|

市場調查報告書

商品編碼

1766282

豬飼料益生菌酵母市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Swine Feed Probiotic Yeast Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

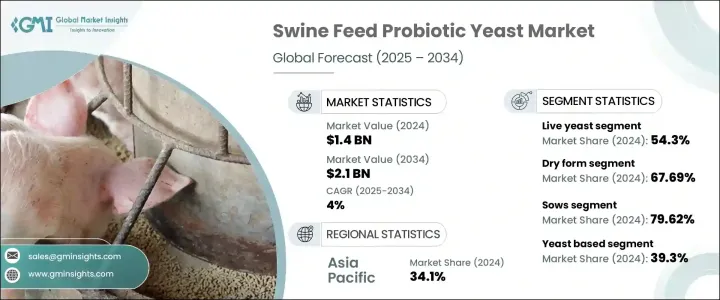

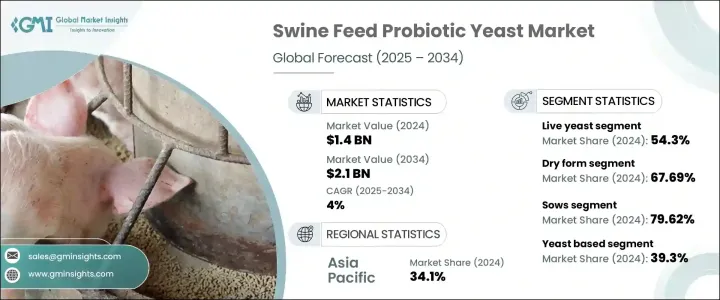

2024年,全球豬飼料益生菌酵母市場規模達14億美元,預計到2034年將以4%的複合年成長率成長,達到21億美元。這一市場成長的動力源自於生產者逐漸放棄使用傳統的抗生素添加劑,轉向使用益生菌酵母的動物飼料。隨著消費者對優質、無抗生素豬肉產品的需求日益成長,對永續的有機替代品的需求也日益成長,這些替代品能夠增強動物的健康。益生菌酵母在改善腸道健康、增強免疫力和促進營養吸收方面發揮著至關重要的作用,有助於提高動物的生產力,使其在整個生命週期中更加健康。此外,人們對抗生素抗藥性的擔憂日益加劇,以及對牲畜抗生素使用監管的日益嚴格,使得益生菌酵母飼料對養豬業更具吸引力。

此外,隨著活酵母產品持續受到青睞,對乾型和液態益生菌酵母的需求也日益成長。這種需求的成長源自於動物營養領域的進步,精準飼餵解決方案日益受到重視。這些創新不僅滿足了人們對更有效、天然飼料添加劑日益成長的需求,也與人們對永續性和法規合規性的日益關注相契合。新技術與更嚴格的法規相結合,正在推動市場朝著更個人化、高效且環保的動物健康和生產力方法邁進。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 21億美元 |

| 複合年成長率 | 4% |

2024年,活酵母市場佔54.3%的市場佔有率,價值8億美元。活酵母的受歡迎程度源自於其改善消化、促進營養吸收和增強免疫力的功效,使其成為抗生素類保健品的重要替代品。這種轉變源自於人們對動物福利日益成長的關注,以及監管法規傾向於天然添加劑。隨著產品設計和特定應用的不斷改進,活酵母市場預計將繼續穩定成長。

2024年,益生菌酵母乾粉佔了67.69%的市佔率。這種形態因其保存期限長、易於儲存以及與飼料混合的兼容性而受到青睞,是大型商業養豬場的理想選擇。乾粉更具成本效益且更耐用,因此在飼料生產商中得到更廣泛的採用。雖然乾粉仍然佔據主導地位,但液態益生菌酵母在注重快速微生物活性和增強吸收率的養殖場中正逐漸受到青睞。

2024年,亞太地區豬飼料益生菌酵母市場佔有34.1%的佔有率,其中中國、越南和菲律賓等國家佔據領先地位。該地區較高的豬肉消費量和不斷擴張的豬業是成長的主要驅動力。此外,消費者對無抗生素豬肉和促進腸道健康和免疫力的酵母飼料的需求也推動了市場需求。該地區各國政府正在對牲畜抗生素的使用實施嚴格的監管,這進一步刺激了對天然益生菌替代品的需求。

全球豬飼料益生菌酵母市場的主要參與者包括科漢森 (Chr. Hansen A/S)、荷蘭皇家帝斯曼集團 (Koninklijke DSM NV)、阿徹丹尼爾斯米德蘭公司 (Archer Daniels Midland Company)、奧特奇公司 (Alltech Inc.) 和拉曼集團 (Lallemand Inc.)。這些公司在各個地區的創新、產品開發和分銷方面處於領先地位。為了鞏固市場地位,豬飼料益生菌酵母產業的公司專注於幾個關鍵策略。首先,他們投入大量資金進行研發,以提高益生菌酵母產品的功效,確保滿足日益成長的強化動物健康解決方案的需求。與飼料生產商和畜牧組織建立策略合作夥伴關係有助於擴大他們的市場範圍和分銷管道。此外,這些公司正在利用先進技術創造更永續、更具成本效益的產品,以滿足消費者對無抗生素天然替代品日益成長的偏好。此外,許多行業領導者致力於永續發展計劃,確保其產品環保,從而吸引更廣泛的環保客戶群。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 活酵母

- 廢酵母

- 酵母衍生物

第6章:市場估計與預測:按屬,2021 - 2034 年

- 主要趨勢

- 酵母菌

- 釀酒酵母

- 布拉氏酵母菌

- 克魯維酵母

- 畢赤酵母

- 其他屬

第7章:市場估計與預測:依形式,2021 - 2034

- 主要趨勢

- 乾燥

- 液體

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 母豬

- 斷奶仔豬

- 種植者

- 終結者

第9章:市場估計與預測:按功能,2021 - 2034 年

- 主要趨勢

- 營養增強

- 改善腸道健康

- 增強免疫力

- 減輕壓力

- 提高產量和生產力

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Chr. Hansen A/S

- Koninklijke DSM NV

- Archer Daniels Midland Company (ADM)

- Alltech Inc.

