|

市場調查報告書

商品編碼

1773341

工業噴墨印表機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Inkjet Printers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

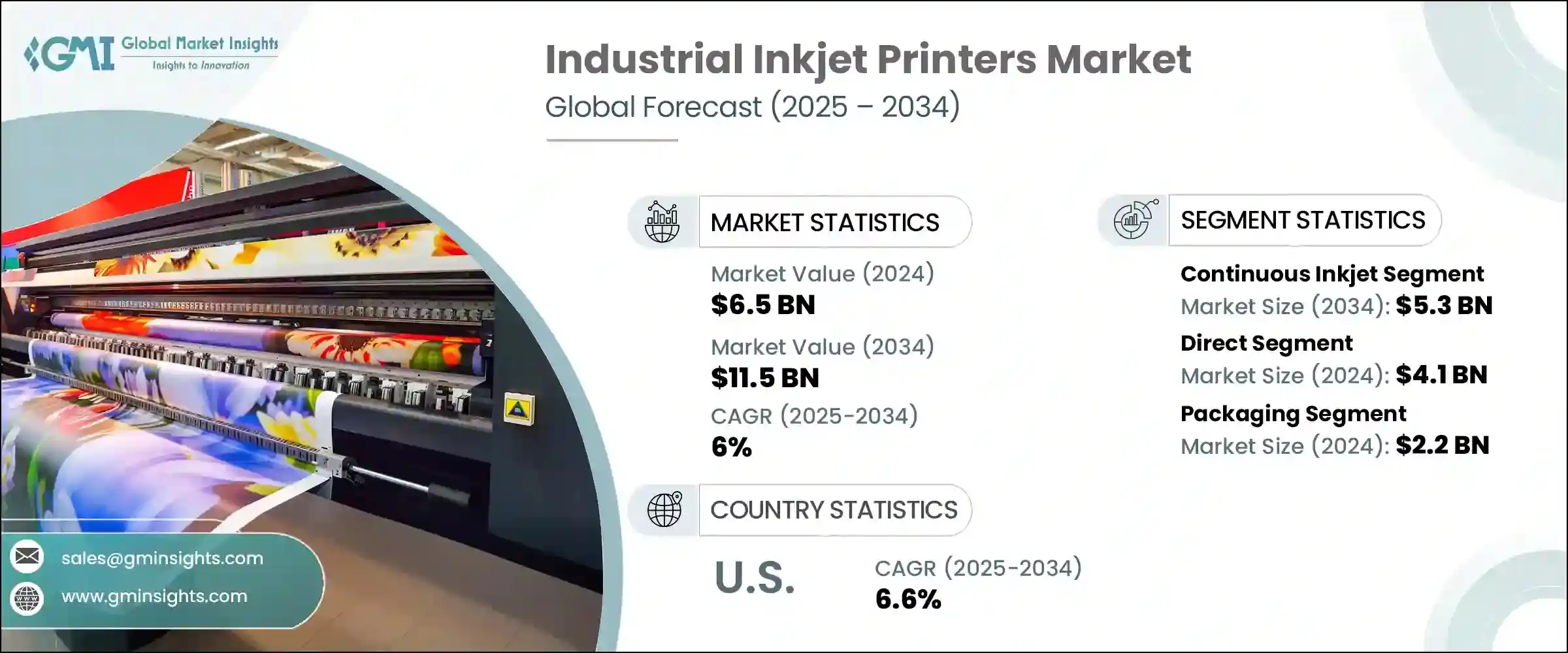

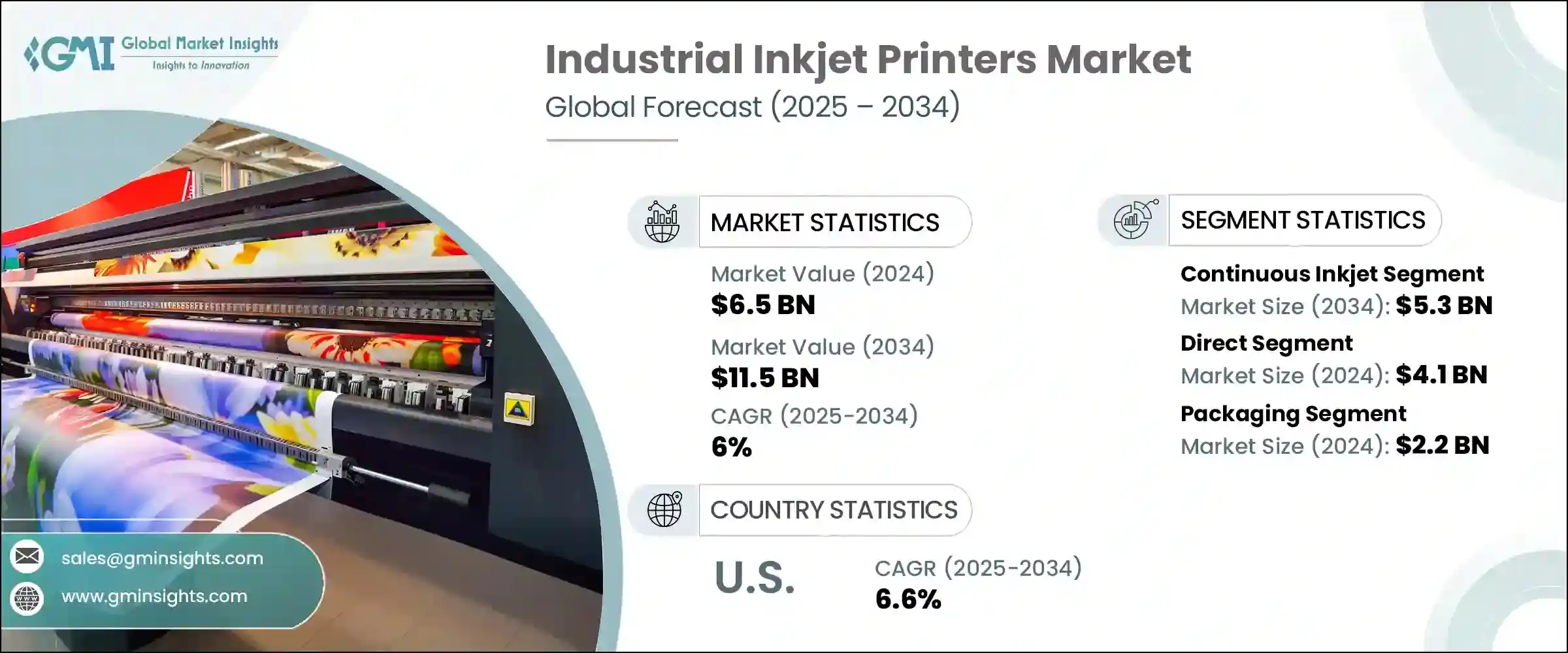

2024年,全球工業噴墨印表機市場規模達65億美元,預計到2034年將以6%的複合年成長率成長,達到115億美元。製藥、紡織和包裝等行業對可變資料列印的需求顯著成長,尤其是在各種材料上即時列印條碼、日期、序號和批次程式碼的需求。消費者對產品個性化、更嚴格的監管標準以及競爭激烈的市場中品牌差異化的期望推動了這一成長。

噴墨系統為短版作業提供靈活且經濟高效的高解析度列印解決方案,無需昂貴的設備改造,正吸引越來越多的終端用戶採用。此外,永續發展的勢頭日益強勁,尤其是在美國環保署 (EPA) 強調減少浪費和提高能源效率的背景下。因此,越來越多的公司選擇噴墨列印作為環保且高效的替代方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 6% |

