|

市場調查報告書

商品編碼

1773385

寵物補品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Supplement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

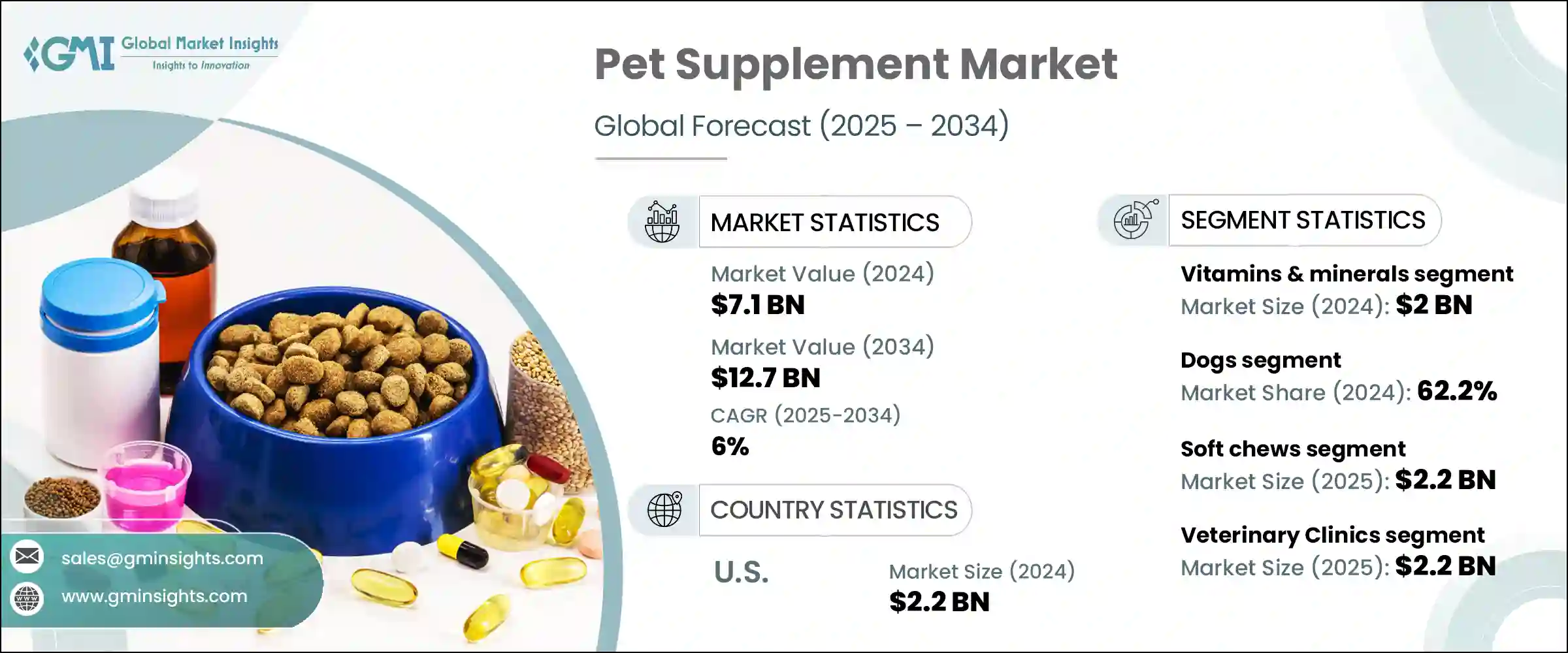

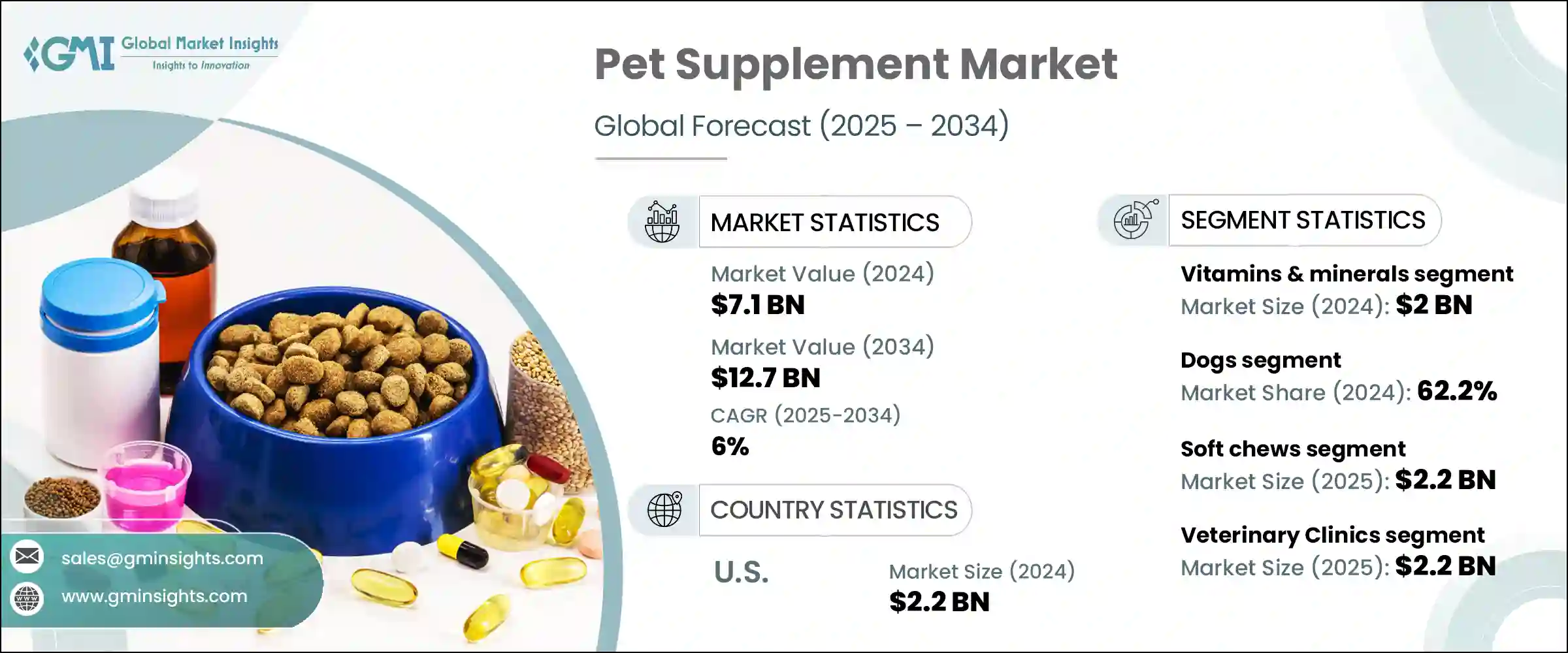

2024年,全球寵物補充劑市場規模達71億美元,預計2034年將以6%的複合年成長率成長,達到127億美元。這種需求的穩定成長與寵物主人不斷變化的觀念息息相關,他們越來越像對待家人一樣對待寵物。消費者對預防性護理和健康的日益關注推動著市場的發展,他們尋求能夠增強關節靈活性、免疫功能、消化功能、皮膚和毛髮健康的解決方案。這一趨勢在城市環境中尤其明顯,因為室內寵物需要營養護理。隨著人們對特殊配方和健康益處的認知不斷提高,符合寵物不同生命階段、品種和特定健康需求的功能性寵物補充劑也越來越受歡迎。

隨著寵物主人養犬數量的增加和生活方式的改變,對犬類補充劑的需求持續成長。同樣,隨著越來越多的家庭投資於為貓咪伴侶量身定做的護理,人們對貓咪健康產品的興趣也在成長。富含多種維生素、益生菌、植物萃取物和歐米伽脂肪酸的補充劑,尤其是那些聲稱有機、非基因改造和無麩質的補充劑,正受到強烈追捧。寵物主人正在轉向寵物年齡或品種的客製化解決方案,以改善其在各個生命階段的生活品質。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 71億美元 |

| 預測值 | 127億美元 |

| 複合年成長率 | 6% |

2024年,維生素和礦物質細分市場貢獻了可觀的收入佔有率,價值達20億美元。此細分市場涵蓋B群維生素、鈣和鐵等必需營養素,以及富含葡萄糖胺、MSM、透明質酸和軟骨素等廣受歡迎的關節保健品。消化產品也蓬勃發展,尤其是那些透過益生元和益生菌來支持腸道菌叢的產品,這反映出消費者對內在健康認知的轉變。

