|

市場調查報告書

商品編碼

1766315

輸配電容器市場機會、成長動力、產業趨勢分析及2025-2034年預測Transmission and Distribution Electric Capacitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

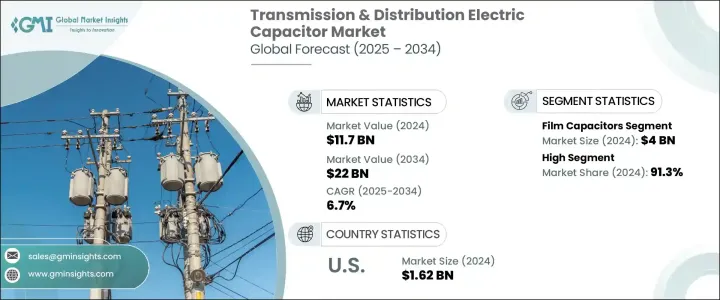

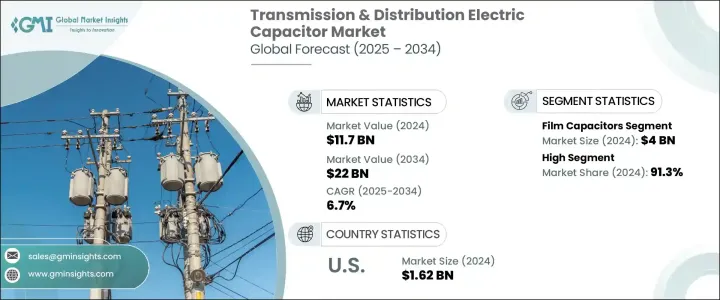

2024年,全球輸配電電容器市場規模達117億美元,預計2034年將以6.7%的複合年成長率成長,達到220億美元。電容器透過按需儲存和釋放能量,幫助維持穩定的電壓水平,防止電壓波動造成電子系統損壞或電路中斷。太陽能和風能等再生能源的整合進一步擴大了對電容器的需求,因為它們有助於管理這些能源的間歇性,並確保電網穩定。透過在輸電線路沿線安裝電容器,公用事業公司可以最佳化電力流,減少能量損失,並提高整體效率。

隨著老化電網亟待升級,電容器對於提升電網可靠性和性能至關重要,尤其是在以老舊基礎設施現代化改造為重點的專案中。電容器是輸電設備更換週期的關鍵,其提高功率因數效率的能力使公用事業公司能夠降低營運成本並節省能源。此外,旨在減少電力損耗的監管措施也推動了對電容器的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 117億美元 |

| 預測值 | 220億美元 |

| 複合年成長率 | 6.7% |

預計到2034年,陶瓷電容器市場的複合年成長率將達到6.7%。陶瓷電容器因其緊湊的特性而日益受到青睞,使其成為高壓應用的理想選擇。其小巧的尺寸使其能夠實現節省空間的設計,從而降低變電站安裝所需的總成本和空間。這使得它們在空間有限的城市環境中尤其具有優勢。此外,它們能夠在佔用最小實體空間的情況下處理高電容,為電力公司在設計和升級電力基礎設施方面提供了更大的靈活性。

2024年,低壓電容器市場價值達2.854億美元,主要得益於其對本地電壓調節和無功功率補償的支援。這些電容器通常部署在變電站或桿上,提供必要的無功功率支援以穩定電壓等級。透過確保電壓等級保持穩定,這些電容器有助於減少電力損耗,提高能源效率,並確保本地電網的整體可靠性。

預計到2034年,歐洲輸配電容器市場將以驚人的9.5%的複合年成長率成長。這一成長主要得益於風能和太陽能等再生能源的快速普及,這催生了對先進電容器技術的需求,以支持這些能源的動態和可變能量輸入。再生能源併入電網需要能夠穩定潮流波動並有助於管理再生能源發電固有不可預測性的電容器。此外,歐洲各地對智慧電網技術的投資正在最佳化能源分配和存儲,增強電網管理能力,並提高能源系統的可靠性。

全球輸配電容器市場中的公司正在採取多種策略來鞏固其地位。這包括投資開發能夠處理再生能源整合的新型、更有效率的電容器技術,以及增強其產品供應以滿足不同電壓等級和電網應用的需求。與電網營運商和公用事業公司的合作也有助於透過使產品供應與電網升級需求保持一致來獲得市場佔有率。此外,領先的公司正專注於新興市場的區域擴張,同時也增加研發投入,以提高電容器的性能和永續性。市場領導者也正在建立策略合作夥伴關係,以提供全面的解決方案,滿足智慧電網應用中對電容器日益成長的需求。市場的主要參與者包括西門子、ABB、TDK 株式會社和村田製作所。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依資料,2021 - 2034 年

- 主要趨勢

- 薄膜電容器

- 陶瓷電容器

- 電解電容器

- 其他

第6章:市場規模及預測:依極化,2021 - 2034

- 主要趨勢

- 偏振

- 非偏振

第7章:市場規模及預測:按電壓,2021 - 2034

- 主要趨勢

- 低的

- 中等的

- 高的

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 奧地利

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- Cornell Dubilier

- ELNA CO., LTD.

