|

市場調查報告書

商品編碼

1684585

真空變壓吸附市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vacuum Pressure Swing Adsorption Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

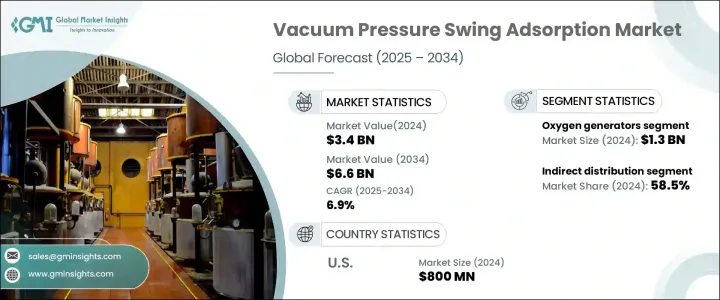

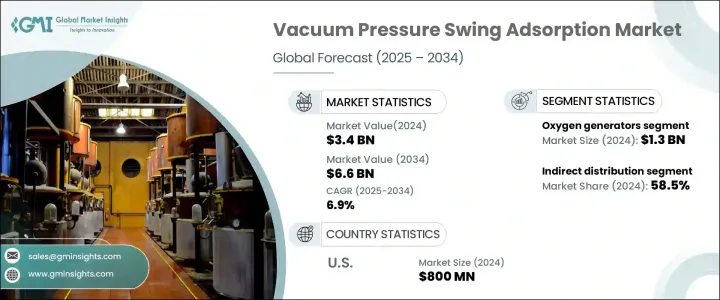

2024 年全球真空變壓器吸附市場價值為 34 億美元,預估 2025 年至 2034 年期間複合年成長率為 6.9%。市場擴張主要得益於醫療保健、化學品、石化和冶金等關鍵領域對氧氣、氮氣和氫氣等工業氣體日益成長的需求。這些氣體對於各種工業應用至關重要,鋼鐵製造等產業的生產過程中需要大量的氧氣。

隨著工業不斷現代化和擴張,對高效能氣體分離技術(如 VPSA 系統)的需求變得更加明顯。此外,人們對環境影響的日益關注和永續發展的趨勢正在鼓勵更多行業採用現場天然氣發電系統,減少對傳統天然氣供應商的依賴。 VPSA 技術能夠高效提取氣體,同時降低能耗並提高成本效益,使其成為廣泛工業應用的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 6.9% |

VPSA 市場按產品類型細分,包括氧氣產生器、氮氣產生器、氫氣發生器、二氧化碳 (CO2) 產生器以及氬氣和氦氣等其他發生器。 2024 年,氧氣產生器佔據市場主導地位,估值達 13 億美元。預計預測期內該部分將以 7.1% 的強勁複合年成長率成長。全球醫療保健基礎設施建設的激增,特別是為應對 COVID-19 疫情,大大增加了醫院和醫療機構對可靠的現場制氧系統的需求。此外,氧氣在鋼鐵生產、化學製造和水處理等各種工業應用中都至關重要,從而進一步推動了對 VPSA 系統的需求。

市場也根據配銷通路分為直接通路和間接通路。 2024 年,間接分銷通路佔 58.5% 的市佔率。這些管道包括擁有廣泛網路和在地化專業知識的中介機構,預計將繼續成長,預計 2025 年至 2034 年之間的複合年成長率為 6.6%。透過利用間接分銷管道,製造商可以擴大其影響範圍,而無需在每個地區建立直銷團隊,使 VPSA 系統更容易被廣泛的行業所接受。

在美國,VPSA 市場在 2024 年創造了 8 億美元的收入。該國先進的工業基礎設施和對醫用級氧氣的高需求(尤其是在醫療保健領域)在這一市場表現中發揮了重要作用。此外,醫療保健、化學品、石化和冶金等領域的大量投資推動了 VPSA 技術的廣泛應用,尤其是在醫療領域,對現場氣體生成系統(尤其是氧氣)的需求正在增加。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 工業氣體需求不斷成長

- 新興經濟體的採用率不斷提高

- 擴大再生能源和氫經濟

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 來自替代技術的競爭

- 成長動力

- 技術與創新格局

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 氧氣發生器

- 氮氣產生器

- 氫氣發生器

- 二氧化碳(CO2)產生器

- 其他(氬、氦)

