|

市場調查報告書

商品編碼

1766258

汽車數據貨幣化市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Data Monetization Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

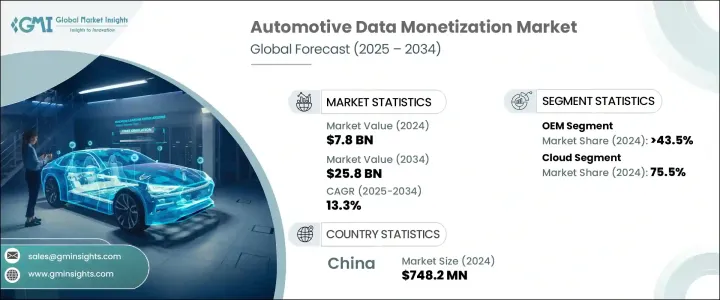

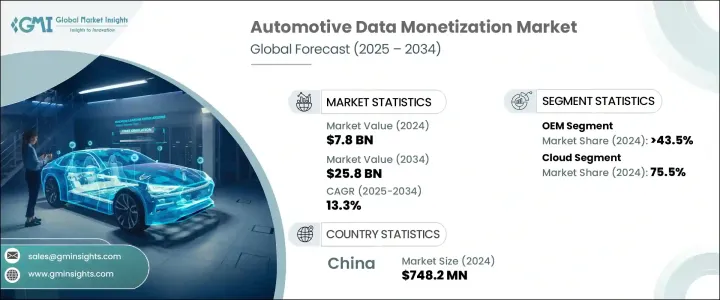

2024年,全球汽車數據貨幣化市場規模達78億美元,預計2034年將以13.3%的複合年成長率成長,達到258億美元。市場成長主要得益於連網汽車的廣泛應用。這些汽車透過嵌入式感測器、遠端資訊處理和通訊系統產生大量即時資料。連網汽車收集的數據,包括駕駛行為、環境狀況、位置資訊,甚至駕駛員健康狀況,為汽車製造商、保險公司、車隊營運商和服務提供商創造了開發新型數據驅動型商業模式的機會。

利用雲端平台和進階分析技術,近乎即時地處理、分析和貨幣化車輛資料的能力變得越來越重要。政府法規和基礎設施的發展也促進了對資料透明度以及車輛與公共系統整合的需求日益成長。此外,預測性維護、基於遠端資訊處理的保險和資訊娛樂服務等先進技術,使企業能夠從汽車資料中開闢新的收入來源。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 78億美元 |

| 預測值 | 258億美元 |

| 複合年成長率 | 13.3% |

2024年,原始設備製造商 ( OEM ) 佔據市場主導地位,價值30億美元,佔43.5%。 OEM是收集和管理連網汽車資料的關鍵參與者,因為它們整合了可直接存取引擎性能、用戶偏好和車輛診斷資料的技術。透過控制和管理資料流,OEM擁有獨特的優勢,可以提供個人化服務,例如基於訂閱的功能、即時資訊娛樂和預測性維護解決方案。此外,OEM正在增加對雲端平台的投資,以便在內部管理資料或與其他企業合作,從而對資料治理保持嚴格的控制。

2024年,雲端運算領域佔了75.5%的佔有率。雲端平台助力汽車資料貨幣化生態系統,因為它們使原始設備製造商(OEM)和服務供應商能夠擴展儲存和處理能力,這對於管理連網汽車產生的大量即時資料至關重要。這些平台透過支援即時分析和機器學習模型,支援各種服務,包括預測性維護、基於使用情況的保險 (UBI) 和行動出行管理。雲端基礎架構也減少了對昂貴的本地IT系統的需求,為資料管理提供了更具成本效益的解決方案,並允許企業按實際使用量付費。這使得雲端運算成為尋求高效、可擴展且經濟實惠的資料貨幣化解決方案的企業中越來越受歡迎的選擇。

亞太地區汽車數據貨幣化產業佔據35%的市場佔有率,2024年創造了7.482億美元的市場規模。中國5G網路的快速普及以及物聯網(IoT)生態系統的進步,推動了對車聯網服務的需求,包括遠端資訊處理和車聯網(V2X)通訊。中國本土汽車製造商正在大力投資雲端服務、車載人工智慧和數位服務平台,這推動了數據驅動型商業模式的成長。中國消費者對數位汽車產品和服務的接受度更高,使得車聯網技術和資料貨幣化策略的接受度更高。

全球汽車數據貨幣化行業的主要參與者包括博世、IBM、Caruso GmbH、大陸集團、Airlinq Inc.、考克斯汽車、Geotab、哈曼國際、甲骨文和 Urgent.ly Inc (Otonomo)。為了鞏固市場地位,汽車資料貨幣化領域的公司正致力於擴大與原始設備製造商 (OEM)、保險公司和服務提供者的合作夥伴關係。這種方法增強了他們提供全面數據驅動解決方案的能力。此外,許多公司正在投資建立強大的基於雲端的平台,以提供可擴展且經濟高效的資料管理服務。這些公司專注於進階分析和機器學習能力,旨在為客戶提供更有價值的洞察和預測功能。此外,公司正在針對特定地區開發客製化解決方案,利用當地的基礎設施、法規和客戶偏好。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 衝擊力