2024年,犬類保健品市佔率達62.2%,預計2025-2034年複合年成長率為5.7%。隨著北美和歐洲犬類飼養量的不斷成長,對針對特定犬種配方的需求也日益成長。大型犬通常需要補充劑來維持活動能力和心血管功能,而小型犬則更適合補充皮膚、毛髮和鎮靜成分。隨著寵物飼養量的不斷成長以及家庭飼養多隻寵物,各大品牌紛紛推出差異化產品,以滿足不同的健康需求。

2024年,美國寵物補充劑市場產值達22億美元。在美國,寵物補充劑受動物食品法規的監管,製造商必須遵守美國獸醫中心(CVM)根據21 CFR 507制定的指南。這些法規要求嚴格遵守標籤、成分定義、安全測試和現行良好生產規範(CGMP)等相關規定。 FDA與美國飼料管理協會(AAFCO)密切合作,確保各州標準統一。只有被歸類為「公認安全」(GRAS)或透過食品添加劑申請核准的成分才允許用於寵物補充劑。

塑造全球寵物補充品產業的關鍵參與者包括碩騰公司 (Zoetis Inc.)、Zesty Paws、Nutramax Laboratories、瑪氏寵物照護 (Mars Petcare) 和雀巢普瑞納寵物照護 (Nestle Purina PetCare)。寵物補充劑行業的領先公司正在利用科學配方、監管透明度和數位化互動來鞏固其市場地位。一項關鍵策略包括推出針對特定品種和年齡的產品線,旨在解決寵物各階段常見的健康問題。各品牌也著重於清潔標籤生產,使用天然且可追溯的成分來滿足消費者的偏好。對電商平台和訂閱模式的投資可以提高客戶留存率和訪問量。與獸醫和寵物健康影響者的合作可以提升信譽和知名度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel 分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 維生素和礦物質

- 複合維生素

- 維生素A

- 維生素D

- 維生素E

- B群維生素

- 鈣

- 鐵

- 其他礦物

- 關節健康補充品

- 葡萄糖胺

- 軟骨素

- MSM(甲基磺醯甲烷)

