|

市場調查報告書

商品編碼

1750459

建築主發電機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Construction Prime Power Generators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

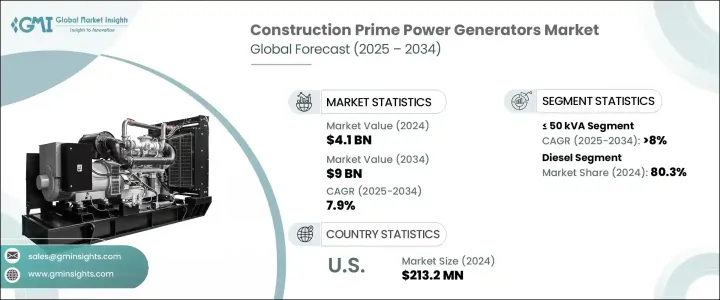

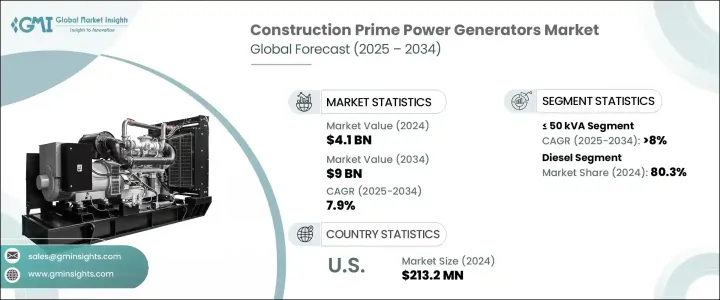

2024年,全球建築主發電機市場規模達41億美元,預計2034年將以7.9%的複合年成長率成長,達到90億美元。建築業對持續不間斷電力供應的需求日益成長,這必將在塑造產業動態方面發揮至關重要的作用。隨著新興經濟體工業化和基礎建設推動建築業不斷發展,對可靠能源的需求也日益凸顯。主發電機作為一種可靠的備用能源解決方案,正日益受到青睞,尤其是在電網連接受限或無法連接的項目中。人們對能源可靠性和效率的日益重視,加上持續整合永續能源替代方案的努力,進一步擴大了該領域的成長潛力。

隨著各地區製造設施和工業單位的蓬勃發展,對經濟高效且性能穩定的發電解決方案的需求也日益成長。尤其是在都市化地區,建築活動大幅成長,促進了發電機組的廣泛應用。此外,對穩定電力供應以支援關鍵機械和製程運作的需求,也推動了對先進發電機技術的投資。全球多個地區停電頻率的不斷上升,加上人們對能源安全的擔憂日益加劇,更凸顯了建立可靠備用系統的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 41億美元 |

| 預測值 | 90億美元 |

| 複合年成長率 | 7.9% |

電氣化和基礎設施建設投資的不斷成長,尤其是在離網和服務不足地區,也推動了該市場的成長動能。隨著越來越多的地區,尤其是農村和半城市地區,努力提高能源可近性,發電機組正在部署以彌補供需之間的差距。向老舊電力系統現代化轉型,包括更換老化發電機,正在進一步推動市場成長。同樣,臨時和移動建築對可擴展發電解決方案的需求,也推動了易於使用和部署靈活的攜帶式發電機型號的採用。

就額定功率而言,市場分為<= 50 kVA、> 50 kVA - 125 kVA、> 125 kVA - 200 kVA、> 200 kVA - 330 kVA、> 330 kVA - 750 kVA 和 > 750 kVA 三個細分市場。預計<= 50 kVA 細分市場將以更快的速度成長,到 2034 年複合年成長率將超過 8%。這一成長主要源自於市場對緊湊輕便發電系統日益成長的需求,這類系統非常適合中小型建築專案。其便攜性和較低的功耗使其成為預算有限或空間受限項目的理想選擇。

市場進一步按燃料類型細分為柴油和天然氣。 2024年,柴油驅動的建築主力發電機佔據市場主導地位,佔總佔有率的80.3%。這種主導地位得益於柴油在偏遠地區和離網地區的廣泛供應,使其成為需要持續能源支援的建築工地的實用選擇。柴油發電機相對較低的前期投資成本也增加了其吸引力,尤其是在預算敏感的建築環境中。