技術進步,尤其是在印表機頭設計、數位墨水配方以及與工業 4.0 平台整合方面的進步,正在顯著提升噴墨印表機的性能。這些改進實現了超高解析度輸出,並透過利用微滴控制和更高像素精度等特性,使裝飾包裝、薄膜標籤和定製材料等特殊應用受益。此外,工業噴墨技術已在積層製造領域佔據一席之地,尤其是黏合劑噴射技術,該技術已被證明是生物醫學、航太和汽車等各領域 3D 列印的可行方法。隨著這些機器的發展,潛在的投資報酬率持續成長,鞏固了它們在現代生產環境中的地位。

2024年,連續噴墨 (CIJ) 市場規模達29億美元,預計2034年將增加至53億美元。該市場以其高速、非接觸式列印能力以及極低的維護需求引領市場。其耐用性以及在嚴苛環境下提供穩定輸出的能力,使其成為需要在各種承印物上列印可變資訊(例如有效期限和追蹤碼)的企業的熱門選擇。憑藉強大的附著力和即使在嚴苛的工業條件下也能無縫運作的CIJ系統,其市場地位持續保持強勁。

2024年,直銷市場規模達41億美元,預估2025-2034年複合年成長率為6.1%。需要高度客製化和技術複雜性的工業應用是推動這一市場發展的主要動力。愛普生、馬肯依瑪士、多米諾印刷科學和偉迪捷等領先製造商透過與客戶建立直接關係,強化了其市場策略。這些公司提供個人化服務,包括系統設定、即時技術支援、維護協議以及與現有工作流程的全面整合,從而確保長期的客戶保留和滿意度。

2024年,北美工業噴墨印表機市場規模達9億美元,預計2025年至2034年期間的複合年成長率將達到6.6%。美國的主導地位源自於其完善且技術先進的製造業生態系統。噴墨系統廣泛應用於電子、食品生產和製藥等行業的標記、編碼和標籤製程。這些系統能夠有效地整合到現有的自動化設備中,顯著提高產量,同時最大限度地減少停機時間。業界領導者持續不斷的研發工作,致力於提升工業噴墨技術的性能、耐用性和運作效率。

影響工業噴墨印表機產業競爭格局的主要參與者包括佳能、富士膠片、Durst Phototechnik、惠普、兄弟工業、柯尼卡美能達、愛普生、日立工業設備系統、三菱重工印刷包裝機械、電子成像、基恩士、Leibinger Group 和多米諾印刷科學。

為了鞏固市場地位,工業噴墨印表機產業的領導者專注於與客戶直接互動,提供客製化解決方案,並提供包括維護、培訓和整合在內的全方位服務。許多企業正在大力投資研發,以改善印表機頭技術、油墨化學和永續實踐,從而滿足法規要求和客戶期望。策略合作和收購也很常見,這有助於擴大產品組合併進入新的區域市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監理框架

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- MEA

- 拉丁美洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術,2021-2034 年

- 主要趨勢

- 連續噴墨

- 按需投放

- UV噴墨

- 其他

第6章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 食品和飲料

- 化學

- 製藥

- 包裝

- 個人護理和化妝品

- 其他

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直銷

- 間接銷售

第8章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第9章:公司簡介

- Brother Industries

- Canon

- Domino Printing Sciences

- Durst Phototechnik

- Electronics For Imaging

- Epson

- Fujifilm

- Hitachi Industrial Equipment Systems

- HP

- Keyence

- Konica Minolta

- Leibinger Group

- Markem-Imaje

- Mitsubishi Heavy Industries Printing & Packaging Machinery

- Videojet

The Global Industrial Inkjet Printers Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 11.5 billion by 2034. Industries such as pharmaceuticals, textiles, and packaging are significantly boosting the demand for variable data printing, particularly for real-time labeling with barcodes, dates, serial numbers, and batch codes across diverse materials. This growth is fueled by consumer expectations for product personalization, stricter regulatory standards, and brand differentiation in competitive markets.

