|

市場調查報告書

商品編碼

1782093

腐植酸和黃腐酸基生物刺激素市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Humic and Fulvic Acid-Based Biostimulants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

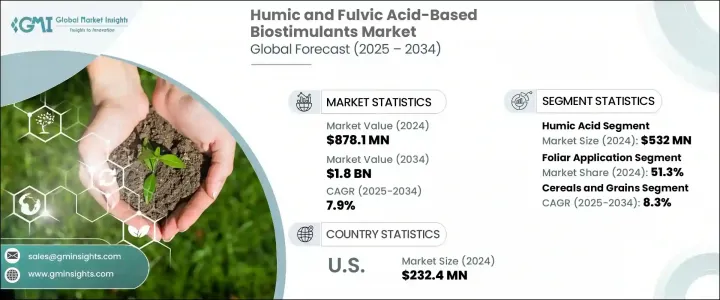

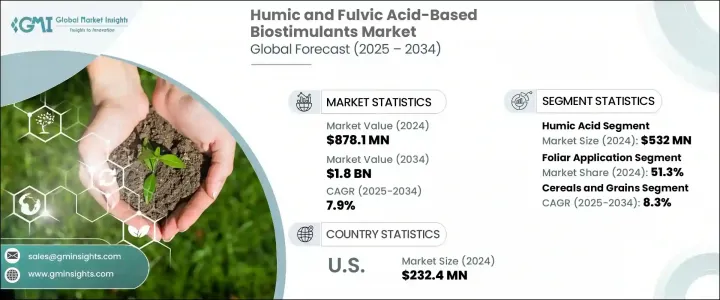

2024年,全球腐植酸和黃腐酸類生物刺激素市場價值8.781億美元,預計2034年將以7.9%的複合年成長率成長,達到18億美元。市場成長的主要動力源自於人們對環保農業實踐的日益重視,以及對提高土壤肥力和作物產量的迫切需求。這些生物刺激素由天然有機化合物組成,在改善養分吸收、增強土壤結構和幫助作物更有效地應對環境壓力方面發揮關鍵作用。隨著農民更加重視生產力和永續性,這些物質已成為水果、蔬菜、穀物和草坪管理系統等各領域作物營養策略中不可或缺的一部分。

它們能夠促進根系發育、提高養分生物利用度並改善土壤微生物群落,使其成為精準農業技術中不可或缺的一部分。腐植酸和黃腐酸類生物刺激素有助於提高土壤保水性和通氣性,即使在惡劣條件下也能促進植物更健康的生長。它們也有助於減少對合成肥料的依賴,順應向生態意識和有機農業實踐的轉變。隨著全球農業的發展,種植者擴大使用這些生物刺激素,不僅是為了提高產量,也是為了確保土壤的長期肥力,增強對氣候變遷的適應力,並支持再生農業模式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.781億美元 |

| 預測值 | 18億美元 |

| 複合年成長率 | 7.9% |

在各類產品中,腐植酸市場領先,2024 年估值達 5.32 億美元。其價值在於高碳濃度和分子複雜性,使其成為增強微生物活性和土壤結構的理想選擇。腐植酸鉀以其水溶性佳、適用於葉面施肥和灌溉施肥系統而聞名,也因其易於施用和對養分吸收的影響而備受青睞。黃腐酸雖然市場佔有率較小,但由於其在植物養分運輸和抗逆性方面發揮的作用,其市場正在成長。

葉面施肥領域在2024年佔據了最大的市場佔有率,達到51.3%,預計在2025-2034年期間的複合年成長率將達到7.6%。這種施用方式因其能夠直接輸送養分、提高效率並減少浪費而持續受到歡迎。其產品系列包括腐植酸、黃腐酸、腐植酸鉀和腐殖酸鈉、混合配方以及先進的功能化產品,每種產品均經過量身定做,可在不同的種植體系中提供特定的農藝效益。

2024年,美國腐植酸和黃腐酸類生物刺激素市場規模達2.324億美元。這一成長源於人們對再生農業和土壤健康管理的大力推動。這些生物刺激素有助於增強根系,促進枝葉生長,並提高種子發芽率。其用途廣泛,涵蓋玉米、番茄、小麥、大豆、黃瓜、柑橘和葡萄等作物。腐植酸和黃腐酸均支持pH值調節,使其在溫室和田間生產模式中具有極強的適應性。

