|

市場調查報告書

商品編碼

1773346

強化牛奶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fortified Milk Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

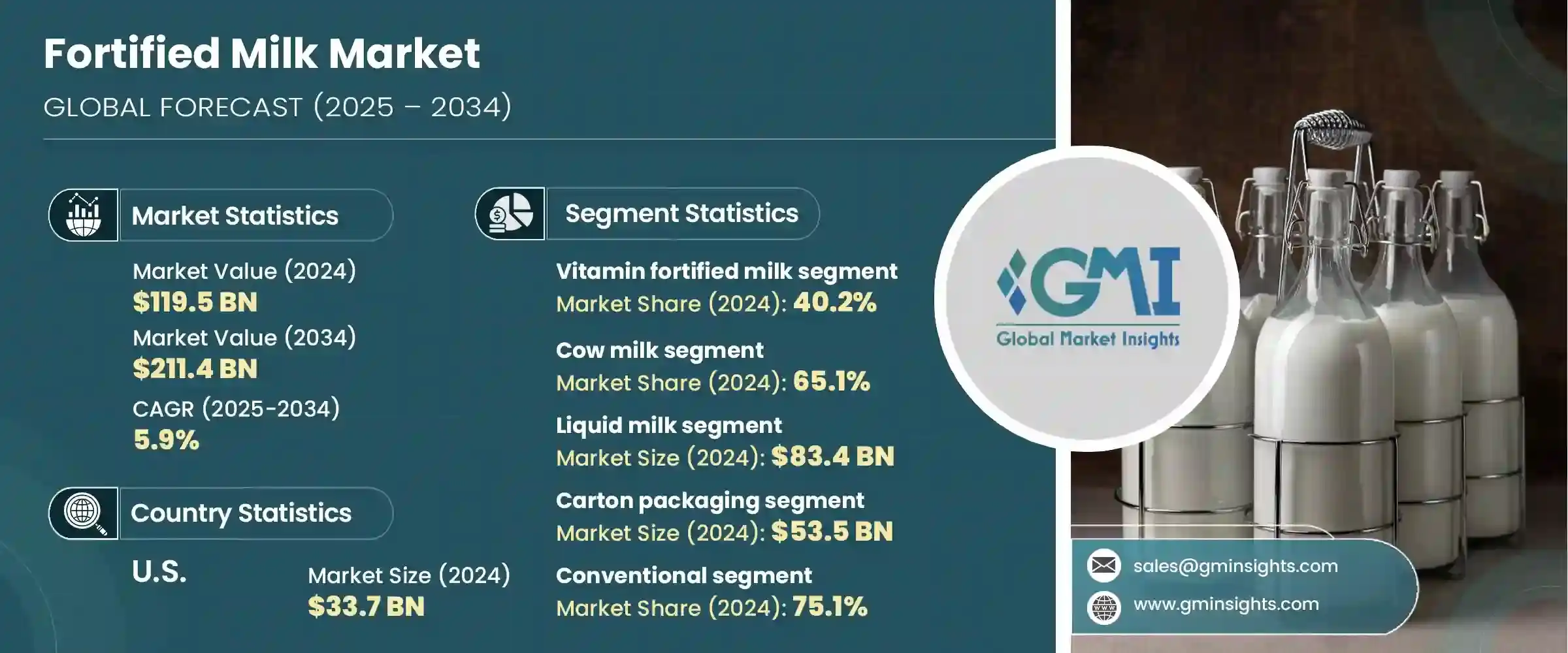

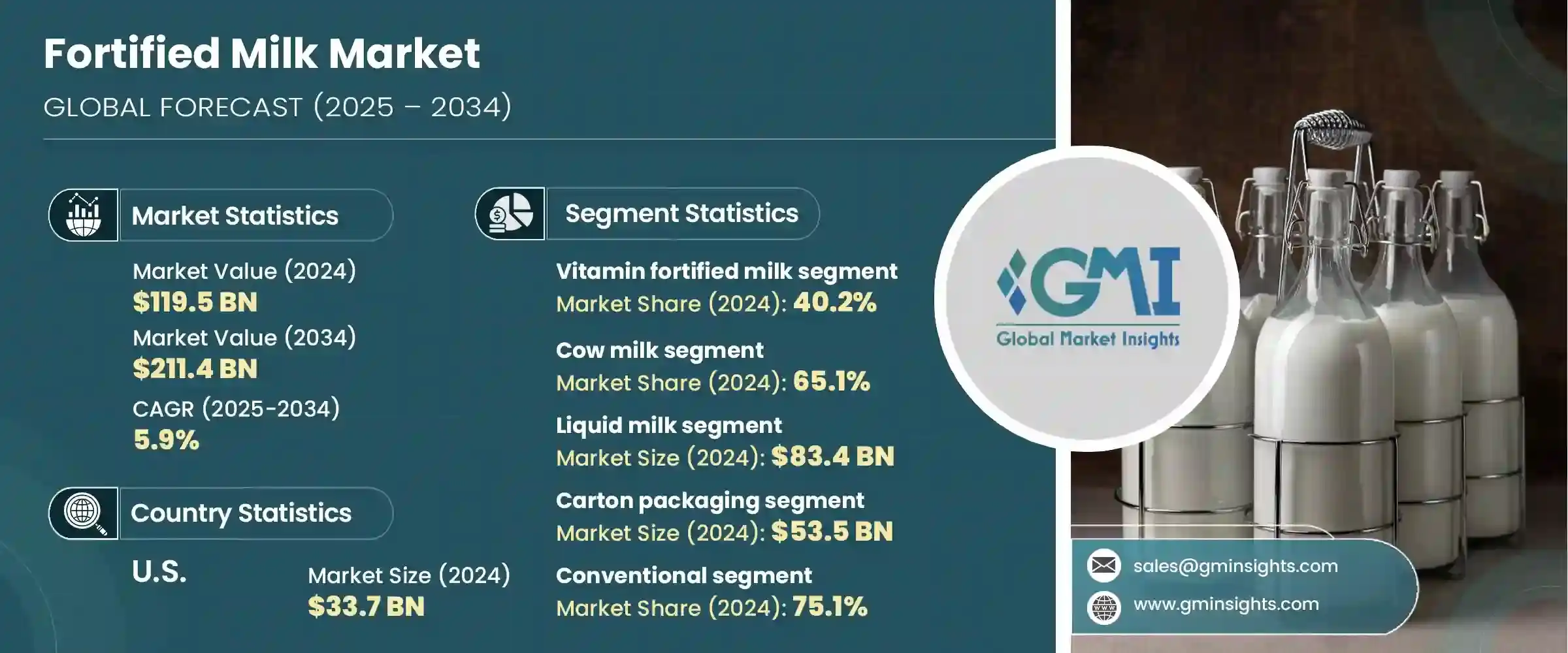

2024年,全球強化乳市場規模達1,195億美元,預計到2034年將以5.9%的複合年成長率成長,達到2,114億美元。這一穩步成長的動力源於人們對營養缺陷問題的認知不斷提高,以及對功能性乳製品需求的不斷成長。隨著消費者健康意識的增強,人們越來越傾向於選擇富含維生素D、維生素A、鈣、鋅和鐵等必需微量營養素的乳製品。這些強化產品有助於骨骼健康、免疫功能和認知發展。疫情過後,人們的重點已顯著轉向增強免疫力的營養,促使製造商推出滿足從幼兒到老年人等各年齡層需求的強化乳產品。

城市化進程加快、可支配收入增加以及公共衛生措施推動的食品強化也推動了市場發展,尤其是在非洲和亞洲的發展中經濟體。強化牛奶在解決貧血、骨質疏鬆症和維生素缺乏症等普遍存在的營養問題方面發揮關鍵作用,為飲食多樣化不足的地區提供了切實可行的解決方案。在許多地區,強化牛奶也是旨在改善學童和孕婦健康狀況的大規模營養計劃的重要組成部分,這進一步鞏固了其作為主流健康產品的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1195億美元 |

| 預測值 | 2114億美元 |

| 複合年成長率 | 5.9% |

2024年,強化維生素牛奶市場佔據40.2%的市場佔有率,預計到2034年將以6.1%的複合年成長率成長。其日益普及的主要原因是消費者對便利的日常營養來源的偏好。富含維生素A、D和B群維生素等必需維生素的強化牛奶尤其受到注重健康的目標群體的青睞,包括成長中的兒童、注重健康的成年人以及尋求更均衡飲食的準媽媽。這些營養成分的添加顯著提升了牛奶的功能價值,並擴大了其對更廣泛人群的吸引力。

