|

市場調查報告書

商品編碼

1773451

捲葉機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Leaf Rolling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

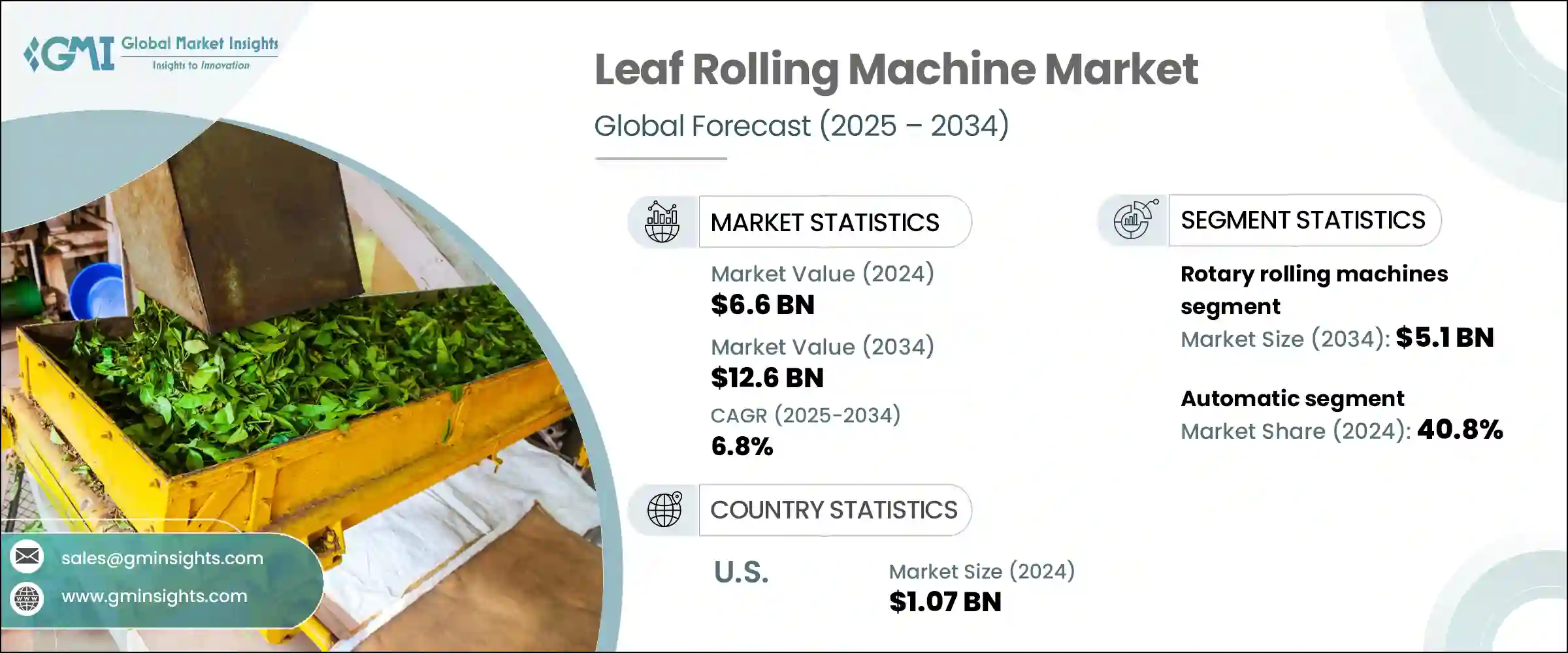

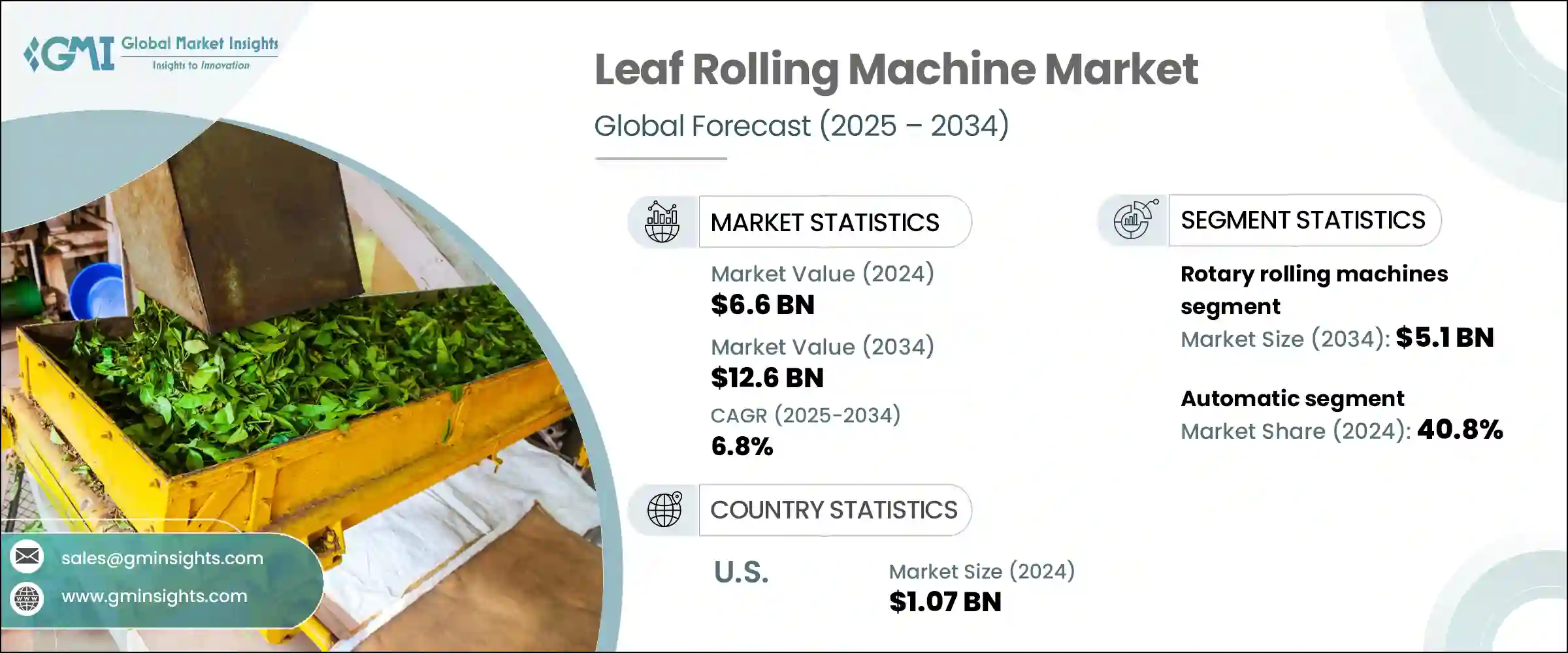

2024年,全球捲葉機市場規模達66億美元,預計到2034年將以6.8%的複合年成長率成長,達到126億美元。不斷成長的勞動成本和自動化的普及,促使菸草、茶葉和大麻等產業以機械化系統取代手工作業。現代化設施正擴大採用OPC UA等工業4.0協議,以實現即時監控和互通性。機械設備與管理系統之間的協調通訊提高了生產可視性並降低了整合成本,這在大批量生產環境中至關重要。配備這些智慧功能的捲葉機可在受監管行業中提供增強的最佳化、可追溯性和品質保證。政府和農業計畫正在支持自動化應用,以解決勞動力短缺問題並吸引年輕工人。

