|

市場調查報告書

商品編碼

1773461

碳市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Spin on Carbon Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

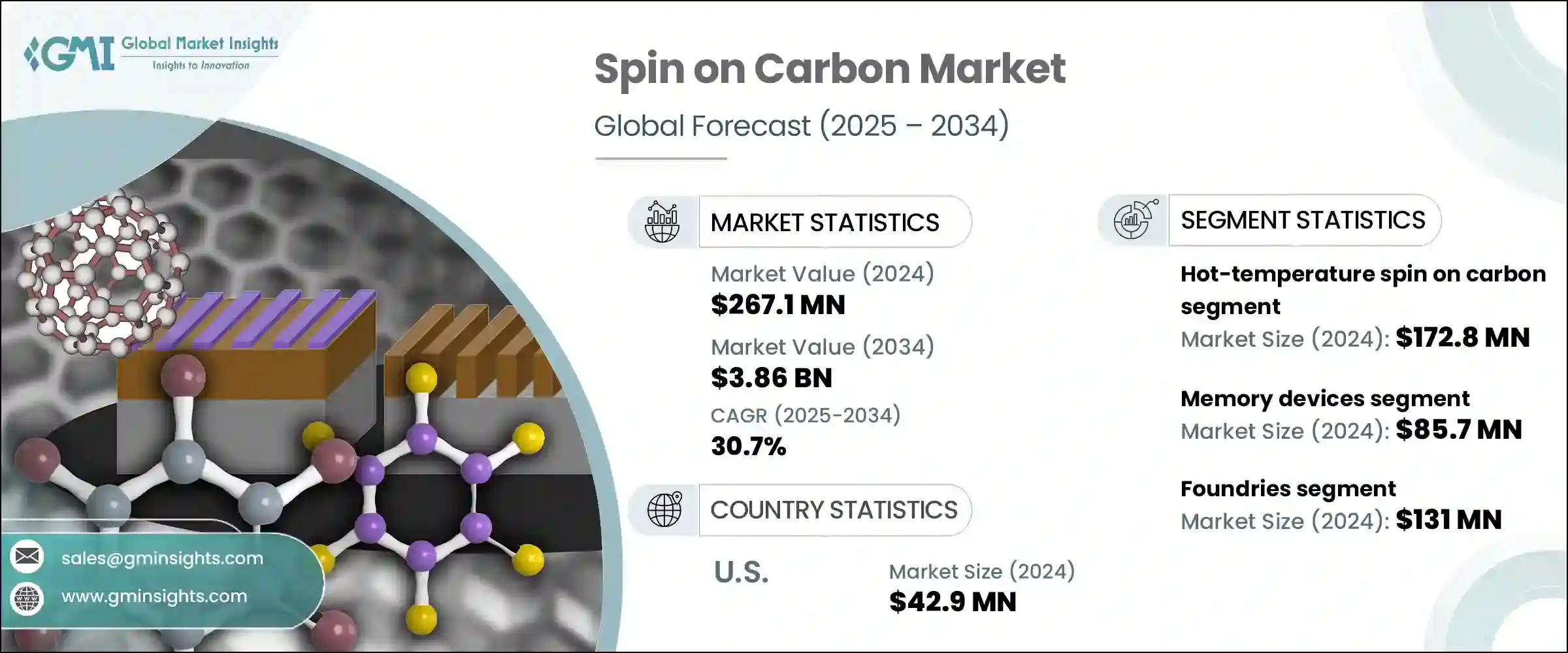

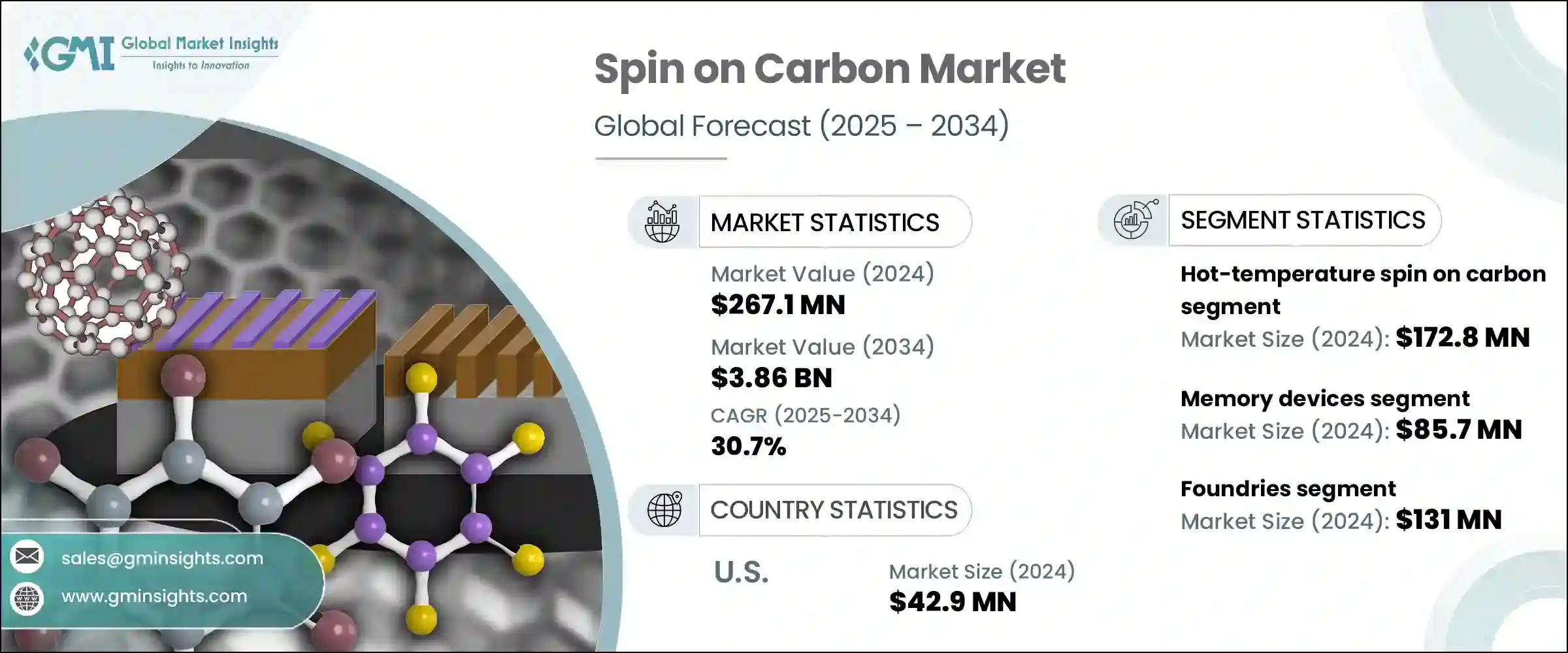

2024年,全球旋塗碳市場規模達2.671億美元,預計2034年將以30.7%的複合年成長率成長,達到38.6億美元。這項快速擴張主要得益於代工廠投資的不斷成長以及極紫外線(EUV)微影技術的日益普及。隨著人工智慧、高效能運算和5G等行業的持續發展,領先的代工廠正在擴大其製造能力,這增加了對旋塗碳等材料的需求。

