|

市場調查報告書

商品編碼

1766269

嬰兒果汁市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Baby Juice Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

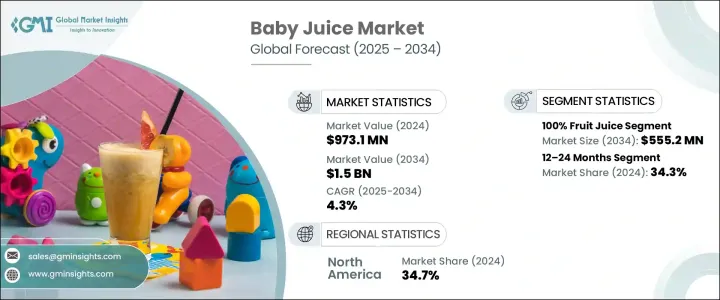

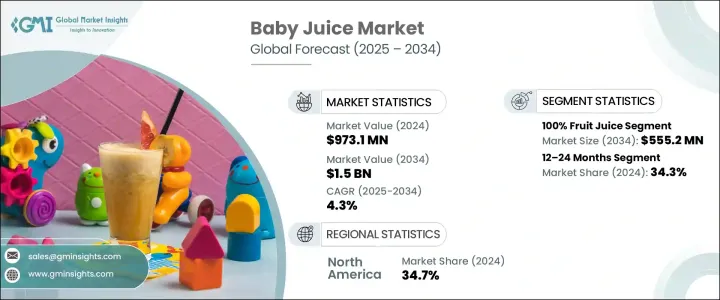

2024年,全球嬰兒果汁市場規模達9.731億美元,預計2034年將以4.3%的複合年成長率成長,達到15億美元。這一穩定成長反映出家長對兒童早期營養意識的不斷提升。家長們越來越注重為嬰幼兒提供營養均衡、營養豐富的飲食,而富含必需維生素和礦物質的嬰兒果汁正成為備受青睞的選擇。隨著全球健康意識的增強,對便利強化產品的需求也日益成長。此外,生活方式的改變,包括越來越多的職業母親和雙收入家庭,也增加了對即食嬰兒食品和飲料的依賴。這些果汁為日程繁忙的家長,尤其是那些經常出差的家長,提供了一個快速實用的解決方案。

拉丁美洲、亞太和非洲等新興市場的成長也發揮關鍵作用。出生率上升、可支配收入增加以及零售基礎設施的改善(包括更強大的電商管道),正在推動嬰兒營養產品的普及。隨著中產階級人口的不斷成長,包裝嬰兒果汁的取得也變得越來越容易,這推動了其在服務欠缺地區的市場滲透,並鞏固了該品類的全球影響力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.731億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 4.3% |

預計到2034年,100%純果汁市場規模將達5.552億美元,複合年成長率為4.5%。注重健康的購買行為正日益成為主流,對兒童飲食中糖分過高的擔憂促使消費者轉向天然替代品。家長越來越青睞不添加糖、注重天然水果成分的果汁。持續進行的促銷和宣傳活動將這些果汁定位為活力四射、天然鮮活的飲品,引起瞭如今注重營養的育兒者的共鳴。這些偏好與人們逐漸放棄溺愛式餵食方式,轉向支持兒童均衡發展的更健康選擇相契合。

從年齡層來看,12-24 個月年齡層在 2024 年佔據 34.3% 的市場佔有率,預計到 2034 年將以 6.8% 的複合年成長率成長。這一階段標誌著兒童飲食習慣的關鍵轉變,因為兒童開始從母乳或配方奶粉過渡到更廣泛的固體和半固體食物,包括果汁。這一年齡層的父母尤其挑剔,他們尋求的產品不僅味道好,還能支持免疫力、消化功能和整體發展。針對此年齡層的嬰兒果汁通常含有維生素 C、鐵和其他重要營養素,並專注於天然成分。包裝也扮演重要角色-防溢漏、符合人體工學的奶瓶專為學習獨立飲水的幼兒設計,有助於提升對父母和幼兒的吸引力。

2024年,北美嬰兒果汁市場佔34.7%的市佔率。該地區的領先地位得益於先進的分銷體系、更高的可支配收入以及消費者對清潔標籤、強化和有機產品的偏好。美國和加拿大的父母越來越注重明智的購買決策,並將早期營養放在首位。產品標籤和安全方面的法規尤其嚴格,這增強了消費者對貨架上產品的信任。政府監管和以營養為重點的標籤有助於建立一個強大透明的嬰兒果汁生態系統,確保產品品質的一致性和消費者安全。

