|

市場調查報告書

商品編碼

1773344

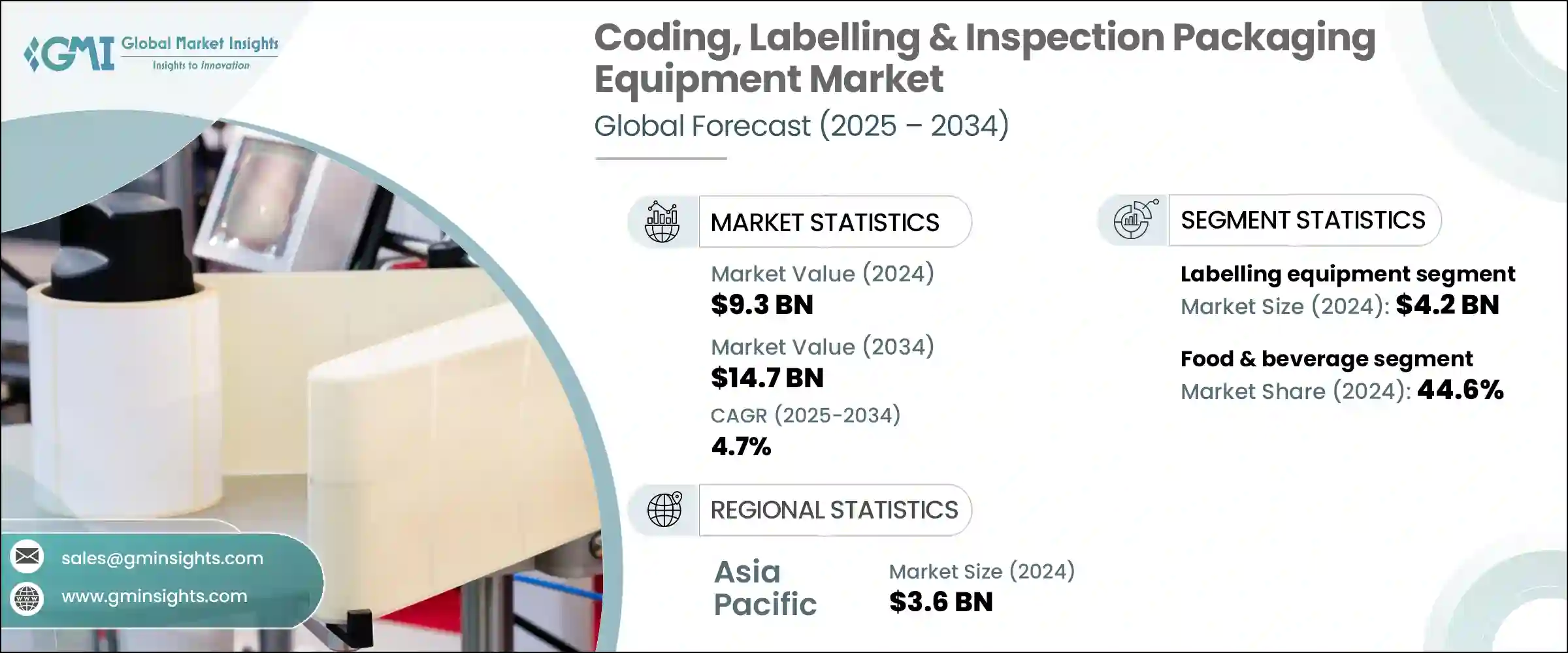

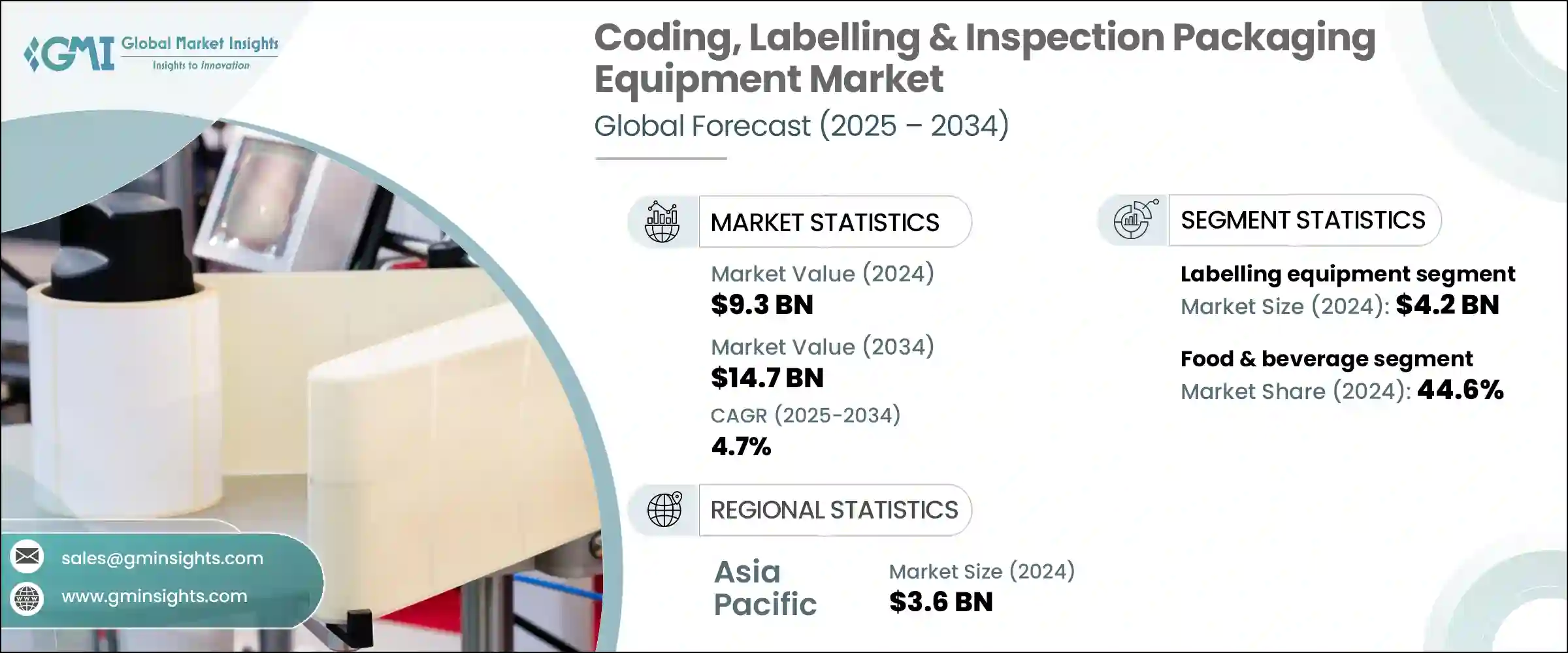

編碼、標籤和檢測包裝設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Coding, Labelling and Inspection Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球編碼、標籤和檢測包裝設備市場價值為 93 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長,達到 147 億美元。這些系統是製藥、消費品、化妝品、食品飲料等行業的重要組成部分,支援包裝和供應鏈流程。編碼和標籤系統可生產耐用、高品質的標籤,不僅確保符合全球各種監管標準,還能提升品牌形象和顧客信任。可追溯性仍然是一個關鍵因素,可幫助製造商有效地管理產品召回並監控批次資訊。同時,配備先進攝影機的偵測設備可檢查包裝、密封和印刷代碼中的缺陷,以維護產品的完整性。物聯網整合、工業 4.0 功能和機器學習等創新正在顯著提高檢測精度和營運效率。

市場上有許多全球參與者,提供根據特定行業需求客製化且可擴展的設備。這些公司正積極擴展其產品組合,推出模組化平台,以適應不同的產品尺寸、生產速度和監管要求。製造商專注於尋求能夠與現有自動化基礎設施無縫整合的解決方案,從而提高靈活性,並減少設備升級或規格變更期間的停機時間。許多參與者也利用智慧技術(例如人工智慧驅動的檢測、基於雲端的資料分析和即時監控系統)來提高整個供應鏈的準確性、效率和可追溯性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 93億美元 |

| 預測值 | 147億美元 |

| 複合年成長率 | 4.7% |

2024年,標籤設備市場規模達42億美元。標籤透過傳達價格、數量和品質等關鍵訊息,在產品可見性和消費者決策中發揮至關重要的作用。隨著各行各業致力於加強庫存管理、驗證產品真偽並提升客戶參與度,對自動化和智慧標籤解決方案的需求日益成長。製藥、個人護理和食品等行業是標籤設備的主要驅動力,推動創新技術的採用。

