|

市場調查報告書

商品編碼

1797730

瀝青添加劑市場機會、成長動力、產業趨勢分析及2025-2034年預測Asphalt Additives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

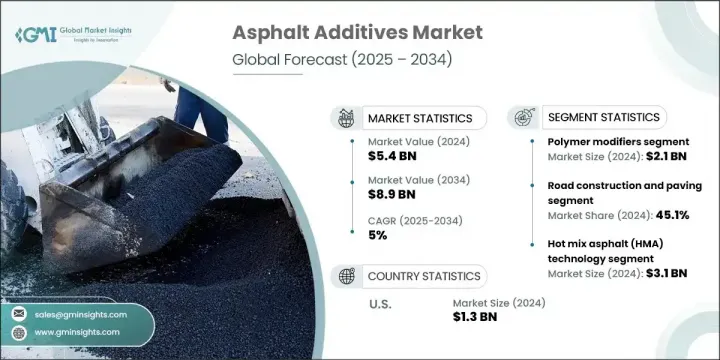

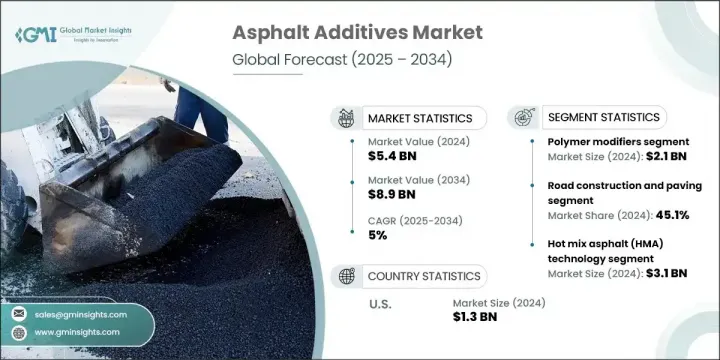

2024年,全球瀝青添加劑市場規模達54億美元,預計2034年將以5%的複合年成長率成長,達到89億美元。隨著全球大型基礎設施項目的增多,對兼具耐用性、永續性和成本效益的瀝青解決方案的需求持續成長。再生劑、抗剝落劑和聚合物改質劑等添加劑擴大用於增強瀝青混合料的抗車轍、抗開裂和抗濕氣損害性能。各國政府正在轉向這些材料,以期在控制長期維護預算的同時延長道路的使用壽命。

隨著低溫混合技術和再生材料的廣泛使用成為行業標準,環保法規正在塑造該領域的創新。瀝青添加劑不僅因其性能優勢,還因其環境優勢(包括降低排放和減少能耗)而日益受到青睞。生物基和奈米改質替代品的興起進一步契合了全球綠色建築實踐的目標。在現代化基礎設施和漸進式建築政策的支持下,北美仍然是領先的市場。同時,歐洲在這一領域也發展迅速,因為它推行以永續性為重點的建築標準,並強調循環經濟模式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 54億美元 |

| 預測值 | 89億美元 |

| 複合年成長率 | 5% |

2024年,聚合物改質劑市場規模達21億美元。它們在瀝青增強領域持續佔據主導地位,源自於其能夠增強彈性和強度,同時在交通繁忙和惡劣天氣下抵抗變形。這些添加劑可以無縫融入現有的瀝青配方,幫助道路保持長期性能,最大程度地減少對路面的干擾。

2024年,道路建設和鋪路產業佔45.1%。該行業的成長反映了市場對耐用、高性能道路的需求成長,這些道路能夠承受高交通負荷和不斷變化的天氣模式。在新建城市道路和高速公路基礎設施項目中,使用聚合物改質和抗剝落添加劑對於提高路面耐久性和抗裂性仍然至關重要。

2024年,美國瀝青添加劑市場規模達13億美元。由於其完善的道路系統、清晰的監管方向以及公共和私營部門在交通升級方面不斷增加的投資,該地區繼續保持領先地位。美國的研究和創新工作重點是開發永續的高性能材料,以降低維護要求並增強基礎設施的韌性。這一趨勢主要源自於對氣候適應型道路網路和環保建築材料(包括溫拌技術和下一代聚合物配方)的迫切需求。