- Havells India Ltd.

- KEMET Corporation

- KYOCERA AVX Components Corporation

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- SAMSUNG ELECTRO-MECHANICS

- Schneider Electric

- Siemens

- TAIYO YUDEN CO., LTD.

- TDK Corporation

- Vishay Intertechnology, Inc.

- WIMA GmbH & Co. KG

- Xuansn Capacitor

The Global Transmission and Distribution Electric Capacitor Market was valued at USD 11.7 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 22 billion by 2034. Electric capacitors help maintain consistent voltage levels by storing and releasing energy as required, preventing voltage fluctuations that could damage electronic systems or disrupt circuits. The integration of renewable energy sources like solar and wind further amplifies the need for capacitors, as they help manage the intermittent nature of these energy sources and ensure grid stability. By placing capacitors along transmission lines, utilities can optimize power flow, reduce energy losses, and improve overall efficiency.

With aging power grids in need of upgrades, capacitors are essential in enhancing grid reliability and performance, especially in projects focused on modernizing old infrastructure. Capacitors are key to the replacement cycle of transmission equipment, and their ability to improve power factor efficiency enables utilities to reduce operational costs and save energy. Moreover, regulatory measures aimed at reducing electrical losses are also driving the demand for capacitors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.7 Billion |

| Forecast Value | $22 Billion |

| CAGR | 6.7% |

The ceramic capacitors segment is anticipated to grow at a CAGR of 6.7% by 2034. Ceramic capacitors are increasingly favored for their compact nature, making them a suitable option for high-voltage applications. Their small size allows for space-efficient designs, which reduces the overall costs and space needed for installation in substations. This makes them particularly advantageous in urban settings where space is limited. Additionally, their ability to handle high capacitance while occupying minimal physical space offers utilities more flexibility in designing and upgrading electrical infrastructure.

The low-voltage segment was valued at USD 285.4 million in 2024 driven by supporting localized voltage regulation and reactive power compensation. These capacitors are typically deployed at substations or on pole-mounted locations, where they provide necessary reactive power support to stabilize voltage levels. By ensuring that voltage levels remain steady, these capacitors help reduce electrical losses, improve energy efficiency, and ensure the overall reliability of local power networks.

Europe Transmission & Distribution Electric Capacitor Market is expected to grow at an impressive CAGR of 9.5% through 2034. This growth is primarily driven by the rapid adoption of renewable energy sources such as wind and solar, which has created a need for advanced capacitor technologies to support the dynamic and variable energy inputs of these sources. The integration of renewable energy into the grid requires capacitors that can stabilize fluctuations in power flow and help manage the inherent unpredictability of renewable generation. Additionally, investments in smart grid technologies across Europe are optimizing energy distribution and storage, enhancing grid management capabilities, and improving the reliability of energy systems.

Companies in the Global Transmission & Distribution Electric Capacitor Market are adopting several strategies to strengthen their positions. This includes investing in the development of new, more efficient capacitor technologies that can handle renewable energy integration, as well as enhancing their product offerings to cater to different voltage levels and grid applications. Collaborations with grid operators and utilities are also helping to gain market share by aligning product offerings with the demand for grid upgrades. Furthermore, leading companies are focusing on regional expansion in emerging markets, while also increasing their R&D investment to improve the performance and sustainability of capacitors. The market leaders are also forming strategic partnerships to offer comprehensive solutions, supporting the growing demand for capacitors in smart grid applications. Key players in the market include Siemens, ABB, TDK Corporation, and Murata Manufacturing Co., Ltd.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (Thousand Units, USD Billion)

- 5.1 Key trends

- 5.2 Film capacitors

- 5.3 Ceramic capacitors

- 5.4 Electrolytic capacitors

- 5.5 Others

Chapter 6 Market Size and Forecast, By Polarization, 2021 - 2034 (Thousand Units, USD Billion)

- 6.1 Key trends

- 6.2 Polarized

- 6.3 Non-Polarized

Chapter 7 Market Size and Forecast, By Voltage, 2021 - 2034 (Thousand Units, USD Billion)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (Thousand Units, USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cornell Dubilier

- 9.3 ELNA CO., LTD.

- 9.4 Havells India Ltd.

- 9.5 KEMET Corporation

- 9.6 KYOCERA AVX Components Corporation

- 9.7 Murata Manufacturing Co., Ltd.

- 9.8 Panasonic Corporation

- 9.9 SAMSUNG ELECTRO-MECHANICS

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 TAIYO YUDEN CO., LTD.

- 9.13 TDK Corporation

- 9.14 Vishay Intertechnology, Inc.

- 9.15 WIMA GmbH & Co. KG

- 9.16 Xuansn Capacitor