|

市場調查報告書

商品編碼

1766309

工業熱水器市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

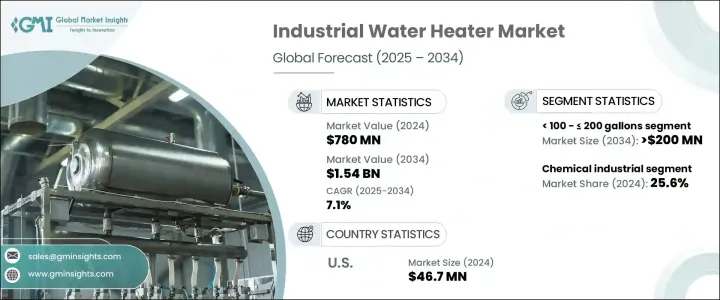

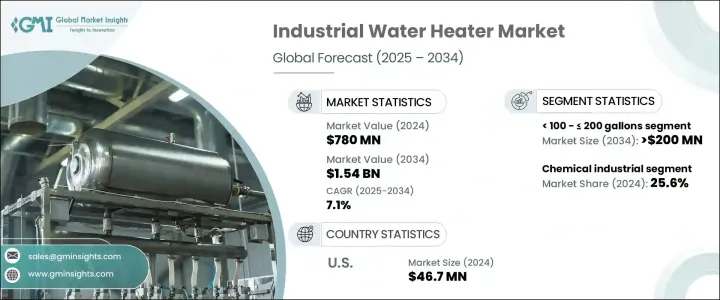

全球工業熱水器市場規模達7.8億美元,預計2034年將以7.1%的複合年成長率成長,達到15.4億美元。這一成長主要源於對節能系統日益成長的需求以及工業能源消耗的增加。這一上升趨勢反映了行業整體向永續且經濟高效的供暖解決方案的轉變,這些解決方案與全球減少排放和遵守嚴格能源法規的努力相一致。

工業運作正在快速發展,促使製造商採用更可靠、更先進的熱水技術。對於不僅能提供穩定性能,還能減少停機時間的系統的需求顯著激增。這些進步對於注重最佳化能源使用並維持營運效率的產業尤其重要。採用先進熱能技術的先進熱水器正在取代老舊系統,減少對環境的影響並改善整體能源管理。對自動化工業流程的日益重視也促進了需求的成長,預測性維護和人工智慧驅動的溫度控制等智慧功能增強了營運靈活性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.8億美元 |

| 預測值 | 15.4億美元 |

| 複合年成長率 | 7.1% |

製造設施中數位基礎設施的日益整合,進一步支持了現代熱水設備的採用。工業 4.0 創新正在重塑工業供熱格局,使設施能夠預測維護需求並避免意外故障。這種變革不僅是為了提高效能,也是為了支持可擴展的營運,特別是對於那些需要應對季節性或波動性加工需求的設施而言。

依容量分類,工業熱水器市場主要分為三大類:100 加侖至 200 加侖(含 100 加侖)、200 加侖以上至 500 加侖(含 500 加侖)以及 500 加侖以上。其中,容量在 100 加侖至 200 加侖(含 100 加侖)之間的系統正受到廣泛關注,預計到 2034 年,其市場規模將超過 2 億美元。這些設備擴大被應用於需要靈活模組化加熱解決方案的場合。其緊湊的體積、更高的能源效率以及與智慧技術的兼容性使其適用於各種工業應用。該領域市場的成長主要歸功於從傳統的燃料系統向現代環保替代能源的轉變,這些替代能源在不影響性能的情況下實現了高效率。

根據應用,市場可分為多個行業,包括紙漿和造紙、食品加工、金屬和採礦、化學品、煉油廠等。其中,化學工業在2024年佔據了最高佔有率,佔整個市場的25.6%。這種主導地位源自於對耐腐蝕、高性能、能夠承受腐蝕性化學環境的加熱器的持續需求。化學加工產業優先考慮能源最佳化,因此高效能熱水器對於確保惡劣操作條件下的可靠性和製程穩定性至關重要。

從地區來看,美國工業熱水器的普及率持續成長。 2022年,美國市場規模為3,550萬美元,2023年增至4,370萬美元,2024年則達4,670萬美元。這項成長主要得益於以節能為重點的監管規定,以及鼓勵投資高效能設備的優惠稅政策。此外,旨在減少工業設施排放的聯邦政府措施也進一步推動了以先進暖氣解決方案取代過時系統的趨勢。

積極塑造工業熱水器市場競爭格局的知名公司包括阿里斯頓集團、AO史密斯、Bradford White Corporation、FLEXIHEAT UK、Eemax、Hevac、Jaguar India、Hubbell Heaters、Lochinvar、Thermex Corporation、Sioux Corporation、Thermotech Systems、Herambh Coolingz、Viessmann和Andrews。這些公司不斷創新,以滿足全球各行各業對永續、智慧和耐用熱水解決方案日益成長的需求。他們專注於產品開發、智慧技術整合以及向新興市場的擴張,預計將在預測期內繼續影響競爭態勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- < 100 - ≤ 200 加侖