- 玻尿酸

- 其他關節健康成分

- 消化健康補充劑

- 益生菌

- 益生元

- 消化酵素

- 纖維補充劑

- 皮膚和毛髮補充劑

- Omega-3脂肪酸

- Omega-6脂肪酸

- 生物素

- 鋅

- 免疫支持補充劑

- 抗氧化劑

- 免疫增強劑

- 鎮靜和緩解焦慮的補充劑

- CBD補充劑

- 天然鎮靜劑

- 其他補充劑

- 心臟健康

- 肝臟支持

- 腎臟支持

- 認知健康

第6章:市場估計與預測:依寵物類型 2021 – 2034

- 主要趨勢

- 狗

- 小的

- 中等的

- 大的

- 貓

- 室內貓

- 戶外貓

- 鳥類

- 魚

- 小動物

- 兔子

- 天竺鼠

- 倉鼠

- 其他小動物

- 爬蟲類

- 其他

第7章:市場估計與預測:依形式,2021 年至 2034 年

- 主要趨勢

- 平板電腦

- 咀嚼片

- 普通平板電腦

- 軟咀嚼物

- 粉末

- 液體

- 液滴

- 液體懸浮液

- 膠囊

- 點心

- 其他

- 凝膠

- 噴霧劑

- 局部應用

第8章:市場估計與預測:按配銷通路2021 – 2034

- 主要趨勢

- 獸醫診所

- 寵物專賣店

- 網路零售

- 電子商務平台

- 直接面對消費者的網站

- 超市和大賣場

- 藥局

- 其他

- 農場和飼料商店

- 美容沙龍

- 寵物旅館及寄宿

第9章:市場估計與預測:按年齡層,2021 年至 2034 年

- 主要趨勢

- 小狗/小貓

- 成人

- 進階的

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- MEA 其餘地區

第 11 章:公司簡介

- Animal Essentials

- Ark Naturals

- Bayer Animal Health

- Boehringer Ingelheim Animal Health

- Ceva Sante Animale

- Dechra Pharmaceuticals

- Elanco Animal Health

- Hill's Pet Nutrition (Colgate-Palmolive)

- Innovet Pet Products

- Mars Petcare

- Nestle Purina PetCare

- NOW Foods (NOW Pets)

- Nutramax Laboratories

- Pet Naturals of Vermont

- PetHonesty

- Vetoquinol

- VetriScience Laboratories

- Virbac

- Zesty Paws

- Zoetis Inc.

The Global Pet Supplement Market was valued at USD 7.1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 12.7 billion by 2034. This steady rise in demand is closely tied to the evolving mindset of pet owners who increasingly treat their pets like family members. The growing focus on preventative care and wellness is driving the market forward, as consumers seek solutions that support joint flexibility, immune function, digestion, skin, and coat health. This trend is particularly evident in urban settings, where indoor pets require nutritional care. Rising awareness of specialized formulations and health benefits has led to the growing popularity of functional pet supplements that match pets' life stages, breeds, and specific health needs.

Demand for dog supplements continues to expand in line with rising dog ownership and active lifestyle choices among pet owners. Likewise, interest in cat health products is climbing, as more households are investing in tailored care for feline companions. Supplements featuring multivitamins, probiotics, botanical extracts, and omega fatty acids-especially those carrying organic, non-GMO, and gluten-free claims-are seeing strong traction. Pet owners are turning to customized solutions with age- or breed-specific functions that improve the quality of life for their pets through every life stage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 6% |

In 2024, vitamins and minerals segment contributed a notable portion of revenue, valued at USD 2 billion. This segment includes essential nutrients like B-complex vitamins, calcium, and iron, along with popular joint health supplements that feature glucosamine, MSM, hyaluronic acid, and chondroitin. Digestive products are also thriving, particularly those that support the gut microbiome with prebiotics and probiotics, reflecting a shift in consumer understanding about internal wellness.

Dogs segment held 62.2% share in 2024 and is projected to grow at a CAGR of 5.7% during 2025-2034. With high dog ownership in North America and Europe, the demand for species-specific formulations is rising. Larger dogs often require supplements for mobility and cardiovascular support, while smaller breeds tend to benefit more from skin, coat, and calming formulations. As pet ownership expands and households adopt multiple pets, brands are working on differentiated offerings to meet various health demands.

U.S. Pet Supplement Market generated USD 2.2 billion in 2024. In the United States, pet supplements fall under animal food regulations, and manufacturers are required to follow the FDA's Center for Veterinary Medicine (CVM) guidelines under 21 CFR 507. These regulations enforce strict compliance related to labeling, ingredient definition, safety testing, and current good manufacturing practices (CGMPs). The FDA works closely with the Association of American Feed Control Officials (AAFCO) to ensure uniform standards across state lines. Only ingredients classified as Generally Recognized as Safe (GRAS) or approved through a food additive petition are permitted for use in pet supplements.

