|

市場調查報告書

商品編碼

1773394

再生瀝青路面 (RAP) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Recycled Asphalt Pavement (RAP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

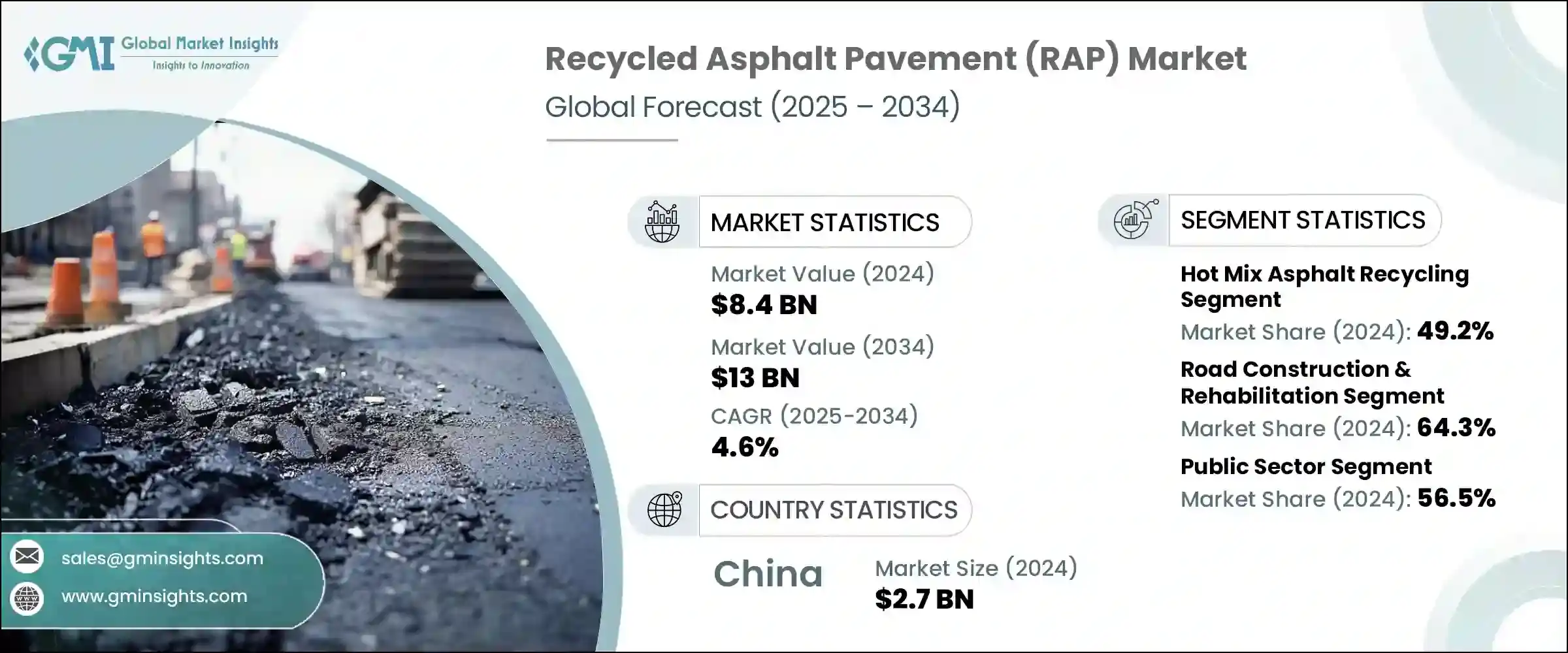

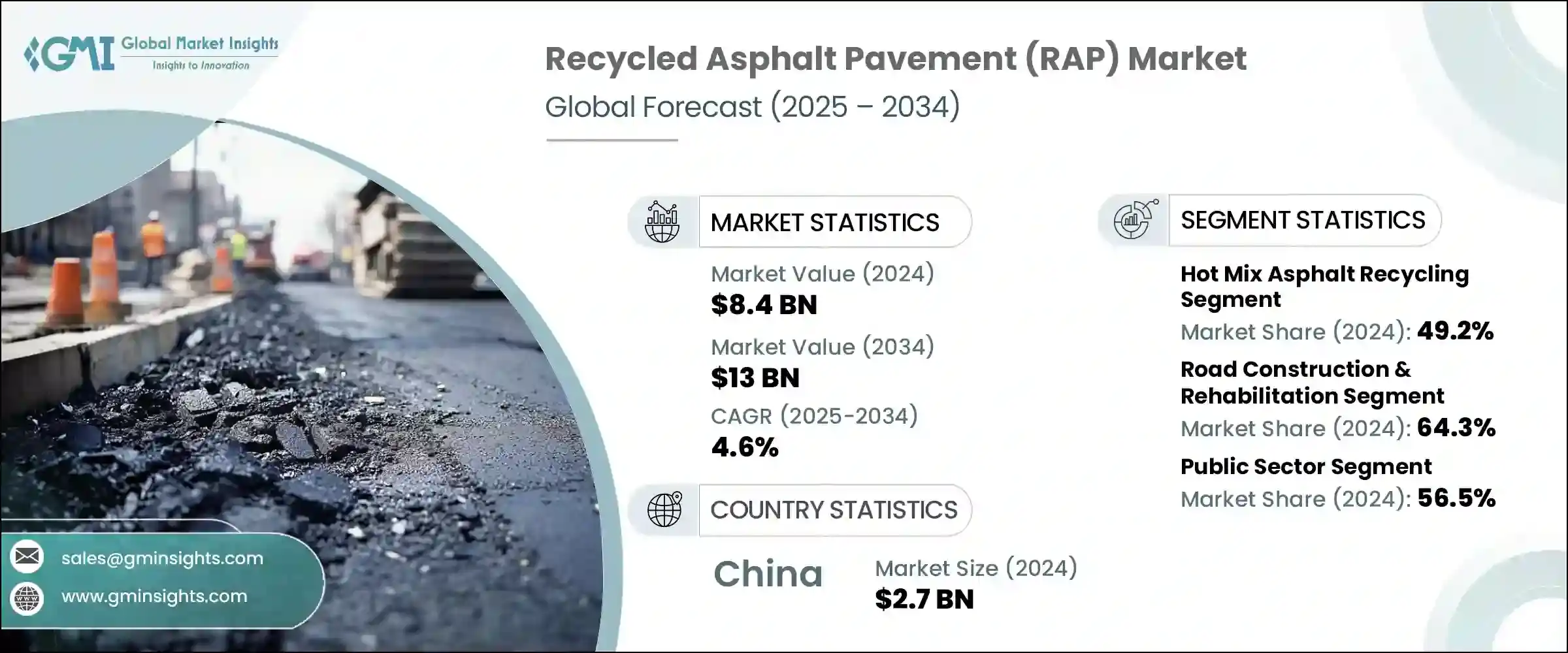

2024年,全球再生瀝青路面市場規模達84億美元,預計2034年將以4.6%的複合年成長率成長,達到130億美元。隨著對經濟高效、永續建築材料的需求不斷成長,再生瀝青路面產業在各個基礎設施領域都獲得了顯著的關注。各國政府和承包商擴大採用瀝青回收,以減少對原生料的依賴,降低專案成本,並最大限度地減少對環境的影響。這一趨勢的驅動力在於,人們越來越重視透過重複使用現有道路材料來減少垃圾掩埋、提高能源效率和限制溫室氣體排放。監管機構持續強調透過永續道路建設實踐來保護環境,這進一步鞏固了再生瀝青路面在全球基礎設施領域的地位。

