|

市場調查報告書

商品編碼

1773361

米澱粉市場機會、成長動力、產業趨勢分析及2025-2034年預測Rice Starch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

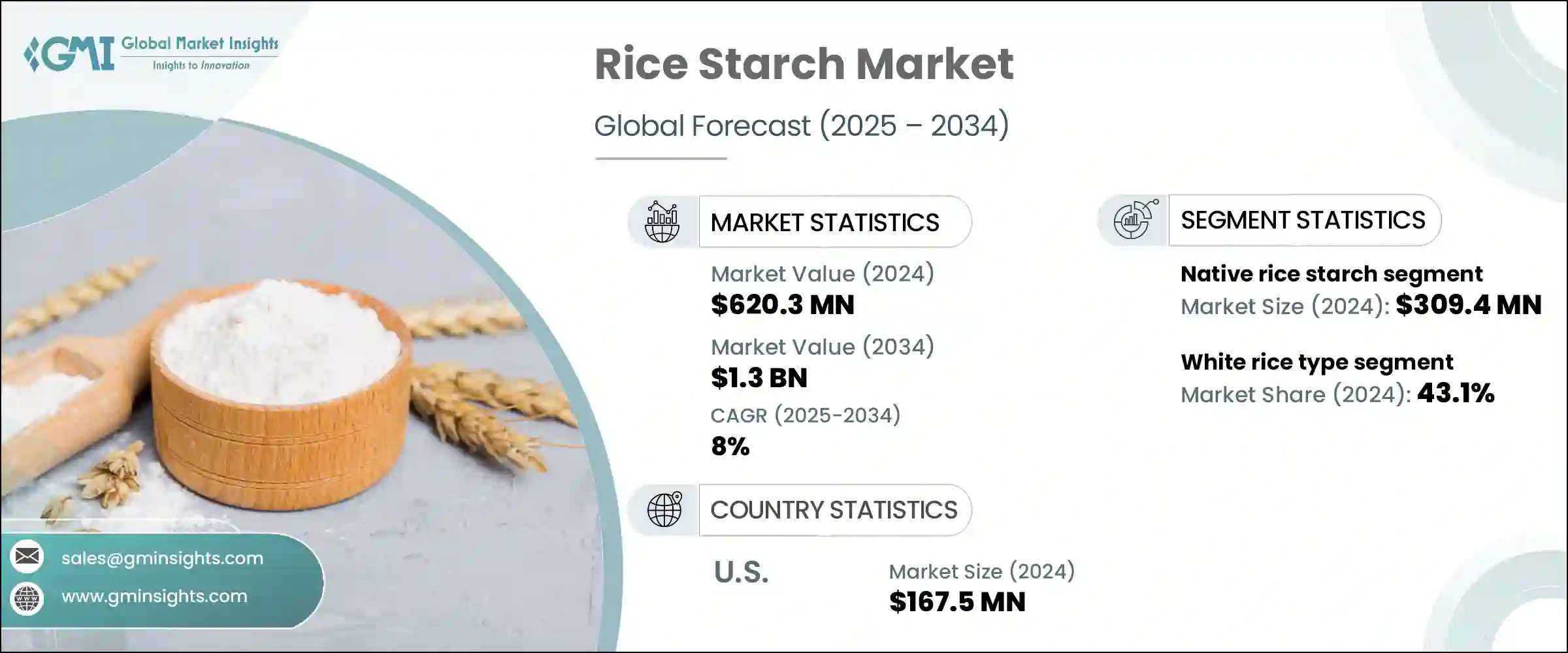

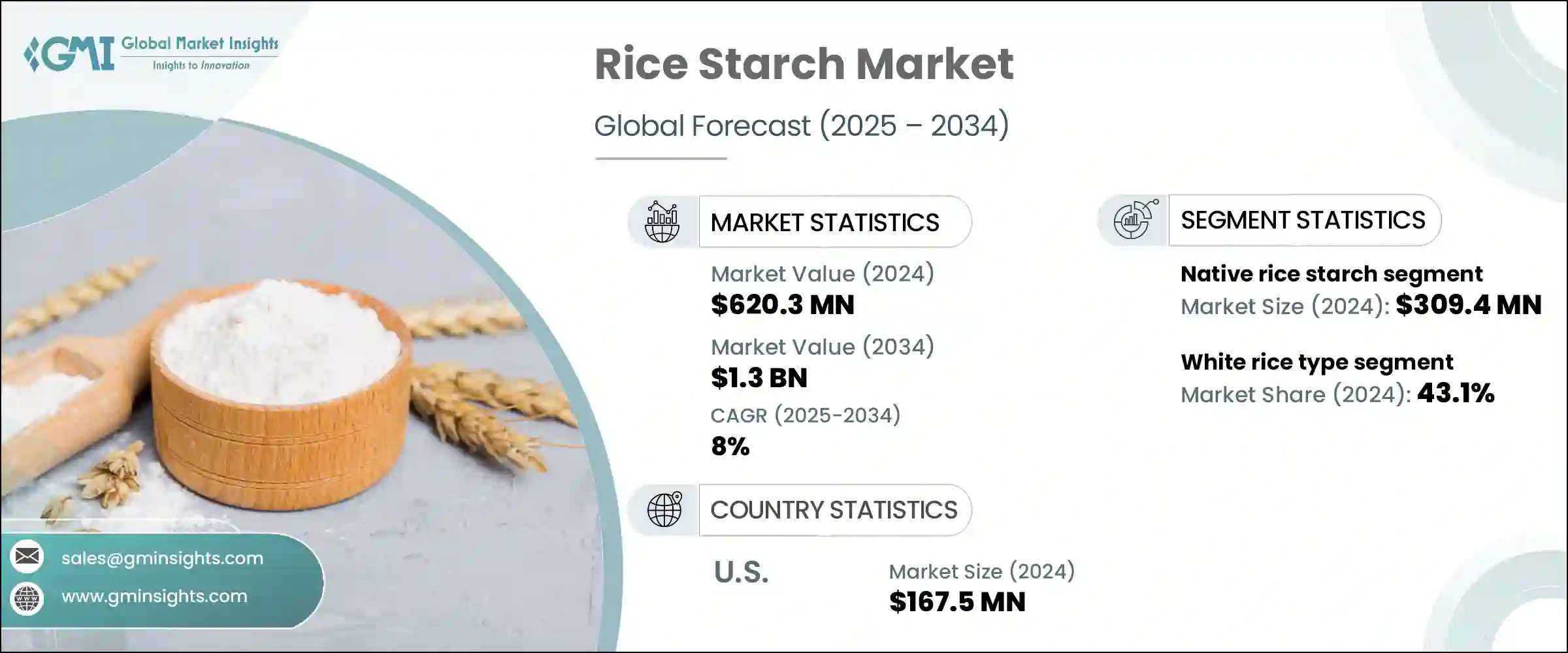

2024 年全球米澱粉市場價值為 6.203 億美元,預計到 2034 年將以 8% 的複合年成長率成長至 13 億美元。這一市場擴張是由多個行業擴大採用米澱粉所驅動的。該分析提供了過去表現和未來預測的平衡視圖,為市場的整體發展趨勢提供了寶貴的見解。對市場價值和數量進行分析以吸引潛在投資者。對清潔標籤成分的需求不斷成長以及消費者更廣泛地轉向天然食品成分,推動了持續成長。食品和飲料行業仍然是主要驅動力,米澱粉具有增稠、質構和穩定等多功能特性,因此被廣泛用於產品配方中。對無麩質和無過敏原產品的需求激增進一步推動了這一趨勢。