- > 200 - ≤ 500 加侖

- > 500 加侖

第6章:市場規模及預測:依燃料,2021 - 2034 年

- 主要趨勢

- 電的

- 氣體

- 其他

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 食品加工

- 紙漿和造紙

- 化學

- 煉油廠

- 金屬與礦業

- 其他

第8章:市場規模及預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 線上

- 經銷商

- 零售

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 葡萄牙

- 羅馬尼亞

- 荷蘭

- 瑞士

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- AO Smith

- Andrews

- Ariston Group

- Bradford White Corporation

- Eemax

- FLEXIHEAT UK

- Herambh Coolingz

- Hevac

- Hubbell Heaters

- Jaguar India

- Lochinvar

- Sioux Corporation

- Thermex Corporation

- Thermotech Systems

- Viessmann

The Global Industrial Water Heater Market was valued at USD 780 million and is estimated to grow at a CAGR of 7.1% to reach USD 1.54 billion by 2034. The growth is driven by the rising need for energy-efficient systems and increased industrial energy consumption. This upward trend reflects a broader industry shift toward sustainable and cost-effective heating solutions that align with global efforts to reduce emissions and comply with stringent energy regulations.

Industrial operations are evolving rapidly, prompting manufacturers to adopt more reliable and advanced water heating technologies. There is a noticeable demand surge for systems that not only deliver consistent performance but also reduce operational downtime. These advancements are especially relevant for industries focused on optimizing their energy use while maintaining operational efficiency. Sophisticated water heaters featuring advanced thermal energy technologies are now replacing older systems, reducing environmental impact and improving overall energy management. The growing emphasis on automated industrial processes is also contributing to the rise in demand, with smart features like predictive maintenance and AI-driven temperature control enhancing operational flexibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $780 Million |

| Forecast Value | $1.54 Billion |

| CAGR | 7.1% |

The increasing integration of digital infrastructure in manufacturing facilities is further supporting the adoption of modern water heating equipment. Industry 4.0 innovations are reshaping industrial heating landscapes, enabling facilities to anticipate maintenance requirements and avoid unexpected failures. This evolution is not just about improving performance but also about supporting scalable operations, especially for facilities dealing with seasonal or fluctuating processing demands.

By capacity, the industrial water heater market is segmented into three key categories: 100 to <= 200 gallons, > 200 to <= 500 gallons, and > 500 gallons. Among these, systems with capacities ranging from 100 to <= 200 gallons are gaining widespread attention, and their market is projected to exceed USD 200 million by 2034. These units are increasingly being adopted in settings that require flexible and modular heating solutions. Their compact footprint, enhanced energy efficiency, and compatibility with smart technologies make them suitable for various industrial applications. The market's growth in this segment is largely attributed to the transition from traditional fuel-based systems to modern, environmentally friendly alternatives that deliver high efficiency without compromising performance.

Based on application, the market is divided into several industries, including pulp and paper, food processing, metal and mining, chemicals, refinery, and others. Among these, the chemical industry accounted for the highest share in 2024, representing 25.6% of the total market. This dominance is fueled by a consistent demand for corrosion-resistant, high-performance heaters that can withstand aggressive chemical environments. The chemical processing sector prioritizes energy optimization, making high-efficiency water heaters essential for ensuring reliability and process stability in harsh operating conditions.

Regionally, the United States continues to demonstrate consistent growth in industrial water heater adoption. The market in the U.S. was valued at USD 35.5 million in 2022, increased to USD 43.7 million in 2023, and reached USD 46.7 million in 2024. This growth is primarily supported by regulatory mandates focused on energy conservation, as well as favorable tax provisions that encourage investments in high-efficiency equipment. Additionally, federal initiatives designed to reduce emissions from industrial facilities have further fueled the replacement of outdated systems with advanced heating solutions.

Prominent companies actively shaping the competitive landscape of the industrial water heater market include Ariston Group, A.O. Smith, Bradford White Corporation, FLEXIHEAT UK, Eemax, Hevac, Jaguar India, Hubbell Heaters, Lochinvar, Thermex Corporation, Sioux Corporation, Thermotech Systems, Herambh Coolingz, Viessmann, and Andrews. These players are constantly innovating to meet the growing demand for sustainable, smart, and durable water heating solutions across global industries. Their focus on product development, integration of smart technologies, and expansion into emerging markets is expected to continue influencing the competitive dynamics over the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 < 100 - ≤ 200 gallons

- 5.3 > 200 - ≤ 500 gallons

- 5.4 > 500 gallons

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Electric

- 6.3 Gas

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Food processing

- 7.3 Pulp & paper

- 7.4 Chemical

- 7.5 Refinery

- 7.6 Metal & mining

- 7.7 Others

Chapter 8 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Dealer

- 8.4 Retail

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Portugal

- 9.3.7 Romania

- 9.3.8 Netherlands

- 9.3.9 Switzerland

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Egypt

- 9.5.4 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 A.O. Smith

- 10.2 Andrews

- 10.3 Ariston Group

- 10.4 Bradford White Corporation

- 10.5 Eemax

- 10.6 FLEXIHEAT UK

- 10.7 Herambh Coolingz

- 10.8 Hevac

- 10.9 Hubbell Heaters

- 10.10 Jaguar India

- 10.11 Lochinvar

- 10.12 Sioux Corporation

- 10.13 Thermex Corporation

- 10.14 Thermotech Systems

- 10.15 Viessmann