|

市場調查報告書

商品編碼

1766354

吸附設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Adsorption Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

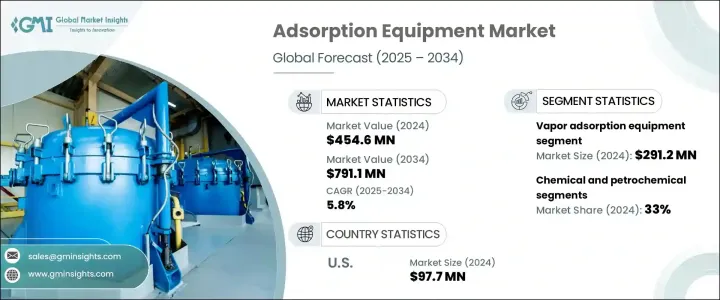

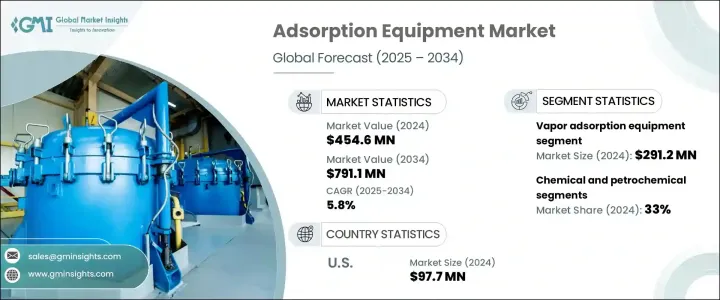

2024 年全球吸附設備市場價值為 4.546 億美元,預計到 2034 年將以 5.8% 的複合年成長率成長至 7.911 億美元。該市場的快速成長可歸因於更嚴格的環境法規以及對清潔水和空氣日益成長的需求。活性碳系統通常用於水處理,對於去除毒素、有機化合物和重金屬至關重要。這些系統對於市政水處理和各種工業應用(包括食品和飲料生產)尤其重要。製藥和食品加工等行業對高品質水和原料的需求進一步推動了吸附設備市場的發展。技術進步也在這一成長中發揮重要作用。金屬有機骨架 (MOF) 和先進活性碳等創新使吸附過程更有效率、更具成本效益。

人們對環境保護的日益重視,尤其是在空氣和水質至關重要的行業,推動了先進吸附材料的廣泛應用。這些材料不僅性能卓越,還能提高營運效率並降低成本。隨著污染控制法規的收緊,各行各業正在尋求更有效的解決方案以滿足合規標準。向永續實踐的轉變正推動製造商採用能夠以更低的能耗和更少的廢棄物產生最佳效果的吸附劑。此外,吸附技術的進步使各行各業能夠提高資源回收率並最大限度地減少排放,進一步刺激了對這些高性能材料的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.546億美元 |

| 預測值 | 7.911億美元 |

| 複合年成長率 | 5.8% |

2024年,蒸汽吸附設備市場規模達2.912億美元,預計未來十年成長率為5.9%。該設備對於去除工業空氣和排氣系統中的揮發性化合物和氣體至關重要,可用於空氣淨化和揮發性有機化合物(VOC)去除。人們對清潔空氣的需求日益成長,尤其是在污染嚴重的城市地區,這推動了蒸汽吸附系統的需求。汽車、製藥和製造業等產業對這些技術的依賴程度日益加深。

2024年,化工和石化產業佔比33%,預計2025年至2034年期間的複合年成長率為6.2%。吸附技術在這些產業中發揮著至關重要的作用,有助於氣體分離、有用物質的回收和排放的減少。變壓器吸附(PSA)和真空變壓吸附(VSA)等技術在天然氣加工和沼氣純化中越來越受歡迎,提高了氣體分離效率。

2024年,美國吸附設備市場規模達9,770萬美元,預計2025年至2034年的成長率為5.7%。美國環保署(EPA)等機構推出的嚴格環境法規推動了該市場的擴張,這些法規鼓勵各行各業採用基於吸附的系統,以符合空氣和水質標準。此外,對製程最佳化、效率和成本降低的需求日益成長,也進一步刺激了對這些系統的需求。化學和石化產業,尤其是天然氣加工和溶劑回收等領域,是市場成長的關鍵驅動力。

吸附設備產業由多家知名企業領軍,包括卡爾岡炭素 (Calgon Carbon)、Bry-Air、杜爾 (Durr)、Evoqua 和希柯環境 (CECO Environmental)。這些公司專注於推動創新,透過投資先進技術並提供解決方案來擴大市場佔有率,以滿足工業和市政部門日益成長的清潔空氣和水需求。為了提升市場地位,吸附設備產業的公司正在實施各種策略,包括專注於研發,推出更有效率、更具成本效益的解決方案。此外,他們正在擴大產品組合,以滿足從水處理到空氣淨化等更廣泛的行業需求。此外,他們也正在尋求策略夥伴關係和收購,以增強自身能力和影響力。各公司正在投資金屬有機骨架和先進吸附材料等尖端技術,以保持競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 波特五力分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 蒸汽吸附設備。

