|

市場調查報告書

商品編碼

1766215

熱成型灌裝封口機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Thermoform Form-Fill-Seal Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

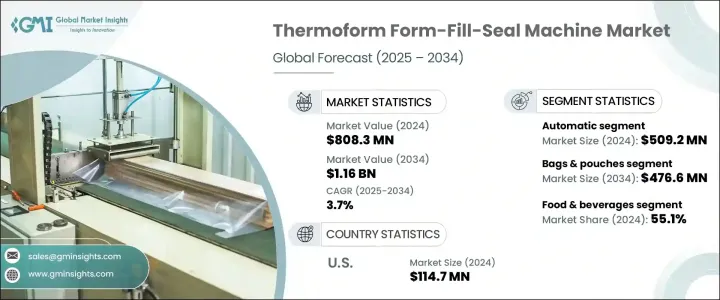

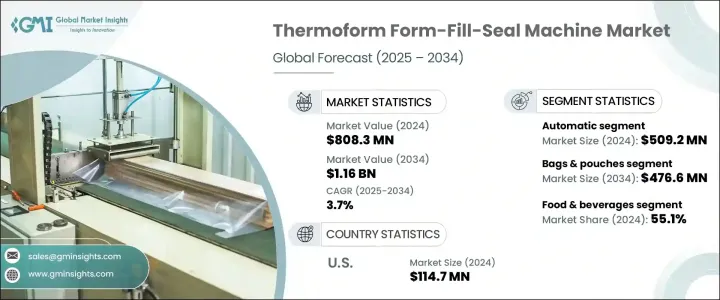

2024年,全球熱成型-填充-封口機市場規模達8.083億美元,預計2034年將以3.7%的複合年成長率成長,達到11.6億美元。這一成長主要源於全球消費的成長以及向永續性和環保製造的迫切轉變。隨著塑膠廢棄物法規的不斷完善,這些機器現在被設計用於處理可回收和可生物分解的材料。企業正在投資下一代設備,不僅是為了遵守環境政策,也是為了滿足消費者對永續包裝日益成長的偏好。循環經濟實踐和智慧工廠計畫的推動,正在推動創新自動化包裝技術的採用。

在製藥、食品和消費品等行業,熱成型-填充-封口機的應用日益廣泛,以滿足人們對更高安全性、防篡改和更長保存期限的需求。在工業 4.0 標準下,感測器與物聯網系統整合以實現預測性維護和流程最佳化的勢頭日益強勁。這項變革正在重塑全球包裝生產線,使機器更加高效,能夠適應各種材料和產品類型,同時支持經濟高效且環保的營運。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.083億美元 |

| 預測值 | 11.6億美元 |

| 複合年成長率 | 3.7% |

2024年,自動熱成型-填充-封口機市場規模達5.092億美元,預計2025年至2034年期間的複合年成長率將達到4.5%。自動化機型因其能夠滿足日益成長的快速、可靠和永續包裝需求而被廣泛採用。消除人工操作可降低人工成本,增強一致性,並提高生產線的產量。這些機器配備了先進的介面,例如即時追蹤、可程式邏輯控制器 (PLC) 和直覺的觸控螢幕控制,從而改善了用戶體驗並提升了營運效率。它們能夠適應多種規格和基材,適用於各行業日益廣泛的應用。

2024年,袋裝和袋式包裝佔據全球市場主導地位,佔39.1%的佔有率,預計到2034年將達到4.766億美元。簡便食品和健康包裝商品的日益普及,也推動了安全衛生包裝解決方案的需求。如今,成型-填充-密封系統具備氣調密封功能,可確保新鮮度並延長保存期限。這些系統也在不斷發展,以支持使用可堆肥和環保材料。隨著製造商尋求防篡改和防污染的解決方案,優先考慮食品安全和包裝完整性的法規持續推動這一領域的創新。

2024年,美國熱成型-灌裝-封口機市場規模達1.147億美元,預計2034年的複合年成長率為3.9%。美國市場的成長與消費品、醫療保健以及食品飲料產業對軟包裝解決方案和永續實踐的廣泛採用密切相關。對環保替代品的需求日益成長,也促使企業採用更新、更節能的技術升級包裝生產線。

熱成型-灌裝-封口機市場的領導者包括 DS Smith、Anchor Packaging, Inc.、Huhtamaki Oyj、ProMach、Amcor PLC、Winpak Ltd.、Bosch Packaging Technology、Placon Corporation、Barry-Wehmiller Group、Paccor Packaging Corporation、Sealed Air Corporation、Syngonam、Barry-Wehmiller Group、Paccor Packaging Corporation、Sealed Air Corporation、Syngonco、Barry-Wehmiller Group、Paccor Packaging Corporation、Sealed Air Corporation、Syngonam、Paccor Pack為了鞏固其在全球熱成型-填充-封口機市場的地位,各公司正專注於整合智慧自動化功能和數位監控工具,以提高機器可靠性並減少停機時間。

許多公司正在投資研發,以支援可回收和可生物分解材料的加工,從而符合不斷變化的環境法規。透過融入靈活的設計功能,這些製造商正在製造相容於各種包裝形式和基材的機器。他們正在與原料供應商和原始設備製造商建立策略合作夥伴關係,以增強供應鏈能力和產品創新。一些公司正在透過設立區域服務中心和技術支援中心來擴大其地域覆蓋範圍,以便更好地服務本地市場並縮短交貨時間。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按機器類型

- 監管格局

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第6章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 包包和小袋

- 杯子和托盤

- 瓶子

- 小袋

- 紙箱

- 其他

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化妝品和個人護理

- 化學品

- 其他

第8章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 塑膠

- 紙

- 鋁箔

- 多層薄膜

- 可生物分解材料

- 其他

第9章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Amcor PLC

- Anchor Packaging, Inc.