機器人技術資助和試點激勵等措施正在推動OEM)的創新和規模化發展,包括捲葉機製造商。這些支援性項目正在促進智慧製造工具的快速試驗,使原始設備製造商能夠將自動化、資料分析和物聯網功能整合到捲葉系統中。政府支持的撥款和補貼正在降低創新成本,並降低製造商採用先進機械的風險。因此,企業正在投資模組化設計原型,並在大型和小型農戶中啟動試點安裝。這種外部支援也加快了具有自適應捲葉精度、遠端診斷和節能運行等功能的下一代機器的上市時間。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 66億美元 |

| 預測值 | 126億美元 |

| 複合年成長率 | 6.8% |

旋轉捲菸機在2024年為該領域帶來了28億美元的收入,預計到2034年將達到51億美元。這些機器專為連續、高通量加工而設計,服務於雪茄、茶葉、大麻捲和草藥卷的大型生產商。這些機器在每小時數千台菸葉的生產過程中,仍能確保始終如一的質量,並且無需進行重大改造即可處理各種菸葉材料,從而為製造商提供了營運靈活性和豐厚的投資回報。

2024年,自動化機械市場規模達27億美元,佔40.8%。全自動捲板系統減少了勞動力需求和人為錯誤,這在薪資成長和勞動力短缺問題嚴峻的已開發地區尤其重要。這些系統能夠生產尺寸、重量和密度均勻的捲板,幫助製造商滿足嚴格的監管和品牌標準。其可擴展性使企業能夠適應需求波動,同時又不犧牲一致性。

