|

市場調查報告書

商品編碼

1773455

AGM VRLA 電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AGM VRLA Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

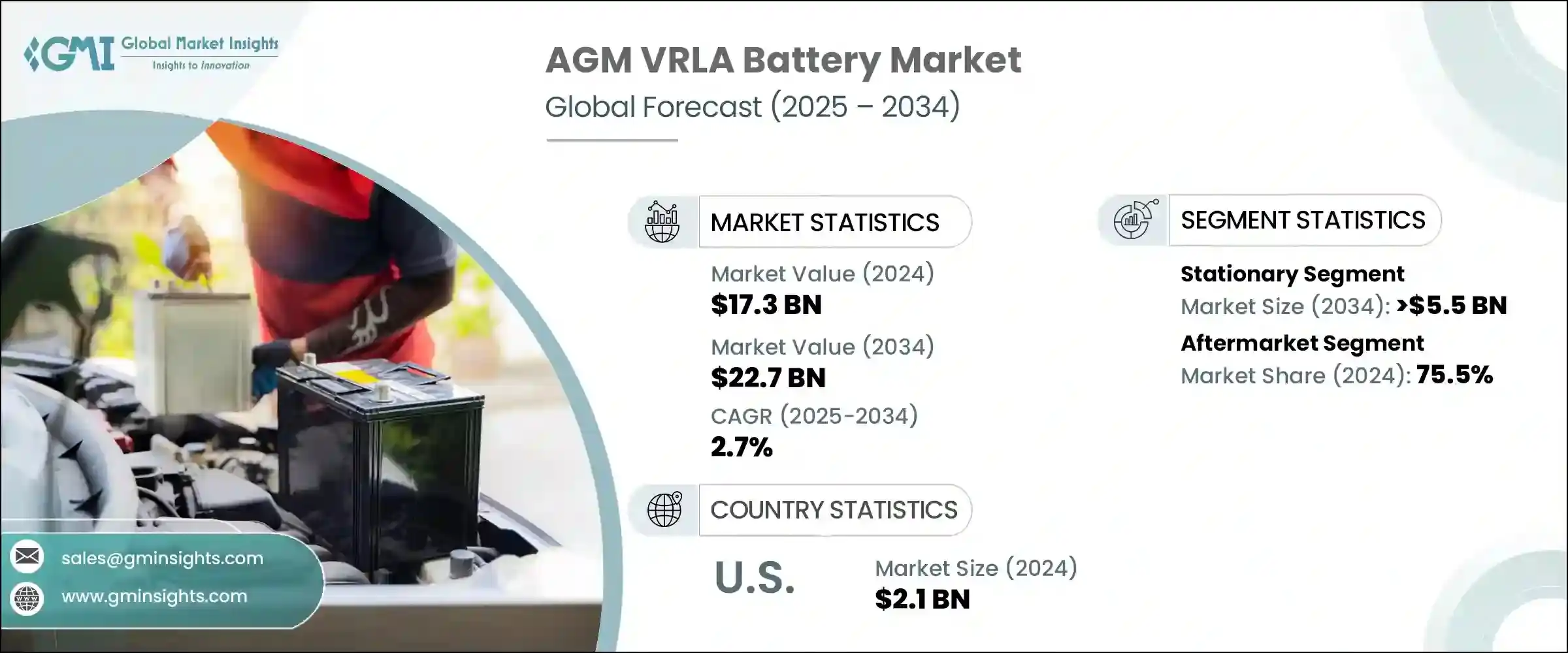

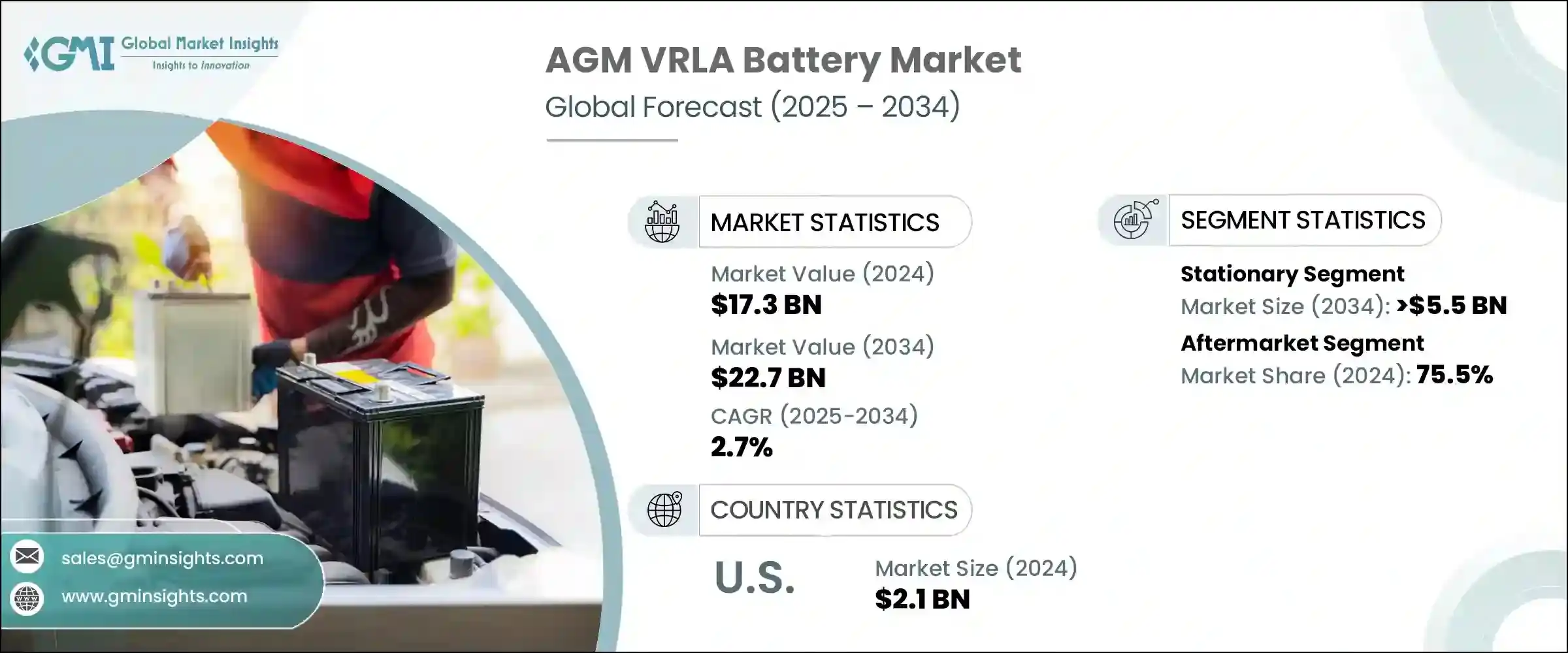

2024年,全球AGM VRLA電池市場規模達173億美元,預計2034年將以2.7%的複合年成長率成長,達到227億美元。隨著各行各業對可靠、低維護和耐用的儲能解決方案的重視,對吸收性玻璃纖維墊閥控鉛酸(AGM VRLA)電池的需求持續成長。電池極板架構和增強型玻璃纖維墊壓縮技術的技術進步正在推動電池性能的提升,尤其是在再生能源、電信和電動車等領域的深度放電應用中。

這些系統採用經過最佳化的玻璃纖維墊,孔隙率更高,吸酸能力更強,可減少分層,延長充電週期,並延長電池壽命,這些特性對於現代離網和電網支援應用至關重要。 AGM VRLA 電池的成本效益也使其成為太陽能系統和農村電氣化專案的理想選擇,尤其是在鋰替代品價格過高或尚不可行的地區。