此外,傳統成長較慢的領域中湧現的全新創新用途,可望為米澱粉市場的整體擴張做出重大貢獻。這些新興應用創造了新的需求流,補充並增強了快速成長產業的動能。透過豐富終端用途,例如專業藥物配方、高級化妝品和利基食品應用,這些新興領域有助於穩定成長,並為跨行業整合創造機會。這種更廣泛的應用不僅推動了產量的成長,還鼓勵了研發投資,推動了產品創新,並使製造商能夠開拓先前尚未開發的市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.203億美元 |

| 預測值 | 13億美元 |

| 複合年成長率 | 8% |

2024年,天然米澱粉市場估值達3.094億美元,預計2034年將以7.9%的複合年成長率成長。由於廣泛應用於各行各業,天然米澱粉將繼續佔據市場主導地位。它尤其受到青睞,因為它採用研磨工藝製成,用途廣泛,並且符合清潔標籤的要求。食品和飲料產業是天然米澱粉最大的消費群體,利用其在乳製品、醬料和嬰兒營養品等產品中的增稠、膠凝和穩定功能。其天然來源和功能性優勢使其成為許多配方中必不可少的成分。

2024年,白米市場規模達2.674億美元,預計到2034年將以8.1%的複合年成長率成長,佔據43.1%的市場佔有率。由於易於加工、供應充足且風味中性,白米仍然是米澱粉的主要來源。消費者和製造商都青睞白米澱粉,因為其產量穩定且品質優良,非常適合用於需要高品質澱粉的食品、藥品和化妝品。大型生產商也青睞白米,因為它具有標準化的特性和高效的提取方法。此外,人們對有機食品和低加工食品的興趣日益濃厚,也推動了對白米澱粉的需求,白米澱粉正日益被視為一種優質原料。

2024年,美國米澱粉市場規模達1.675億美元,預計2025年至2034年期間的複合年成長率將達到7.8%。美國市場的成長歸因於人們對清潔標籤、無麩質和植物性成分日益成長的偏好。食品和飲料產業仍然是主要的消費領域,尤其是在烘焙、乳製品和簡便食品領域。由於米澱粉具有低致敏性和可生物分解的特性,製藥和化妝品行業的需求也在成長。加工技術的進步提高了產品質量,擴大了應用範圍,進一步增強了市場成長。美國是北美最活躍的市場參與者,推動著整個地區的成長。

在全球範圍內,米澱粉市場呈現中等規模整合,羅蓋特公司 (Roquette Freres)、嘉吉公司 (Cargill Incorporation)、貝諾公司 (BENEO GmbH)、阿格那公司 (AGRANA Beteiligungs-AG) 和 Ingredient Incorporated 等主要參與者佔據主導地位。這些公司佔有相當大的市場佔有率,並在塑造行業趨勢方面發揮重要作用。米澱粉市場的領先公司採取各種策略措施來鞏固其市場地位。他們高度重視創新,開發新的配方和加工技術,以增強產品功能並滿足清潔標籤的要求。與食品和飲料製造商建立策略合作夥伴關係有助於擴大其分銷網路和最終用途應用。對永續採購和生產實踐的投資強化了他們對環境責任的承諾,從而吸引了具有環保意識的消費者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對清潔標籤成分的需求不斷成長

- 麩質不耐症盛行率上升

- 食品飲料產業應用日益增多

- 擴大在醫藥和化妝品的應用

- 產業陷阱與挑戰

- 來自替代澱粉的競爭

- 原物料價格波動

- 市場機會

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- Pestel 分析

- 價格趨勢

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 天然米澱粉

- 改性米澱粉

- 實體改造

- 預糊化米澱粉

- 熱濕處理米澱粉

- 其他物理改性米澱粉

- 化學改性

- 交聯米澱粉

- 氧化米澱粉

- 乙醯化米澱粉

- 其他化學改性米澱粉

- 酵素改性

- 實體改造

- 抗性米澱粉

第6章:市場估計與預測:依來源,2021-2034

- 主要趨勢

- 白米

- 糙米

- 碎米及副產品

- 其他

第7章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 液體和凝膠

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 烘焙和糖果

- 乳製品

- 湯、醬汁和調味品

- 肉類和家禽產品

- 零食和簡便食品

- 飲料

- 嬰兒食品和嬰兒產品類型

- 無麩質產品

- 其他食品應用

- 製藥

- 藥片黏合崩解

- 膠囊產品解決方案

- 藥物輸送系統

- 其他藥物應用

- 化妝品和個人護理

- 保養產品

- 護髮產品

- 彩妝

- 其他化妝品應用

- 紙張和紡織品

- 紙張施膠和塗層

- 紡織品上漿和整理

- 其他紙張和紡織品應用

- 其他應用

- 黏合劑和膠水

- 可生物分解包裝

- 其他工業應用

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- A&B Ingredients

- AGRANA Beteiligungs-AG

- Agrana Group

- Anhui Lianhe

- Archer Daniels Midland Company

- Bangkok Starch Industrial Co., Ltd.