食品飲料業佔比44.6%,2024年市場規模達41億美元。消費者對透明度、可追溯性和嚴格安全法規合規性的需求日益成長,這促使食品製造商大力投資高精度標籤系統,例如環繞式貼標機和貼紙貼標機。北美和歐洲等地區的監管要求正促使企業採用能夠在不影響合規性的情況下處理大量生產的先進解決方案。

2024年,美國編碼、標籤和檢測包裝設備市場佔據64%的市場。美國市場的成長受到嚴格的標籤法規和大規模生產營運的推動。食品、製藥和物流等關鍵產業越來越依賴先進的標籤和檢測系統來簡化其生產和分銷工作流程。

編碼、標籤和檢測包裝設備市場的領先公司包括多米諾 (Domino)、萊賓格 (Leibinger)、馬肯依瑪士 (Markem-Imaje)、偉迪捷 (Videojet)、Accutek Packaging Equipment、佐藤 (SATO)、HERMA、日立 IESA、科爾伯 (Korber AGmment、Corberzoan、HERMA、Axini Group、Corberxid Group (Korber AGx)、CKorber 組合、Cpini Group、Cpini Group、Campini Group、CakxA)。為了鞏固市場地位,各公司專注於多種策略方針。創新仍然是公司的首要任務,公司在研發方面投入資金,以開發更智慧、更快速、更靈活的設備,並與數位供應鏈和工業 4.0 技術無縫整合。

企業正透過策略合作、收購和強化售後服務等方式拓展全球業務,以建立更緊密的客戶關係並確保長期忠誠度。客製化和模組化設計受到重視,以滿足不同行業的特定需求。此外,製造商透過創建節能系統和減少浪費,將永續性放在首位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 食品和飲料行業對標籤設備的需求不斷增加

- 電子商務和物流的成長

- 產品認證和防偽需求不斷成長

- 產業陷阱與挑戰

- 整合複雜性

- 原物料價格波動

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按設備類型,2021 年至 2034 年

- 主要趨勢

- 噴碼設備

- 噴墨打碼機

- 雷射打碼機

- 其他

- 貼標設備

- 壓力

- 收縮套標

- 列印並應用

- 其他

- 檢測設備

- 機器視覺系統

- 洩漏檢測

- 檢重秤

- 金屬探測器

- 其他

第6章:市場估計與預測:依包裝類型,2021 年至 2034 年

- 主要趨勢

- 基本的

- 次要

- 第三

第7章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 手動的

- 半自動

- 自動的

第8章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化妝品和個人護理

- 電子產品

- 化學品

- 工業產品

- 其他

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Accutek Packaging Equipment

- CVC Technologies

- Domino

- GEA

- HERMA

- Hitachi IESA

- Korber AG

- Leibinger

- Marchesini Group

- Markem-Imaje

- Paxiom

- Romaco Group

- SATO

- Uhlmann Group

- Videojet

The Global Coding, Labelling and Inspection Packaging Equipment Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 14.7 billion by 2034. These systems are vital components across industries such as pharmaceuticals, consumer goods, cosmetics, and food and beverages, supporting packaging and supply chain processes. Coding and labeling systems produce durable, high-quality labels that not only ensure compliance with diverse regulatory standards worldwide but also enhance brand identity and customer trust. Traceability remains a key factor, helping manufacturers efficiently manage product recalls and monitor batch information. Meanwhile, inspection equipment equipped with advanced cameras checks for defects in packaging, seals, and printed codes to maintain product integrity. Innovations like IoT integration, Industry 4.0 capabilities, and machine learning are significantly enhancing inspection precision and operational efficiency.