全球對發展中經濟體能源可近性和脫碳的推動正在塑造該市場的未來發展軌跡。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 173億美元 |

| 預測值 | 227億美元 |

| 複合年成長率 | 2.7% |

AGM VRLA 電池在混合能源系統中的整合度不斷提升,通常與鋰離子電池組配合使用以實現負載平衡,這進一步提升了其重要性。這些系統因其與智慧電池管理系統 (BMS) 的兼容性而備受青睞,BMS 可提供精確的健康診斷、更精準的運行時間估算和生命週期追蹤。隨著分散式電源需求的成長,微電網和分散式再生能源系統擴大採用 AGM VRLA 電池,以確保穩定性和成本控制。

預計到2034年,AGM VRLA電池市場的固定式部分將達到55億美元,主要得益於關鍵任務設施對持續供電的需求。這類電池因其密封防漏設計以及幾乎無需日常維護的特點,在資料中心、醫院系統、電信基礎設施和緊急控制單元中廣受歡迎。其緊湊的外形和高能量密度使其能夠有效部署在城市基礎設施和對正常運行時間要求嚴格的獨立設施中。隨著全球網際網路使用量的成長和數位基礎設施的擴張,對可靠、始終線上備用電源的需求也在迅速成長,這使得固定式AGM VRLA系統成為系統整合商和公用事業規劃人員的首選。