引領這一市場的領導企業包括拜耳股份公司、UPL有限公司、瓦拉格羅公司、諾維信公司和巴斯夫公司。為了鞏固其在腐植酸和黃腐酸基生物刺激素市場的佔有率,各公司正專注於幾項核心策略。他們高度重視研發創新,持續開發高效能、針對特定作物的配方。領先的公司正在投資環保生產流程,並採購永續原料,以符合全球永續發展目標。透過分銷合作夥伴關係和在地化生產設施向新興市場擴張,有助於企業在降低成本的同時擴大業務規模。各公司也積極進行策略性收購和合作,以整合互補技術並擴展其產品組合。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel 分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 腐植酸

- 黃腐酸

- 腐植酸鉀

- 腐植酸鈉

- 腐植酸混合物

- 特種和功能化產品

第6章:市場估計與預測:按應用 2021 - 2034

- 主要趨勢

- 葉面施肥

- 土壤應用

- 種子處理

- 水肥一體化和水耕系統

- 根浸種及移植應用

第7章:市場估計與預測:按作物類型,2021 - 2034 年

- 主要趨勢

- 穀物和穀類

- 小麥的應用和益處

- 水稻生產系統

- 玉米和玉米的應用

- 其他穀物(大麥、燕麥、高粱)

- 水果和蔬菜

- 樹果和果園

- 蔬菜生產

- 漿果生產

- 特種漿果作物

- 草坪和觀賞植物

- 高爾夫球場管理

- 運動場應用

- 景觀和住宅草坪

- 觀賞植物生產

- 大田作物和工業應用

- 油籽作物

- 纖維作物

- 糖料作物

- 飼料和牧草

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- MEA 其餘地區

第9章:公司簡介

- Agrinos AS

- Agro Bio Chemicals

- AgTonik, LLC

- BASF SE

- Bayer AG (Crop Science Division)

- Biostadt India Limited

- Bio-Tech Pharmacal, Inc.

- Fertrell Company

- FMC Corporation

- Groupe Roullier

- Humatech (Pty) Ltd.

- Humic Growth Solutions

- Humintech GmbH

- ICL Group Ltd.

- Koppert Biological Systems

- Marrone Bio Innovations, Inc.

- Mycsa AG

- Novozymes A/S

- Nutri-Tech Solutions Pty Ltd.

- OMEX Agriculture Ltd.

- Saint Humic Acid

- Shenyang Humate Technology Co., Ltd.

- Tradecorp International

- UPL Limited

- Valagro SpA

The Global Humic and Fulvic Acid-Based Biostimulants Market was valued at USD 878.1 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 1.8 billion by 2034. The market is primarily fueled by the growing emphasis on environmentally responsible farming practices and the urgent need to boost soil fertility and crop yields. These biostimulants, composed of naturally derived organic compounds, play a key role in improving nutrient absorption, enhancing soil structure, and helping crops manage environmental pressures more effectively. As farmers focus more on productivity and sustainability, these substances have become an integral component of crop nutrition strategies across various segments, including fruits, vegetables, cereals, and turf management systems.

Their ability to enhance root development, increase nutrient bioavailability, and improve soil microbiology has made them essential in precision farming techniques. Humic and fulvic acid-based biostimulants contribute to better water retention and soil aeration, which supports healthier plant growth even in adverse conditions. They also help reduce dependency on synthetic fertilizers, aligning with the shift toward eco-conscious and organic farming practices. As global agriculture evolves, growers are increasingly turning to these biostimulants not only to boost yield but also to ensure long-term soil fertility, promote resilience against climate variability, and support regenerative farming models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $878.1 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 7.9% |

Among product categories, humic acid leads the market, reaching a valuation of USD 532 million in 2024. Its value lies in its high carbon concentration and molecular complexity, making it ideal for enhancing microbial activity and soil structure. Potassium humate, known for its water solubility and suitability in foliar and fertigation systems, is also gaining strong traction for its ease of application and impact on nutrient assimilation. Fulvic acid, though a smaller segment, is growing due to its role in nutrient transport and stress resistance in plants.