2024年,美國捲菸機市場規模達10.7億美元,預計2025年至2034年的複合年成長率將達到6.4%。合法娛樂和醫用大麻在30多個州的快速擴張,引發了人們對自動化預捲菸生產設備的濃厚興趣。獲得許可的生產商正在投資全自動機器,以滿足GMP標準,減少對勞動力的依賴,並提供品質一致的預包裝產品。菸草和新興草本保健品牌也正在更新生產線,採用整合工業4.0功能的旋轉式和自動捲菸機。批次級可追溯性、無塵室相容性和機器人搬運等重點領域正在推動採購決策轉向高度數據驅動、技術含量高的機器。

全球捲葉機市場的主要參與者包括:GreenBroz Inc.、福州科士達機械有限公司、湖北品洋科技有限公司、深圳市哈納科技有限公司、Teamachinerys(ZC Machinery)、STM Canna、泉州市德力農林機械有限公司、泉州市威特茶葉機械有限公司、Haccoand LOM 工業有限公司、法新工業有限公司、機械式工業有限公司、機械式工業有限公司及金融工業有限公司。在這種競爭激烈的情況下,領先的製造商正在強調幾項策略舉措。

首先,他們正在大力投資工業4.0整合,例如即時資料平台和OPC UA合規性,以提供先進的可追溯性和品質控制。其次,各公司正在擴展其產品組合,提供可處理多種菸葉類型(菸草、大麻、茶葉)的客製化解決方案,從而為客戶提供營運靈活性。第三,各公司正在與農業和政府機構建立合作夥伴關係並獲得試點計畫資金,以加速自動化應用,並確保在新興市場取得早期成功。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業影響力量

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按系統

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 旋轉滾壓機

- 壓軋機

- 泡殼捲繞機

- 模具式滾壓機

第6章:市場估計與預測:按菸葉類型,2021 - 2034 年

- 主要趨勢

- 菸草

- 大麻或大麻葉

- 茶葉

- 檳榔葉和可食用葉子

- 其他

第7章:市場估計與預測:依自動化水平,2021 - 2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第8章:市場估計與預測:依生產能力,2021 - 2034 年

- 主要趨勢

- 低產能(<500 單位/小時)

- 中等產能(501-2,000 單位/小時)

- 高產能(>2,001 單位/小時)

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 工業的

- 商業的

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Fuzhou KeShiDa Machinery Co., Ltd.

- GreenBroz Inc.

- Hangzhou LOM Technology Co., Ltd.

- Hubei Pinyang Technology Co., Ltd.

- Langfang ShengXing Food Machinery Co,.Ltd

- Quanzhou Deli Agroforestrial Machinery Co., Ltd.

- Quanzhou Wit Tea Machinery Co., Ltd.

- Shenzhen Hana-Tech Co., Ltd.

- STM Canna

- Teamachinerys (ZC Machinery)

- Tobacco And Machines

- Zhengzhou Jawo Machinery Co., Ltd.

- Zhengzhou Wenming Machinery Co., Ltd.

The Global Leaf Rolling Machine Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 12.6 billion by 2034. Growing labor costs and the spread of automation are prompting industries like tobacco, tea, and cannabis to replace manual processes with mechanized systems. Modern facilities are increasingly implementing Industry 4.0 protocols such as OPC UA for real-time monitoring and interoperability. Harmonized communication between machinery and management systems improves production visibility and reduces integration costs, crucial in high-volume production environments. Leaf rolling machines equipped with these smart features deliver enhanced optimization, traceability, and quality assurance in regulated sectors. Government and agricultural programs are supporting automation adoption to tackle labor shortages and attract younger workers.

Initiatives such as robotics funding and pilot incentives are driving OEM innovation and scaling, including among makers of leaf rolling machines. These supportive programs are fostering rapid experimentation with intelligent manufacturing tools, enabling OEMs to integrate automation, data analytics, and IoT features into rolling systems. Government-backed grants and subsidies are lowering the cost of innovation and de-risking the adoption of advanced machinery for manufacturers. As a result, companies are investing in prototyping modular designs and launching pilot installations in both large-scale and smallholder operations. This external support is also accelerating time-to-market for next-gen machines with capabilities such as adaptive rolling precision, remote diagnostics, and energy-efficient operation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $12.6 Billion |

| CAGR | 6.8% |

Rotary rolling machines pulled segment in USD 2.8 billion in revenue in 2024 and are expected to reach USD 5.1 billion by 2034. Designed for continuous, high-throughput processing, they serve large-scale producers of cigars, tea, cannabis pre-rolls, and herbal wraps. These machines ensure consistent quality at thousands of units per hour and can handle diverse leaf materials without needing major modifications, giving manufacturers operational flexibility and strong returns on investment.