2024年,強化牛奶市場中牛奶佔有率達到65.1%,預計到2034年將以5.9%的複合年成長率成長。牛奶的廣泛應用不僅源自於其營養成分,也源自於其作為全球最常見、最受認可的奶類的地位。牛奶是蛋白質、鈣和維生素的可靠來源,使其成為強化食品的天然選擇。牛奶與多種營養添加劑(包括Omega-3脂肪酸和礦物質)的兼容性,使其作為一種便捷且營養豐富的基礎食品持續成長。

2024年,美國強化乳市場規模達337億美元,預計2034年將以6.1%的複合年成長率成長。美國市場憑藉其發達的乳製品行業和高度重視營養健康的民眾,在北美地區脫穎而出。全國各地的消費者都在積極尋求功能性食品,而強化乳也透過廣泛的分銷管道廣泛普及。大眾對健康、預防性營養和日常健康最佳化日益成長的興趣,正在增強消費者需求,並加速產品創新。全國性的廣告宣傳和強化乳製品益處的教育,進一步推動了其普及。

全球強化牛奶市場的關鍵參與者包括Arla Foods amba、雀巢公司、可口可樂公司(Fairlife)、恆天然合作Group Limited和達能公司。為了鞏固市場領先地位,頂級強化牛奶公司正在採用創新、策略擴張和有針對性的健康行銷相結合的策略。他們正在投資研發針對免疫力、骨骼強度和整體健康的營養配方。

許多公司正在推出針對不同年齡層的產品線,以吸引不同的消費者群體。不斷擴張的全球分銷網路,尤其是在新興市場,使這些公司能夠抓住尚未開發的需求。此外,與公共衛生機構的合作以及參與營養推廣計畫有助於建立信任並增強品牌影響力。環保包裝和清潔標籤計畫也是他們滿足不斷變化的消費者期望的策略的一部分。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)

