|

市場調查報告書

商品編碼

1741047

汽車數據記錄器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Data Logger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

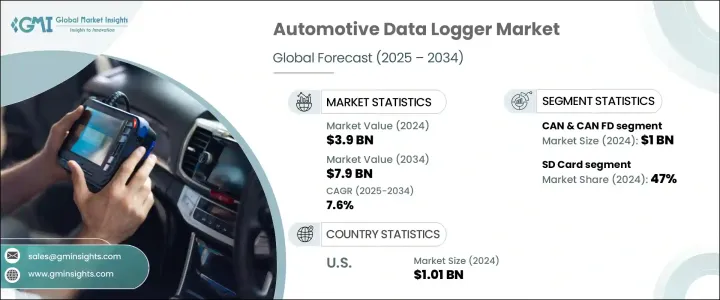

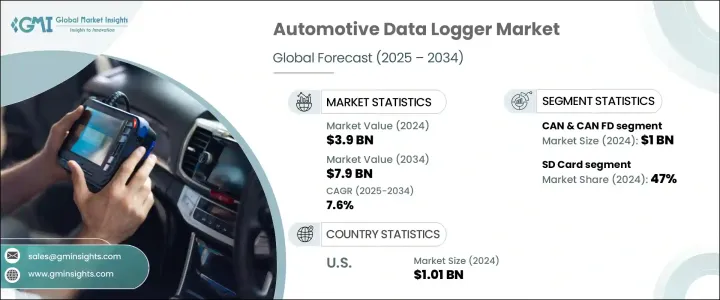

2024年,全球汽車數據記錄器市場規模達39億美元,預計2034年將以7.6%的複合年成長率成長至79億美元。這一成長主要源自於連網汽車技術的快速發展、安全與排放法規的嚴格執行,以及對先進車輛診斷和遠端資訊處理日益成長的需求。隨著全球汽車製造商向電動化和自動駕駛平台轉型,資料記錄器在收集、儲存和分析乘用車和商用車性能資料方面發揮核心作用。這些設備是即時追蹤和系統評估的重要工具,能夠從電池管理系統、資訊娛樂單元、ADAS和ECU等各種組件中擷取資料。它們的使用增強了預測性維護、軟體調試、法規遵循和駕駛員行為洞察,這些對於確保車輛效率和安全都至關重要。隨著物聯網和雲端生態系統在汽車領域的影響力日益增強,現代資料記錄器越來越能夠支援遠端操作和無線更新,從而實現與互聯出行和車隊管理系統的無縫整合。

就通訊協定而言,市場細分為 CAN 和 CAN FD、LIN、FlexRay 和乙太網路。其中,CAN 和 CAN FD 類別在 2024 年引領市場,創造了約 10 億美元的收入。這些協議的主導地位源於它們在汽車行業的長期採用。幾十年來,CAN 一直是可靠的車載通訊標準,促進了引擎控制和車輛安全等領域的關鍵系統互動。升級後的 CAN FD 版本允許更高的資料吞吐量並支援更多資料密集型功能,特別是那些涉及現代駕駛輔助系統的功能。其廣泛的實用性、成本效益和低延遲功能繼續使 CAN 和 CAN FD 成為車載診斷和測試應用中不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 79億美元 |

| 複合年成長率 | 7.6% |

從連接類型來看,市場選項包括 USB、藍牙/Wi-Fi 和 SD 卡。 SD 卡在 2024 年佔據 47% 的市場佔有率,佔據領先地位。這種優勢源自於 SD 卡的可靠性、易用性和價格實惠。 SD 卡體積小巧,提供高容量儲存空間,非常適合在測試和試駕期間記錄大量車輛資料。其即插即用的設計簡化了設置,並允許在離線環境中提取資料,使其成為在無線基礎設施可能受限或易受干擾的預生產階段非常有價值的工具。

依組件分類,市場分為硬體和軟體兩大類,其中硬體在2024年將佔據主導地位。此細分市場是汽車資料記錄系統的核心,包括用於資料擷取的微處理器、用於資料儲存的大容量記憶體、用於維護資料完整性的訊號調節器以及用於即時監控的感測器介面。這些組件支援資料記錄器和車輛系統使用CAN、FlexRay和乙太網路等協定進行通訊。製造商不斷增強這些硬體平台,以滿足電動和自動駕駛汽車系統日益成長的複雜性,以及在實際應用中對多通道、高速和多協議功能日益成長的需求。