第6章:市場估計與預測:按營運,2021 – 2034 年

- 主要趨勢

- 半自動

- 自動的

第 7 章:市場估計與預測:按產能,2021 年至 2034 年

- 主要趨勢

- 高達 50 Nm³/h

- 50 Nm³/h 和 500 Nm³/h

- 高於 500 Nm³/h

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 衛生保健

- 工業的

- 化學

- 環境的

- 石油和天然氣

- 能源與電力

- 其他(食品飲料、冶金等)

第 9 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- AirSep

- NOVAIR USA

- Precision Medical

- Air Products and Chemicals

- PKU Pioneer

- Adsorption Research

- Valmet

- NES Company

- Chenrui Air Separation Technology

- CAIRE

- Linde

- Praxair Technology

- Messer Group

- Oxymat

- PCI Gases

The Global Vacuum Pressure Swing Adsorption Market was valued at USD 3.4 billion in 2024 and is expected to expand at a CAGR of 6.9% from 2025 to 2034. This market expansion is largely fueled by the growing demand for industrial gases like oxygen, nitrogen, and hydrogen across key sectors such as healthcare, chemicals, petrochemicals, and metallurgy. These gases are crucial for various industrial applications, and industries like steel manufacturing require large volumes of oxygen for their production processes.

As industries continue to modernize and expand, the need for efficient gas separation technologies, like VPSA systems, becomes more apparent. Additionally, rising concerns about environmental impact and the growing trend of sustainability are encouraging more industries to adopt on-site gas generation systems, reducing reliance on traditional gas suppliers. VPSA technology enables the efficient extraction of gases with reduced energy consumption and greater cost-effectiveness, making it an attractive option for a wide range of industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 6.9% |

The VPSA market is segmented by product type, including oxygen generators, nitrogen generators, hydrogen generators, carbon dioxide (CO2) generators, and others such as argon and helium. In 2024, oxygen generators dominated the market with a valuation of USD 1.3 billion. This segment is expected to grow at a robust CAGR of 7.1% during the forecast period. The surge in global healthcare infrastructure development, particularly in response to the COVID-19 pandemic, has significantly increased the demand for reliable on-site oxygen generation systems in hospitals and medical facilities. In addition, oxygen is essential in various industrial applications, such as steel production, chemical manufacturing, and water treatment, driving further demand for VPSA systems.

The market is also divided by distribution channel into direct and indirect channels. In 2024, indirect distribution channels held a leading market share of 58.5%. These channels, which include intermediaries with extensive networks and localized expertise, are expected to continue their growth, with a forecasted CAGR of 6.6% between 2025 and 2034. By leveraging indirect distribution channels, manufacturers can extend their reach without the need to establish direct sales teams in every region, making VPSA systems more accessible to a broad range of industries.

In the United States, the VPSA market generated USD 800 million in 2024. The country's advanced industrial infrastructure and the high demand for medical-grade oxygen, particularly in healthcare, have played a significant role in this market performance. Moreover, major investments in sectors like healthcare, chemicals, petrochemicals, and metallurgy have driven the increased adoption of VPSA technology, especially in medical settings, where the need for on-site gas generation systems, particularly for oxygen, is on the rise.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for industrial gases

- 3.2.1.2 Growing adoption in emerging economies

- 3.2.1.3 Expansion of renewable energy and hydrogen economy

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance cost

- 3.2.2.2 Competition from alternative technologies

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Oxygen generators

- 5.3 Nitrogen generators

- 5.4 Hydrogen generators

- 5.5 Carbon dioxide (CO2 ) generators

- 5.6 Others (Argon, Helium)

Chapter 6 Market Estimates & Forecast, By Operation, 2021 – 2034, (USD Billion)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Billion)

- 7.1 Key trends

- 7.2 Up to 50 Nm³/h

- 7.3 50 Nm³/h and 500 Nm³/h

- 7.4 Above 500 Nm³/h

Chapter 8 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 Industrial

- 8.4 Chemical

- 8.5 Environmental

- 8.6 Oil & gas

- 8.7 Energy & power

- 8.8 Other (Food & Beverages, Metallurgy, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 AirSep

- 11.2 NOVAIR USA

- 11.3 Precision Medical

- 11.4 Air Products and Chemicals

- 11.5 PKU Pioneer

- 11.6 Adsorption Research

- 11.7 Valmet

- 11.8 NES Company

- 11.9 Chenrui Air Separation Technology

- 11.10 CAIRE

- 11.11 Linde

- 11.12 Praxair Technology

- 11.13 Messer Group

- 11.14 Oxymat

- 11.15 PCI Gases