The automatic machine segment generated USD 2.7 billion in 2024 and held a 40.8% share. Fully automatic leaf rolling systems reduce labor needs and human error-particularly valuable in developed regions where wage growth and labor shortages are critical issues. These systems produce uniform roll dimensions, weights, and densities, helping manufacturers meet strict regulatory and brand standards. Their scalability enables businesses to adapt to demand fluctuations without sacrificing consistency.

U.S. Leaf Rolling Machine Market was valued at USD 1.07 billion in 2024 and is projected to grow at a CAGR of 6.4% from 2025 to 2034. The rapid expansion of legal recreational and medical cannabis across more than 30 states has driven strong interest in automated pre-roll production equipment. Licensed producers are investing in fully automatic machines to meet GMP standards, reduce labor dependency, and deliver consistent pre-packaged products. Tobacco and emerging herbal wellness brands are similarly updating production lines with rotary and automatic rollers integrated with Industry 4.0 features. Focus areas such as batch-level traceability, cleanroom compatibility, and robotic handling are shifting procurement decisions toward highly data-driven, technology-rich machinery.

Major players in the Global Leaf Rolling Machine Market include: GreenBroz Inc., Fuzhou KeShiDa Machinery Co., Ltd., Hubei Pinyang Technology Co., Ltd., Shenzhen Hana Tech Co., Ltd., Teamachinerys (ZC Machinery), STM Canna, Quanzhou Deli Agroforestrial Machinery Co., Ltd., Quanzhou Wit Tea Machinery Co., Ltd., Hangzhou LOM Technology Co., Ltd., Langfang ShengXing Food Machinery Co., Ltd., Tobaccoandmachines, Zhengzhou Jawo Machinery Co., Ltd., and Zhengzhou Wenming Machinery Co., Ltd. In this competitive landscape, leading manufacturers are emphasizing several strategic moves.

First, they are investing heavily in Industry 4.0 integration-such as real-time data platforms and OPC UA compliance-to provide advanced traceability and quality control. Second, firms are expanding their portfolios to offer customizable solutions that handle multiple leaf types (tobacco, cannabis, tea), giving customers operational flexibility. Third, companies are securing partnerships and pilot program funding with agricultural and government bodies to accelerate automation adoption and secure early-stage wins in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Machine Type

- 2.2.2 Leaf Type

- 2.2.3 Automation Level

- 2.2.4 Production Capacity

- 2.2.5 End Use

- 2.2.6 Distribution Channel

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By system

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Rotary Rolling Machines

- 5.3 Compression Rolling Machines

- 5.4 Blister Rolling Machines

- 5.5 Die-Based Rolling Machines

Chapter 6 Market Estimates & Forecast, By Leaf Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Tobacco

- 6.3 Cannabis or Hemp Leaves

- 6.4 Tea Leaves

- 6.5 Betel Leaves & Edible Leaves

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Automation Level, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates & Forecast, By Production Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low Capacity (<500 units/hour)

- 8.3 Medium Capacity (501-2,000 units/hour)

- 8.4 High Capacity (>2,001 units/hour)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Industrial

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct Sales

- 10.3 Indirect Sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 U.K.

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Fuzhou KeShiDa Machinery Co., Ltd.

- 12.2 GreenBroz Inc.

- 12.3 Hangzhou LOM Technology Co., Ltd.

- 12.4 Hubei Pinyang Technology Co., Ltd.

- 12.5 Langfang ShengXing Food Machinery Co,.Ltd

- 12.6 Quanzhou Deli Agroforestrial Machinery Co., Ltd.

- 12.7 Quanzhou Wit Tea Machinery Co., Ltd.

- 12.8 Shenzhen Hana-Tech Co., Ltd.

- 12.9 STM Canna

- 12.10 Teamachinerys (ZC Machinery)

- 12.11 Tobacco And Machines

- 12.12 Zhengzhou Jawo Machinery Co., Ltd.

- 12.13 Zhengzhou Wenming Machinery Co., Ltd.