系統單晶片 (SoC) 是半導體生產的關鍵組件,尤其是在先進的晶片設計中,它能夠提供抗蝕刻性能並實現均勻的薄膜塗覆。晶片設計的演變,加上半導體製造流程的不斷發展,推動了市場對旋塗碳材料的需求。此外,半導體製造向 EUV 光刻技術的轉變,以其能夠創建超精細特徵的能力而聞名,進一步推動了市場的成長。 EUV 的採用對於開發更小、更強大的半導體裝置至關重要,而 SoC 材料對於實現精確的圖案轉移和提高 7 奈米以下節點的蝕刻精度至關重要,因此對市場的成長做出了重大貢獻。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.671億美元 |

| 預測值 | 38.6億美元 |

| 複合年成長率 | 30.7% |

2024年,高溫旋塗碳材料佔最大市場佔有率,價值1.728億美元。隨著半導體應用(尤其是高速處理器和記憶體晶片)對更高的熱穩定性和更低的介電常數的需求,高溫SoC材料的發展勢頭強勁。這些材料是先進封裝技術和3D積體電路的理想選擇,這些技術和積體電路需要能夠承受高溫而不發生性能劣化的材料。半導體裝置的日益小型化也推動了對高溫SoC材料的需求,尤其是在銅互連技術領域。

