|

市場調查報告書

商品編碼

1766310

商用電鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Electric Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

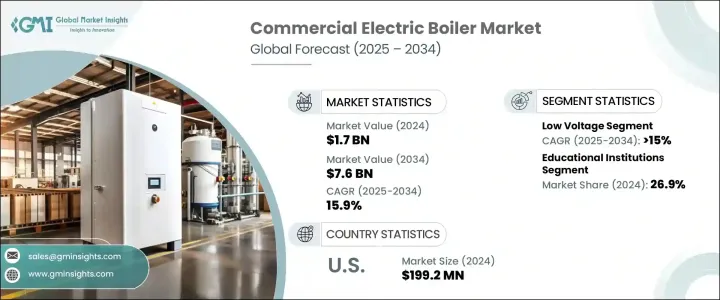

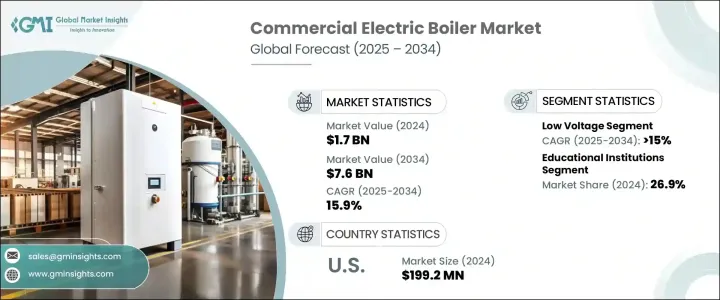

2024年,全球商用電鍋爐市場規模達17億美元,預計2034年將以15.9%的複合年成長率成長,達到76億美元。這一成長主要源自於商業設施對節能供暖解決方案日益成長的需求。受環境永續意識增強以及化石能源成本上升的推動,企業正逐步從傳統的化石燃料加熱系統過渡到電鍋爐。此外,政府透過財政獎勵措施和政策框架推動清潔能源使用的措施也進一步加速了這項轉變。

隨著商業機構優先考慮減排策略,電鍋爐正成為能源管理計畫中的關鍵要素。它們能夠以最低的排放提供穩定的供暖性能,這與脫碳目標相符,尤其是在環境嚴格規範的地區。電網基礎設施的改善和再生能源系統的整合也支持了這一轉變,使電鍋爐在技術和經濟上都更具可行性。值得注意的是,這些系統能夠利用剩餘的可再生電力、儲存能源並按需供暖,從而提高了其運作效率,使其成為現代商業基礎設施的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 76億美元 |

| 複合年成長率 | 15.9% |

按額定電壓細分,商用電鍋爐市場包括中壓和低壓系統。預計到2034年,低壓市場的複合年成長率將超過15%。這項需求受到旨在減少碳足跡和在商業環境中推廣清潔技術的支持性監管政策和激勵措施的推動。低壓電鍋爐設計緊湊,維護需求低,對中小型營運尤其具有吸引力。這些系統也更容易與現有基礎設施進行改造,這對於老建築的現代化至關重要。隨著人們越來越重視減少對燃氣或燃油設備的依賴,低壓電鍋爐預計將在未來幾年獲得可觀的市場佔有率。

按應用領域分類,教育機構在2024年佔據了最大的市場佔有率,佔26.9%。該領域對電鍋爐的青睞源自於學校、學院和大學普遍致力於暖氣系統現代化。各機構正在投資更換老舊設備,以節省成本並符合新的能源效率標準。由於教育機構通常預算固定,電加熱解決方案的長期成本優勢在採用過程中發揮重要作用。此外,低噪音、零現場排放和易於安裝的特性使電鍋爐成為此類環境的理想選擇。

從地區來看,美國近年來電加熱技術的應用顯著成長,市場估值從2022年的1.599億美元成長至2024年的1.992億美元。全國範圍內減少溫室氣體排放的舉措,以及建築規範向電加熱而非燃氣加熱的轉變,進一步強化了這一趨勢。隨著企業將營運與永續發展目標結合,美國商用電鍋爐的需求持續成長。隨著辦公大樓、醫院和零售場所對電加熱的偏好日益成長,美國可望繼續成為全球市場中重要的收入來源。

縱觀整個地區,預計到2034年,北美地區的複合年成長率將超過18%。對環保目標的堅定承諾,加上對清潔建築技術投資的不斷增加,正在推動對高效電力加熱系統的需求。隨著各市政府實施低排放發展策略,美國和加拿大的城市中心在這項轉型中特別活躍。商業空間的基礎設施升級,尤其是老舊建築的現代化改造,也促進了區域成長。

商用電鍋爐市場的領先公司包括 ACV、Bosch Industriekessel、Acme Engineering Products、Chromalox、Cochrane Engineering、Cleaver-Brooks、Danstoker、Flexiheat UK、Ecotherm Austria、Fulton、Klopper-Therm、Hi-Therm Boilers、SPELARS Heating Systems、OvELASd、AulAii、FLA1 Boilers、Thermon、Thermona 和 Vattenfall。這些公司專注於創新、產品效率和系統整合,以滿足商用供暖行業不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依電壓等級,2021 - 2034 年