- 液體吸附設備

第6章:市場估計與預測:按流量,2021 - 2034 年

- 主要趨勢

- 高達 10,000 CFM

- 10,000 - 20,000 立方英尺/分鐘

- 超過 20,000 CFM

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 製藥

- 廢棄物和廢水處理。

- 化工和石化

- 汽車

- 印刷

- 其他(農藥、塗料等)

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Bry-Air

- Calgon Carbon

- Carbtrol

- CECO Environmental

- Durr

- Evoqua

- General Carbon

- GUNT

- KCH

- Microtrac

- Munters

- Process Combustion Corporation

- Suny Group

- Thermax

- TIGG

The Global Adsorption Equipment Market was valued at USD 454.6 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 791.1 million by 2034. The rapid growth in this market can be attributed to stricter environmental regulations and the increasing need for clean water and air. Activated carbon systems, commonly used for water treatment, are essential for removing toxins, organic compounds, and heavy metals. These systems are particularly important for municipal water treatment and various industrial applications, including food and beverage production. The demand for high-quality water and raw materials in industries like pharmaceuticals and food processing is further driving the market for adsorption equipment. Technological advancements are also playing a significant role in this growth. Innovations like metal-organic frameworks (MOFs) and advanced activated carbon are making adsorption processes more efficient and cost-effective.

The growing emphasis on environmental protection, particularly in industries where air and water quality are critical, is driving the widespread use of advanced adsorption materials. These materials not only offer superior performance but also enhance operational efficiency while reducing costs. As regulations around pollution control tighten, industries are turning to more effective solutions to meet compliance standards. The shift toward sustainable practices is pushing manufacturers to adopt adsorbents that deliver optimal results with lower energy consumption and reduced waste generation. Furthermore, advancements in adsorption technologies are enabling industries to improve resource recovery and minimize emissions, further boosting the demand for these high-performance materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $454.6 Million |

| Forecast Value | $791.1 Million |

| CAGR | 5.8% |

The vapor adsorption equipment segment generated USD 291.2 million in 2024, with an estimated growth rate of 5.9% over the next decade. This equipment is essential for removing volatile compounds and gases from industrial air and exhaust systems, with applications in air purification and VOC removal. The growing need for cleaner air, especially in polluted urban areas, is pushing the demand for vapor adsorption systems. Industries such as automotive, pharmaceuticals, and manufacturing are increasing their reliance on these technologies.

The chemical and petrochemical segment accounted for a 33% share in 2024 and is expected to grow at a CAGR of 6.2% between 2025 and 2034. Adsorption plays a vital role in these industries by helping with the separation of gases, the recovery of useful materials, and the reduction of emissions. Technologies like pressure swing adsorption (PSA) and vacuum swing adsorption (VSA) are becoming increasingly popular in natural gas processing and biogas upgrading, offering improved efficiency in gas separation.

U.S. Adsorption Equipment Market was valued at USD 97.7 million in 2024, with an estimated growth rate of 5.7% from 2025 to 2034. The market's expansion is being driven by stringent environmental regulations from bodies like the EPA, which are encouraging industries to adopt adsorption-based systems to comply with air and water quality standards. Additionally, the increasing demand for process optimization, efficiency, and cost reduction is further fueling the demand for these systems. The chemical and petrochemical sectors, particularly in areas like natural gas processing and solvent recovery, are key contributors to market growth.

Several prominent players are leading the Adsorption Equipment Industry, including Calgon Carbon, Bry-Air, Durr, Evoqua, and CECO Environmental. These companies are focused on driving innovation and expanding their market presence by investing in advanced technologies and offering solutions that meet the growing demands for clean air and water in the industrial and municipal sectors. To enhance their market position, companies in the adsorption equipment industry are implementing various strategies. These include focusing on research and development to introduce more efficient and cost-effective solutions. Additionally, they are expanding their product portfolios to cater to a wider range of industries, from water treatment to air purification. Strategic partnerships and acquisitions are also being pursued to strengthen their capabilities and reach. Companies are investing in state-of-the-art technologies like metal-organic frameworks and advanced adsorption materials to maintain their competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Flow rate

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Vapor adsorption equipment.

- 5.3 Liquid adsorption equipment

Chapter 6 Market Estimates & Forecast, By Flow Rate, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 10,000 CFM

- 6.3 10,000 - 20,000 CFM

- 6.4 More than 20,000 CFM

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceutical

- 7.3 Waste & wastewater treatment.

- 7.4 Chemical and Petrochemical

- 7.5 Automotive

- 7.6 Printing

- 7.7 Others (pesticide, coating etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Bry-Air

- 10.2 Calgon Carbon

- 10.3 Carbtrol

- 10.4 CECO Environmental

- 10.5 Durr

- 10.6 Evoqua

- 10.7 General Carbon

- 10.8 GUNT

- 10.9 KCH

- 10.10 Microtrac

- 10.11 Munters

- 10.12 Process Combustion Corporation

- 10.13 Suny Group

- 10.14 Thermax

- 10.15 TIGG