- Beneo (Sudzucker Group)

- Cargill, Incorporated

- Golden Agriculture Co., Ltd.

- Herba Ingredients

- Hunan ER-KANG

- Ingredion Incorporated

- Jiangxi Golden Agriculture Co., Ltd.

- Roquette Freres

- Shaanxi Tianyu Pharmaceutical Co., Ltd.

- Sonish Starch Technology Co., Ltd.

- Tate & Lyle PLC

- THAI WAH PUBLIC COMPANY LIMITED

- Thai Flour Industry Co., Ltd.

- Wuxi Chuangda Food Co., Ltd.

The Global Rice Starch Market was valued at USD 620.3 million in 2024 and is estimated to grow at a CAGR of 8% to reach USD 1.3 billion by 2034. This market expansion is driven by the increasing adoption of rice starch across multiple industries. The analysis provides a balanced view of past performance alongside future projections, offering valuable insights into the market's overall trajectory. Both market value and volume are analyzed to attract potential investors. Consistent growth has been supported by rising demand for clean-label ingredients and a broader consumer shift towards natural food components. The food and beverage sector remains the primary driver, with rice starch's multifunctional properties, like thickening, texturizing, and stabilizing, leading to its widespread inclusion in product formulations. The surge in demand for gluten-free and allergen-free products has further fueled this trend.

Additionally, new and innovative uses emerging within traditionally slower-growing segments are poised to contribute significantly to the rice starch market's overall expansion. These developing applications create fresh demand streams that complement and strengthen the momentum seen in faster-growing industries. By diversifying the range of end-use cases, such as specialized pharmaceutical formulations, advanced cosmetic products, and niche food applications, these emerging sectors help stabilize growth and open opportunities for cross-industry integration. This broader adoption not only drives incremental volume but also encourages investment in research and development, fueling product innovation and enabling manufacturers to tap into previously untapped markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $620.3 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 8% |

In 2024, the native rice starch segment held a valuation of USD 309.4 million and is anticipated to grow at a CAGR of 7.9% through 2034. Native rice starch continues to dominate the market due to its extensive use across various industries. It is especially favored because of its milled-derived form, versatility, and alignment with clean-label requirements. The food and beverage industry represents the largest consumer base for native rice starch, leveraging its thickening, gelling, and stabilizing functions in products such as dairy, sauces, and infant nutrition. Its natural origin and functional benefits make it an essential ingredient in many formulations.

The white rice type segment accounted for USD 267.4 million in 2024 and is expected to grow at an 8.1% CAGR through 2034, holding a 43.1% share. White rice remains the leading source of rice starch, thanks to its ease of processing, abundant availability, and neutral flavor profile. Both consumers and manufacturers prefer rice starch derived from white rice due to its consistent, high-quality yield, making it ideal for use in food, pharmaceutical, and cosmetic products that demand superior starch quality. Large-scale producers also favor white rice because of its standardized properties and efficient extraction methods. Additionally, rising interest in organic and minimally processed foods is boosting the demand for rice starch from white rice, which is increasingly perceived as a premium ingredient.

U.S. Rice Starch Market was valued at USD 167.5 million in 2024 and is expected to grow at a 7.8% CAGR from 2025 to 2034. Growth in the U.S. is attributed to the rising preference for clean-label, gluten-free, and plant-based ingredients. The food and beverage industry continues to be the dominant consumer, particularly within bakery, dairy, and convenience food applications. Demand is also increasing in the pharmaceutical and cosmetics sectors due to rice starch's hypoallergenic and biodegradable properties. Advances in processing technologies have enhanced product quality and expanded the range of applications, further strengthening market growth. The U.S. stands as the most active market player in North America, driving growth across the region.