(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 營養分析與健康益處

- 強化牛奶的營養成分

- 宏量營養素

- 微量營養素

- 生物活性化合物

- 目標消費者的健康益處

- 嬰幼兒

- 兒童和青少年

- 成年人

- 老年

- 孕婦及哺乳期婦女

- 運動員和健身愛好者

- 解決營養不足問題

- 維生素D缺乏症

- 鈣缺乏

- 缺鐵

- 其他營養缺乏症

- 臨床研究和研究結果

- 骨骼健康

- 免疫功能

- 認知發展

- 其他健康領域

- 比較分析

- 強化牛奶與普通牛奶

- 強化牛奶與植物性替代品

- 強化牛奶與膳食補充劑

- 強化牛奶的營養成分

- 消費者行為分析

- 消費者人口統計

- 年齡層分析

- 收入水平分析

- 地理分佈

- 學歷

- 購買決策因素

- 營養益處

- 價格敏感度

- 品牌忠誠度

- 包裝偏好

- 口味和風味

- 消費模式

- 消費頻率

- 基於場合的消費

- 季節變化

- 消費者意識和看法

- 強化益處的知識

- 標籤閱讀行為

- 對健康聲明的信任

- 消費者區隔

- 注重健康的消費者

- 價值追求者

- 高級買家

- 注重便利的消費者

- 消費者人口統計

- 行銷和定價策略

- 品牌定位

- 高階定位

- 價值定位

- 以健康為中心的定位

- 目標特定定位

- 行銷管道

- 傳統媒體

- 數位行銷

- 社群媒體策略

- 影響力行銷

- 品牌定位

- 生產加工分析

- 原物料採購

- 牛奶採購

- 強化成分採購

- 品質控制措施

- 強化過程

- 直接添加

- 微膠囊化

- 脂質體遞送

- 其他強化方法

- 加工技術

- 巴氏殺菌

- 超高溫(UHT)加工

- 噴霧乾燥

- 其他加工技術

- 品質保證和測試

- 營養穩定性測試

- 微生物檢測

- 感官評價

- 保存期限測試

- 封裝技術

- 無菌包裝

- 氣調包裝

- 活性包裝

- 永續包裝解決方案

- 原物料採購

- 未來展望及策略建議

- 市場演變情景

- 樂觀情境

- 現實場景

- 悲觀情景

- 新興趨勢

- 個人化營養

- 清潔標籤強化

- 新型輸送系統

- 數位化整合

- 創新機會

- 新的強化成分

- 包裝創新

- 加工技術

- 產品配方

- 策略建議

- 對於製造商

- 對於零售商

- 對於投資者

- 對於監管機構

- 市場演變情景

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依強化類型,2021-2034

- 主要趨勢

- 維生素強化牛奶

- 維生素A

- 維生素D

- 維生素B複合物

- 維生素E

- 其他維生素

- 礦物質強化牛奶

- 鈣

- 鐵

- 鋅

- 其他礦物

- 蛋白質強化牛奶

- Omega-3強化牛奶

- 益生菌強化牛奶

- 多營養強化牛奶

- 其他防禦類型

第6章:市場估計與預測:依牛奶類型,2021-2034

- 主要趨勢

- 牛奶

- 全脂牛奶

- 半脫脂牛奶

- 脫脂牛奶

- 水牛奶

- 山羊乳

- A2牛奶

- 其他牛奶類型

第7章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 液態乳

- 鮮液態乳

- 超高溫滅菌牛奶

- 調味牛奶

- 奶粉

- 全脂奶粉

- 脫脂奶粉

- 調味奶粉

- 煉乳

- 淡奶

第8章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 紙箱包裝

- 利樂

- 山牆頂

- 其他紙箱類型

- 塑膠瓶

- 寵物瓶

- HDPE瓶

- 其他塑膠類型

- 玻璃瓶

- 袋裝

- 罐頭

- 其他包裝類型

第9章:市場估計與預測:依目標消費者,2021-2034 年

- 主要趨勢

- 嬰幼兒(0-3歲)

- 兒童(4-12歲)

- 青少年(13-18歲)

- 成人(19-50歲)

- 老年人(50歲以上)

- 孕婦及哺乳期婦女

- 運動員和健身愛好者

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 超市和大賣場

- 便利商店

- 網路零售

- 電子商務平台

- 直接面對消費者的網站

- 專賣店

- 藥局和藥局

- 餐飲服務

- HoReCa (飯店、餐廳、咖啡館)

- 機構

- 其他

第 11 章:市場估計與預測:按性質,2021-2034 年

- 主要趨勢

- 傳統的

- 有機的

- 不含乳糖

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第13章:公司簡介

- Alaska Milk Corporation

- Almarai Company

- Arla Foods amba

- Dairy Farmers of America

- Danone SA

- Dean Foods Company

- Fonterra Co-operative Group Limited

- Groupe Lactalis

- Gujarat Cooperative Milk Marketing Federation (Amul)

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Meiji Holdings Co., Ltd.

- Mother Dairy Fruit & Vegetable Pvt Ltd

- Nestle SA

- Parmalat SpA

- Saputo Inc.

- The Coca-Cola Company (Fairlife)

- Vinamilk

The Global Fortified Milk Market was valued at USD 119.5 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 211.4 billion by 2034. This steady growth is being fueled by a heightened awareness of nutritional deficiencies and a rising demand for functional dairy products. As consumer health consciousness broadens, there is a growing inclination toward dairy options enhanced with essential micronutrients like vitamin D, vitamin A, calcium, zinc, and iron. These enriched products support bone health, immune function, and cognitive development. Post-pandemic priorities have shifted significantly toward immune-boosting nutrition, driving manufacturers to launch fortified milk options that cater to every life stage, from young children to the elderly.

