|

市場調查報告書

商品編碼

1773412

冷拌瀝青市場機會、成長動力、產業趨勢分析及2025-2034年預測Cold Mix Asphalt Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

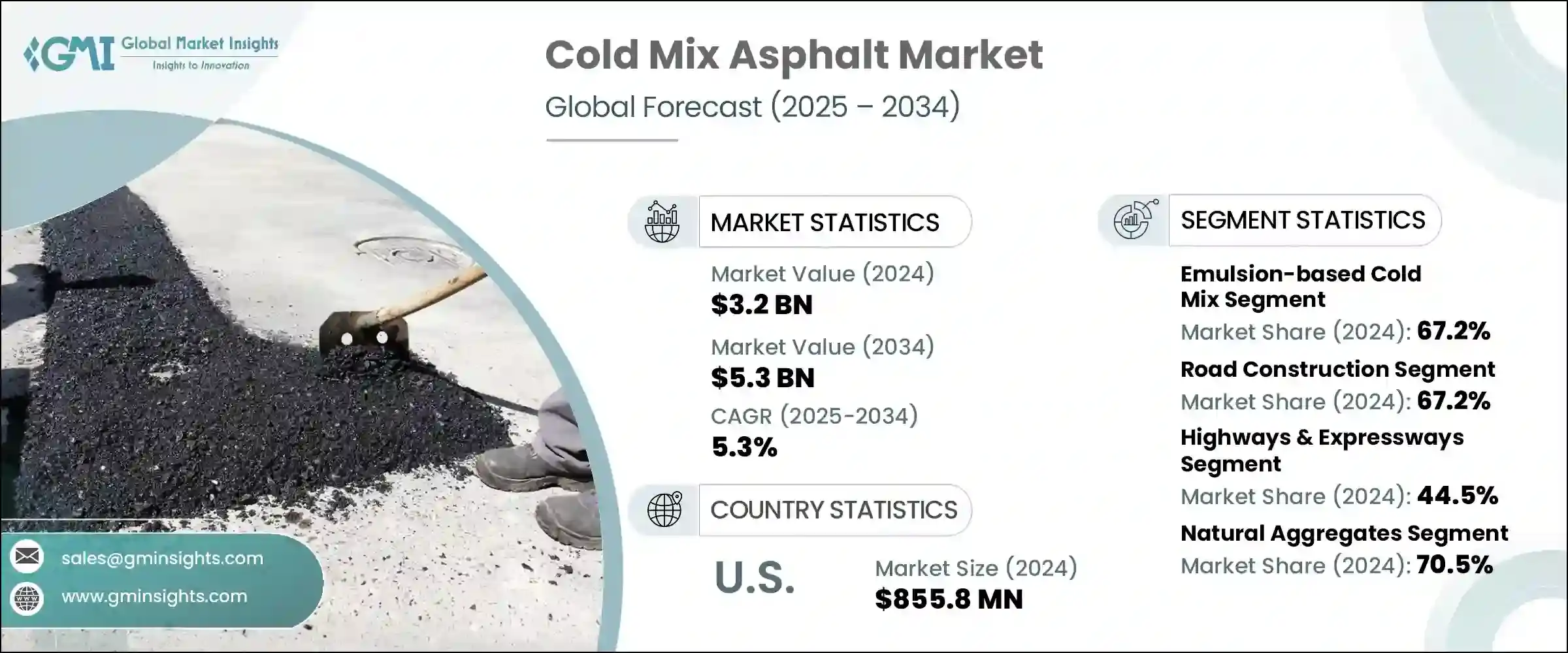

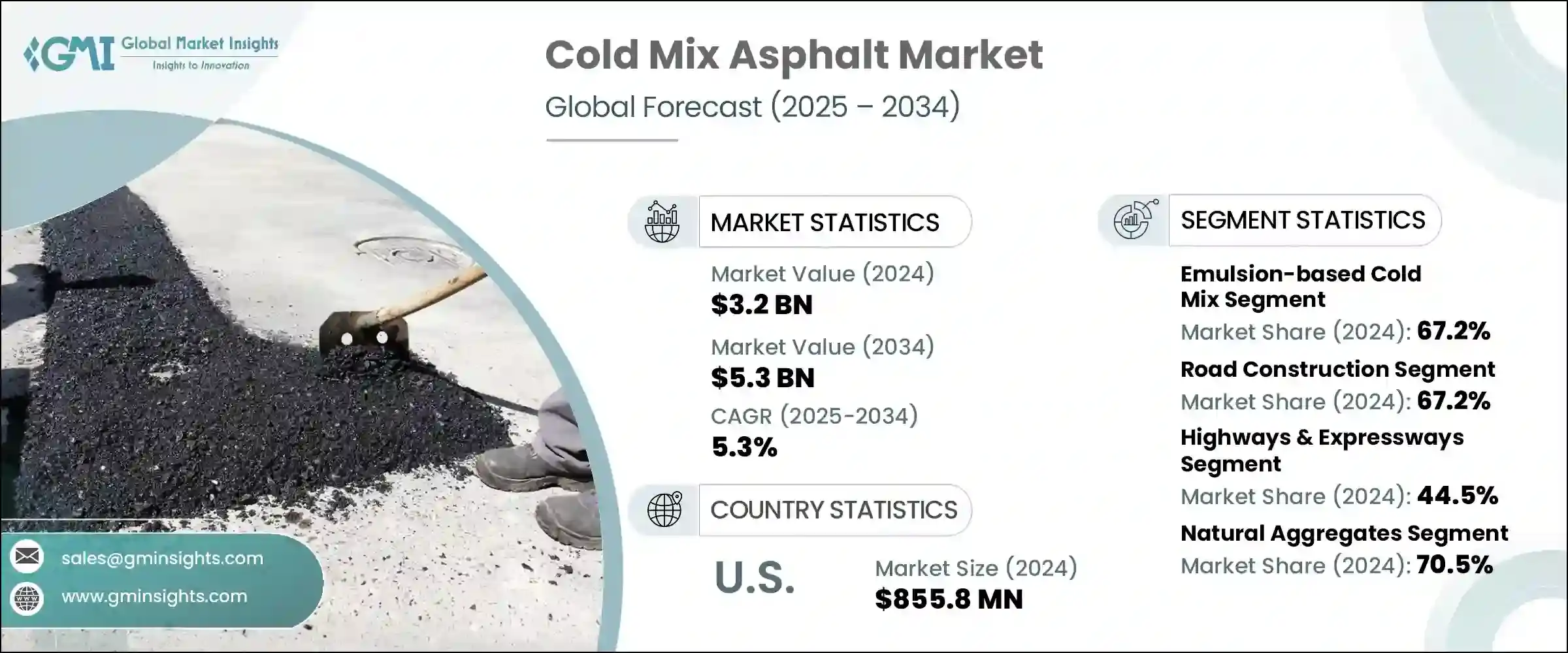

2024 年全球冷拌瀝青混合料市場價值為 32 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長至 53 億美元。這項成長動力來自全球持續的基礎設施投資、對低排放建築材料日益成長的需求以及對道路維護和修復項目日益成長的關注。冷拌瀝青混合料由於使用方便、設備要求低、幾乎可以在任何天氣條件下施工,作為傳統熱拌瀝青混合料的替代品,其受歡迎程度正穩步提升。發展中和已開發地區的政府都在推動道路連通和養護計劃,尤其是在熱拌瀝青混合料廠有限或根本不存在的地區。因此,冷拌瀝青混合料替代品正成為農村道路建設和現場維修項目中不可或缺的一部分。

這種瀝青類型也有助於降低溫室氣體排放,在有利於永續基礎設施建設的監管環境下,它成為一個相當吸引力的選擇。它廣泛應用於臨時維修、公共設施斷路恢復以及低流量道路的維護,使其成為成本敏感且物流挑戰較大的場合中不可或缺的材料。此外,國家政策支援和配方技術進步提高了其可靠性、保存期限以及對現代鋪路標準的遵循。冷拌瀝青不僅降低了人工和能源成本,還延長了儲存時間,使其成為分散施工和緊急維修的首選解決方案。這種便利性,加上其高效的性能,確保了冷拌瀝青繼續受到公共工程部門和私人承包商的青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 5.3% |