- Lallemand Inc.

- Phileo by Lesaffre

- Cargill Incorporated

- Evonik Industries AG

- Novus International, Inc.

- Angel Yeast Co., Ltd.

- Novozymes A/S

- Associated British Foods plc

- Biorigin

- Leiber GmbH

- Biomin Holding GmbH

- Novonesis (formerly Novozymes)

- Aniamor Nutrition

- DuPont (IFF)

- Land O'Lakes, Inc.

- Nutreco NV

The Global Swine Feed Probiotic Yeast Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 2.1 billion by 2034. This market growth is driven by a shift toward probiotic yeast-based animal feed as producers move away from traditional antibiotic additives. As consumers increasingly demand high-quality, antibiotic-free pork products, there is a rising need for sustainable, organic alternatives that can enhance animal health. Probiotic yeast plays a vital role in improving gut health, boosting immunity, and aiding nutrient absorption, which contributes to higher productivity and healthier animals throughout the lifecycle. Additionally, the growing concerns over antibiotic resistance and tightening regulations on antibiotic use in livestock have made probiotic yeast feeds more attractive for swine farming.

Additionally, as live yeast products continue to gain traction, there is a growing demand for both dry and liquid forms of probiotic yeast. This increase in demand is driven by advancements in animal nutrition, where precision feeding solutions are becoming more prominent. These innovations are not only meeting the growing need for more effective, natural feed additives but are also aligning with the increasing focus on sustainability and regulatory compliance. The combination of new technologies and stricter regulations is pushing the market toward more tailored, efficient, and environmentally friendly approaches to animal health and productivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 4% |

In 2024, the live yeast segment captured a 54.3% share, valued at USD 800 million. The popularity of live yeast stems from its ability to improve digestion, increase nutrient absorption, and enhance immunity, making it a key substitute for antibiotic-based health promoters. This shift is a result of growing concerns about animal welfare and regulatory changes favoring natural additives. The live yeast segment is expected to continue growing steadily, with ongoing improvements in product design and development for specific applications.

The dry form of the probiotic yeast segment held a 67.69% share in 2024. This form is favored for its extended shelf life, easy storage, and compatibility with feed mixing, making it ideal for large-scale commercial pig farms. The dry segment is more cost-effective and durable, leading to wider adoption among feed producers. While the dry form remains dominant, liquid probiotic yeast is gradually gaining traction in operations where rapid microbial activity and enhanced absorption are prioritized.

Asia Pacific Swine Feed Probiotic Yeast Market held a 34.1% share in 2024, with countries like China, Vietnam, and the Philippines leading the way. High pork consumption and the expanding swine farming industry in this region are major drivers of growth. Furthermore, consumer demand for antibiotic-free pork and yeast-based feeds that promote gut health and immunity is fueling market demand. Governments in this region are enforcing strict regulations on antibiotic use in livestock, further boosting the demand for natural probiotic alternatives.

Key players in the Global Swine Feed Probiotic Yeast Market include Chr. Hansen A/S, Koninklijke DSM N.V., Archer Daniels Midland Company, Alltech Inc., and Lallemand Inc. These companies are leading the charge in innovation, product development, and distribution across various regions. To strengthen their market position, companies in the swine feed probiotic yeast industry focus on several key strategies. First, they invest heavily in research and development to improve the efficacy of probiotic yeast products, ensuring they meet the growing demand for enhanced animal health solutions. Strategic partnerships with feed producers and livestock organizations help to expand their market reach and distribution channels. Moreover, these companies are leveraging advanced technologies to create more sustainable, cost-effective products that align with the rising consumer preference for antibiotic-free, natural alternatives. Additionally, many of the industry's leading players are committed to sustainability initiatives, ensuring their products are environmentally friendly, thus appealing to a broader, eco-conscious customer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Live yeast

- 5.3 Spent yeast

- 5.4 Yeast derivatives

Chapter 6 Market Estimates and Forecast, By Genus, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Saccharomyces

- 6.2.1 Saccharomyces cerevisiae

- 6.2.2 Saccharomyces boulardii

- 6.3 Kluyveromyces

- 6.4 Pichia

- 6.5 Other genera

Chapter 7 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dry

- 7.3 Liquid

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Sows

- 8.3 Weaners

- 8.4 Growers

- 8.5 Finishers

Chapter 9 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Nutrition enhancement

- 9.3 Gut Health improvement

- 9.4 Immunity boosting

- 9.5 Stress reduction

- 9.6 Yield & productivity enhancement

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Chr. Hansen A/S

- 11.2 Koninklijke DSM N.V.

- 11.3 Archer Daniels Midland Company (ADM)

- 11.4 Alltech Inc.

- 11.5 Lallemand Inc.

- 11.6 Phileo by Lesaffre

- 11.7 Cargill Incorporated

- 11.8 Evonik Industries AG

- 11.9 Novus International, Inc.

- 11.10 Angel Yeast Co., Ltd.

- 11.11 Novozymes A/S

- 11.12 Associated British Foods plc

- 11.13 Biorigin

- 11.14 Leiber GmbH

- 11.15 Biomin Holding GmbH

- 11.16 Novonesis (formerly Novozymes)

- 11.17 Aniamor Nutrition

- 11.18 DuPont (IFF)

- 11.19 Land O'Lakes, Inc.

- 11.20 Nutreco N.V.