|

市場調查報告書

商品編碼

1766263

建築攜帶式發電機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Construction Portable Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

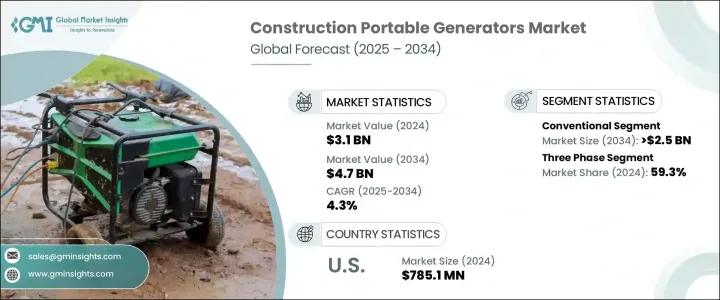

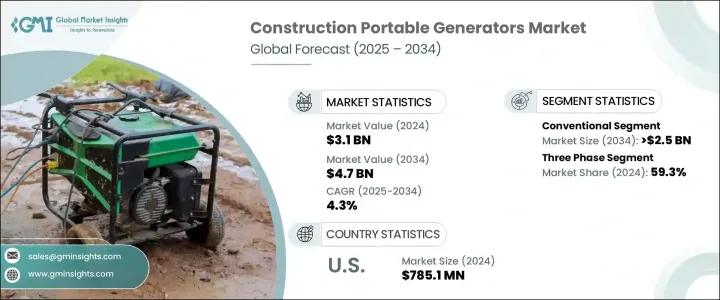

2024年,全球建築攜帶式發電機市場規模達31億美元,預計2034年將以4.3%的複合年成長率成長,達到47億美元。這一穩定成長主要源自於全球建築業對更清潔、更智慧、更節能的電力解決方案日益成長的需求。產業對減少排放、提高燃油經濟性和便利運輸的期望不斷變化,這正在影響主要製造商的產品開發策略。隨著建築企業擴大採用永續實踐,混合系統(結合電池、太陽能組件和逆變器技術)的整合發展勢頭強勁,為攜帶式發電機的部署創造了有利的前景。

城市建設活動持續快速成長,尤其是在政府機構實施嚴格排放標準的地區,企業也積極努力遵守綠建築認證。市場受益於對緊湊、低噪音、輕便發電機的持續需求,這些發電機非常適合在狹窄或敏感的工作環境中使用。發電機引擎性能的技術進步——尤其是符合Stage V和Tier 4等最新排放標準的技術進步——對於提升產品吸引力至關重要。同時,向更清潔燃料替代品的轉變以及雙燃料系統的日益普及,正在解決環境問題,同時確保所有施工現場的可靠電力供應。這些不斷發展的標準正在為行動能源解決方案領域帶來新的機遇,並促進產品的快速創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 47億美元 |

| 複合年成長率 | 4.3% |

建築攜帶式發電機市場按產品細分為傳統攜帶式和逆變器攜帶式。其中,傳統設備仍被廣泛使用,預計到2034年其收入將超過25億美元。它們之所以受歡迎,源自於其可靠的電力供應,尤其是在經常受天氣影響停電或可靠電網接入受限的地區。從更安靜的引擎運行到更省油的設計,這些產品的持續改進正在提高其在各種建築環境中(從大型基礎設施到住宅項目)的接受度。

市場也依相位分為單相和三相系統。 2024年,三相攜帶式發電機佔據了59.3%的主導市場佔有率,因其能夠提供高容量、穩定的電力而越來越受到青睞,非常適合需要更高電力負載的大型建築應用。隨著建築工地的電力需求日益複雜,預計該領域將在整個預測期內保持強勁地位。