2024年,儲存裝置市場價值達8,570萬美元,這得益於其在低k電介質和互連製造中的重要作用。這些材料對於支援雲端運算、人工智慧和5G等尖端應用中的高速資料傳輸至關重要,而效能和效率在這些應用中至關重要。隨著記憶體架構的不斷縮小和堆疊記憶體技術的不斷發展,材料滿足日益嚴格的需求的壓力也越來越大。隨著裝置朝向更小節點和更高密度配置發展,對SoC材質的需求變得更加關鍵。

2024年,美國旋塗碳產業產值達4,290萬美元。美國在航太創新領域的領先地位推動了對旋塗碳等先進材料的需求,這些材料可用於製造國防和飛機應用中的輕質高強度零件。此外,向風能和太陽能等再生能源的轉變,也推動了儲能系統對耐用輕質碳基材料的需求。汽車電氣化趨勢的日益成長,進一步刺激了輕質電池零件和熱管理系統對旋塗碳的需求,確保美國在市場上保持主導地位。

旋塗碳產業的主要參與者包括 Brewer Science, Inc.、杜邦、DONGJIN SEMICHEM CO LTD、Applied Materials, Inc.、Merck KGaA、JSR Micro, Inc.、Irresistible Materials、Shin-Etsu Chemical Co., Ltd.、Nano-C、KOYJ Co.M Ltd. Ltd., Ltd.、Nano-C、KOYJ Co.M Ltd., Ltd. 和 SDI Ltd., Ltd. 和 SDI.為了鞏固市場地位,旋塗碳產業的公司正專注於技術進步和材料創新。

他們正在大力投入研發,以提高旋塗碳在半導體製造過程中的性能,尤其是在 7 奈米以下等超先進節點。與代工廠和半導體製造商建立策略合作夥伴關係也至關重要,以確保與最新製造技術的兼容性。此外,各公司正在擴展其產品線,以滿足再生能源和航太等各行各業日益成長的需求。在維持高品質標準的同時,精簡生產流程、降低成本,對於在這個快速發展的市場中提升競爭力至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 半導體產業節點尺寸不斷縮小

- EUV微影技術的採用率不斷提高

- 不斷成長的代工投資

- 增強抗蝕刻性和薄膜均勻性

- 先進封裝的應用日益廣泛

- 產業陷阱與挑戰

- 材料和加工成本高

- 環境和廢棄物管理問題

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 永續性措施

- 消費者情緒分析

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各區域市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 高溫碳旋

- 常溫自旋碳

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 邏輯元件

- 儲存裝置

- 功率元件

- 微機電系統

- 光子學

- 先進封裝

- 其他

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 鑄造廠

- 整合設備製造商

- 外包半導體組裝和測試

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Applied Materials, Inc.

- Brewer Science, Inc.

- DONGJIN SEMICHEM CO LTD

- DuPont

- Irresistible Materials

- JSR Micro, Inc.

- KOYJ Co., Ltd.

- Merck KGaA

- Nano-C

- Samsung SDI Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- YCCHEM CO.,Ltd.

The Global Spin on Carbon Market was valued at USD 267.1 million in 2024 and is estimated to grow at a CAGR of 30.7% to reach USD 3.86 billion by 2034. This rapid expansion is primarily driven by the growing investments in foundries and the increasing adoption of extreme ultraviolet (EUV) lithography. As industries such as artificial intelligence, high-performance computing, and 5G continue to rise, leading foundries are scaling up their manufacturing capabilities, which increases the demand for materials like spin-on carbon.

