|

市場調查報告書

商品編碼

1766259

製袋灌裝封口 (FFS) 機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Form-Fill-Seal (FFS) Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

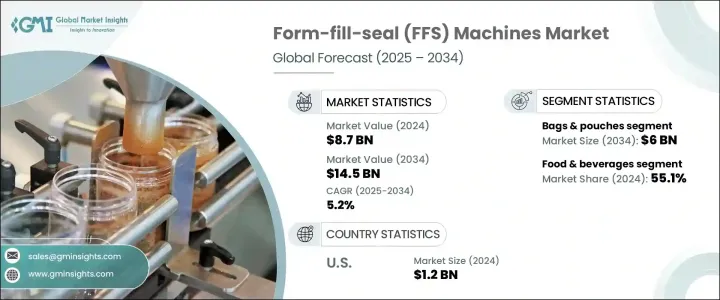

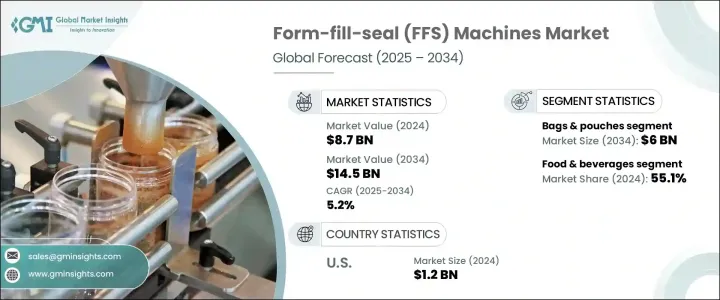

2024年,全球製袋-灌裝-封口機市場規模達87億美元,預計到2034年將以5.2%的複合年成長率成長,達到145億美元。這一成長主要源於日益成長的監管壓力,這些壓力要求逐步淘汰對環境有害的材料,並轉向永續的包裝替代品。 FFS機器正在不斷發展,以處理可回收和可生物分解的材料,這與全球遏制塑膠垃圾的努力一致。隨著法規的收緊和環保意識的增強,企業紛紛投資升級FFS技術,以維持合規性並提升其永續發展資質。除了環保合規性之外,自動化程度的提高也在推動FFS系統需求方面發揮重要作用。

包裝作業,尤其是在食品、製藥和消費品產業,越來越依賴FFS解決方案來提高產量、降低人力成本並確保產品安全。這些機器透過提高包裝速度、準確性和一致性,同時減少人為錯誤,提供長期價值。 FFS系統因其適應性強,能夠處理衛生要求嚴格的大批量包裝,尤其是在保存期限、防篡改和產品完整性至關重要的行業,一直受到製造商的青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 87億美元 |

| 預測值 | 145億美元 |

| 複合年成長率 | 5.2% |

包裝袋和小袋佔了39.1%的市場佔有率,預計到2034年將達到60億美元的市場規模。即食食品和飲料消費的不斷成長,推動了對靈活、便攜且衛生的包裝解決方案的需求。健康食品市場的擴張,促使製造商採用有助於保鮮和保質的包裝技術。隨著成型-填充-密封系統的不斷發展,它們如今支持諸如氣調密封和氣密屏障等創新技術,有助於延長保存期限。對符合環保標準的包裝的需求日益成長,也推動了可堆肥和可生物分解基材的使用,進一步推動了向永續FFS技術的轉變。

食品飲料產業在2024年佔據55.1%的市場佔有率,預計在整個預測期內仍將保持主導地位。 FFS機器擴大用於將固體、粉末和液體包裝到各種類型的包裝袋中,包括扁平、立式和帶吸嘴的包裝袋。 FFS系統的多功能性使其能夠使用環保薄膜處理各種產品形式。電子商務的影響力日益增強,以及對輕量化、防護性和可客製化包裝的需求日益成長,使得FFS機器成為許多製造商的首選解決方案,旨在在不影響品質或性能的情況下減少材料使用。

美國製袋-灌裝-封口機市場在2024年創收12億美元,預計到2034年將以5.4%的複合年成長率成長。食品、製藥和個人護理行業的快速發展推動了對軟性高性能包裝的需求。消費者偏好轉向環保解決方案,促使美國企業投資能夠實現速度、合規性和永續性的下一代FFS設備。

活躍於全球製袋-灌裝-封口機市場的知名公司包括 ULMA Packaging、ProMach、All-Fill Inc.、博世包裝技術、WeighPack Systems Inc.、Coesia Group、Matrix Packaging Machinery、Barry-Wehmiller Group、PFM Packaging、Ilapak、Synteam、Triangle Package flex 組合、商店組合。領先的製造商正在透過整合自動化、人工智慧控制和物聯網功能來改善其產品線,以提高速度、精度和機器效能。

許多公司正在投資研發與可堆肥和可回收材料相容的機器,幫助客戶符合全球永續發展標準。他們正在尋求策略聯盟、併購,以擴大地域覆蓋範圍並強化分銷管道。客製化是另一項核心策略,公司會根據獨特的產品類型和包裝形式設計客製化的全功能管線 (FFS) 系統。這些努力使品牌能夠提供靈活、可擴展的解決方案,以滿足不斷變化的行業需求,同時在競爭激烈的市場中保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按機器類型

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 臥式FFS機

- 立式FFS機

- 熱成型FFS機

第6章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 包包和小袋

- 杯子和托盤

- 瓶子

- 小袋

- 紙箱

- 其他

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化妝品和個人護理

- 化學品

- 其他

第8章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 塑膠

- 紙

- 鋁箔

- 多層薄膜

- 可生物分解材料

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- All-Fill Inc.

