|

市場調查報告書

商品編碼

1721544

瓦斯熱水器市場機會、成長動力、產業趨勢分析及2025-2034年預測Gas Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

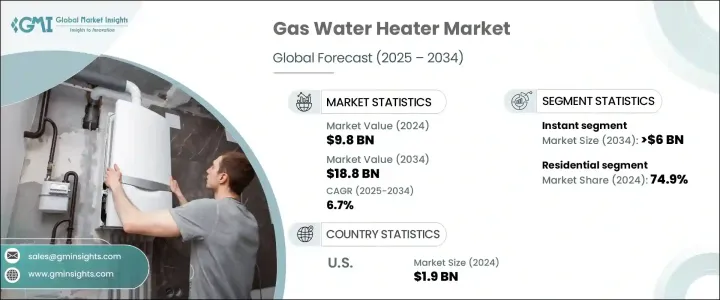

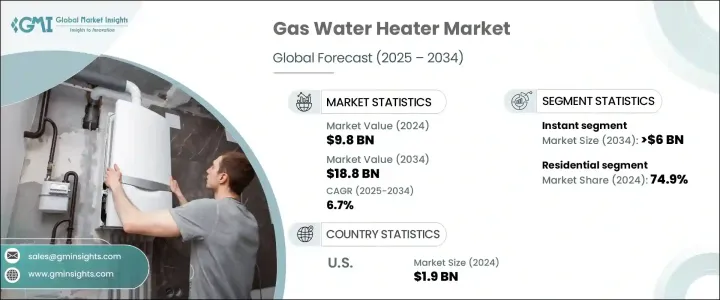

2024 年全球燃氣熱水器市場價值為 98 億美元,預計到 2034 年將以 6.7% 的複合年成長率成長,達到 188 億美元。這一成長主要得益於消費者對兼具性能、便利性和永續性的高效加熱系統的需求不斷成長。隨著家庭和商業設施擴大轉向對環境負責的解決方案,與電力替代品相比,燃氣熱水器因其較低的營運成本和減少的碳足跡而脫穎而出。隨著能源法規越來越嚴格以及公用事業價格的波動,燃氣動力系統的吸引力不斷增強。此外,越來越多的智慧城市、城市住房計畫和生態意識社區正在支持採用符合永續發展目標和能源效率要求的下一代設備。

如今,消費者期望的不僅是按需提供熱水。他們想要智慧、反應靈敏且易於使用的設備。這種預期正在重塑瓦斯熱水器的格局。提供 Wi-Fi 連線、語音輔助和遠端控制功能的系統目前處於領先地位。增強的可用性(例如簡化的溫度調節和即時診斷警報)不再是可選的,而是必不可少的。產品開發正在轉向先進的控制、自動化以及與家庭生態系統的無縫整合。因此,製造商優先考慮創新,以提供可靠、直覺的系統來改善日常生活。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 98億美元 |

| 預測值 | 188億美元 |

| 複合年成長率 | 6.7% |

永續建築和智慧建築的趨勢繼續推動對低排放、高性能燃氣熱水器的需求。這些產品既符合環境法規,也符合現代消費者的偏好。天然氣基礎設施的廣泛普及進一步支持了市場擴張,特別是在天然氣比電力更具成本效益的地區。在經常停電的地區,燃氣熱水器是可靠的熱水來源,增強了其市場相關性。

根據產品,市場分為即熱式熱水器和儲水式熱水器。即熱式燃氣熱水器正在迅速普及,預計到 2034 年該領域的市場規模將達到 60 億美元。消費者被其節省空間的設計、更快的加熱速度和節能功能所吸引。靈活的容量選擇和實惠的價格進一步提升了它們的受歡迎程度。綠色基礎設施項目(包括新建和改造)正在加速採用,特別是在旨在獲得節能認證的住宅開發項目中。

2024 年,住宅領域佔據了 74.9% 的主導佔有率,更多屋主選擇燃氣熱水器,因為它們節能、供暖成本較低且性能穩定。零排放住宅開發的興起正在強化這種轉變。洩漏偵測、智慧監控、觸控螢幕和語音控制等功能使這些系統更具吸引力。

北美佔了 25% 的佔有率,其中美國在 2024 年創造了 19 億美元的市場規模。日益增強的環保意識和更嚴格的能源法規正在推動製造商利用低排放材料和智慧自動化進行創新。能率株式會社、博世熱技術公司、海爾集團和 AO 史密斯等領先企業正在大力投資研發,推出支援 Wi-Fi、應用程式控制和語音啟動的機型。這些進步為能源效率和使用者體驗樹立了新的標竿。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

- 公司市佔率

第5章:市場規模及預測:依產品,2021 年至 2034 年

- 主要趨勢

- 立即的

- 貯存

第6章:市場規模及預測:依產能,2021 年至 2034 年

- 主要趨勢

- 30公升以下

- 30 – 100 公升

- 100 – 250 公升

- 250 – 400 公升

- >400公升

第7章:市場規模及預測:依應用,2021 年至 2034 年

- 主要趨勢

- 住宅

- 商業的

- 學院/大學

- 辦公室

- 政府/建築

- 其他

第8章:市場規模及預測:依燃料,2021 年至 2034 年

- 主要趨勢

- 天然氣

- 液化石油氣

第9章:市場規模及預測:依地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 奧地利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 歐亞大陸

- 俄羅斯

- 白俄羅斯

- 哈薩克

- 吉爾吉斯斯坦

- 亞美尼亞

- 獨立國協

- 亞塞拜然

- 莫耳多瓦

- 塔吉克

- 土庫曼

- 烏茲別克

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 墨西哥

第10章:公司簡介

- American Water Heater

- Ariston Thermo

- AO Smith

- BDR Thermea Group

- Bosch Thermotechnology Corp.

