|

市場調查報告書

商品編碼

1766262

工業印表機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Industrial Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

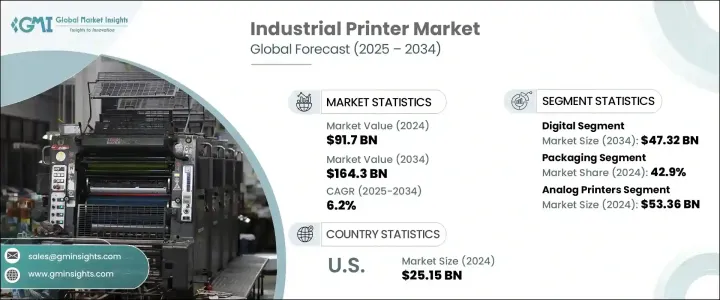

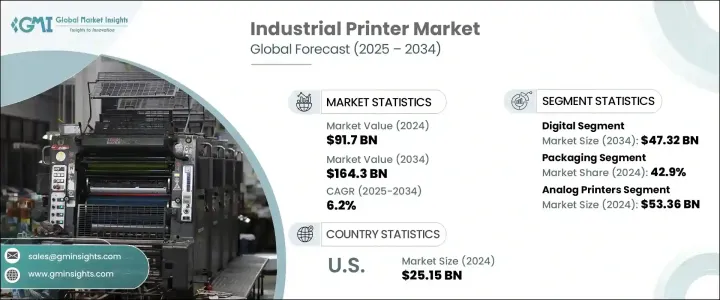

2024 年全球工業印表機市場價值為 917 億美元,預計到 2034 年將以 6.2% 的複合年成長率成長至 1,643 億美元。隨著工業自動化日益普及,以及包裝、紡織、電子和製造等行業對高速、高解析度列印的需求,該市場正在持續擴張。國際貿易的擴張和電子商務的興起大大增加了對準確標籤和即時產品編碼的需求。數位印刷和柔版印刷的融合因其速度、適應性和客製化而受到重視,正在獲得發展勢頭,尤其是在可追溯性要求變得更加嚴格的情況下。從類比印刷平台到數位印刷平台的轉變有助於改善與 ERP 系統和供應鏈的同步,從而提高營運效率。同時,對環保實踐的日益重視也增加了人們對低浪費、節能印刷解決方案的興趣。隨著越來越多的行業採用自動化和即時追蹤,工業印刷正在迅速發展以滿足不斷變化的需求和生產週期。

不斷擴展的工業應用場景也促進了市場成長,包括品牌應用和電子產品的精密電路列印需求。紡織和電子等行業擴大使用數位和噴墨印表機進行靈活的按需生產。包裝仍然是最主要的應用領域,這得益於對智慧個人化包裝日益成長的需求。小型企業由於價格實惠而開始採用緊湊型桌上型印表機,而傳統的類比印表機仍然適用於成熟產業的大規模生產。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 917億美元 |

| 預測值 | 1643億美元 |

| 複合年成長率 | 6.2% |

2024年,數位印刷產值達251億美元,預計到2034年將達到473.2億美元。該領域的快速成長歸功於其高效、快速交付成果的能力以及無需印版等設定。這使其成為短期、客製化和時效性專案的理想選擇。在注重精準度和頻繁設計變更的行業中,數位印刷的應用尤其廣泛。其鮮豔的色彩輸出、高品質的成像和按需列印功能等特性,使數位印刷機成為高級包裝和標籤的首選。此外,其節能運作和使用無毒油墨等永續特性也與企業環保目標相契合。

2024 年,包裝產業佔據工業印表機市場的主導地位,佔整體市場佔有率的 42.9%,預計到 2034 年將以 6.6% 的複合年成長率成長。線上零售的快速成長以及對品牌化和客製化包裝的追求推動了該領域對高性能列印的需求。工業印表機在這一領域至關重要,因為它們能夠以經濟高效的方式大規模生產詳細的標籤、圖形和條碼。這一點在快速消費品、醫療保健和食品服務等行業擴大採用靈活的包裝形式的情況下尤其重要。隨著永續性成為優先事項,人們對可回收材料和環保油墨的興趣也越來越大。工業印表機能夠按需提供高速、無浪費的列印,這是滿足動態包裝需求的關鍵資產。