至2034年,AGM VRLA電池市場的OEM細分市場將以2.9%的複合年成長率成長。汽車行業的原始設備製造商擴大將AGM VRLA電池整合到其車輛平台中,尤其是在混合動力和電動堆高機領域。這些電池具有更好的循環穩定性和抗振性,是商用和非公路電動旅行解決方案的理想選擇。運輸和物流行業日益成長的電氣化趨勢,以及對永續倉儲解決方案的需求不斷成長,正在加速這些電池的普及。堆高機製造商正在利用AGM VRLA技術,為室內作業提供高效、低維護的電動解決方案。

2024年,美國AGM VRLA電池市場規模達21億美元,反映備用電源基礎設施的穩定投資。聯邦政府致力於交通和通訊網路現代化,推動AGM VRLA電池的部署,以支援冗餘系統,尤其是在關鍵任務領域。醫療保健、資料管理和電信領域對正常運作時間和可靠性的嚴格標準不斷推行,持續提振了市場需求。此外,在緊急應變和關鍵行動中要求配備備用能源儲存的法規的實施,進一步刺激了產品的普及。隨著基礎設施的持續更新和對分散式能源系統的日益依賴,美國市場在預測期內仍將是重要的收入來源。

影響該市場的主要參與者包括 EnerSys、HOPPECKE Batterien、Clarios、GS Yuasa International、EXIDE INDUSTRIES、JYC BATTERY MANUFACTURER、Microtex Energy、MUST ENERGY、NorthBatt、Okaya Power、Caterpillar、 Evertar InternationalChamp Group、深圳市 Power、深圳立山驅動器。 AGM VRLA 電池市場的公司正在推行以創新為中心的策略,以保持其競爭地位。

他們正在積極改進極板和隔膜技術,以提高充電效率和循環壽命,尤其適用於電信和太陽能儲能等高需求應用。許多製造商正在投資智慧電池管理系統,以提供遠端診斷、預測性維護警報和即時效能追蹤。永續性也是關注的重點——企業正在採用環保材料和回收工藝,以減少對環境的影響並遵守不斷變化的法規。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 固定式

- 電信

- UPS

- 控制和開關設備

- 其他

- 動機

- 速連

- 汽車

- 摩托車

第6章:市場規模及預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 奧地利

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 泰國

- 菲律賓

- 越南

- 新加坡

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 埃及

- 土耳其

- 摩洛哥

- 南非

- 奈及利亞

- 阿爾及利亞

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 智利

第8章:公司簡介

- C&D技術

- 毛蟲

- 冠軍電力科技

- 克拉里奧

- 能源系統公司

- 埃克塞德工業公司

- GS湯淺國際

- HOPPECKE 電池

- JYC電池製造商

- 理士國際技術

- Microtex 能源

- 必需能量

- 穆特魯電池

- 北營

- 岡谷電力

- 瑞達國際集團

- 山東聖陽電源

- 深圳市恆越實業有限公司

The Global AGM VRLA Battery Market was valued at USD 17.3 billion in 2024 and is estimated to grow at a CAGR of 2.7% to reach USD 22.7 billion by 2034. The demand for absorbent glass mat valve-regulated lead-acid (AGM VRLA) batteries continues to expand as industries emphasize reliable, low-maintenance, and durable energy storage solutions. Technological progress in battery plate architecture and enhanced glass mat compression techniques is driving performance improvements, especially in deep-discharge applications across sectors such as renewable energy, telecom, and electric mobility.

With optimized fiberglass mats offering higher porosity and acid absorption, these systems reduce stratification, improve charge cycles, and extend battery life-critical attributes for modern off-grid and grid-support applications. The cost-efficiency of AGM VRLA batteries also makes them ideal for solar-powered systems and rural electrification programs, especially in regions where lithium alternatives are either too expensive or not yet viable. The global push for energy access and decarbonization in developing economies is shaping the future trajectory of this market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.3 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 2.7% |

The growing integration of AGM VRLA batteries in hybrid energy setups-often in tandem with lithium-ion packs for load balancing-continues to enhance their relevance. These systems are gaining traction due to their compatibility with intelligent battery management systems (BMS), which offer precise health diagnostics, improved runtime estimates, and lifecycle tracking. As demand for decentralized power rises, microgrids and distributed renewable systems increasingly adopt AGM VRLA batteries to ensure stability and cost control.