Inkjet systems offer a flexible and cost-effective solution for high-resolution printing on short-run jobs without the need for costly retooling, which is attracting growing adoption among end-users. Furthermore, sustainability is gaining momentum, especially with the emphasis from the U.S. Environmental Protection Agency (EPA) on reducing waste and improving energy efficiency. As a result, more companies are turning to inkjet printing as an environmentally responsible and productive alternative.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 6% |

Technological advancements, especially in printhead design, digital ink formulations, and integration with Industry 4.0 platforms, are significantly enhancing the performance of inkjet printers. These improvements allow for ultra-high-resolution outputs, benefiting specialized applications like decorative packaging, film labeling, and custom materials by leveraging features such as micro-droplet control and increased pixel accuracy. Additionally, industrial inkjet technology has found a place in additive manufacturing, particularly binder jetting, which is proving to be a viable method in 3D printing across various sectors, including biomedical, aerospace, and automotive. The potential return on investment continues to increase as these machines evolve, solidifying their role in modern production environments.

The continuous inkjet (CIJ) segment accounted for USD 2.9 billion in 2024 and is expected to rise to USD 5.3 billion by 2034. This segment leads the market due to its ability to perform high-speed, non-contact printing with minimal maintenance requirements. Its durability and ability to deliver consistent output in demanding settings make it a popular choice for businesses that rely on printing variable information such as expiration dates and tracking codes on a variety of substrates. With strong adhesion properties and seamless operation even under challenging industrial conditions, CIJ systems continue to maintain a strong market position.

The direct sales segment accounted for USD 4.1 billion in 2024 and is anticipated to grow at a CAGR of 6.1% during 2025-2034. Industrial applications that demand a high degree of customization and technical complexity primarily drive this segment. Leading manufacturers such as Epson, Markem-Imaje, Domino Printing Sciences, and Videojet have strengthened their market approach by building direct relationships with clients. These companies provide personalized services, including system setup, real-time technical support, maintenance agreements, and full integration with existing workflows, ensuring long-term client retention and satisfaction.

North America Industrial Inkjet Printers Market was valued at USD 900 million in 2024 and is projected to grow at a CAGR of 6.6% between 2025 and 2034. The dominance of the U.S. stems from its well-established and technologically advanced manufacturing ecosystem. Inkjet systems are widely adopted for marking, coding, and labeling processes within various sectors such as electronics, food production, and pharmaceuticals. These systems integrate efficiently into existing automation setups, significantly boosting throughput while minimizing downtime. Ongoing research and development efforts by industry leaders continue to enhance the performance, durability, and operational efficiency of industrial inkjet technologies.

Key players shaping the competitive landscape of the Industrial Inkjet Printer Industry include Canon, Fujifilm, Durst Phototechnik, HP, Brother Industries, Konica Minolta, Epson, Hitachi Industrial Equipment Systems, Mitsubishi Heavy Industries Printing & Packaging Machinery, Electronics For Imaging, Keyence, Leibinger Group, and Domino Printing Sciences.

To strengthen their market position, leading companies in the industrial inkjet printers industry are focusing on direct client engagement, enabling tailored solutions, and offering full-service packages including maintenance, training, and integration. Many are investing heavily in R&D to advance printhead technology, ink chemistry, and sustainable practices to align with regulatory requirements and customer expectations. Strategic collaborations and acquisitions are also common, helping to expand product portfolios and access new regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 End use industry

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Continuous inkjet

- 5.3 Drop on demand

- 5.4 UV inkjet

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Chemical

- 6.4 Pharmaceutical

- 6.5 Packaging

- 6.6 Personal care & cosmetics

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Indirect sales

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 The U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Brother Industries

- 9.2 Canon

- 9.3 Domino Printing Sciences

- 9.4 Durst Phototechnik

- 9.5 Electronics For Imaging

- 9.6 Epson

- 9.7 Fujifilm

- 9.8 Hitachi Industrial Equipment Systems

- 9.9 HP

- 9.10 Keyence

- 9.11 Konica Minolta

- 9.12 Leibinger Group

- 9.13 Markem-Imaje

- 9.14 Mitsubishi Heavy Industries Printing & Packaging Machinery

- 9.15 Videojet