相較之下,預計到2034年,單相建築攜帶式發電機的市場成長率將達到4.2%。這類發電機在需要穩定清潔能源來驅動低容量工具或敏感電子設備的使用者中越來越受歡迎。許多型號現在都配備了逆變技術,可以更好地控制輸出品質和能耗。此外,符合人體工學的數位顯示器、透過行動應用程式進行無線監控以及整合安全功能等產品升級,顯著提高了可用性和現場可靠性,使這類設備成為越來越有吸引力的選擇。

縱觀北美,美國仍然是整個產業收入的主要貢獻者。該國建築攜帶式發電機市場規模在2022年為6.876億美元,2023年為7.359億美元,2024年達到7.851億美元。這一成長主要得益於城市重建、改造項目以及臨時基礎設施建設期間對行動電源需求的增加。從短期專案的設備支援到災難復原行動中的緊急使用,攜帶式發電機對於確保工作現場工作流程的不間斷和安全至關重要。

引領全球競爭格局的是五大關鍵企業-本田印度動力產品公司、Generac 動力系統公司、阿特拉斯·科普柯公司、康明斯公司和雅馬哈引擎公司。這些公司佔據了近 50% 的市場佔有率。他們的主導地位源於其對持續創新的承諾、強大的全球分銷網路以及旨在滿足不同地區市場建築專業人士特定需求的多樣化產品。他們對清潔技術和智慧功能的整合的投資進一步鞏固了他們作為攜帶式電源領域值得信賴的解決方案提供者的地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 傳統攜帶式

- 手提式逆變器

第6章:市場規模及預測:依燃料及電力等級,2021 - 2034 年

- 主要趨勢

- 柴油引擎

- < 20 千瓦

- 20 - 50 千瓦

- > 50 - 100 千瓦

- 汽油

- < 2 千瓦

- 2千瓦-5千瓦

- 6千瓦-8千瓦

- > 8千瓦 - 15千瓦

- 其他

第7章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 德國

- 法國

- 西班牙

- 奧地利

- 義大利

- 亞太地區

- 澳洲

- 日本

- 中國

- 印度

- 印尼

- 泰國

- 馬來西亞

- 新加坡

- 韓國

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亞

- 阿爾及利亞

- 南非

- 莫三比克

- 拉丁美洲

- 墨西哥

- 智利

- 阿根廷

- 巴西

第9章:公司簡介

- Allmand Bros

- Atlas Copco

- Briggs & Stratton

- Caterpillar

- Champion Power Equipment

- Cummins

- Deere & Company

- DEWALT

- DuroMax Power Equipment

- FIRMAN Power Equipment

- Generac Power Systems

- GENMAC

- HIMOINSA

- Honda India Power Products

- Kirloskar Oil Engines

- Rehlko

- Wacker Neuson

- Westinghouse Electric Corporation

- Yamaha Motor

- YANMAR HOLDINGS

The Global Construction Portable Generators Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.7 billion by 2034. This steady growth is primarily driven by rising demand for cleaner, smarter, and more energy-efficient power solutions across construction operations worldwide. Evolving industry expectations toward reduced emissions, enhanced fuel economy, and ease of transport are shaping the product development strategies of key manufacturers. As construction businesses increasingly adopt sustainable practices, the integration of hybrid systems-combining batteries, solar modules, and inverter technologies-is gaining momentum, creating a favorable landscape for portable generator deployments.

Urban construction activity continues to rise at a rapid pace, especially in regions where government bodies have imposed strict emission norms, and companies are actively working to comply with green-building certifications. The market benefits from consistent requirements for compact, low-noise, and lightweight generators ideal for confined or sensitive work environments. Technological advancements in generator engine performance-particularly those aligned with updated emission standards such as Stage V and Tier 4-are crucial in boosting product appeal. Simultaneously, the shift toward cleaner fuel alternatives and the growing use of dual-fuel systems are addressing environmental concerns while maintaining reliable power access across job sites. These evolving standards are fostering new opportunities in the mobile energy solutions space and encouraging rapid product innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 4.3% |

The construction portable generators market is segmented by product into conventional portable and inverter portable types. Among these, conventional units remain widely used and are projected to exceed USD 2.5 billion in revenue by 2034. Their popularity is rooted in the dependable power supply they provide, especially in regions frequently affected by weather-related outages or where reliable grid access is limited. Continuous product improvements, ranging from quieter engine operation to fuel-efficient designs, are increasing their acceptance across various construction settings, from large-scale infrastructure to residential projects.