在追求更永續的道路修復解決方案方面,再生瀝青 (RAP) 展現出顯著的經濟和生態優勢。再生瀝青可以融入鋪路工程中,且性能絲毫不受影響,是傳統瀝青的耐用替代品。它與現有的間歇式和滾筒式混合技術相容,使其成為大規模道路建設的實用選擇。近年來,人們越來越重視減少基礎設施專案生命週期排放,這也促進了再生瀝青 (RAP) 的普及。透過將再生材料納入施工流程,承包商能夠在保持結構完整性的同時降低碳足跡。此外,RAP 的操作彈性(例如可使用行動回收設備在現場加工)也提高了其效率並使其廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 130億美元 |

| 複合年成長率 | 4.6% |

在各種回收方法中,熱拌瀝青混合料 (HMA) 回收已成為主流,2024 年佔據了整體市場佔有率的 49.2%。 HMA 回收因其能夠提供接近原始性能的性能,同時顯著降低材料成本和碳排放而脫穎而出。它對高 RAP 含量混合料的適應性使其成為高速公路重鋪和道路升級的首選方法。此外,技術進步提高了 HMA 回收製程的一致性和質量,使其能夠應用於結構要求嚴格的路面層。

在應用方面,道路建設和修復佔據市場主導地位,佔2024年總需求的64.3%。永續城市發展和經濟高效的道路升級需求日益成長,導致該領域再生瀝青(RAP)的使用量激增。如今,再生材料被廣泛應用於主幹道和地方道路,幫助市政當局和私人承包商在最佳化資源利用的同時實現環境目標。再生瀝青(RAP)能夠利用高比例的再生材料來維持路面性能,使其成為公共和私人基礎設施項目的關鍵組成部分。隨著越來越多的司法管轄區尋求與長期永續發展目標保持一致,將其融入道路工程變得更具戰略意義。

按最終用戶細分,公共部門在2024年佔據再生材料市場的最大佔有率,達56.5%。政府支持的基礎設施計劃和永續發展要求已使再生材料成為公共工程的標準組成部分。國家和地區層面的主管部門擴大要求在招標規範中使用再生材料,尤其是在高速公路和市政重建項目中。公共機構也優先考慮那些符合環境認證和長期性能的材料,從而增強了再生材料在採購策略中的價值。

從區域來看,中國引領全球再生瀝青 (RAP) 市場,2024 年估值達 27 億美元。中國高度重視基礎設施互聯互通、都市更新和環境責任,推動了各省大規模採用再生瀝青。支持再生建築材料的政策框架,加上現代化再生工廠的蓬勃發展,持續支撐再生瀝青在各類專案中的應用。中國在國家公路建設中採用結構化方法,將再生瀝青融入其中,這顯著提升了該地區的市場佔有率。

隨著大型基礎設施公司不斷提升其永續發展能力,再生瀝青路面產業的競爭格局正在改變。市場領導者正在將瀝青回收納入核心營運,並專注於垂直整合,以確保整個供應鏈的品質控制。從擁有骨材生產單位到營運瀝青混合料廠和提供攤舖服務,這些公司已經建立了精簡的流程,以有效地回收和再利用再生瀝青。

許多企業正在透過建立專用設施、升級滾筒攪拌機以及利用行動設備進行高再生瀝青應用來擴大其回收能力。技術整合也變得越來越重要,企業部署數位化工具以實現再生瀝青的精準計量、溫度調節和排放監測,以支援符合低碳建築標準。此外,產業參與者正在與公共機構合作進行研究和試點項目,旨在提高再生瀝青使用的規範並最佳化全深度回收技術。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 道路維修和基礎設施修復的需求不斷成長

- 與原生瀝青相比,材料和生產成本更低

- 嚴格的環境法規促進再生材料

- 產業陷阱與挑戰

- 專用回收設備和工廠改造的初始投資成本

- 再生瀝青材料的品質和性能不一致

- 市場機會

- 擴大政府資助的永續基礎設施項目,鼓勵 RAP 整合

- 道路建設中擴大採用就地冷填和全深度再生技術

- 開發性能增強添加劑以提高高 RAP 混合料的質量

- 私營部門對商業項目綠建築材料的興趣日益濃厚

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按回收流程,2021 - 2034 年

- 主要趨勢

- 熱拌瀝青回收

- 批次廠

- 鼓廠

- 冷拌瀝青再生利用

- 就地冷再生

- 中央工廠冷回收

- 就地回收

- 就地冷再生(CIR)