在產品細分方面,2024年,乳液基冷拌混合料佔據市場主導地位,佔總收入佔有率的67.2%。這種優勢源自於其生產過程中更低的能耗和更安全的施工操作,這與全球安全和永續發展目標高度契合。乳液基混合料因其與各種骨材的兼容性以及適用於路面修補和一般維護而廣泛應用。配方日益普及也得益於其在潮濕環境下也能施工的特性,這進一步增強了其在各種氣候和環境下的實用性。

2024年,道路建設領域是最大的應用領域,市佔率達67.2%。尤其是在半城市化和農村地區,道路建設項目越來越重視高效、經濟的解決方案,這持續推動了冷拌瀝青的需求。這種材料具有運輸便利、無需現場加熱等物流優勢,是建造通道、小路和低流量交通走廊的理想選擇。它能夠快速部署,資源消耗極少,也使其成為基礎設施擴建工程中初期表面處理和鋪路的首選材料。

從終端產業角度來看,2024年,高速公路和快速公路佔了44.5%的市場。隨著國家和區域公路投資的不斷增加,對速凝和耐候材料的需求日益成長,這些材料能夠承受頻繁的車輛荷載,同時最大限度地減少交通中斷。冷拌瀝青混合料能夠很好地滿足這項需求,尤其是在需要持續維修、路肩加固和路面穩定的地方。其快速部署能力可確保最大限度地減少停機時間,這對於繁忙路線和高流量高速公路至關重要。

2024年,美國引領全球冷拌瀝青混合料市場,市場估價達8.558億美元。聯邦政府專注於基礎設施現代化的資金投入,以及向環保材料的廣泛轉變,在支撐市場成長方面發揮了關鍵作用。各州和市政機構在道路維護工作中擴大採用冷拌瀝青混合料,這主要得益於其多功能性,以及在極端天氣波動地區的緊急維修、季節性修補和長期路面處理方面的適用性。

塑造競爭格局的關鍵參與者包括 All States Materials Group、Martin Marietta Materials、Lakeside Industries、UNIQUE Paving Materials 和嘉吉。這些公司利用區域專業知識和先進的研發能力,提供滿足不同地區需求的高效能產品。他們高度重視可靠性、耐用性和生態效率,並不斷改進產品,以滿足永續道路建設不斷變化的需求。受消費者日益青睞、符合現代基礎設施優先事項的即用型、全天候路面解決方案的推動,那些強調聚合物改性冷補解決方案和以客戶為中心的支援系統的品牌也在擴大其業務範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 基礎建設不斷推進

- 成本效益和能源效率

- 環境永續性重點

- 易於應用和儲存

- 產業陷阱與挑戰

- 品質一致性問題

- 發展中地區的認知有限

- 來自熱拌瀝青的競爭

- 標準化挑戰

- 市場機會

- 新興市場基礎建設成長

- 技術進步

- 永續建築趨勢

- 偏遠地區應用

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 乳化冷混料

- 陽離子乳液冷混料

- 陰離子乳液冷混劑

- 非離子乳液冷混料

- 稀釋瀝青

- 快速固化(RC)削減

- 中等固化(mc)削減

- 慢速固化(SC)削減

- 泡沫瀝青

- 冷再生混合料

- 現場冷回收

- 中央工廠冷回收

- 其他類型

- 聚合物改質冷拌混合料

- 纖維增強冷混料

- 添加劑增強冷混合料

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 道路建設

- 新道路建設

- 道路拓寬

- 臨時道路

- 道路維護和維修

- 修補坑洞

- 裂縫密封

- 表面處理

- 緊急維修

- 路面修復

- 全面深度復墾

- 就地冷再生

- 基層穩定

- 其他應用

- 肩部結構

- 公用事業削減恢復

- 自行車道和人行道

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 高速公路和快速公路

- 州際公路

- 州際公路

- 高速公路

- 市政道路

- 城市道路

- 郊區道路

- 鄉村道路

- 機場

- 跑道

- 滑行道

- 圍裙

- 停車區

- 商業停車場

- 住宅停車場

- 工業停車場

- 其他

- 港口和海港

- 工業區

- 休閒區

第8章:市場估計與預測:依總體類型,2021 - 2034 年

- 主要趨勢

- 天然骨材

- 碎石

- 碎石

- 沙

- 再生骨材

- 再生瀝青路面(RAP)

- 再生混凝土骨材(RCA)

- 其他再生材料

- 合成骨材

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- ExxonMobil Corporation

- BASF

- Total Energies SE

- All States Materials Group.