2024年,北美工業印表機市場規模達251.5億美元。該地區在包裝、電子和製藥製造業的雄厚基礎,持續支撐著按需標籤和智慧包裝解決方案的需求成長。隨著個人化趨勢的興起,北美各地的企業正在升級其列印能力,以提供精準、快速和客製化的產品。此外,由於電子商務行業的蓬勃發展,該地區對條碼和運輸相關列印的需求也日益成長。

全球工業印表機市場的主要參與者包括理光株式會社、達美樂印刷科學、佳能公司、武藤控股株式會社、惠普公司、Durst Phototechnik AG、愛普生株式會社、康麗數位有限公司、斑馬技術公司、精工控股株式會社、賽爾公司、兄弟會公司控股委員會、柯尼梉堡式會社經公司和圖社社科。領先的工業印表機製造商正致力於透過數位技術和永續材料的研發投資來鞏固其市場地位。許多公司正在推出具有增強影像解析度的節能印表機,以及專為中小企業量身定做的緊湊型、經濟高效的型號。該公司還透過整合用於即時資料監控和自動化工作流程的軟體來擴展產品組合,提高可追溯性和營運效率。與工業自動化公司和供應鏈解決方案提供者的合作有助於提升他們的價值主張。此外,參與者正在透過開發低VOC墨水和可回收墨盒來實現環保目標。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 工業自動化和數位化的興起

- 電子商務成長與全球貿易擴張

- 印刷電子產品需求不斷成長

- 產業陷阱與挑戰

- 初期投資成本高

- 技術快速淘汰

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按下印表機技術

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼84433990)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按印表機技術,2021 - 2034 年(十億美元)

- 平版印刷

- 柔版印刷

- 螢幕

- 凹版印刷

- 凸版印刷

- 數位的

第6章:市場估計與預測:按印表機類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 類比印表機

- 桌上型印表機

第7章:市場估計與預測:按應用,2021 - 2034 年(十億美元)

- 包裝

- 紡織品

- 電子產品

- 其他

第8章:市場估計與預測:按最終用途,2021 - 2034 年(十億美元)

- 主要趨勢

- 個人的

- 家庭

第9章:市場估計與預測:按配銷通路,2021 - 2034 年(十億美元)

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Brother Industries Ltd.

- Canon Inc

- Domino Printing Sciences

- Durst Phototechnik AG

- Epson Corporation

- Heidelberger Druckmaschinen AG

- HP Inc

- Kornit Digital Ltd.

- Konica Minolta, Inc.

- Mutoh Holdings Co., Ltd.

- Ricoh Company Ltd.

- Seiko Holdings Corporation

- Xaar plc

- Xerox Holdings Corporation

- Zebra Technologies Corporation

The Global Industrial Printer Market was valued at USD 91.7 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 164.3 billion by 2034. This market is experiencing consistent expansion as industrial automation becomes more prevalent and industries demand high-speed, high-resolution printing across sectors such as packaging, textiles, electronics, and manufacturing. The expansion of international trade and the rise in e-commerce have significantly increased the need for accurate labeling and real-time product coding. Integration of digital and flexographic printing-valued for their speed, adaptability, and customization-is gaining momentum, particularly as traceability requirements become stricter. The shift from analog to digital printing platforms has helped improve synchronization with ERP systems and supply chains, promoting operational efficiency. Meanwhile, growing emphasis on eco-conscious practices has increased interest in low-waste, energy-efficient printing solutions. As more industries embrace automation and real-time tracking, industrial printing is rapidly evolving to meet changing demands and production cycles.

An expanding range of industrial use cases is also contributing to market growth, including branding applications and precise circuit printing needs in electronics. Sectors such as textiles and electronics are increasingly using digital and inkjet printers for flexible, on-demand production. Packaging remains the top application area, fueled by increasing demand for smart, personalized packaging. Smaller businesses are adopting compact desktop printers due to affordability, while traditional analog printers still cater to large-scale production across established industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $91.7 Billion |

| Forecast Value | $164.3 Billion |

| CAGR | 6.2% |

In 2024, digital printing generated USD 25.1 billion and is projected to reach USD 47.32 billion by 2034. The rapid growth of this segment is attributed to its efficiency, ability to deliver quick results, and elimination of setup needs such as printing plates. This makes it ideal for short-run, customized, and time-sensitive projects. Its adoption is strong in industries where precision and frequent design changes are essential. Features like vivid color output, high-quality imaging, and on-demand printing capabilities make digital printers a go-to for advanced packaging and labeling. Additionally, sustainable features such as energy-efficient operations and the use of non-toxic inks align well with corporate environmental goals.