- Barry-Wehmiller Group

- Bosch Packaging Technology

- Bossar Packaging

- BW Flexible Systems

- Coesia Group

- Ilapak

- IMA Group

- Matrix Packaging Machinery

- PFM Packaging

- ProMach

- Syntegon

- Triangle Package Machinery Co.

- ULMA Packaging

- WeighPack Systems Inc.

The Global Form-Fill-Seal Machines Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 14.5 billion by 2034. This growth is largely propelled by increasing regulatory pressure to phase out environmentally harmful materials and move toward sustainable packaging alternatives. FFS machines are evolving to process recyclable and biodegradable materials, aligning with global efforts to curb plastic waste. As regulations tighten and environmental awareness rises, companies are responding with investments in upgraded FFS technology to remain compliant and enhance their sustainability credentials. In addition to environmental compliance, the rise in automation is playing a major role in boosting the demand for FFS systems.

Packaging operations, especially in the food, pharmaceutical, and consumer goods industries, are becoming increasingly reliant on FFS solutions to improve output, minimize labor costs, and ensure product safety. These machines offer long-term value by increasing speed, accuracy, and consistency in packaging while reducing human error. Manufacturers continue to favor FFS systems due to their adaptability and ability to handle high-volume packaging with strict hygiene requirements, particularly in sectors where shelf life, tamper resistance, and product integrity are paramount.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 billion |

| Forecast Value | $14.5 billion |

| CAGR | 5.2% |

The bags and pouches segment held a 39.1% share and is estimated to generate USD 6 billion by 2034. The rising consumption of ready-to-eat foods and beverages is fueling demand for flexible, portable, and hygienic packaging solutions. The expansion of health-focused food markets is pushing manufacturers to adopt packaging technologies that help preserve freshness and product quality. As form-fill-seal systems advance, they now support innovations such as controlled atmosphere sealing and airtight barriers, helping to extend shelf life. The growing need for packaging that meets environmental standards has also led to the use of compostable and biodegradable substrates, further reinforcing the shift toward sustainable FFS technologies.

The food & beverage segment held a 55.1% share in 2024 and is expected to maintain its dominance throughout the forecast period. FFS machines are increasingly used to package solids, powders, and liquids into a wide range of pouch types, including flat, stand-up, and spouted variations. The versatility of FFS systems allows them to handle a wide spectrum of product formats using eco-conscious films. The rising influence of e-commerce and the growing demand for lightweight, protective, and customizable packaging have made FFS machines the go-to solution for many manufacturers aiming to cut down on material use without compromising quality or performance.

United States Form-Fill-Seal Machines Market generated USD 1.2 billion in 2024 and is forecast to grow at a CAGR of 5.4% through 2034. Rapid developments in the food, pharmaceutical, and personal care sectors are fueling the demand for flexible, high-performance packaging. The shift in consumer preference toward eco-friendly solutions is pushing companies in the U.S. to invest in next-generation FFS equipment that can deliver speed, compliance, and sustainability.

Prominent companies active in the Global Form-Fill-Seal Machines Market include ULMA Packaging, ProMach, All-Fill Inc., Bosch Packaging Technology, WeighPack Systems Inc., Coesia Group, Matrix Packaging Machinery, Barry-Wehmiller Group, PFM Packaging, Ilapak, Syntegon, Triangle Package Machinery Co., Bossar Packaging, IMA Group, and BW Flexible Systems. Leading manufacturers are advancing their product lines by incorporating automation, AI-powered controls, and IoT capabilities to improve speed, precision, and machine performance.

Many are investing in research to develop machines compatible with compostable and recyclable materials, helping customers align with global sustainability standards. Strategic alliances, mergers, and acquisitions are being pursued to expand geographical presence and strengthen distribution channels. Customization is another core strategy, with companies designing FFS systems tailored to unique product types and packaging formats. These efforts allow brands to offer versatile, scalable solutions to meet evolving industry requirements while staying ahead in a highly competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 End use industry

- 2.2.4 Packaging type

- 2.2.5 Material type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Horizontal ffs machines

- 5.3 Vertical ffs machines

- 5.4 Thermoform ffs machines

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Bags & pouches

- 6.3 Cups & trays

- 6.4 Bottles

- 6.5 Sachets

- 6.6 Cartons

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Cosmetics & personal care

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Material Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Plastic

- 8.3 Paper

- 8.4 Aluminum foil

- 8.5 Multi-layer films

- 8.6 Biodegradable materials

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 All-Fill Inc.

- 11.2 Barry-Wehmiller Group

- 11.3 Bosch Packaging Technology

- 11.4 Bossar Packaging

- 11.5 BW Flexible Systems

- 11.6 Coesia Group

- 11.7 Ilapak

- 11.8 IMA Group

- 11.9 Matrix Packaging Machinery

- 11.10 PFM Packaging

- 11.11 ProMach

- 11.12 Syntegon

- 11.13 Triangle Package Machinery Co.

- 11.14 ULMA Packaging

- 11.15 WeighPack Systems Inc.