On a global scale, the Rice Starch Market is moderately consolidated, with major players such as Roquette Freres, Cargill Incorporation, BENEO GmbH, AGRANA Beteiligungs-AG, and Ingredient Incorporated leading the competition. These companies hold significant market shares and are instrumental in shaping industry trends. Leading companies in the rice starch market adopt various strategic initiatives to strengthen their market position. They focus heavily on innovation, developing new formulations and processing techniques that enhance product functionality and meet clean-label demands. Strategic partnerships and collaborations with food and beverage manufacturers help expand their distribution networks and end-use applications. Investment in sustainable sourcing and production practices reinforces their commitment to environmental responsibility, which appeals to eco-conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360 synopsis

- 2.2 Key market trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for clean label ingredients

- 3.2.1.2 Rising prevalence of gluten intolerance

- 3.2.1.3 Increasing applications in food & beverage industry

- 3.2.1.4 Expanding use in pharmaceutical & cosmetic products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative starches

- 3.2.2.2 Price volatility of raw materials

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle east & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Native rice starch

- 5.3 Modified rice starch

- 5.3.1 Physically modified

- 5.3.1.1 Pre-gelatinized rice starch

- 5.3.1.2 Heat-moisture treated rice starch

- 5.3.1.3 Other physically modified rice starch

- 5.3.2 Chemically modified

- 5.3.2.1 Cross-linked rice starch

- 5.3.2.2 Oxidized rice starch

- 5.3.2.3 Acetylated rice starch

- 5.3.2.4 Other chemically modified rice starch

- 5.3.3 Enzymatically modified

- 5.3.1 Physically modified

- 5.4 Resistant Rice Starch

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 White rice

- 6.3 Brown rice

- 6.4 Broken rice & by-products

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Liquid & gel

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Bakery & confectionery

- 8.2.2 Dairy products

- 8.2.3 Soups, sauces & dressings

- 8.2.4 Meat & Poultry Products

- 8.2.5 Snacks & convenience foods

- 8.2.6 Beverages

- 8.2.7 Baby food & infant product type

- 8.2.8 Gluten-free products

- 8.2.9 Other food applications

- 8.3 Pharmaceuticals

- 8.3.1 Tablet binding & disintegration

- 8.3.2 Capsule product solutions

- 8.3.3 Drug delivery systems

- 8.3.4 Other pharmaceutical applications

- 8.3.5 Cosmetics & personal care

- 8.3.6 Skin care products

- 8.3.7 Hair care products

- 8.3.8 Color cosmetics

- 8.3.9 Other cosmetic applications

- 8.4 Paper & textile

- 8.4.1 Paper sizing & coating

- 8.4.2 Textile sizing & finishing

- 8.4.3 Other paper & textile applications

- 8.5 Other applications

- 8.5.1 Adhesives & glues

- 8.5.2 Biodegradable packaging

- 8.5.3 Other industrial applications

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 A&B Ingredients

- 10.2 AGRANA Beteiligungs-AG

- 10.3 Agrana Group

- 10.4 Anhui Lianhe

- 10.5 Archer Daniels Midland Company

- 10.6 Bangkok Starch Industrial Co., Ltd.

- 10.7 Beneo (Sudzucker Group)

- 10.8 Cargill, Incorporated

- 10.9 Golden Agriculture Co., Ltd.

- 10.10 Herba Ingredients

- 10.11 Hunan ER-KANG

- 10.12 Ingredion Incorporated

- 10.13 Jiangxi Golden Agriculture Co., Ltd.

- 10.14 Roquette Freres

- 10.15 Shaanxi Tianyu Pharmaceutical Co., Ltd.

- 10.16 Sonish Starch Technology Co., Ltd.

- 10.17 Tate & Lyle PLC

- 10.18 THAI WAH PUBLIC COMPANY LIMITED

- 10.19 Thai Flour Industry Co., Ltd.

- 10.20 Wuxi Chuangda Food Co., Ltd.