2034 年

- 主要趨勢

- 質子幫浦抑制劑(PPI)

- H2受體拮抗劑

- 抗酸藥

- 抗生素

- 細胞保護劑

- 其他藥物類型

第6章:市場估計與預測:按潰瘍類型,2021 年至 2034 年

- 主要趨勢

- 胃潰瘍

- 十二指腸潰瘍

- 食道潰瘍

第7章:市場估計與預測:依藥物類型,2021 年至 2034 年

- 主要趨勢

- 品牌

- 泛型

第8章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服腸外

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AstraZeneca

- Aurobindo Pharma

- Azurity Pharmaceuticals

- Cadila Healthcare

- Dr. Reddy's Laboratories

- Eisai

- GlaxoSmithKline

- Granules India

- Pfizer

- Phathom Pharmaceuticals

- Ranbaxy Laboratories

- Strides Pharma

- Sun Pharma

- Takeda

The Global Peptic Ulcers Treatment Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 8.6 billion by 2034. The market growth is largely driven by the rising incidence of gastrointestinal conditions among adults and the continued development of innovative pharmaceutical solutions. A key contributor to this demand is the widespread prevalence of Helicobacter pylori infections, which remain a dominant cause of peptic ulcers globally. As noted by global health bodies, this infection affects more than half the world's population, with particularly high rates in low- and middle-income regions. This alarming prevalence is expected to accelerate the demand for more effective treatment options to manage and eliminate the condition.

Another factor fueling market expansion is the increasing misuse of non-steroidal anti-inflammatory drugs, which often damage the stomach lining and lead to ulcer formation. Alongside this, advancements in diagnostics and the rising adoption of innovative treatment regimens-including dual and triple combination therapies-are improving patient recovery rates and minimizing ulcer recurrence. These factors, combined with rising awareness and enhanced healthcare accessibility in both developed and emerging countries, are expected to sustain steady demand for peptic ulcer treatment solutions in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.3% |

The proton pump inhibitors (PPIs) segment generated USD 2.3 billion in 2024 and is forecasted to hit USD 3.7 billion by 2034, registering a CAGR of 5.1%. PPIs have become the cornerstone of ulcer therapy due to their effectiveness in reducing gastric acid levels, accelerating healing, and relieving pain. Their dependable efficacy and minimal side effects have made them widely preferred in treatment regimens. Their contribution to multi-drug therapy approaches for H. pylori eradication further cements their dominant market position. High healing success rates have been consistently reported in clinical settings, particularly when PPIs are administered over a treatment window of four to eight weeks.

The duodenal ulcers segment held a 50.8% share in 2024 and is set to experience significant growth throughout the forecast period. These ulcers typically form in the upper part of the small intestine and are primarily triggered by bacterial infection and long-term use of NSAIDs. They are prevalent across a broad population and frequently present with distinct symptoms that allow for quicker diagnosis and more immediate intervention, supporting higher treatment rates.

North America Peptic Ulcers Treatment Market generated USD 2.1 billion in 2024 and is expected to reach USD 3.6 billion by 2034, growing at a CAGR of 5.5%. This regional dominance can be attributed to the high burden of NSAID-related complications and H. pylori cases. A well-established healthcare framework, better access to advanced medications, and increasing awareness regarding gastrointestinal care and preventive health all contribute to the region's strong market position. Additionally, the active presence of leading pharmaceutical companies continues to support growth in this region.

Major players in the Global Peptic Ulcers Treatment Industry include Takeda, GlaxoSmithKline, Cadila Healthcare, Aurobindo Pharma, Ranbaxy Laboratories, Pfizer, Dr. Reddy's Laboratories, Strides Pharma, Phathom Pharmaceuticals, Granules India, AstraZeneca, Sun Pharma, Eisai, and Azurity Pharmaceuticals. To solidify their market positions, key players in the peptic ulcer treatment space are focusing on diverse strategic initiatives. Many are investing heavily in R&D to develop new therapies with higher efficacy and lower side effects. Formulation improvements, especially around combination drug regimens, are aimed at increasing treatment adherence and minimizing recurrence.

Companies are also expanding their manufacturing capabilities and strengthening their global supply chains to ensure wider access to treatment. Additionally, firms are entering strategic partnerships and engaging in mergers and acquisitions to broaden their portfolios and geographical presence. Targeted awareness campaigns and physician education programs further enhance product visibility and brand credibility, especially in emerging healthcare markets where diagnostic and treatment rates are steadily climbing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug type

- 2.2.3 Ulcer type

- 2.2.4 Medication type

- 2.2.5 Route of administration

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of Helicobacter pylori Infections

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Expanding R&D fundings and activities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects of long-term PPI use

- 3.2.3 Market opportunities

- 3.2.3.1 Novel therapies & drug delivery innovations

- 3.2.3.2 Expansion of online pharmacies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Proton pump inhibitors (PPIs)

- 5.3 H2-receptor antagonists

- 5.4 Antacids

- 5.5 Antibiotics

- 5.6 Cytoprotective agents

- 5.7 Other drug types

Chapter 6 Market Estimates and Forecast, By Ulcer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gastric ulcers

- 6.3 Duodenal ulcers

- 6.4 Esophageal ulcers

Chapter 7 Market Estimates and Forecast, By Medication Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Branded

- 7.3 Generics

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral Parenteral

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AstraZeneca

- 11.2 Aurobindo Pharma

- 11.3 Azurity Pharmaceuticals

- 11.4 Cadila Healthcare

- 11.5 Dr. Reddy’s Laboratories

- 11.6 Eisai

- 11.7 GlaxoSmithKline

- 11.8 Granules India

- 11.9 Pfizer

- 11.10 Phathom Pharmaceuticals

- 11.11 Ranbaxy Laboratories

- 11.12 Strides Pharma

- 11.13 Sun Pharma

- 11.14 Takeda