將傳統柴油或燃氣發電機與太陽能或電池儲能等再生能源相結合的混合系統也正在蓬勃發展。這種轉變是由日益增強的環保意識和不斷上漲的燃料成本所推動的,這促使利害關係人採用更節能、更環保的替代方案。這些混合系統越來越被視為減少對化石燃料依賴同時保持高電力傳輸可靠性的可行解決方案。

在美國,建築主發電機市場在過去幾年中穩步成長,2022 年估值為 1.872 億美元,2023 年為 2.005 億美元,2024 年為 2.132 億美元。推動低排放技術發展的監管框架,以及符合環保標準的節能發電機組需求的不斷成長,共同支撐了這一積極趨勢。隨著美國繼續推動建築實踐現代化並整合更智慧的電力系統,預計將保持強勁的成長勢頭。

引領建築主發電機市場格局的領導企業包括阿特拉斯·科普柯、阿肖克·利蘭、百力通、康明斯、Caterpillar、迪爾公司、伊蒙妮莎、Generac Power Systems、Kirloskar、三菱重工、馬恆達POWEROL、PR INDUSTRIAL、Rehlko、勞斯萊斯、阿堪魯這些公司正在積極投資技術進步,並擴展其產品組合,以滿足不斷變化的客戶需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依功率等級,2021 - 2034 年

- 主要趨勢

- ≤50千伏安

- > 50千伏安 - 125千伏安

- > 125 千伏安 - 200 千伏安

- > 200 千伏安 - 330 千伏安

- > 330 千伏安 - 750 千伏安

- > 750千伏安

第6章:市場規模及預測:依燃料,2021 - 2034 年

- 主要趨勢

- 柴油引擎

- 氣體

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 俄羅斯

- 英國

- 德國

- 法國

- 西班牙

- 奧地利

- 義大利

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 菲律賓

- 緬甸

- 孟加拉

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 伊朗

- 阿曼

- 非洲

- 埃及

- 奈及利亞

- 阿爾及利亞

- 南非

- 安哥拉

- 肯亞

- 莫三比克

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

第8章:公司簡介

- Ashok Leyland

- Atlas Copco

- Briggs & Stratton

- Caterpillar

- Cummins

- Deere & Company

- Generac Power Systems

- HIMOINSA

- Kirloskar

- Mahindra POWEROL

- Mitsubishi Heavy Industries

- PR INDUSTRIAL

- Rapid Power Generation

- Rehlko

- Rolls-Royce

- Scania

- Siemens Energy

- Volvo Penta

- Wartsilä

- YANMAR HOLDINGS

The Global Construction Prime Power Generators Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 9 billion by 2034. The rising demand for consistent and uninterrupted power supply across construction activities is set to play a vital role in shaping industry dynamics. As the construction sector continues to evolve, fueled by industrialization and infrastructure development in emerging economies, the need for dependable energy sources is becoming increasingly critical. Prime power generators are gaining traction as a reliable energy backup solution, particularly in projects where grid connectivity is limited or unavailable. The growing emphasis on energy reliability and efficiency, coupled with ongoing efforts to integrate sustainable energy alternatives, is further amplifying growth potential.

With an upswing in the development of manufacturing facilities and industrial units across various regions, the requirement for cost-effective and robust power generation solutions has intensified. Construction activities, particularly in urbanizing areas, are seeing a substantial increase, encouraging wider adoption of generator sets. Additionally, the need for a consistent electricity supply to support the operation of essential machinery and processes is driving investments in advanced generator technologies. The increasing frequency of power disruptions in several parts of the world, combined with rising concerns over energy security, has only reinforced the importance of having reliable backup systems in place.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $9 Billion |

| CAGR | 7.9% |

Growing investments in electrification efforts and infrastructure development, especially in off-grid and underserved areas, are also contributing to the upward momentum of this market. As more regions strive to enhance energy accessibility, particularly in rural and semi-urban locations, generator sets are being deployed to bridge the gap between demand and supply. The shift toward modernizing outdated power systems, including the replacement of aging generators, is adding further impetus to market growth. Likewise, the demand for scalable power generation solutions in temporary and mobile construction setups is fueling the adoption of portable generator models that offer ease of use and deployment flexibility.