- 全深度填海(FDR)

- 就地熱回收 (HIR)

- 中央工廠回收

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 道路建設與修復

- 高速公路和快速公路

- 城市道路和街道

- 鄉村道路

- 停車場和人行道

- 機場跑道和滑行道

- 人行道、自行車道和休閒場地

- 其他基礎設施(港口、工業場地)

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 公部門

- 交通運輸部(DOT)

- 市政當局和地方政府

- 機場和港口當局

- 私部門

- 建築和工程公司

- 房地產開發商

- 工業和商業最終用途

- 承包商和分包商

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Colas SA

- Eurovia (VINCI Group)

- Granite Construction Inc.

- Oldcastle Materials (CRH)

- LafargeHolcim Ltd.

- CEMEX SAB de CV

- Vulcan Materials Company

- Road Science

- The Lane Construction Corporation

- GreenRap

- Downer Group (Reconophalt)

- Gencor Industries

- Phoenix Industries

- Atmos Technologies

The Global Recycled Asphalt Pavement Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13 billion by 2034. As demand for cost-effective and sustainable construction materials increases, the RAP industry is gaining significant traction across various infrastructure segments. Governments and contractors are increasingly embracing asphalt recycling to reduce dependence on virgin raw materials, lower project costs, and minimize environmental impact. The trend is driven by a growing focus on reducing landfill waste, improving energy efficiency, and limiting greenhouse gas emissions through the reuse of existing road materials. Regulatory bodies continue to emphasize environmental preservation through sustainable road construction practices, which has further solidified RAP's position in the global infrastructure sector.

In the pursuit of more sustainable road rehabilitation solutions, RAP presents considerable economic and ecological advantages. Recycled asphalt can be integrated into paving projects without compromising performance, offering a durable alternative to conventional asphalt. Its compatibility with existing batch and drum mix technologies makes it a practical choice for large-scale road construction. In recent years, the increased focus on reducing lifecycle emissions from infrastructure projects has also contributed to RAP's rising popularity. By incorporating reclaimed materials into construction workflows, contractors are able to lower their carbon footprints while maintaining high structural integrity. Moreover, the operational flexibility of RAP, such as its ability to be processed on-site using mobile recycling equipment, adds to its efficiency and widespread adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $13 Billion |

| CAGR | 4.6% |

Among recycling methods, hot mix asphalt (HMA) recycling has emerged as the leading process, accounting for 49.2% of the overall market share in 2024. HMA recycling stands out due to its ability to deliver near-virgin performance while significantly cutting down on both material costs and carbon emissions. Its adaptability to high-RAP-content mixes has made it the preferred method for highway resurfacing and road upgrades. Additionally, advances in technology have improved the consistency and quality of HMA recycling processes, making it feasible for use in structurally demanding road layers.

In terms of application, road construction and rehabilitation dominated the market, representing 64.3% of total demand in 2024. The increasing need for sustainable urban development and cost-effective roadway upgrades has led to a surge in RAP usage within this segment. Recycled materials are now widely incorporated into arterial and local roads, helping municipalities and private contractors meet environmental goals while optimizing resource use. The ability to maintain pavement performance using high percentages of recycled content has made RAP a key component in public and private infrastructure projects. Its integration into roadworks has become more strategic as more jurisdictions seek to align with long-term sustainability targets.

When segmented by end user, the public sector held the largest share of the RAP market in 2024, accounting for 56.5%. Government-backed infrastructure initiatives and sustainability mandates have made RAP a standard component in public works. Authorities at national and regional levels increasingly require the use of recycled materials in tender specifications, particularly for highways and municipal redevelopment projects. Public agencies are also prioritizing materials that contribute to environmental certifications and long-term performance, thereby reinforcing the value of RAP in procurement strategies.