The stationary segment of the AGM VRLA battery market is anticipated to reach USD 5.5 billion by 2034, largely fueled by demand for continuous power supply across mission-critical facilities. These batteries are widely favored in data centers, hospital systems, telecom infrastructure, and emergency control units due to their sealed, leak-proof design and the fact that they require virtually no routine maintenance. Their compact form factor and high energy density allow for effective deployment in urban infrastructure and isolated installations where uptime is non-negotiable. As global internet usage grows and digital infrastructure expands, the need for dependable, always-on power backups is scaling rapidly, making stationary AGM VRLA systems a preferred choice for system integrators and utility planners alike.

The OEM segment in the AGM VRLA Battery Market will grow at a CAGR of 2.9% through 2034. Original equipment manufacturers in the automotive sector are increasingly integrating AGM VRLA batteries into their vehicle platforms, particularly in hybrid and electric forklift categories. These batteries offer better cycling stability and vibration resistance, which is ideal for commercial and off-highway electric mobility solutions. Rising electrification trends in the transport and logistics industries, along with increased demand for sustainable warehousing solutions, are accelerating the adoption of these batteries. Forklift manufacturers are leveraging AGM VRLA technology to deliver high-efficiency, low-maintenance electric solutions for indoor operations.

United States AGM VRLA Battery Market generated USD 2.1 billion in 2024, reflecting steady investment in backup power infrastructure. Federal initiatives focused on modernizing transportation and communication networks are propelling the deployment of AGM VRLA units in support of redundancy systems, especially in mission-critical sectors. The adoption of stringent standards for uptime and reliability in healthcare, data management, and telecommunications continues to bolster demand. Additionally, the enforcement of regulations requiring backup energy storage in emergency response and critical operations further stimulates product uptake. With ongoing infrastructure overhauls and expanding reliance on distributed energy systems, the U.S. market will remain a key revenue contributor through the forecast period.

Major players influencing this market space include EnerSys, HOPPECKE Batterien, Clarios, GS Yuasa International, EXIDE INDUSTRIES, JYC BATTERY MANUFACTURER, Microtex Energy, MUST ENERGY, NorthBatt, Okaya Power, Caterpillar, Ritar International Group, Shenzhen EverExceed Industrial, Mutlu Battery, C&D Technologies, Champion Power Tech, and Shandong Sacred Sun Power Sources. Companies in the AGM VRLA battery market are pursuing innovation-focused strategies to maintain their competitive positioning.

They are actively enhancing plate and separator technologies to improve charge efficiency and cycle life, particularly for high-demand applications like telecom and solar storage. Many manufacturers are investing in smart battery management systems to deliver remote diagnostics, predictive maintenance alerts, and real-time performance tracking. Sustainability is also a central focus-firms are adopting eco-friendly materials and recycling processes to reduce environmental impact and comply with evolving regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Stationary

- 5.2.1 Telecommunications

- 5.2.2 UPS

- 5.2.3 Control & switchgear

- 5.2.4 Others

- 5.3 Motive

- 5.4 SLI

- 5.4.1 Automobiles

- 5.4.2 Motorcycles

Chapter 6 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.3.6 Spain

- 7.3.7 Austria

- 7.3.8 Netherlands

- 7.3.9 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Philippines

- 7.4.10 Vietnam

- 7.4.11 Singapore

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Iran

- 7.5.4 Egypt

- 7.5.5 Turkey

- 7.5.6 Morocco

- 7.5.7 South Africa

- 7.5.8 Nigeria

- 7.5.9 Algeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Mexico

- 7.6.4 Chile

Chapter 8 Company Profiles

- 8.1 C&D Technologies

- 8.2 Caterpillar

- 8.3 Champion Power Tech

- 8.4 Clarios

- 8.5 EnerSys

- 8.6 EXIDE INDUSTRIES

- 8.7 GS Yuasa International

- 8.8 HOPPECKE Batterien

- 8.9 JYC BATTERY MANUFACTURER

- 8.10 leoch International Technology

- 8.11 Microtex Energy

- 8.12 MUST ENERGY

- 8.13 Mutlu Battery

- 8.14 NorthBatt

- 8.15 Okaya Power

- 8.16 Ritar International Group

- 8.17 Shandong Sacred Sun Power Sources

- 8.18 Shenzhen EverExceed Industrial