根據應用,市場分為售前和售後兩部分。售前部分在2024年成為主導領域。數據記錄器在車輛上市前被廣泛使用,用於驗證性能、安全性和環保標準合規性。工程師依靠在設計和測試階段的精確資料採集來最佳化動力系統、校準ADAS功能並驗證電動車型的電池效率。儘管售後部分由於其在診斷和預測性維護中的作用而正在成長,但目前其在整體市場佔有率中所佔比例較小。

就最終用戶而言,市場包括原始設備OEM商 (OEM)、服務站、監管機構等。 OEM 細分市場在 2024 年佔據最大佔有率,因為製造商在整個車輛開發生命週期中仍然高度依賴資料記錄器。從原型設計到最終驗證,資料記錄器用於確保始終滿足品質標準。隨著車輛採用的技術日益複雜,OEM 正在投資先進的資料記錄解決方案,以管理從 ECU 驗證到下一代系統整合的所有環節。

從地區來看,美國引領北美市場,2024 年營收達 10.1 億美元,預測期內複合年成長率預計為 6.4%。美國強大的市場地位源於其快速的技術應用、強大的研究基礎設施以及對電動和互聯出行的持續推動。美國各地的研究實驗室、測試機構和製造商持續部署尖端資料記錄設備,以支援創新、合規性和系統驗證。

在整個產業中,企業正透過合併、策略合作以及對感測器技術和即時分析的投資不斷進步。越來越多的企業轉向智慧、物聯網和無線連接的資料記錄器,以簡化診斷和效能追蹤。這些創新正在幫助整個汽車價值鏈上的企業提高可靠性,滿足更嚴格的監管要求,並支援更永續、更智慧的車輛設計。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 硬體提供者

- 軟體供應商

- 技術提供者

- 最終用途

- 利潤率分析

- 供應商格局

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 監管格局

- 用例

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 增加電動車產量和自動駕駛汽車測試

- 現代車輛對 ADAS 功能的需求不斷成長

- 對即時車輛資料的需求不斷增加

- 大幅提高排放標準以減少對環境的影響

- 車隊管理解決方案需求不斷成長

- 產業陷阱與挑戰

- 缺乏訓練有素的勞動力來開發先進的資料記錄器

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 軟體

第6章:市場估計與預測:按通路,2021 - 2034 年

- 主要趨勢

- CAN 和 CAN FD

- 林

- FlexRay

- 乙太網路

第7章:市場估計與預測:按連接,2021 - 2034 年

- 主要趨勢

- SD卡

- 藍牙/Wi-Fi

- USB

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 預售

- 售後

- ADAS 和安全

- 汽車保險

- 車隊管理

- 車載診斷系統 (OBD)

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- OEM

- 服務站

- 監管機構

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞

- 澳新銀行

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aptiv

- Continental

- Danlaw

- Delphi

- Dewesoft

- dSPACE

- Elektrobit

- HEM Data

- Influx Technology

- Intrepid

- IPETRONIK

- Kistler

- MathWorks

- National Instruments

- NSM Solutions

- Racelogic

- Robert Bosch

- TT Tech

- Vector Informatik

- Xilinx

The Global Automotive Data Logger Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 7.9 billion by 2034. This growth is being shaped by the fast-paced development of connected car technologies, heightened safety and emissions regulations, and the rising demand for advanced vehicle diagnostics and telematics. As automakers worldwide transition toward electric and autonomous platforms, data loggers are playing a central role in gathering, storing, and analyzing performance data across both passenger and commercial vehicle categories. These devices are essential tools for real-time tracking and system evaluations, capturing data from various components like battery management systems, infotainment units, ADAS, and ECUs. Their use enhances predictive maintenance, software debugging, regulatory compliance, and driver behavior insights, which are all crucial for ensuring vehicle efficiency and safety. With the rising influence of IoT and cloud-based ecosystems in the automotive landscape, modern data loggers are increasingly capable of supporting remote operations and over-the-air updates, offering seamless integration into connected mobility and fleet management systems.

In terms of communication protocols, the market is segmented into CAN & CAN FD, LIN, FlexRay, and Ethernet. Among these, the CAN & CAN FD category led the market in 2024, generating approximately USD 1 billion in revenue. The dominance of these protocols stems from their longstanding adoption across the automotive industry. CAN has been a reliable in-vehicle communication standard for decades, facilitating critical system interactions in areas like engine control and vehicle safety. The upgraded CAN FD version allows higher data throughput and supports more data-intensive functions, especially those involving modern driving assistance systems. Their widespread utility, cost-efficiency, and low-latency capabilities continue to make CAN & CAN FD indispensable for in-vehicle diagnostics and testing applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.9 Billion |

| CAGR | 7.6% |

Looking at the market by connection type, options include USB, Bluetooth/Wi-Fi, and SD card. The SD card segment took the lead with a 47% market share in 2024. This preference is due to the SD card's reliability, ease of use, and affordability. Offering high-capacity storage in a compact format, SD cards are well-suited for logging vast volumes of vehicle data during tests and trials. Their plug-and-play design simplifies setup and allows data extraction in offline environments, making them valuable tools in pre-production phases where wireless infrastructure might be limited or vulnerable to interference.