瀝青添加劑市場呈現溫和整合趨勢,巴斯夫歐洲公司、阿科瑪集團、贏創工業股份公司、英傑維蒂公司和杜邦公司等領先公司在該領域佔有重要地位。瀝青添加劑領域的領先公司正在投資永續產品創新,專注於開發低揮發性有機化合物 (VOC)、生物基和溫拌相容性添加劑。這些公司正積極拓展研發能力,以滿足日益成長的氣候適應型道路基礎設施需求。許多公司正在與基礎設施開發商和政府機構建立合作夥伴關係,試行符合環保準則並延長道路使用壽命的先進添加劑配方。地域擴張仍然是一項核心策略,各公司透過分銷合作夥伴關係和本地生產瞄準新興市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依材料類型

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 聚合物改質劑

- 苯乙烯-丁二烯-苯乙烯(SBS)

- 苯乙烯-丁二烯橡膠(sbr)

- 乙烯醋酸乙烯酯 (eva)

- 聚乙烯和聚丙烯

- 其他聚合物改質劑

- 抗剝落劑

- 胺類藥劑

- 石灰基藥劑

- 磷酸衍生物

- 有機矽烷化合物

- 乳化劑和表面活性劑

- 陰離子乳化劑

- 陽離子乳化劑

- 非離子乳化劑

- 溫拌瀝青添加劑

- 蠟基添加劑

- 化學添加物

- 發泡添加劑

- 再生劑和再循環劑

- 奈米材料添加劑

- 奈米二氧化矽

- 奈米黏土

- 碳奈米管

- 石墨烯和氧化石墨烯

- 生物基和永續添加劑

- 其他特種添加劑

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 道路建設和鋪設

- 公路建設

- 城市道路建設

- 農村公路基礎設施

- 道路維護和修復

- 表面處理

- 覆蓋應用程式

- 裂縫密封和修復

- 機場跑道建設

- 屋頂應用

- 商業屋頂

- 住宅屋頂

- 工業屋頂

- 防水密封

- 其他應用

第7章:市場估計與預測:按技術,2021-2034 年

- 主要趨勢

- 熱拌瀝青(hma)技術

- 溫拌瀝青(WMA)技術

- 冷拌瀝青技術

- 半溫拌瀝青混合料技術

- 回收技術

- 就地熱回收

- 就地冷再生

- 植物性回收

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Arkema Group

- BASF SE

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- Ingevity Corporation

- Kraton Corporation

- Honeywell International Inc.

- The Dow Chemical Company

- Sasol Limited

The Global Asphalt Additives Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 8.9 billion by 2034. As large-scale infrastructure projects increase worldwide, demand continues to rise for asphalt solutions that offer durability, sustainability, and cost-effectiveness. Additives such as rejuvenators, anti-stripping agents, and polymer modifiers are increasingly used to enhance asphalt mixtures by improving resistance to rutting, cracking, and moisture-related damage. Governments are turning to these materials as they seek to extend the lifespan of roads while keeping long-term maintenance budgets under control.

Environmental mandates are shaping innovation in this sector, as lower-temperature mixing technologies and greater use of recycled materials become standard. Asphalt additives are gaining traction not only for their performance benefits but also for their environmental advantages, including lower emissions and reduced energy usage. The rise of bio-based and nano-modified alternatives further aligns with global goals for greener construction practices. North America remains the leading market, backed by modern infrastructure and progressive construction policies. Meanwhile, Europe is rapidly advancing in this space as it enforces sustainability-focused construction standards and emphasizes circular economy models.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 billion |

| Forecast Value | $8.9 billion |

| CAGR | 5% |

The polymer modifiers segment generated USD 2.1 billion in 2024. Their continued dominance in asphalt enhancement stems from the ability to boost elasticity and strength while resisting deformation under intense traffic and severe weather. These additives blend seamlessly into existing asphalt formulations and help roads maintain long-term performance with minimal disruption.