- 成長動力

- 連網汽車的普及

- 預測性維護的成長

- 擴大車隊和行動服務

- 政府法規和智慧基礎設施

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 缺乏標準化

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 直接獲利

- 間接獲利

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 保險

- 預測性維護

- 車隊管理

- 出遊即服務 (MaaS)

- 政府和基礎設施

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- OEM

- 車隊營運商

- 第三方服務提供者

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Airlinq

- Bosch

- Caruso

- Continental

- Cox Automotive

- Geotab

- Harman

- High Mobility

- IBM

- INRIX

- Lear

- Masternaut

- Motorq

- Nexar

- Octo Telematics

- Oracle

- The Floow

- Urgent.ly (Otonomo)

- Vinchain

- Vinli

The Global Automotive Data Monetization Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 13.3% to reach USD 25.8 billion by 2034. The growth in the market is primarily driven by the widespread adoption of connected vehicles. These vehicles generate vast amounts of real-time data through embedded sensors, telematics, and communication systems. Data gathered from connected cars, including driving behavior, environmental conditions, location, and even driver health, creates opportunities for automotive manufacturers, insurance providers, fleet operators, and service providers to develop new data-driven business models.

By leveraging cloud-based platforms and advanced analytics, the ability to process, analyze, and monetize vehicle data in near real-time has become increasingly essential. Government regulations and infrastructure developments are also contributing to the increasing demand for data transparency and the integration of vehicles with public systems. Additionally, advanced technologies, such as predictive maintenance, telematics-based insurance, and infotainment services, are enabling companies to unlock new revenue streams from automotive data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $25.8 Billion |

| CAGR | 13.3% |

In 2024, the OEM (Original Equipment Manufacturer) segment held a dominant position in the market, valued at USD 3 billion and accounting for a 43.5% share. OEMs are key players in collecting and managing data from connected vehicles, as they integrate technologies that provide direct access to data on engine performance, user preferences, and vehicle diagnostics. By controlling and managing data flow, OEMs are in a unique position to offer personalized services such as subscription-based features, real-time infotainment, and predictive maintenance solutions. Additionally, OEMs are increasingly investing in their cloud platforms to manage data internally or collaborate with other businesses, maintaining strict control over data governance.

The cloud segment held a 75.5% share in 2024. Cloud platforms help in the automotive data monetization ecosystem, as they enable OEMs and service providers to scale storage and processing capabilities, crucial for managing massive volumes of real-time data generated by connected vehicles. These platforms support various services, including predictive maintenance, usage-based insurance (UBI), and mobility management, by enabling real-time analytics and machine learning models. The cloud infrastructure also reduces the need for expensive on-premises IT systems, offering a more cost-effective solution for data management and allowing companies to pay only for what they use. This has made the cloud an increasingly popular choice among businesses seeking efficient, scalable, and affordable solutions for data monetization.

Asia Pacific Automotive Data Monetization Industry held a 35% share and generated USD 748.2 million in 2024. China's rapid adoption of 5G networks and advancements in the Internet of Things (IoT) ecosystem have helped in driving the demand for connected vehicle services, including telematics and vehicle-to-everything (V2X) communication. Domestic vehicle manufacturers in China are investing heavily in cloud services, in-car artificial intelligence, and digital services platforms, which are fueling the growth of data-driven business models. Chinese consumers are more receptive to digital automotive products and services, enabling greater acceptance of connected car technologies and data monetization strategies.

Key players in the Global Automotive Data Monetization Industry include Bosch, IBM, Caruso GmbH, Continental, Airlinq Inc., Cox Automotive, Geotab, Harman International, Oracle, and Urgent.ly Inc (Otonomo). To strengthen their market position, companies in the automotive data monetization sector are focusing on expanding their partnerships with OEMs, insurance firms, and service providers. This approach enhances their ability to offer comprehensive, data-driven solutions. Additionally, many companies are investing in building robust cloud-based platforms to offer scalable and cost-efficient data management services. Emphasizing advanced analytics and machine learning capabilities, these firms aim to provide more valuable insights and predictive features to their clients. Furthermore, companies are developing tailored solutions for specific regions, leveraging local infrastructure, regulations, and customer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.5 Forecast model

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Deployment

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of connected vehicles

- 3.2.1.2 Growth in predictive maintenance

- 3.2.1.3 Expansion of fleet and mobility services

- 3.2.1.4 Government regulations and smart infrastructure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Data privacy and security concerns

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Direct monetization

- 5.3 Indirect monetization

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Insurance

- 7.3 Predictive maintenance

- 7.4 Fleet management

- 7.5 Mobility-as-a-service (MaaS)

- 7.6 Government & infrastructure

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Fleet operators

- 8.4 Third-party service providers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airlinq

- 10.2 Bosch

- 10.3 Caruso

- 10.4 Continental

- 10.5 Cox Automotive

- 10.6 Geotab

- 10.7 Harman

- 10.8 High Mobility

- 10.9 IBM

- 10.10 INRIX

- 10.11 Lear

- 10.12 Masternaut

- 10.13 Motorq

- 10.14 Nexar

- 10.15 Octo Telematics

- 10.16 Oracle

- 10.17 The Floow

- 10.18 Urgent.ly (Otonomo)

- 10.19 Vinchain

- 10.20 Vinli