The market features numerous global players providing customizable and scalable equipment tailored to specific industry demands. These companies are actively expanding their portfolios with modular platforms that can be adapted to different product sizes, production speeds, and regulatory requirements. Manufacturers are focusing on solutions that can integrate seamlessly with existing automation infrastructures, allowing for greater flexibility and reduced downtime during equipment upgrades or format changes. Many players are also leveraging smart technologies-such as AI-driven inspection, cloud-based data analytics, and real-time monitoring systems-to enhance accuracy, efficiency, and traceability across supply chains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 4.7% |

In 2024, the labeling equipment segment generated USD 4.2 billion. Labeling plays a crucial role in product visibility and consumer decision-making by conveying essential details such as price, quantity, and quality. As industries aim to boost inventory management, verify product authenticity, and improve customer engagement, demand for automated and smart labeling solutions is on the rise. Sectors like pharmaceuticals, personal care, and food are major drivers for labeling equipment, pushing the adoption of innovative technologies.

The food & beverage segment accounted for 44.6% share and generated USD 4.1 billion in 2024. Growing consumer demand for transparency, traceability, and compliance with stringent safety regulations is pushing food manufacturers to invest heavily in high-precision labeling systems like wrap-around and sticker labeling machines. Regulatory requirements in regions such as North America and Europe are motivating companies to adopt advanced solutions capable of handling high-volume production without compromising compliance.

United States Coding, Labelling & Inspection Packaging Equipment Market held a 64% share in 2024. The U.S. market's growth is driven by strict labeling regulations and large-scale manufacturing operations. Key industries, including food, pharmaceuticals, and logistics, increasingly depend on sophisticated labeling and inspection systems to streamline their production and distribution workflows.

Leading companies in the Coding, Labelling & Inspection Packaging Equipment Market include Domino, Leibinger, Markem-Imaje, Videojet, Accutek Packaging Equipment, SATO, HERMA, Hitachi IESA, Korber AG, Romaco Group, Uhlmann Group, CVC Technologies, Marchesini Group, GEA, and Paxiom. To strengthen their market position, companies focus on several strategic approaches. Innovation remains a priority, with investments in R&D to develop smarter, faster, and more flexible equipment that integrates seamlessly with digital supply chains and Industry 4.0 technologies.

Firms are expanding their global footprint through strategic partnerships, acquisitions, and enhanced after-sales services to build closer customer relationships and ensure long-term loyalty. Customization and modular design are emphasized to meet the specific needs of diverse industries. Additionally, manufacturers prioritize sustainability by creating energy-efficient systems and reducing waste.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Packaging type

- 2.2.4 Operation mode

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for labelling equipment from food & beverages industry

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Rising demand for product authentication & anti-counterfeiting

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Integration complexity

- 3.2.2.2 Fluctuating raw material prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Coding equipment

- 5.2.1 Inkjet coders

- 5.2.2 Laser coders

- 5.2.3 Others

- 5.3 Labeling equipment

- 5.3.1 Pressure-sensitive

- 5.3.2 Shrink sleeve

- 5.3.3 Print and apply

- 5.3.4 Others

- 5.4 Inspection equipment

- 5.4.1 Machine vision systems

- 5.4.2 Leak detection

- 5.4.3 Checkweighers

- 5.4.4 Metal detectors

- 5.4.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Primary

- 6.3 Secondary

- 6.4 Tertiary

Chapter 7 Market Estimates and Forecast, By Operation Mode, 2021 – 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Automatic

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Cosmetics & personal care

- 8.5 Electronics

- 8.6 Chemicals

- 8.7 Industrial products

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.1.1 Direct sales

- 9.1.2 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Accutek Packaging Equipment

- 11.2 CVC Technologies

- 11.3 Domino

- 11.4 GEA

- 11.5 HERMA

- 11.6 Hitachi IESA

- 11.7 Korber AG

- 11.8 Leibinger

- 11.9 Marchesini Group

- 11.10 Markem-Imaje

- 11.11 Paxiom

- 11.12 Romaco Group

- 11.13 SATO

- 11.14 Uhlmann Group

- 11.15 Videojet