Increased urbanization, higher disposable incomes, and food fortification efforts promoted by public health initiatives are also propelling the market forward, particularly across developing economies in Africa and Asia. Fortified milk is playing a pivotal role in addressing widespread nutritional concerns, such as anemia, osteoporosis, and vitamin deficiencies, offering a practical solution in regions with limited access to diverse diets. In many areas, it is also a key component of large-scale nutritional programs designed to improve the well-being of school children and expectant mothers, further reinforcing its relevance as a mainstream health product.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $119.5 Billion |

| Forecast Value | $211.4 Billion |

| CAGR | 5.9% |

Vitamin-enriched milk segment held a 40.2% share in 2024 and is forecasted to grow at a CAGR of 6.1% through 2034. Its rising popularity is largely attributed to consumer preference for convenient sources of daily nutrition. Fortified milk rich in essential vitamins such as A, D, and B-complex is especially appealing to target groups focused on health, including growing children, wellness-minded adults, and expectant mothers seeking better dietary balance. These nutrient additions significantly boost milk's functional value and expand its appeal to broader demographics.

The cow milk segment in the fortified milk market held 65.1% share in 2024 and is projected to grow at a CAGR of 5.9% through 2034. Its widespread use stems from both its nutritional profile and its position as the most familiar and accepted milk type globally. Cow milk offers a reliable source of protein, calcium, and vitamins, making it a natural choice for fortification. Its compatibility with a range of nutritional additives, including omega-3 fatty acids and minerals, supports its continued growth as a convenient and nutrient-rich base.

United States Fortified Milk Market generated USD 33.7 billion in 2024 and is anticipated to grow at a CAGR of 6.1% through 2034. The US market stands out within North America due to its well-developed dairy industry and a population that places a high value on nutritional health. Consumers across the country actively seek functional foods, and fortified milk is widely accessible through extensive distribution channels. Growing public interest in wellness, preventive nutrition, and daily health optimization is reinforcing consumer demand and accelerating product innovation. National advertising campaigns and education on the benefits of fortified dairy have further driven adoption.

Key players shaping the Global Fortified Milk Market include Arla Foods amba, Nestle S.A., The Coca-Cola Company (Fairlife), Fonterra Co-operative Group Limited, and Danone S.A. To solidify their market leadership, top fortified milk companies are employing a combination of innovation, strategic expansion, and targeted health marketing. They are investing in research to develop nutrient-specific formulations aimed at immunity, bone strength, and overall wellness.

Many are launching age-targeted product lines to appeal to different consumer segments. Expanding global distribution networks, especially in emerging markets, allows these companies to capture untapped demand. Additionally, partnerships with public health agencies and participation in nutrition outreach programs help build trust and strengthen brand presence. Eco-friendly packaging and clean-label initiatives are also part of their strategy to meet evolving consumer expectations.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fortification type

- 2.2.3 Milk type

- 2.2.4 Target customer

- 2.2.5 Form

- 2.2.6 Packaging type

- 2.2.7 Distribution channel

- 2.2.8 Nature

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Nutritional analysis & health benefits