The market is also divided based on phase into single-phase and three-phase systems. Three-phase portable generators held a dominant market share of 59.3% in 2024 and are increasingly preferred for their ability to deliver high-capacity, stable power, making them well-suited for larger construction applications requiring higher electrical loads. As power needs on construction sites become more sophisticated, this segment is expected to maintain its strong position throughout the forecast period.

In contrast, single-phase construction portable generators are projected to grow at a faster rate of 4.2% through 2034. These generators are becoming more popular among users who need steady, clean energy for lower-capacity tools or sensitive electronic equipment. Many models are now equipped with inverter technology, offering advanced control over output quality and energy consumption. Furthermore, product upgrades such as ergonomic digital displays, wireless monitoring through mobile applications, and integrated safety features are significantly improving usability and onsite reliability, making these units an increasingly attractive choice.

Across North America, the U.S. remains a major contributor to overall industry revenue. The country's construction portable generators market was valued at USD 687.6 million in 2022, USD 735.9 million in 2023, and reached USD 785.1 million in 2024. This growth is driven by an uptick in urban redevelopment, renovation initiatives, and the need for mobile power during temporary infrastructure setups. From equipment support on short-term projects to emergency use in disaster recovery operations, portable generators have become vital in ensuring uninterrupted workflow and safety on job sites.

Leading the global competitive landscape are five key players-Honda India Power Products, Generac Power Systems, Atlas Copco, Cummins, and Yamaha Motor. These companies account for nearly 50% of the total market share. Their dominance is fueled by their commitment to continuous innovation, a strong global distribution footprint, and diverse product offerings that are designed to meet the specific needs of construction professionals across various geographic markets. Their investments in cleaner technologies and integration of smart features are further reinforcing their positions as trusted solution providers in the portable power sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & '000 Units)

- 5.1 Key trends

- 5.2 Conventional portable

- 5.3 Inverter portable

Chapter 6 Market Size and Forecast, By Fuel & Power Rating, 2021 - 2034 (USD Million & '000 Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.2.1 < 20 kW

- 6.2.2 20 - 50 kW

- 6.2.3 > 50 - 100 kW

- 6.3 Gasoline

- 6.3.1 < 2 kW

- 6.3.2 2 kW - 5 kW

- 6.3.3 6 kW - 8 kW

- 6.3.4 > 8 kW - 15 kW

- 6.4 Others

Chapter 7 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & '000 Units)

- 7.1 Key trends

- 7.2 Single phase

- 7.3 Three phase

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & '000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 Australia

- 8.4.2 Japan

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Singapore

- 8.4.9 South Korea

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Mozambique

- 8.7 Latin America

- 8.7.1 Mexico

- 8.7.2 Chile

- 8.7.3 Argentina

- 8.7.4 Brazil

Chapter 9 Company Profiles

- 9.1 Allmand Bros

- 9.2 Atlas Copco

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Champion Power Equipment

- 9.6 Cummins

- 9.7 Deere & Company

- 9.8 DEWALT

- 9.9 DuroMax Power Equipment

- 9.10 FIRMAN Power Equipment

- 9.11 Generac Power Systems

- 9.12 GENMAC

- 9.13 HIMOINSA

- 9.14 Honda India Power Products

- 9.15 Kirloskar Oil Engines

- 9.16 Rehlko

- 9.17 Wacker Neuson

- 9.18 Westinghouse Electric Corporation

- 9.19 Yamaha Motor

- 9.20 YANMAR HOLDINGS