Regionally, China led the global RAP market, with a valuation of USD 2.7 billion in 2024. The country's strong emphasis on infrastructure connectivity, urban renewal, and environmental responsibility has driven large-scale adoption of recycled asphalt across its provinces. Policy frameworks supporting recycled construction materials, coupled with the growth of modern recycling plants, continue to support RAP deployment in various projects. China's structured approach to integrating RAP in national highway development has contributed significantly to the region's dominant market share.

The competitive landscape of the recycled asphalt pavement industry is evolving as major infrastructure companies enhance their sustainability credentials. Market leaders are incorporating asphalt recycling into core operations, focusing on vertical integration to ensure quality control across the supply chain. From owning aggregate production units to operating asphalt mix plants and paving services, these companies have established streamlined processes to recover and reuse reclaimed asphalt efficiently.

Many are expanding their recycling capacity by setting up dedicated facilities, upgrading drum mixers, and utilizing mobile units for high-RAP applications. Technological integration is also becoming more prominent, with firms deploying digital tools for precise RAP dosing, temperature regulation, and emissions monitoring to support compliance with low-carbon construction standards. In addition, industry participants are collaborating with public agencies on research and pilot projects aimed at enhancing specifications for recycled asphalt use and optimizing full-depth recycling techniques.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Recycling Process

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for road repair and infrastructure rehabilitation

- 3.2.1.2 Lower material and production costs compared to virgin asphalt

- 3.2.1.3 Stringent environmental regulations promoting recycled materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Initial investment costs for specialized recycling equipment and plant modifications

- 3.2.2.2 Inconsistent quality and performance of reclaimed asphalt material

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of government-funded sustainable infrastructure programs encouraging RAP integration

- 3.2.3.2 Rising adoption of cold-in-place and full-depth reclamation techniques in road construction

- 3.2.3.3 Development of performance-enhancing additives to improve high RAP mix quality

- 3.2.3.4 Increasing private sector interest in green construction materials for commercial projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Recycling Process, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hot mix asphalt recycling

- 5.2.1 Batch plant

- 5.2.2 Drum plant

- 5.3 Cold mix asphalt recycling

- 5.3.1 In-place cold recycling

- 5.3.2 Central plant cold recycling

- 5.4 In-place recycling

- 5.4.1 Cold in-place recycling (CIR)

- 5.4.2 Full depth reclamation (FDR)

- 5.4.3 Hot in-place recycling (HIR)

- 5.5 Central plant recycling

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Road construction & rehabilitation

- 6.2.1 Highways and expressways

- 6.2.2 Urban roads and streets

- 6.2.3 Rural roads

- 6.3 Parking lots and pavements

- 6.4 Airport runways and taxiways

- 6.5 Pathways, bike lanes, and recreational surfaces

- 6.6 Other infrastructure (ports, industrial sites)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Public sector

- 7.2.1 Departments of transportation (DOTs)

- 7.2.2 Municipalities and local governments

- 7.2.3 Airports and ports authorities

- 7.3 Private sector

- 7.3.1 Construction and engineering firms

- 7.3.2 Real estate developers

- 7.3.3 Industrial and commercial end use

- 7.4 Contractors and subcontractors

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Colas S.A.

- 9.2 Eurovia (VINCI Group)

- 9.3 Granite Construction Inc.

- 9.4 Oldcastle Materials (CRH)

- 9.5 LafargeHolcim Ltd.

- 9.6 CEMEX S.A.B. de C.V.

- 9.7 Vulcan Materials Company

- 9.8 Road Science

- 9.9 The Lane Construction Corporation

- 9.10 GreenRap

- 9.11 Downer Group (Reconophalt)

- 9.12 Gencor Industries

- 9.13 Phoenix Industries

- 9.14 Atmos Technologies