- 3.13.1 Nutritional profile of fortified milk

- 3.13.1.1 Macronutrients

- 3.13.1.2 Micronutrients

- 3.13.1.3 Bioactive compounds

- 3.13.2 Health benefits by target consumer

- 3.13.2.1 Infants & toddlers

- 3.13.2.2 Children & adolescents

- 3.13.2.3 Adults

- 3.13.2.4 Elderly

- 3.13.2.5 Pregnant & lactating women

- 3.13.2.6 Athletes & fitness enthusiasts

- 3.13.3 Addressing nutritional deficiencies

- 3.13.3.1 Vitamin d deficiency

- 3.13.3.2 Calcium deficiency

- 3.13.3.3 Iron deficiency

- 3.13.3.4 Other nutritional deficiencies

- 3.13.4 Clinical studies & research findings

- 3.13.4.1 Bone health

- 3.13.4.2 Immune function

- 3.13.4.3 Cognitive development

- 3.13.4.4 Other health areas

- 3.13.5 Comparative analysis

- 3.13.5.1 Fortified milk vs. Regular milk

- 3.13.5.2 Fortified milk vs. Plant-based alternatives

- 3.13.5.3 Fortified milk vs. Dietary supplements

- 3.13.1 Nutritional profile of fortified milk

- 3.14 Consumer behavior analysis

- 3.14.1 Consumer demographics

- 3.14.1.1 Age group analysis

- 3.14.1.2 Income level analysis

- 3.14.1.3 Geographic distribution

- 3.14.1.4 Educational background

- 3.14.2 Purchase decision factors

- 3.14.2.1 Nutritional benefits

- 3.14.2.2 Price sensitivity

- 3.14.2.3 Brand loyalty

- 3.14.2.4 Packaging preferences

- 3.14.2.5 Taste & flavor

- 3.14.3 Consumption patterns

- 3.14.3.1 Frequency of consumption

- 3.14.3.2 Occasion-based consumption

- 3.14.3.3 Seasonal variations

- 3.14.4 Consumer awareness & perception

- 3.14.4.1 Knowledge of fortification benefits

- 3.14.4.2 Label reading behavior

- 3.14.4.3 Trust in health claims

- 3.14.5 Consumer segmentation

- 3.14.5.1 Health-conscious consumers

- 3.14.5.2 Value seekers

- 3.14.5.3 Premium buyers

- 3.14.5.4 Convenience-oriented consumers

- 3.14.1 Consumer demographics

- 3.15 Marketing & pricing strategies

- 3.15.1 Brand positioning

- 3.15.1.1 Premium positioning

- 3.15.1.2 Value positioning

- 3.15.1.3 Health-focused positioning

- 3.15.1.4 Target-specific positioning

- 3.15.2 Marketing channels

- 3.15.2.1 Traditional media

- 3.15.2.2 Digital marketing

- 3.15.2.3 Social media strategies

- 3.15.2.4 Influencer marketing

- 3.15.1 Brand positioning

- 3.16 Production & processing analysis

- 3.16.1 Raw material sourcing

- 3.16.1.1 Milk sourcing

- 3.16.1.2 Fortification ingredients sourcing

- 3.16.1.3 Quality control measures

- 3.16.2 Fortification process

- 3.16.2.1 Direct addition

- 3.16.2.2 Microencapsulation

- 3.16.2.3 Liposomal delivery

- 3.16.2.4 Other fortification methods

- 3.16.3 Processing technologies

- 3.16.3.1 Pasteurization

- 3.16.3.2 Ultra-High Temperature (UHT) processing

- 3.16.3.3 Spray drying

- 3.16.3.4 Other processing technologies

- 3.16.4 Quality assurance & testing

- 3.16.4.1 Nutrient stability testing

- 3.16.4.2 Microbiological testing

- 3.16.4.3 Sensory evaluation

- 3.16.4.4 Shelf-life testing

- 3.16.5 Packaging technologies

- 3.16.5.1 Aseptic packaging

- 3.16.5.2 Modified atmosphere packaging

- 3.16.5.3 Active packaging

- 3.16.5.4 Sustainable packaging solutions

- 3.16.1 Raw material sourcing

- 3.17 Future outlook & strategic recommendations

- 3.17.1 Market evolution scenario

- 3.17.1.1 Optimistic scenario

- 3.17.1.2 Realistic scenario

- 3.17.1.3 Pessimistic scenario

- 3.17.2 Emerging trends

- 3.17.2.1 Personalized nutrition

- 3.17.2.2 Clean label fortification

- 3.17.2.3 Novel delivery systems

- 3.17.2.4 Digital integration

- 3.17.3 Innovation opportunities

- 3.17.3.1 New fortification ingredients

- 3.17.3.2 Packaging innovations

- 3.17.3.3 Processing technologies

- 3.17.3.4 Product formulations

- 3.17.4 Strategic recommendations

- 3.17.4.1 For manufacturers

- 3.17.4.2 For retailers

- 3.17.4.3 For investors

- 3.17.4.4 For regulatory bodies

- 3.17.1 Market evolution scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fortification Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trend