The road construction and paving segment represented a 45.1% share in 2024. The sector's growth reflects increased demand for long-lasting, high-performance roads that can withstand both heavy traffic loads and shifting weather patterns. Use of polymer-modified and anti-stripping additives remains essential for delivering surface durability and crack resistance in new urban roadways and highway infrastructure projects.

United States Asphalt Additives Market generated USD 1.3 billion in 2024. The region continues to lead thanks to its robust road systems, clear regulatory direction, and rising public and private sector investment in transportation upgrades. Research and innovation efforts in the country are focused on developing sustainable, high-performance materials that lower maintenance requirements while enhancing infrastructure resilience. This trend is largely driven by the urgent need for climate-adapted road networks and environmentally conscious construction materials, including warm mix technologies and next-generation polymer formulations.

The Asphalt Additives Market shows moderate consolidation, with leading companies such as BASF SE, Arkema Group, Evonik Industries AG, Ingevity Corporation, and DuPont de Nemours, Inc. playing a major role in the sector. Leading firms in the asphalt additives space are investing in sustainable product innovation, focusing on the development of low-VOC, bio-based, and warm mix-compatible additives. These companies are actively expanding R&D capabilities to address the growing demand for climate-resilient road infrastructure. Many are forming partnerships with infrastructure developers and government agencies to pilot advanced additive formulations that meet environmental guidelines and improve road longevity. Geographic expansion remains a core strategy, with companies targeting emerging markets through distribution partnerships and local production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 Technology trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo tons)

- 5.1 Key trends

- 5.2 Polymer modifiers

- 5.2.1 Styrene-butadiene-styrene (sbs)

- 5.2.2 Styrene-butadiene rubber (sbr)

- 5.2.3 Ethylene vinyl acetate (eva)

- 5.2.4 Polyethylene and polypropylene

- 5.2.5 Other polymer modifiers

- 5.3 Anti-stripping agents

- 5.3.1 Amine-based agents

- 5.3.2 Lime-based agents

- 5.3.3 Phosphoric acid derivatives

- 5.3.4 Organosilane compounds

- 5.4 Emulsifiers and surfactants

- 5.4.1 Anionic emulsifiers

- 5.4.2 Cationic emulsifiers

- 5.4.3 Non-ionic emulsifiers

- 5.5 Warm mix asphalt additives

- 5.5.1 Wax-based additives

- 5.5.2 Chemical-based additives

- 5.5.3 Foaming additives

- 5.6 Rejuvenators and recycling agents

- 5.7 Nanomaterial additives

- 5.7.1 Nanosilica

- 5.7.2 Nanoclay

- 5.7.3 Carbon nanotubes

- 5.7.4 Graphene and graphene oxide

- 5.8 Bio-based and sustainable additives

- 5.9 Other specialty additives

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo tons)

- 6.1 Key trends

- 6.2 Road construction and paving

- 6.2.1 Highway construction

- 6.2.2 Urban road development

- 6.2.3 Rural road infrastructure

- 6.3 Road maintenance and rehabilitation

- 6.3.1 Surface treatments

- 6.3.2 Overlay applications

- 6.3.3 Crack sealing and repair

- 6.4 Airport runway construction

- 6.5 Roofing applications

- 6.5.1 Commercial roofing

- 6.5.2 Residential roofing

- 6.5.3 Industrial roofing

- 6.6 Waterproofing and sealing

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo tons)

- 7.1 Key trends

- 7.2 Hot mix asphalt (hma) technology

- 7.3 Warm mix asphalt (wma) technology

- 7.4 Cold mix asphalt technology

- 7.5 Half-warm mix asphalt technology

- 7.6 Recycling technologies

- 7.6.1 Hot in-place recycling

- 7.6.2 Cold in-place recycling

- 7.6.3 Plant-based recycling

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 United Kingdom

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Argentina

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema Group

- 9.2 BASF SE

- 9.3 DuPont de Nemours, Inc.

- 9.4 Evonik Industries AG

- 9.5 Nouryon (formerly AkzoNobel Specialty Chemicals)

- 9.6 Ingevity Corporation

- 9.7 Kraton Corporation

- 9.8 Honeywell International Inc.

- 9.9 The Dow Chemical Company

- 9.10 Sasol Limited