- Barry-Wehmiller Group

- Bosch Packaging Technology

- Coesia Group

- DS Smith

- Huhtamaki Oyj

- Mondi Group

- Paccor Packaging Corporation

- Placon Corporation

- ProMach

- Sealed Air Corporation

- Sonoco Products Company

- Syntegon

- Winpak Ltd.

The Global Thermoform Form-Fill-Seal Machine Market was valued at USD 808.3 million in 2024 and is estimated to grow at a CAGR of 3.7% to reach USD 1.16 billion by 2034. This growth is fueled by rising global consumption and the urgent shift toward sustainability and eco-conscious manufacturing. With evolving plastic waste regulations, these machines are now designed to handle recyclable and biodegradable materials. Businesses are investing in next-generation equipment not only to stay compliant with environmental policies but also to align with growing consumer preferences for sustainable packaging. The push toward circular economy practices and smart factory initiatives is encouraging the adoption of innovative, automated packaging technologies.

In industries such as pharmaceuticals, food, and consumer goods, thermoform form-fill-seal machines are increasingly used to meet demands for improved safety, tamper resistance, and longer shelf life. The integration of sensors and IoT-enabled systems for predictive maintenance and process optimization is gaining momentum under Industry 4.0 standards. This evolution is reshaping packaging lines globally, making machines more efficient and adaptive to a wide variety of materials and product types while supporting cost-effective and environmentally friendly operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $808.3 million |

| Forecast Value | $1.16 billion |

| CAGR | 3.7% |

In 2024, the automatic thermoform form-fill-seal machine segment recorded USD 509.2 million and is expected to grow at a CAGR of 4.5% between 2025 and 2034. Automatic models are being widely adopted due to their ability to meet rising demands for fast, reliable, and sustainable packaging. The elimination of manual tasks reduces labor costs, enhances consistency, and increases throughput across manufacturing lines. These machines are equipped with advanced interfaces like real-time tracking, programmable logic controllers (PLCs), and intuitive touchscreen controls, which improve user experience and boost operational efficiency. Their adaptability to multiple formats and substrates makes them suitable for an expanding range of applications across sectors.

The bags and pouches packaging format led the global market in 2024, securing a 39.1% share and is forecasted to reach USD 476.6 million by 2034. The growing popularity of convenience foods and health-focused packaged goods is increasing demand for secure and hygienic packaging solutions. Form-fill-seal systems now offer controlled atmosphere sealing capabilities, ensuring freshness and extending shelf life. They are also evolving to support the use of compostable and environmentally safe materials. Regulations that prioritize food safety and packaging integrity continue to drive innovation in this category, as manufacturers seek tamper-proof and contamination-resistant solutions.

United States Thermoform Form-Fill-Seal Machine Market generated USD 114.7 million in 2024, with an anticipated CAGR of 3.9% through 2034. Growth in the U.S. is closely linked to expanding adoption of flexible packaging solutions and sustainable practices across the consumer goods, healthcare, and food and beverage sectors. Increasing demand for eco-friendly alternatives is also pushing companies to upgrade packaging lines with newer, more energy-efficient technologies.

Leading players in the Thermoform Form-Fill-Seal Machine Market include DS Smith, Anchor Packaging, Inc., Huhtamaki Oyj, ProMach, Amcor PLC, Winpak Ltd., Bosch Packaging Technology, Placon Corporation, Barry-Wehmiller Group, Paccor Packaging Corporation, Sealed Air Corporation, Syntegon, Mondi Group, Sonoco Products Company, and Coesia Group. To strengthen their position in the global thermoform form-fill-seal machine market, companies are focusing on integrating smart automation features and digital monitoring tools that enhance machine reliability and reduce operational downtime.

Many are investing in research and development to support the processing of recyclable and biodegradable materials in compliance with evolving environmental regulations. By incorporating flexible design features, these manufacturers are making machines compatible with various packaging formats and substrates. Strategic partnerships with raw material suppliers and OEMs are being formed to enhance supply chain capabilities and product innovation. Some are expanding their geographic presence by setting up regional service centers and technical support hubs to better serve localized markets and reduce lead times.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 End use industry

- 2.2.4 Packaging type

- 2.2.5 Material type

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Million)(Thousand Units)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Semi-automatic

- 5.4 Fully automatic

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034, (USD Million)(Thousand Units)

- 6.1 Key trends

- 6.2 Bags & pouches

- 6.3 Cups & trays

- 6.4 Bottles

- 6.5 Sachets

- 6.6 Cartons

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Million)(Thousand Units)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Cosmetics & personal care

- 7.5 Chemicals

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Material Type, 2021 - 2034, (USD Million)(Thousand Units)

- 8.1 Key trends

- 8.2 Plastic

- 8.3 Paper

- 8.4 Aluminum foil

- 8.5 Multi-layer films

- 8.6 Biodegradable materials

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amcor PLC

- 11.2 Anchor Packaging, Inc.

- 11.3 Barry-Wehmiller Group

- 11.4 Bosch Packaging Technology

- 11.5 Coesia Group

- 11.6 DS Smith

- 11.7 Huhtamaki Oyj

- 11.8 Mondi Group

- 11.9 Paccor Packaging Corporation

- 11.10 Placon Corporation

- 11.11 ProMach

- 11.12 Sealed Air Corporation

- 11.13 Sonoco Products Company

- 11.14 Syntegon

- 11.15 Winpak Ltd.