Key players shaping the Global Pet Supplement Industry include Zoetis Inc., Zesty Paws, Nutramax Laboratories, Mars Petcare, and Nestle Purina PetCare. Leading companies in the pet supplement industry are leveraging science-backed formulations, regulatory transparency, and digital engagement to strengthen their foothold. A key approach includes the launch of breed- and age-specific product lines designed to address common pet health issues at every stage. Brands are also focusing on clean-label production, using natural and traceable ingredients to align with consumer preferences. Investment in e-commerce platforms and subscription models enhances customer retention and access. Collaborations with veterinarians and pet wellness influencers drive credibility and awareness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Pet type

- 2.2.4 Form

- 2.2.5 Distribution channel

- 2.2.6 Age group

- 2.3 TAM analysis, 2025-2034

- 2.4 Cxo perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste Reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vitamins & minerals

- 5.2.1 Multivitamins

- 5.2.2 Vitamin A

- 5.2.3 Vitamin D

- 5.2.4 Vitamin E

- 5.2.5 B- Complex vitamins

- 5.2.6 Calcium

- 5.2.7 Iron

- 5.2.8 Other minerals

- 5.3 Joint health supplements

- 5.3.1 Glucosamine

- 5.3.2 Chondroitin

- 5.3.3 MSM (methylsulfonylmethane)

- 5.3.4 Hyaluronic acid

- 5.3.5 Other joint health ingredients

- 5.4 Digestive health supplements

- 5.4.1 Probiotics

- 5.4.2 Prebiotics

- 5.4.3 Digestive enzymes

- 5.4.4 Fiber supplements

- 5.5 Skin & coat supplements

- 5.5.1 Omega-3 fatty acids

- 5.5.2 Omega-6 fatty acids

- 5.5.3 Biotin

- 5.5.4 Zinc

- 5.5.5 Immune support supplements

- 5.5.6 Antioxidants

- 5.5.7 Immune boosters

- 5.6 Calming & anxiety supplements

- 5.6.1 Cbd-based supplements

- 5.6.2 Natural calming agents

- 5.7 Other supplements

- 5.7.1 Heart health

- 5.7.2 Liver support

- 5.7.3 Kidney support

- 5.7.4 Cognitive health

Chapter 6 Market Estimates and Forecast, By Pet Type 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dogs

- 6.2.1 Small

- 6.2.2 Medium

- 6.2.3 Large

- 6.3 Cats

- 6.3.1 Indoor cats

- 6.3.2 Outdoor cats

- 6.4 Birds

- 6.5 Fish

- 6.6 Small animals

- 6.6.1 Rabbits

- 6.6.2 Guinea pigs

- 6.6.3 Hamsters

- 6.6.4 Other small animals

- 6.7 Reptiles

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tablets

- 7.2.1 Chewable tablets

- 7.2.2 Regular tablets

- 7.3 Soft chews

- 7.4 Powders

- 7.5 Liquid

- 7.5.1 Liquid drops

- 7.5.2 Liquid suspensions

- 7.6 Capsules

- 7.7 Treats

- 7.8 Others

- 7.8.1 Gels

- 7.8.2 Sprays

- 7.8.3 Topical applications

Chapter 8 Market Estimates and Forecast, By Distribution Channel 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Veterinary clinics

- 8.3 Pet specialty stores

- 8.4 Online retail

- 8.4.1 E-commerce platforms

- 8.4.2 Direct-to-consumer websites

- 8.5 Supermarkets & hypermarkets

- 8.6 Pharmacies

- 8.7 Others

- 8.7.1 Farm & feed stores

- 8.7.2 Grooming salons

- 8.7.3 Pet hotels & boarding

Chapter 9 Market Estimates and Forecast, By Age Group, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Puppy/kitten

- 9.3 Adult

- 9.4 Senior

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 Animal Essentials

- 11.2 Ark Naturals

- 11.3 Bayer Animal Health

- 11.4 Boehringer Ingelheim Animal Health

- 11.5 Ceva Sante Animale

- 11.6 Dechra Pharmaceuticals

- 11.7 Elanco Animal Health

- 11.8 Hill's Pet Nutrition (Colgate-Palmolive)

- 11.9 Innovet Pet Products

- 11.10 Mars Petcare

- 11.11 Nestle Purina PetCare

- 11.12 NOW Foods (NOW Pets)

- 11.13 Nutramax Laboratories

- 11.14 Pet Naturals of Vermont

- 11.15 PetHonesty

- 11.16 Vetoquinol

- 11.17 VetriScience Laboratories

- 11.18 Virbac

- 11.19 Zesty Paws

- 11.20 Zoetis Inc.