- Martin Marietta Materials

- Asphalt Materials

- UNIQUE Paving Materials

- Arkema Group

- Kao Corporation

- Ingevity Corporation

- Colas SA

- Aggregate Industries

- Cargill

- HEI-Way Premium Asphalt

- Simon Team

- Heidelberg Materials AG

- Reeves Construction Company

- Tarmac (CRH Company)

- Lakeside Industries

The Global Cold Mix Asphalt Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 5.3 billion by 2034. This growth is being driven by ongoing infrastructure investments, a rising demand for low-emission construction materials, and increasing attention toward road maintenance and rehabilitation projects worldwide. Cold mix asphalt is steadily gaining traction as an alternative to traditional hot mix due to its ease of use, minimal equipment requirements, and ability to be applied in virtually any weather condition. Governments across developing and developed regions are pushing for road connectivity and preservation programs, especially in areas where access to hot mix plants is limited or non-existent. As a result, the cold mix alternative is becoming integral to rural road development and spot repair projects.

This asphalt type also contributes to lower greenhouse gas emissions, making it an attractive option in a regulatory landscape that favors sustainable infrastructure practices. Its use in temporary repairs, utility cut reinstatements, and maintenance of low-traffic roads has made it indispensable in cost-sensitive and logistically challenged scenarios. Furthermore, national policy support and technological advancements in formulation have enhanced its reliability, shelf life, and adherence to modern paving standards. Cold mix asphalt not only reduces labor and energy costs but also enables longer storage, making it a go-to solution for decentralized construction and emergency repairs. This convenience, coupled with its performance efficiency, ensures that cold mix continues to gain preference among public works departments and private contractors alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 5.3% |

In terms of product segmentation, emulsion-based cold mix dominated the market in 2024, accounting for 67.2% of the total revenue share. This dominance stems from its lower energy consumption during production and safer handling during application, which aligns well with global safety and sustainability goals. Emulsion-based mixes are widely used due to their compatibility with various aggregates and suitability for patchwork and general road surface maintenance. The rising adoption of this formulation is also supported by its ability to be applied in damp conditions, further enhancing its practicality in a range of climates and environments.

The road construction segment represented the largest application area in 2024, holding a market share of 67.2%. The increasing emphasis on efficient, cost-effective solutions for road development projects, particularly in semi-urban and rural regions, continues to boost demand for cold mix asphalt. This material offers logistical advantages, such as easier transport and no need for onsite heating, making it ideal for building access roads, byways, and low-volume traffic corridors. Its capacity to be deployed quickly with minimal resources has also made it a preferred material for initial surface treatments and paving in infrastructure expansion projects.

From an end-use industry perspective, highways and expressways contributed to 44.5% of the market share in 2024. As investments in national and regional roadways intensify, there is a growing need for quick-setting and weather-resistant materials that can withstand frequent vehicle loads while minimizing traffic disruptions. Cold mix asphalt fulfills this requirement well, particularly in areas where continuous repairs, shoulder reinforcement, and surface stabilization are needed. Its rapid deployability ensures minimal downtime, which is critical for busy routes and high-traffic expressways.

The United States led the global cold mix asphalt market in 2024, with a valuation of USD 855.8 million. Federal funding focused on infrastructure modernization, along with a broader shift toward environmentally conscious materials, has played a pivotal role in supporting market growth. The adoption of cold mix in road preservation efforts across state and municipal agencies is increasing, particularly due to its versatility and suitability for emergency repairs, seasonal patching, and long-term surface treatments in areas with extreme weather fluctuations.