活躍於全球嬰兒果汁市場的主要參與者包括 Beech-Nut Nutrition Company、卡夫亨氏公司、Sprout Foods, Inc.、金寶湯公司和雀巢公司。領先品牌正在透過提供有機、非基因改造和無過敏原產品來實現產品組合的多樣化,從而鞏固其市場地位。許多品牌已擴展到添加維生素、礦物質和益生菌的功能性飲料,以吸引注重營養的父母。對美觀、便捷的包裝(例如可重新密封、防溢容器)的策略性投資正在提高父母和幼兒的可用性。品牌還利用數位行銷和社交媒體平台與千禧世代和 Z 世代的父母建立聯繫,同時透過電子商務擴大分銷以提高可及性。與兒科營養師的合作和遵守安全認證進一步提升了品牌在注重健康的消費者中的信譽和信任。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 方便嬰兒食品的需求日益成長

- 發展中經濟體可支配所得不斷增加

- 職業婦女人口不斷增加

- 產品創新與強化

- 產業陷阱與挑戰

- 兒童不宜過早飲用果汁

- 與糖含量有關的健康問題

- 偏好完整水果和自製水果

- 嚴格的監管框架

- 市場機會

- 有機和天然變體的開發

- 新興市場的擴張

- 電子商務成長

- 功能性和強化型嬰兒果汁產品

- 成長動力

- 成長潛力分析

- 監管格局

- 嬰兒食品和飲料的全球法規

- FDA法規和指南

- 歐盟監管框架

- 果汁HACCP要求

- 標籤和健康聲明法規

- 法規對市場成長的影響

- 波特的分析

- PESTEL分析

- 當前的技術趨勢

- 新興技術

- 按地區

- 按產品

- 當前的技術趨勢

- 新興技術

- 主要進口國

- 主要出口國

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 父母的偏好與決策因素

- 購買模式

- 兒科建議的影響

- 健康和營養意識

- 品牌忠誠度與轉換行為

- 不斷發展的嬰兒營養指南

- 適合年齡的飲料建議

- 兒童早期糖攝取問題

- 果汁在兒童發育中的作用

- 嬰幼兒的替代飲料選擇

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 100%果汁

- 果汁混合

- 蔬菜汁

- 有機嬰兒果汁

- 強化嬰兒果汁

- 其他

第6章:市場估計與預測:依年齡層,2021-2034 年

- 主要趨勢

- 6-12個月

- 12–24個月

- 24–36個月

- 36個月以上

第7章:市場估計與預測:依包裝類型,2021-2034

- 主要趨勢

- 瓶子

- 袋裝

- 紙箱

- 其他

第8章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 超市和大賣場

- 專賣店

- 便利商店

- 網路零售

- 藥局和藥局

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Nestle SA (Gerber Products Company)

- The Kraft Heinz Company

- Danone SA

- Beech-Nut Nutrition Company

- Hain Celestial Group

- Campbell Soup Company (Plum Organics)

- Nurture Inc. (Happy Family Organics)

- Sprout Foods, Inc.

- Ella's Kitchen

- Once Upon a Farm

- Apple & Eve, LLC

- Welch Foods Inc.

- Bellamy's Organic

- Organix Brands Ltd.

- The Coca-Cola Company

The Global Baby Juice Market was valued at USD 973.1 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 1.5 billion by 2034. This steady growth reflects rising parental awareness about early childhood nutrition. Parents are increasingly focused on providing well-rounded, nutrient-rich diets for their infants and toddlers, and baby juices-often enriched with essential vitamins and minerals-are becoming a favored option. As health consciousness grows globally, demand for convenient, fortified products is increasing. Additionally, lifestyle changes, including a growing population of working mothers and dual-income households, have boosted reliance on ready-to-consume baby foods and beverages. These juices offer a quick and practical solution for parents with busy schedules, especially those frequently on the go.

Growth in emerging markets across regions such as Latin America, Asia-Pacific, and Africa is also playing a key role. Rising birth rates, higher disposable incomes, and improved retail infrastructure-including stronger e-commerce channels-are supporting the spread of baby nutrition products. As middle-class populations continue to expand, accessibility to packaged baby juices is becoming easier, pushing forward market penetration in underserved regions and cementing the global reach of the category.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $973.1 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 4.3% |

The 100% fruit juice segment is forecast to reach USD 555.2 million by 2034, growing at a CAGR of 4.5% during 2034. Health-conscious buying behaviors are becoming more mainstream, and concerns around excess sugar in children's diets have driven consumers toward natural alternatives. Parents are gravitating toward juices with no added sugar and a focus on real fruit content. Ongoing promotions and awareness campaigns that position these juices as energizing and naturally vibrant are resonating with today's nutrition-minded caregivers. These preferences align with the shift away from indulgent feeding practices and a move toward healthier options that support balanced childhood development.

