|

市場調查報告書

商品編碼

1766231

多格式包裝線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Multi-format Packaging Lines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

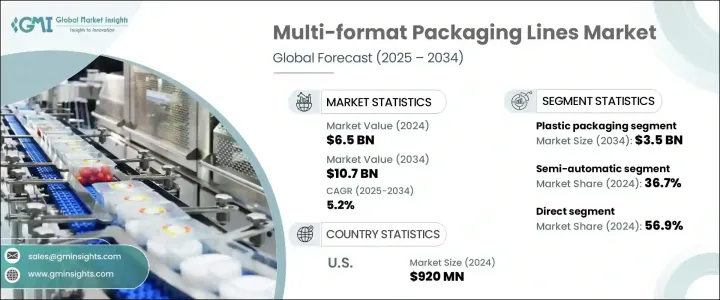

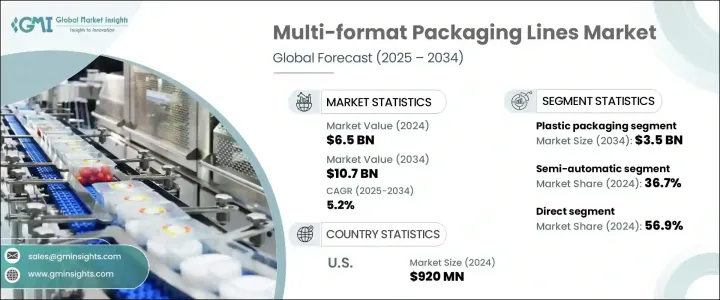

2024年,全球多規格包裝生產線市場規模達65億美元,預計到2034年將以5.2%的複合年成長率成長,達到107億美元。這一成長源於消費者對便利性和永續性日益成長的需求,促使食品飲料、個人護理和醫藥等行業廣泛採用軟包裝。多規格包裝生產線不斷發展,能夠適應各種包裝類型、形狀和材料,使製造商能夠在不同規格之間切換,並最大程度地減少停機時間。這種適應性提高了營運效率,並降低了維護多台專用機器的成本。

此外,競爭激烈的零售格局促使品牌尋求能夠快速回應市場需求和季節性變化的包裝解決方案,這進一步凸顯了對靈活包裝系統的需求。這種保持相關性和即時適應性的壓力促使企業優先考慮能夠快速切換規格、最大限度縮短停機時間並支援多種物料處理的包裝技術。隨著消費趨勢的快速變化——無論是節日、促銷、限量版還是區域偏好——品牌都被迫調整產品的外觀和規格。多規格包裝生產線使製造商能夠快速執行這些更改,而不會影響效率或成本控制。這種靈活性不僅增強了貨架吸引力,也支持多元化的產品組合,旨在佔領細分市場並在飽和的市場中最大限度地提高品牌知名度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 5.2% |

2024年,塑膠包裝材料市場規模達23億美元,佔據主導地位,預計2034年將達35億美元。塑膠包裝材料的廣泛應用主要歸功於其適應性強、強度高、重量輕等特性,這些特性使其能夠滿足各種包裝需求。由於塑膠材料與高速包裝生產線相容,並且能夠成型為各種形狀和尺寸,從而適應產品展示的創新,因此將繼續保持領先地位。食品飲料、藥品、個人護理和家居用品等行業高度依賴塑膠包裝,因為塑膠具有保存期限長、防篡改和生產成本低等特徵。

半自動包裝線市場在2024年的市佔率為36.7%,預計到2034年將以6.8%的複合年成長率成長。這些系統因其兼具手動控制和自動化效率的優勢而日益受到青睞,從而創造了靈活的生產環境,而無需承擔全自動化帶來的高成本。它們尤其適合需要可靠、格式靈活且易於整合到現有工作流程中的設備的中小企業和合約製造商。

2024年,美國多規格包裝生產線市場規模達9.2億美元,預計2025年至2034年期間的複合年成長率將達到5.7%。美國憑藉其先進的製造設施、全自動化系統以及食品飲料、個人護理和製藥等行業的顯著影響力,引領北美市場。消費者對環保產品和多樣化庫存單位(SKU)的需求推動了智慧軟性包裝技術的採用。

多格式包裝生產線產業的主要參與者包括富士機械株式會社、博世包裝技術公司 (Syntegon)、Coesia 集團、Haver & Boecker、IMA 集團、石田株式會社、KHS GmbH、Marchesini 集團、Multivac 集團、ProMach Inc.、Serac 集團、Sidelib 集團、SIGac集團、Sidelb 集團、Sidelb 集團、Sidelb。多格式包裝生產線市場的公司正專注於多種策略來加強其影響力。這些措施包括投資研發以創造滿足不斷變化的消費者偏好的創新包裝解決方案。公司正在與其他行業參與者建立夥伴關係和協作,以擴大產品供應並進入新市場。此外,該公司正在透過開發環保包裝材料和製程來採用永續的做法,以應對日益成長的環境問題。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按包裝類型

- 監理框架

- 標準和認證

- 環境法規

- 進出口法規

- 貿易統計(HS 編碼-8422)

- 主要進口國

- 主要出口國

- 波特五力分析

- PESTEL分析

- 消費者行為分析

- 購買模式

- 偏好分析

- 消費者行為的區域差異

- 電子商務對購買決策的影響

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按包裝類型,2021 - 2034 年

- 主要趨勢

- 基本的

- 次要

- 第三

第6章:市場估計與預測:依格式類型,2021 - 2034 年

- 主要趨勢

- 小袋

- 瓶子

- 能

- 紙盒

- 小袋

- 管子

- 其他

第7章:市場估計與預測:按自動化,2021 - 2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第8章:市場估計與預測:依包裝材料,2021 - 2034 年

- 主要趨勢

- 塑膠

- 玻璃

- 金屬

- 紙和紙板

- 其他(薄膜、箔片等)

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 包裝食品

- 乳製品

- 烘焙和糖果

- 製藥

- 化妝品和個人護理

- 電子產品和消費品

- 其他(煙草、文具等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第12章:公司簡介

- Barry-Wehmiller Companies

- Bosch Packaging Technology (Syntegon)

- Coesia Group

- Fuji Machinery Co., Ltd.