SoC serves as a crucial component in semiconductor production, especially in advanced chip designs, providing etch resistance and enabling uniform film coating. This evolution in chip design, paired with rising semiconductor manufacturing, propels the demand for spin-on carbon in the market. Additionally, the shift toward EUV lithography in semiconductor fabrication, known for its ability to create ultra-fine features, further fuels the market growth. The adoption of EUV is critical to developing smaller, more powerful semiconductor devices, and SoC materials are essential in enabling accurate pattern transfer and enhancing etching precision in sub-7nm nodes, thus contributing significantly to the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $267.1 Million |

| Forecast Value | $3.86 Billion |

| CAGR | 30.7% |

In 2024, the hot-temperature spin-on carbon segment accounted for the largest market share, valued at USD 172.8 million. As semiconductor applications, particularly high-speed processors and memory chips, demand better thermal stability and low dielectric constant, hot-temperature SoCs have gained momentum. These materials are ideal for advanced packaging technologies and 3D integrated circuits, which require materials capable of enduring high process temperatures without degradation. The increasing miniaturization of semiconductor devices also drives the demand for hot-temperature SoCs, especially in copper interconnect technologies.

The memory device segment was valued at USD 85.7 million in 2024, driven by their essential role in the fabrication of low-k dielectrics and interconnects. These materials are crucial for supporting high-speed data transfer in cutting-edge applications such as cloud computing, AI, and 5G, where performance and efficiency are paramount. As memory architecture continues to shrink and stacked memory technologies evolve, the pressure on materials to meet increasingly stringent demands has grown. The need for SoC materials becomes even more critical as devices move towards smaller nodes and higher-density configurations.

U.S. Spin on Carbon Industry generated USD 42.9 million in 2024. The country's leadership in aerospace innovation drives the demand for advanced materials like spin-on carbon, used in lightweight, high-strength components for defense and aircraft applications. Additionally, the shift toward renewable energy sources, such as wind and solar, is boosting the need for durable and lightweight carbon-based materials in energy storage systems. The growing trend toward vehicle electrification is further fueling demand for spin-on carbon in lightweight battery components and thermal management systems, ensuring the U.S. remains a dominant force in the market.

Key players in the Spin on Carbon Industry include Brewer Science, Inc., DuPont, DONGJIN SEMICHEM CO LTD, Applied Materials, Inc., Merck KGaA, JSR Micro, Inc., Irresistible Materials, Shin-Etsu Chemical Co., Ltd., Nano-C, KOYJ Co., Ltd., YCCHEM CO., Ltd., Samsung SDI Co., Ltd. To strengthen their market position, companies in the spin-on carbon industry are focusing on technological advancements and material innovations.

They are investing heavily in research and development to improve the performance of spin-on carbon in semiconductor manufacturing processes, particularly in ultra-advanced nodes like sub-7nm. Strategic partnerships with foundries and semiconductor manufacturers are also critical to ensure compatibility with the latest fabrication technologies. Additionally, companies are expanding their product offerings to meet the growing demand across diverse industries, including renewable energy and aerospace. Efforts to streamline production processes and reduce costs while maintaining high-quality standards are central to enhancing competitiveness in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material type trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shrinking node sizes in semiconductor industry

- 3.2.1.2 Increased adoption of EUV lithography

- 3.2.1.3 Growing foundry investments

- 3.2.1.4 Enhanced etch resistance and film uniformity

- 3.2.1.5 Rising use in advanced packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High material and processing costs

- 3.2.2.2 Environmental and waste management concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ Startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hot-temperature spin on carbon

- 5.3 Normal-temperature spin on carbon

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Logic devices

- 6.3 Memory devices

- 6.4 Power devices

- 6.5 Micro-electromechanical systems

- 6.6 Photonics

- 6.7 Advanced packaging

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Foundries

- 7.3 Integrated device manufacturers

- 7.4 Outsourced semiconductor assembly & test

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Applied Materials, Inc.

- 9.2 Brewer Science, Inc.

- 9.3 DONGJIN SEMICHEM CO LTD

- 9.4 DuPont

- 9.5 Irresistible Materials

- 9.6 JSR Micro, Inc.

- 9.7 KOYJ Co., Ltd.

- 9.8 Merck KGaA

- 9.9 Nano-C

- 9.10 Samsung SDI Co., Ltd.

- 9.11 Shin-Etsu Chemical Co., Ltd.

- 9.12 YCCHEM CO.,Ltd.