In terms of age demographics, the 12-24 months segment held 34.3% share in 2024 and is expected to grow at a CAGR of 6.8% through 2034. This stage marks a critical shift in dietary habits as children begin to transition from breast milk or formula to a broader range of solid and semi-solid foods, including juices. Parents in this segment are particularly selective, seeking products that not only taste good but also support immunity, digestion, and overall development. Baby juices tailored to this age group typically contain vitamin C, iron, and other important nutrients, with a strong focus on natural ingredients. Packaging also plays a major role-non-spill, ergonomic bottles are designed for toddlers learning to drink independently, helping boost appeal for both parents and young children.

North America Baby Juice Market held 34.7% share in 2024. The region's leadership is backed by advanced distribution systems, higher disposable incomes, and a shift toward clean-label, fortified, and organic options. Parents in both the U.S. and Canada are increasingly driven by informed purchasing decisions that prioritize early-life nutrition. Regulations around product labeling and safety are particularly stringent, which builds trust in the products available on the shelves. Government oversight and nutrition-focused labeling contribute to a robust and transparent baby juice ecosystem, ensuring consistency in quality and consumer safety.

Key players active in the Global Baby Juice Market include Beech-Nut Nutrition Company, The Kraft Heinz Company, Sprout Foods, Inc., Campbell Soup Company, and Nestle S.A. Leading brands are strengthening their market position by diversifying product portfolios with organic, non-GMO, and allergen-free offerings. Many have expanded into functional beverages fortified with vitamins, minerals, and probiotics to appeal to nutrition-savvy parents. Strategic investments in attractive, convenient packaging-such as resealable, spill-proof containers-are enhancing usability for parents and toddlers alike. Brands are also leveraging digital marketing and social media platforms to connect with millennial and Gen Z parents, while broadening distribution via e-commerce to boost accessibility. Collaborations with pediatric nutritionists and compliance with safety certifications further elevate brand credibility and trust among health-conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Age group

- 2.2.3 Packaging type

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for convenient baby food options

- 3.2.1.2 Rising disposable income in developing economies

- 3.2.1.3 Increasing working women population

- 3.2.1.4 Product innovations and fortification

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Pediatric recommendations against early juice consumption

- 3.2.2.2 Health concerns related to sugar content

- 3.2.2.3 Preference for whole fruits and homemade options

- 3.2.2.4 Stringent regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Development of organic and natural variants

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 E-commerce growth

- 3.2.3.4 Functional and fortified baby juice products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global regulations for baby food and beverages

- 3.4.2 FDA regulations and guidelines

- 3.4.3 European Union regulatory framework

- 3.4.4 Juice HACCP requirements

- 3.4.5 Labeling and health claim regulations

- 3.4.6 Impact of regulations on market growth

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.1.1 Juice processing technologies

- 3.6.1.2 Preservation methods

- 3.6.1.3 Packaging innovations

- 3.6.1.4 Quality testing advancements

- 3.6.1.5 Digital technologies in supply chain

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.6.1 Technology and Innovation landscape

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Consumer Behavior Analysis

- 3.13.1 Parental preferences and decision factors

- 3.13.2 Purchase patterns

- 3.13.3 Influence of pediatric recommendations

- 3.13.4 Health and nutrition awareness

- 3.13.5 Brand loyalty and switching behavior

- 3.14 Pediatric nutrition trends

- 3.14.1 Evolving guidelines for infant nutrition

- 3.14.2 Age-appropriate beverage recommendations

- 3.14.3 Sugar intake concerns in early childhood

- 3.14.4 Role of juices in child development

- 3.14.5 Alternative beverage options for infants and toddlers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Liters)

- 5.1 Key trends

- 5.2 100% fruit juice

- 5.3 Fruit juice blends

- 5.4 Vegetable juice

- 5.5 Organic baby juice

- 5.6 Fortified baby juice

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Age Group, 2021-2034 (USD Million) (Kilo Liters)

- 6.1 Key trends

- 6.2 6–12 months

- 6.3 12–24 months

- 6.4 24–36 months

- 6.5 Above 36 months

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Million) (Kilo Liters)

- 7.1 Key trends

- 7.2 Bottles

- 7.3 Pouches

- 7.4 Cartons

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Liters)

- 8.1 Key trends

- 8.2 Supermarkets and hypermarkets

- 8.3 Specialty stores

- 8.4 Convenience stores

- 8.5 Online retail

- 8.6 Pharmacies and drug stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Liters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Nestle S.A. (Gerber Products Company)

- 10.2 The Kraft Heinz Company

- 10.3 Danone S.A.

- 10.4 Beech-Nut Nutrition Company

- 10.5 Hain Celestial Group

- 10.6 Campbell Soup Company (Plum Organics)

- 10.7 Nurture Inc. (Happy Family Organics)

- 10.8 Sprout Foods, Inc.

- 10.9 Ella’s Kitchen

- 10.10 Once Upon a Farm

- 10.11 Apple & Eve, LLC

- 10.12 Welch Foods Inc.

- 10.13 Bellamy's Organic

- 10.14 Organix Brands Ltd.

- 10.15 The Coca-Cola Company