- Haver & Boecker

- IMA Group

- Ishida Co., Ltd.

- KHS GmbH

- Marchesini Group

- Multivac Group

- ProMach Inc.

- Serac Group

- Sidel Group

- SIG Combibloc Group

- Tetra Pak

The Global Multi-format Packaging Lines Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 10.7 billion by 2034. This growth is driven by the increasing consumer demand for convenience and sustainability, leading to the widespread adoption of flexible packaging across industries such as food and beverage, personal care, and pharmaceuticals. Multi-format packaging lines have evolved to accommodate various package types, shapes, and materials, allowing manufacturers to switch between different formats with minimal downtime. This adaptability enhances operational efficiency and reduces costs associated with maintaining multiple dedicated machines.

Additionally, the competitive retail landscape has led brands to seek packaging solutions that can quickly respond to market demands and seasonal changes, further emphasizing the need for flexible packaging systems. This pressure to remain relevant and adaptive in real time has driven companies to prioritize packaging technologies capable of rapid format changeovers, minimal downtime, and multi-material handling. As consumer trends evolve rapidly-whether due to holidays, promotions, limited editions, or regional preferences-brands are compelled to modify product appearance and format. Multi-format packaging lines enable manufacturers to execute these changes swiftly without compromising efficiency or cost control. This agility enhances shelf appeal but also supports diversified product portfolios aimed at capturing niche segments and maximizing brand visibility in a saturated marketplace.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 5.2% |

The plastic packaging materials segment held a dominant share of USD 2.3 billion in 2024 and is forecasted to reach USD 3.5 billion by 2034. Their widespread application is largely attributed to their adaptability, strength, and lightweight properties, which make them suitable for a broad spectrum of packaging requirements. These materials continue to lead due to their compatibility with high-speed packaging lines and ability to be molded into various shapes and sizes, accommodating innovations in product presentation. Industries such as food and beverage, pharmaceuticals, personal care, and household goods rely heavily on plastics for packaging due to their extended shelf-life protection, tamper resistance, and low production cost.

The semi-automatic packaging lines segment held a market share of 36.7% in 2024 and is projected to grow at a CAGR of 6.8% through 2034. These systems are becoming increasingly favored due to their ability to offer both manual control and automated efficiency, creating a flexible production environment without the high costs associated with full automation. They are especially suitable for SMEs and contract manufacturers who require reliable, format-adaptable equipment that can be easily integrated into existing workflows.

United States Multi-Format Packaging Lines Market was valued at USD 920 million in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. The U.S. leads the North American market due to its advanced manufacturing facilities, fully automated systems, and the significant presence of industries like food and beverage, personal care, and pharmaceuticals. The adoption of smart and flexible packaging technologies is driven by consumer demand for environmentally sustainable products and a diverse range of stock-keeping units (SKUs).

Key players in the Multi-Format Packaging Lines Industry include Fuji Machinery Co., Ltd., Bosch Packaging Technology (Syntegon), Coesia Group, Haver & Boecker, IMA Group, Ishida Co., Ltd., KHS GmbH, Marchesini Group, Multivac Group, ProMach Inc., Serac Group, Sidel Group, SIG Combibloc Group, and Tetra Pak. Companies in the multi-format packaging lines market are focusing on several strategies to strengthen their presence. These include investing in research and development to create innovative packaging solutions that meet evolving consumer preferences. Partnerships and collaborations with other industry players are being pursued to expand product offerings and enter new markets. Additionally, companies are adopting sustainable practices by developing eco-friendly packaging materials and processes to align with increasing environmental concerns.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Packaging type

- 2.2.3 Format type

- 2.2.4 Automation

- 2.2.5 Packaging material

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By packaging type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code-8422)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Packaging type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Primary

- 5.3 Secondary

- 5.4 Tertiary

Chapter 6 Market Estimates & Forecast, By Format type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Pouch

- 6.3 Bottle

- 6.4 Can

- 6.5 Carton

- 6.6 Sachet

- 6.7 Tube

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Automation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Fully automatic

Chapter 8 Market Estimates & Forecast, By Packaging material, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Plastic

- 8.3 Glass

- 8.4 Metal

- 8.5 Paper and paperboard

- 8.6 Others (films, foils, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food and beverages

- 9.3 Packaged food

- 9.4 Dairy products

- 9.5 Bakery and confectionery

- 9.6 Pharmaceuticals

- 9.7 Cosmetics and personal care

- 9.8 Electronics and consumer goods

- 9.9 Others (tobacco, stationery, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Barry-Wehmiller Companies

- 12.2 Bosch Packaging Technology (Syntegon)

- 12.3 Coesia Group

- 12.4 Fuji Machinery Co., Ltd.

- 12.5 Haver & Boecker

- 12.6 IMA Group

- 12.7 Ishida Co., Ltd.

- 12.8 KHS GmbH

- 12.9 Marchesini Group

- 12.10 Multivac Group

- 12.11 ProMach Inc.

- 12.12 Serac Group

- 12.13 Sidel Group

- 12.14 SIG Combibloc Group

- 12.15 Tetra Pak