- 主要趨勢

- 低電壓

- 中壓

第6章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 0.3 - 2.5 百萬英熱單位/小時

- > 2.5 - 10 百萬英熱單位/小時

- > 10 - 50 百萬英熱單位/小時

- > 50 - 100 百萬英熱單位/小時

- > 100 - 250 百萬英熱單位/小時

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 辦公室

- 醫療保健設施

- 教育機構

- 住宿

- 零售店

- 其他

第8章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 熱水

- 蒸氣

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 德國

- 俄羅斯

- 奧地利

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 菲律賓

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 埃及

- 奈及利亞

- 肯亞

- 摩洛哥

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

第10章:公司簡介

- Acme Engineering Products

- ACV

- Bosch Industriekessel

- Chromalox

- Cleaver-Brooks

- Cochrane Engineering

- Danstoker

- Ecotherm Austria

- Flexiheat UK

- Fulton

- Hi-Therm Boilers

- Klopper

- KOSPEL Spolka

- LAARS Heating Systems

- Lochinvar

- Precision Boilers

- SAS Lacaze Energies

- Thermon

- Thermona

- Vattenfall

The Global Commercial Electric Boiler Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 15.9% to reach USD 7.6 billion by 2034. This growth is largely attributed to the increasing demand for energy-efficient heating solutions across commercial facilities. Businesses are gradually transitioning from conventional heating systems powered by fossil fuels to electric boilers, driven by heightened awareness around environmental sustainability and the rising cost of fossil-based energy sources. Additionally, government initiatives promoting clean energy usage through financial incentives and policy frameworks are further accelerating this transition.

As commercial establishments prioritize emission reduction strategies, electric boilers are becoming a key element in energy management plans. Their ability to deliver consistent heating performance with minimal emissions aligns with decarbonization targets, especially in regions with stringent environmental norms. Improved grid infrastructure and the integration of renewable energy systems are also supporting the shift, making electric boilers more viable both technically and economically. Notably, the capability of these systems to utilize surplus renewable electricity, store energy, and provide heating on demand enhances their operational efficiency, making them a desirable option for modern commercial infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 15.9% |

Segmented by voltage rating, the commercial electric boiler market includes medium voltage and low voltage systems. The low voltage segment is anticipated to grow at a CAGR exceeding 15% through 2034. This demand is driven by supportive regulatory policies and incentives aimed at reducing carbon footprints and promoting cleaner technologies in commercial settings. The compact design and reduced maintenance needs of low voltage electric boilers make them particularly attractive for small- to medium-scale operations. These systems are also easier to retrofit into existing infrastructure, which is a key advantage as older buildings move toward modernization. With increasing attention on minimizing reliance on gas or oil-fired units, low voltage electric boilers are positioned to gain substantial market share over the coming years.

By application, educational institutions held the largest market share in 2024, accounting for 26.9%. The preference for electric boilers in this segment is supported by widespread efforts to modernize heating systems in schools, colleges, and universities. Institutions are investing in the replacement of outdated units to achieve cost savings and comply with new efficiency standards. As educational facilities often operate on fixed budgets, the long-term cost advantages of electric heating solutions play a significant role in adoption. Additionally, the low noise, zero on-site emissions, and ease of installation make electric boilers an ideal fit for these settings.

Regionally, the United States has witnessed significant adoption in recent years, with market valuations rising from USD 159.9 million in 2022 to USD 199.2 million by 2024. This trend is reinforced by a national push toward reducing greenhouse gas emissions and the shift in building codes favoring electric over gas-based heating. As businesses align their operations with sustainability targets, demand for commercial electric boilers in the U.S. continues to gain traction. With a growing preference for electrified heating in office buildings, hospitals, and retail spaces, the country is poised to remain a prominent revenue generator in the global market.

Across the broader region, North America is expected to exhibit a CAGR of more than 18% through 2034. A strong commitment to environmental goals, coupled with rising investments in clean building technologies, is fueling the demand for efficient electric heating systems. Urban centers across the U.S. and Canada are especially active in this transition as municipalities implement low-emission development strategies. Infrastructure upgrades in commercial spaces, particularly in older buildings being brought up to modern standards, are also contributing to regional growth.

Leading companies in the commercial electric boiler market include ACV, Bosch Industriekessel, Acme Engineering Products, Chromalox, Cochrane Engineering, Cleaver-Brooks, Danstoker, Flexiheat UK, Ecotherm Austria, Fulton, Klopper-Therm, Hi-Therm Boilers, LAARS Heating Systems, KOSPEL Spolka, Lochinvar, S.A.S Lacaze Energies, Precision Boilers, Thermon, Thermona, and Vattenfall. These players are focusing on innovation, product efficiency, and system integration to meet the evolving needs of the commercial heating industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low voltage

- 5.3 Medium voltage

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Offices

- 7.3 Healthcare facilities

- 7.4 Educational institutions

- 7.5 Lodgings

- 7.6 Retail stores

- 7.7 Others

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Germany

- 9.3.7 Russia

- 9.3.8 Austria

- 9.3.9 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Philippines

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Egypt

- 9.5.5 Nigeria

- 9.5.6 Kenya

- 9.5.7 Morocco

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Colombia

- 9.6.4 Chile

Chapter 10 Company Profiles

- 10.1 Acme Engineering Products

- 10.2 ACV

- 10.3 Bosch Industriekessel

- 10.4 Chromalox

- 10.5 Cleaver-Brooks

- 10.6 Cochrane Engineering

- 10.7 Danstoker

- 10.8 Ecotherm Austria

- 10.9 Flexiheat UK

- 10.10 Fulton

- 10.11 Hi-Therm Boilers

- 10.12 Klopper

- 10.13 KOSPEL Spolka

- 10.14 LAARS Heating Systems

- 10.15 Lochinvar

- 10.16 Precision Boilers

- 10.17 S.A.S Lacaze Energies

- 10.18 Thermon

- 10.19 Thermona

- 10.20 Vattenfall