The foliar application segment held the largest market share of 51.3% in 2024 and is expected to grow at a 7.6% CAGR during 2025-2034. This application method continues to gain popularity as it enables direct nutrient delivery, improving efficiency and minimizing waste. The product lineup includes humic acid, fulvic acid, potassium and sodium humate, blended formulations, and advanced functionalized options-each tailored to deliver specific agronomic benefits across different cropping systems.

United States Humic and Fulvic Acid-Based Biostimulants Market was valued at USD 232.4 million in 2024. This growth stems from a strong push toward regenerative farming and soil health management. These biostimulants contribute to stronger root systems, more vigorous shoot and leaf development, and better seed germination. Their usage spans a wide range of crops, including maize, tomatoes, wheat, soybeans, cucumbers, citrus, and grapes. Both humic and fulvic acids support pH regulation, making them highly adaptable across greenhouse and field production models.

Leading players shaping this market include Bayer AG, UPL Limited, Valagro S.p.A., Novozymes A/S, and BASF SE. To strengthen their presence, companies in the humic and fulvic acid-based biostimulants market are focusing on several core strategies. A major emphasis is being placed on research and innovation, with continuous development of high-efficiency, crop-specific formulations. Leading firms are investing in eco-friendly manufacturing processes and sourcing sustainable raw materials to align with global sustainability goals. Expansion into emerging markets through distribution partnerships and localized production facilities helps players scale their operations while reducing costs. Firms are also engaging in strategic acquisitions and collaborations to integrate complementary technologies and expand their product portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Crop type

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Humic acid

- 5.3 Fulvic acid

- 5.4 Potassium humate

- 5.5 Sodium humate

- 5.6 Humic fulvic acid blends

- 5.7 Speciality and functionalized products

Chapter 6 Market Estimates and Forecast, By Application 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Foliar application

- 6.3 Soil application

- 6.4 Seed treatment

- 6.5 Fertigation and hydroponic systems

- 6.6 Root dipping and transplant application

Chapter 7 Market Estimates and Forecast, By Crop type, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cereals and grains

- 7.2.1 Wheat applications and benefits

- 7.2.2 Rice production systems

- 7.2.3 Corn and maize applications

- 7.2.4 Other cereals (barley, oats, sorghum)

- 7.3 Fruits and vegetables

- 7.3.1 Tree fruits and orchards

- 7.3.2 Vegetable production

- 7.3.3 Berry production

- 7.3.4 Specialty berry crops

- 7.4 Turf and ornamentals

- 7.4.1 Golf course management

- 7.4.2 Sports field applications

- 7.4.3 Landscape and residential turf

- 7.4.4 Ornamental plant production

- 7.5 Field crops and industrial applications

- 7.5.1 Oilseed crops

- 7.5.2 Fiber crops

- 7.5.3 Sugar crops

- 7.5.4 Forage and pasture

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Agrinos AS

- 9.2 Agro Bio Chemicals

- 9.3 AgTonik, LLC

- 9.4 BASF SE

- 9.5 Bayer AG (Crop Science Division)

- 9.6 Biostadt India Limited

- 9.7 Bio-Tech Pharmacal, Inc.

- 9.8 Fertrell Company

- 9.9 FMC Corporation

- 9.10 Groupe Roullier

- 9.11 Humatech (Pty) Ltd.

- 9.12 Humic Growth Solutions

- 9.13 Humintech GmbH

- 9.14 ICL Group Ltd.

- 9.15 Koppert Biological Systems

- 9.16 Marrone Bio Innovations, Inc.

- 9.17 Mycsa AG

- 9.18 Novozymes A/S

- 9.19 Nutri-Tech Solutions Pty Ltd.

- 9.20 OMEX Agriculture Ltd.

- 9.21 Saint Humic Acid

- 9.22 Shenyang Humate Technology Co., Ltd.

- 9.23 Tradecorp International

- 9.24 UPL Limited

- 9.25 Valagro S.p.A.