- 5.2 Vitamin fortified milk

- 5.2.1 Vitamin A

- 5.2.2 Vitamin D

- 5.2.3 Vitamin B Complex

- 5.2.4 Vitamin E

- 5.2.5 Other vitamins

- 5.3 Mineral fortified milk

- 5.3.1 Calcium

- 5.3.2 Iron

- 5.3.3 Zinc

- 5.3.4 Other minerals

- 5.4 Protein fortified milk

- 5.5 Omega-3 fortified milk

- 5.6 Probiotic fortified milk

- 5.7 Multi-nutrient fortified milk

- 5.8 Other fortification types

Chapter 6 Market Estimates & Forecast, By Milk Type, 2021-2034 (USD Billion) (Thousand Litres)

- 6.1 Key trend

- 6.2 Cow milk

- 6.2.1 Whole milk

- 6.2.2 Semi-skimmed milk

- 6.2.3 Skimmed milk

- 6.3 Buffalo milk

- 6.4 Goat milk

- 6.5 A2 milk

- 6.6 Other milk types

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Thousand Litres)

- 7.1 Key trend

- 7.2 Liquid milk

- 7.2.1 Fresh liquid milk

- 7.2.2 UHT milk

- 7.2.3 Flavored milk

- 7.3 Powdered milk

- 7.3.1 Whole milk powder

- 7.3.2 Skimmed milk powder

- 7.3.3 Flavored milk powder

- 7.4 Condensed milk

- 7.5 Evaporated milk

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion) (Thousand Litres)

- 8.1 Key trend

- 8.2 Carton packaging

- 8.2.1 Tetra pak

- 8.2.2 Gable top

- 8.2.3 Other carton types

- 8.3 Plastic bottles

- 8.3.1 Pet bottles

- 8.3.2 HDPE bottles

- 8.3.3 Other plastic types

- 8.4 Glass bottles

- 8.5 Pouches

- 8.6 Cans

- 8.7 Other packaging types

Chapter 9 Market Estimates & Forecast, By Target Consumer, 2021-2034 (USD Billion) (Thousand Litres)

- 9.1 Key trend

- 9.2 Infants & toddlers (0-3 years)

- 9.3 Children (4-12 years)

- 9.4 Adolescents (13-18 years)

- 9.5 Adults (19-50 years)

- 9.6 Elderly (above 50 years)

- 9.7 Pregnant & lactating women

- 9.8 Athletes & fitness enthusiasts

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Litres)

- 10.1 Key trend

- 10.2 Supermarkets & hypermarkets

- 10.3 Convenience stores

- 10.4 Online retail

- 10.4.1 E-commerce platforms

- 10.4.2 Direct-to-consumer websites

- 10.5 Specialty stores

- 10.6 Pharmacies & drug stores

- 10.7 Foodservice

- 10.7.1 HoReCa (Hotels, Restaurants, Cafes)

- 10.7.2 Institutional

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Nature, 2021-2034 (USD Billion) (Thousand Litres)

- 11.1 Key trend

- 11.2 Conventional

- 11.3 Organic

- 11.4 Lactose-free

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Litres)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East & Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East & Africa

Chapter 13 Company Profiles

- 13.1 Alaska Milk Corporation

- 13.2 Almarai Company

- 13.3 Arla Foods amba

- 13.4 Dairy Farmers of America

- 13.5 Danone S.A.

- 13.6 Dean Foods Company

- 13.7 Fonterra Co-operative Group Limited

- 13.8 Groupe Lactalis

- 13.9 Gujarat Cooperative Milk Marketing Federation (Amul)

- 13.10 Inner Mongolia Yili Industrial Group Co., Ltd.

- 13.11 Meiji Holdings Co., Ltd.

- 13.12 Mother Dairy Fruit & Vegetable Pvt Ltd

- 13.13 Nestle S.A

- 13.14 Parmalat S.p.A.

- 13.15 Saputo Inc.

- 13.16 The Coca-Cola Company (Fairlife)

- 13.17 Vinamilk