When categorized by component, the market is divided into hardware and software, with hardware taking the dominant share in 2024. This segment represents the core of automotive data logging systems, consisting of microprocessors for data acquisition, high-capacity memory for data storage, signal conditioners to maintain data integrity, and sensor interfaces for real-time monitoring. These components enable communication between data loggers and vehicle systems using protocols like CAN, FlexRay, and Ethernet. Manufacturers continue to enhance these hardware platforms to meet the rising complexity of electric and autonomous vehicle systems, increasing demand for multi-channel, high-speed, and multi-protocol capabilities in real-world conditions.

Based on application, the market is split into pre-sale and post-sale uses. The pre-sale segment emerged as the dominant area in 2024. Data loggers are widely used before a vehicle reaches the market to validate performance, safety, and compliance with environmental standards. Engineers depend on accurate data capture during the design and testing stages to optimize powertrains, calibrate ADAS features, and verify battery efficiency in electric models. Though the post-sale segment is growing due to its role in diagnostics and predictive maintenance, it currently accounts for a smaller portion of the overall market share.

In terms of end users, the market includes OEMs, service stations, regulatory authorities, and others. The OEM segment held the largest share in 2024, as manufacturers continue to rely heavily on data loggers throughout the vehicle development lifecycle. From prototyping to final validation, data loggers are used to ensure quality standards are consistently met. As vehicles incorporate increasingly complex technologies, OEMs are investing in sophisticated data logging solutions to manage everything from ECU validation to next-gen system integration.

Regionally, the United States led the North American market, recording USD 1.01 billion in revenue in 2024, with a projected CAGR of 6.4% during the forecast period. The country's strong position stems from rapid technological adoption, robust research infrastructure, and an increasing push toward electric and connected mobility. Research labs, test facilities, and manufacturers across the U.S. continue to deploy cutting-edge data logging equipment to support innovation, compliance, and system validation.

Across the industry, companies are advancing through mergers, strategic collaborations, and investments in sensor technologies and real-time analytics. There's a growing shift toward smart, IoT-enabled, and wirelessly connected data loggers that streamline diagnostics and performance tracking. These innovations are helping organizations across the automotive value chain improve reliability, meet stricter regulatory demands, and support more sustainable and intelligent vehicle designs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Hardware providers

- 3.1.1.2 Software providers

- 3.1.1.3 Technology providers

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing electric vehicle production and autonomous vehicle testing

- 3.8.1.2 Rising demand for ADAS features in modern vehicles

- 3.8.1.3 Increasing demand for real-time vehicle data

- 3.8.1.4 Surge in emission norms to reduce environmental impact

- 3.8.1.5 Rising demand for fleet management solutions

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Lack of a trained workforce for the development of advanced data loggers

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates & Forecast, By Channel, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 CAN & CAN FD

- 6.3 LIN

- 6.4 FlexRay

- 6.5 Ethernet

Chapter 7 Market Estimates & Forecast, By Connection, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 SD Card

- 7.3 Bluetooth/Wi-Fi

- 7.4 USB

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Pre-sale

- 8.3 Post-sale

- 8.3.1 ADAS and safety

- 8.3.2 Automotive insurance

- 8.3.3 Fleet management

- 8.3.4 OBD

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Service station

- 9.4 Regulatory bodies

- 9.5 others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Benelux

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Southeast Asia

- 10.4.6 ANZ

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Continental

- 11.3 Danlaw

- 11.4 Delphi

- 11.5 Dewesoft

- 11.6 dSPACE

- 11.7 Elektrobit

- 11.8 HEM Data

- 11.9 Influx Technology

- 11.10 Intrepid

- 11.11 IPETRONIK

- 11.12 Kistler

- 11.13 MathWorks

- 11.14 National Instruments

- 11.15 NSM Solutions

- 11.16 Racelogic

- 11.17 Robert Bosch

- 11.18 TT Tech

- 11.19 Vector Informatik

- 11.20 Xilinx