- Bradford White Corporation

- FERROLI SpA

- Hubbell Heaters

- Havells India Ltd.

- Haier Inc.

- Lennox International Inc.

- Noritz Corporation

- Parker Boiler Company

- Rheem Manufacturing Company

- Rinnai America Corporation

- State Industries

- Vaillant

- Westinghouse Electric Corporation

The Global Gas Water Heater Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 18.8 billion by 2034. This growth is largely fueled by rising consumer demand for high-efficiency heating systems that combine performance, convenience, and sustainability. As households and commercial facilities increasingly shift toward environmentally responsible solutions, gas water heaters stand out for their lower operational costs and reduced carbon footprint compared to electric alternatives. With energy regulations getting stricter and utility prices fluctuating, the appeal of gas-powered systems continues to strengthen. In addition, the growing number of smart cities, urban housing projects, and eco-conscious communities are supporting the adoption of next-gen appliances that meet both sustainability goals and energy-efficiency mandates.

Consumers today expect more than just hot water on demand. They want appliances that are smart, responsive, and easy to use. This expectation is reshaping the gas water heater landscape. Systems that offer Wi-Fi connectivity, voice assistance, and remote control features are now leading the charge. Enhanced usability, such as simplified temperature adjustments and real-time diagnostic alerts, is no longer optional-it's essential. Product development is shifting toward advanced controls, automation, and seamless integration with home ecosystems. As a result, manufacturers are prioritizing innovation to deliver reliable, intuitive systems that enhance everyday living.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 6.7% |

The trend toward sustainable construction and smart buildings continues to drive demand for low-emission, high-performance gas water heaters. These products align with both environmental regulations and modern consumer preferences. The widespread availability of natural gas infrastructure further supports market expansion, especially in regions where natural gas remains more cost-effective than electricity. In areas with frequent power disruptions, gas water heaters serve as a dependable source of hot water, reinforcing their market relevance.

By product, the market is segmented into instant and storage water heaters. Instant gas water heaters are rapidly gaining traction, with the segment expected to generate USD 6 billion by 2034. Consumers are drawn to their space-saving design, faster heating, and energy-saving capabilities. Flexible capacity options and affordable pricing further boost their popularity. Green infrastructure projects-both new builds and retrofits-are accelerating adoption, especially in residential developments aiming for energy-efficient certifications.

The residential segment accounted for a dominant 74.9% share in 2024, with more homeowners opting for gas water heaters due to their energy savings, lower heating costs, and consistent performance. The rise of zero-emission housing developments is reinforcing this shift. Features like leak detection, smart monitoring, touchscreens, and voice-activated controls make these systems even more attractive.

North America held a 25% share, with the U.S. generating USD 1.9 billion in 2024. Growing environmental awareness and tighter energy regulations are pushing manufacturers to innovate with low-emission materials and smart automation. Leading players such as Noritz Corporation, Bosch Thermotechnology Corp., Haier Inc., and A. O. Smith are investing heavily in R&D to introduce Wi-Fi-enabled, app-controlled, and voice-activated models. These advancements are setting new benchmarks in energy efficiency and user experience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

- 4.4 Company market share

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Below 30 liters

- 6.3 30 – 100 liters

- 6.4 100 – 250 liters

- 6.5 250 – 400 liters

- 6.6 >400 liters

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 College/University

- 7.3.2 Offices

- 7.3.3 Government/Building

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 Natural gas

- 8.3 LPG

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Austria

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Eurasia

- 9.5.1 Russia

- 9.5.2 Belarus

- 9.5.3 Kazakhstan

- 9.5.4 Kyrgyzstan

- 9.5.5 Armenia

- 9.6 CIS

- 9.6.1 Azerbaijan

- 9.6.2 Moldova

- 9.6.3 Tajikistan

- 9.6.4 Turkmenistan

- 9.6.5 Uzbekistan

- 9.7 Middle East & Africa

- 9.7.1 Saudi Arabia

- 9.7.2 UAE

- 9.7.3 Qatar

- 9.7.4 Kuwait

- 9.7.5 Oman

- 9.8 Latin America

- 9.8.1 Brazil

- 9.8.2 Argentina

- 9.8.3 Chile

- 9.8.4 Mexico

Chapter 10 Company Profiles

- 10.1 American Water Heater

- 10.2 Ariston Thermo

- 10.3 A. O. Smith

- 10.4 BDR Thermea Group

- 10.5 Bosch Thermotechnology Corp.

- 10.6 Bradford White Corporation

- 10.7 FERROLI S.p.A

- 10.8 Hubbell Heaters

- 10.9 Havells India Ltd.

- 10.10 Haier Inc.

- 10.11 Lennox International Inc.

- 10.12 Noritz Corporation

- 10.13 Parker Boiler Company

- 10.14 Rheem Manufacturing Company

- 10.15 Rinnai America Corporation

- 10.16 State Industries

- 10.17 Vaillant

- 10.18 Westinghouse Electric Corporation