Key players shaping the competitive landscape include All States Materials Group, Martin Marietta Materials, Lakeside Industries, UNIQUE Paving Materials, and Cargill. These companies leverage regional expertise and advanced R&D capabilities to offer high-performance products tailored to diverse geographic needs. With a strong focus on reliability, durability, and eco-efficiency, they continue to refine their offerings to support the evolving demands of sustainable road construction. Brands that emphasize polymer-modified cold patch solutions and customer-centric support systems are also expanding their footprint, driven by increasing consumer preference for ready-to-use, all-season pavement solutions that align with modern infrastructure priorities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Manufacturing process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing infrastructure development

- 3.2.1.2 Cost-effectiveness & energy efficiency

- 3.2.1.3 Environmental sustainability focus

- 3.2.1.4 Ease of application & storage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality consistency issues

- 3.2.2.2 Limited awareness in developing regions

- 3.2.2.3 Competition from hot mix asphalt

- 3.2.2.4 Standardization challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets infrastructure growth

- 3.2.3.2 Technological advancements

- 3.2.3.3 Sustainable construction trends

- 3.2.3.4 Remote area applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Emulsion-based cold mix

- 5.2.1 Cationic emulsion cold mix

- 5.2.2 Anionic emulsion cold mix

- 5.2.3 Non-ionic emulsion cold mix

- 5.3 Cutback asphalt

- 5.3.1 Rapid curing (RC) cutback

- 5.3.2 Medium curing (mc) cutback

- 5.3.3 Slow curing (SC) cutback

- 5.4 Foamed asphalt

- 5.5 Cold recycled mix

- 5.5.1 Place cold recycling

- 5.5.2 Central plant cold recycling

- 5.6 Other types

- 5.6.1 Polymer modified cold mix

- 5.6.2 Fiber reinforced cold mix

- 5.6.3 Additive enhanced cold mix

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Road construction

- 6.2.1 New road construction

- 6.2.2 Road widening

- 6.2.3 Temporary roads

- 6.3 Road maintenance & repair

- 6.3.1 Pothole patching

- 6.3.2 Crack sealing

- 6.3.3 Surface treatment

- 6.3.4 Emergency repairs

- 6.4 Pavement rehabilitation

- 6.4.1 Full depth reclamation

- 6.4.2 Cold in-place recycling

- 6.4.3 Base course stabilization

- 6.5 Other applications

- 6.5.1 Shoulder construction

- 6.5.2 Utility cuts restoration

- 6.5.3 Bike paths & walkways

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Highways & expressways

- 7.2.1 Interstate highways

- 7.2.2 State highways

- 7.2.3 Expressways

- 7.3 Municipal roads

- 7.3.1 Urban roads

- 7.3.2 Suburban roads

- 7.3.3 Rural roads

- 7.4 Airports

- 7.4.1 Runways

- 7.4.2 Taxiways

- 7.4.3 Aprons

- 7.5 Parking areas

- 7.5.1 Commercial parking lots

- 7.5.2 Residential parking

- 7.5.3 Industrial parking

- 7.6 Others

- 7.6.1 Ports & harbors

- 7.6.2 Industrial areas

- 7.6.3 Recreational areas

Chapter 8 Market Estimates and Forecast, By Aggregate Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Natural aggregates

- 8.2.1 Crushed stone

- 8.2.2 Gravel

- 8.2.3 Sand

- 8.3 Recycled aggregates

- 8.3.1 Reclaimed asphalt pavement (RAP)

- 8.3.2 Recycled concrete aggregate (RCA)

- 8.3.3 Other recycled materials

- 8.4 Synthetic aggregates

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ExxonMobil Corporation

- 10.2 BASF

- 10.3 Total Energies SE

- 10.4 All States Materials Group.

- 10.5 Martin Marietta Materials

- 10.6 Asphalt Materials

- 10.7 UNIQUE Paving Materials

- 10.8 Arkema Group

- 10.9 Kao Corporation

- 10.10 Ingevity Corporation

- 10.11 Colas SA

- 10.12 Aggregate Industries

- 10.13 Cargill

- 10.14 HEI-Way Premium Asphalt

- 10.15 Simon Team

- 10.16 Heidelberg Materials AG

- 10.17 Reeves Construction Company

- 10.18 Tarmac (CRH Company)

- 10.19 Lakeside Industries