In terms of power rating, the market is categorized into <= 50 kVA > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, and > 750 kVA segments. The <= 50 kVA segment is forecasted to grow at a faster pace, with a CAGR exceeding 8% through 2034. This growth is being propelled by the increasing need for compact and lightweight power generation systems, which are ideal for small to medium-scale construction projects. Their portability and lower power consumption make them an attractive option for projects with constrained budgets or spatial limitations.

The market is further segmented by fuel type into diesel and gas. Diesel-powered construction prime power generators dominated the market in 2024, accounting for 80.3% of the total share. This dominance is supported by the widespread availability of diesel fuel in remote and off-grid areas, making it a practical choice for construction sites that require continuous energy support. The relatively lower upfront investment cost of diesel generators also adds to their appeal, particularly in budget-sensitive construction environments.

Hybrid systems that combine traditional diesel or gas-powered generators with renewable energy sources such as solar or battery storage are gaining momentum as well. This shift is driven by growing environmental awareness and rising fuel costs, encouraging stakeholders to adopt more energy-efficient and eco-friendly alternatives. These hybrid systems are increasingly seen as a viable solution to reduce dependency on fossil fuels while maintaining high reliability in power delivery.

In the United States, the construction prime power generators market has shown steady growth over the past few years, with valuations of USD 187.2 million in 2022, USD 200.5 million in 2023, and USD 213.2 million in 2024. This positive trend is being supported by regulatory frameworks promoting lower-emission technologies alongside rising demand for energy-efficient gensets that align with environmental standards. The country is expected to maintain a strong growth trajectory as it continues to modernize its construction practices and integrate smarter power systems.

Leading players shaping the construction prime power generators landscape include Atlas Copco, Ashok Leyland, Briggs & Stratton, Cummins, Caterpillar, Deere & Company, HIMOINSA, Generac Power Systems, Kirloskar, Mitsubishi Heavy Industries, Mahindra POWEROL, PR INDUSTRIAL, Rehlko, Rolls-Royce, Scania, Rapid Power Generation, Siemens Energy, Wartsila, Volvo Penta, and YANMAR HOLDINGS. These companies are actively investing in technological advancements and expanding their portfolios to cater to evolving customer needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 50 kVA

- 5.3 > 50 kVA - 125 kVA

- 5.4 > 125 kVA - 200 kVA

- 5.5 > 200 kVA - 330 kVA

- 5.6 > 330 kVA - 750 kVA

- 5.7 > 750 kVA

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gas

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Russia

- 7.3.2 UK

- 7.3.3 Germany

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Austria

- 7.3.7 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.4.8 Thailand

- 7.4.9 Vietnam

- 7.4.10 Philippines

- 7.4.11 Myanmar

- 7.4.12 Bangladesh

- 7.5 Middle East

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Turkey

- 7.5.5 Iran

- 7.5.6 Oman

- 7.6 Africa

- 7.6.1 Egypt

- 7.6.2 Nigeria

- 7.6.3 Algeria

- 7.6.4 South Africa

- 7.6.5 Angola

- 7.6.6 Kenya

- 7.6.7 Mozambique

- 7.7 Latin America

- 7.7.1 Brazil

- 7.7.2 Mexico

- 7.7.3 Argentina

- 7.7.4 Chile

Chapter 8 Company Profiles

- 8.1 Ashok Leyland

- 8.2 Atlas Copco

- 8.3 Briggs & Stratton

- 8.4 Caterpillar

- 8.5 Cummins

- 8.6 Deere & Company

- 8.7 Generac Power Systems

- 8.8 HIMOINSA

- 8.9 Kirloskar

- 8.10 Mahindra POWEROL

- 8.11 Mitsubishi Heavy Industries

- 8.12 PR INDUSTRIAL

- 8.13 Rapid Power Generation

- 8.14 Rehlko

- 8.15 Rolls-Royce

- 8.16 Scania

- 8.17 Siemens Energy

- 8.18 Volvo Penta

- 8.19 Wartsilä

- 8.20 YANMAR HOLDINGS