The packaging sector dominated the industrial printer market in 2024, accounting for 42.9% of the overall share, and is projected to grow at a CAGR of 6.6% through 2034. Demand for high-performance printing in this segment is driven by the rapid growth of online retail and the push for branded and customized packaging. Industrial printers are essential in this space for their ability to cost-effectively produce detailed labels, graphics, and barcodes at scale. This is particularly important as industries such as FMCG, healthcare, and food services increasingly adopt flexible packaging formats. As sustainability becomes a priority, there's greater interest in recyclable materials and eco-friendly inks. The capacity of industrial printers to deliver high-speed, waste-free prints on demand is a key asset for meeting dynamic packaging needs.

North America Industrial Printer Market generated USD 25.15 billion in 2024. The region's strong foundation in packaging, electronics, and pharmaceutical manufacturing continues to support the rise in demand for on-demand labeling and smart packaging solutions. As personalization trends gain momentum, businesses across North America are upgrading their printing capabilities to deliver precise, fast, and custom results. The region also benefits from the increasing need for barcode and shipping-related prints due to a thriving e-commerce sector.

Prominent players in the Global Industrial Printer Market include Ricoh Company Ltd., Domino Printing Sciences, Canon Inc., Mutoh Holdings Co., Ltd., HP Inc., Durst Phototechnik AG, Epson Corporation, Kornit Digital Ltd., Zebra Technologies Corporation, Seiko Holdings Corporation, Xaar plc, Brother Industries Ltd., Konica Minolta, Inc., Heidelberger Druckmaschinen AG, Xerox Holdings Corporation. Leading industrial printer manufacturers are focusing on strengthening their market position through R&D investments in digital technologies and sustainable materials. Many are rolling out energy-efficient printers with enhanced image resolution, as well as compact, cost-effective models tailored for SMEs. Companies are also expanding portfolios by integrating software for real-time data monitoring and automated workflow, improving traceability and operational efficiency. Collaborations with industrial automation firms and supply chain solution providers help enhance their value propositions. Additionally, players are aligning with environmental goals by developing low-VOC inks and recyclable cartridges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Printer technology

- 2.2.3 Printer type

- 2.2.4 Substrate type

- 2.2.5 Ink type

- 2.2.6 Application

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The rising industrial automation and digitization

- 3.2.1.2 E-commerce growth and global trade expansion

- 3.2.1.3 Increasing demand for printed electronics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Rapid technological obsolescence

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Printer technology

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 84433990)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Printer Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 1.1 Offset lithography

- 1.2 Flexography

- 1.3 Screen

- 1.4 Gravure

- 1.5 Letter press

- 1.6 Digital

Chapter 6 Market Estimates & Forecast, By Printer Type, 2021 - 2034 ($Bn) (Thousand Units)

- 1.7 Key trends

- 1.8 Analog printers

- 1.9 Desktop printers

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 1.10 Packaging

- 1.11 Textiles

- 1.12 Electronics

- 1.13 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 1.14 Key trends

- 1.15 Personal

- 1.16 Household

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 2.1 Key trends

- 2.2 Direct

- 2.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 2.4 Key trends

- 2.5 North America

- 2.5.1 U.S.

- 2.5.2 Canada

- 2.6 Europe

- 2.6.1 UK

- 2.6.2 Germany

- 2.6.3 France

- 2.6.4 Italy

- 2.6.5 Spain

- 2.6.6 Russia

- 2.7 Asia Pacific

- 2.7.1 China

- 2.7.2 India

- 2.7.3 Japan

- 2.7.4 South Korea

- 2.7.5 Australia

- 2.8 Latin America

- 2.8.1 Brazil

- 2.8.2 Mexico

- 2.9 MEA

- 2.9.1 UAE

- 2.9.2 South Africa

- 2.9.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Brother Industries Ltd.

- 11.2 Canon Inc

- 11.3 Domino Printing Sciences

- 11.4 Durst Phototechnik AG

- 11.5 Epson Corporation

- 11.6 Heidelberger Druckmaschinen AG

- 11.7 HP Inc

- 11.8 Kornit Digital Ltd.

- 11.9 Konica Minolta, Inc.

- 11.10 Mutoh Holdings Co., Ltd.

- 11.11 Ricoh Company Ltd.

- 11.12 Seiko Holdings Corporation

- 11.13 Xaar plc

- 11.14 Xerox Holdings Corporation

- 11.15 Zebra Technologies Corporation