|

市場調查報告書

商品編碼

1766219

導電聚合物(PEDOT、PANI)市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Conductive Polymers (PEDOT, PANI) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

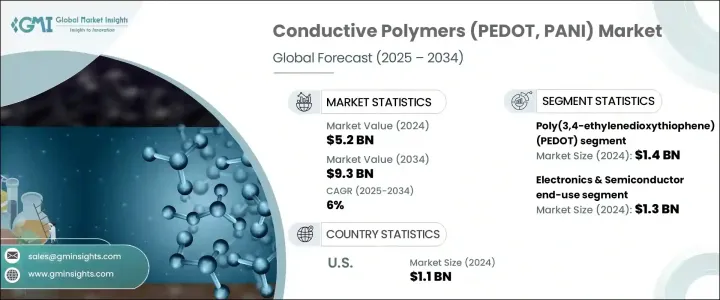

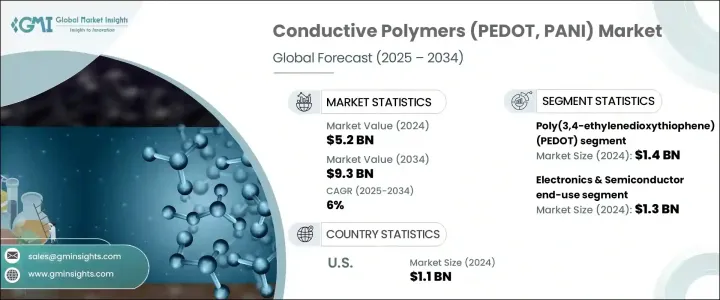

2024年,全球導電聚合物(PEDOT、PANI)市場規模達52億美元,預計2034年將以6%的複合年成長率成長,達到93億美元。市場擴張與基礎設施建設、政府支出以及更廣泛的工業產出密切相關,這些因素將繼續作為宏觀經濟成長的催化劑。全球製造業和都市化的穩定發展,推動了導電材料需求的強勁成長。這些趨勢與國際產業報告相符,顯示全球需求不僅受資料和預測的影響,也受到更廣泛的經濟變化的影響。加工技術的持續進步降低了生產成本,並提高了效率,從而增強了市場競爭力。

同時,環境政策法規也推動了整個供應鏈的清潔生產實務和回收。這種轉變正在為永續成長創造新的機會。新興市場中產階級的崛起進一步推動了電子、運輸和儲能解決方案的需求——所有這些都是關鍵的終端用戶領域。儘管全球供應鏈挑戰仍然存在,但適應性框架、自動化和技術創新正在推動市場在整個預測期內穩步成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 52億美元 |

| 預測值 | 93億美元 |

| 複合年成長率 | 6% |

聚苯胺 (PANI) 細分市場憑藉其在不同環境條件下適應性強的導電性和回彈性,在 2024 年創造了可觀的收入。受工業和運輸業活動成長的推動,該聚合物在防腐和感測器應用方面的需求年成長率約為 10%。展望未來,隨著需求的成長,預計市場將保持這一上升趨勢。其他類型的聚合物由於加工過程複雜且可擴展性有限,仍然面臨限制。這表明,需要創新來提高其在大規模應用中的相容性、整合度和結構穩定性。

2024年,固有導電聚合物 (ICP) 市場規模達23億美元,預計2034年將以6.1%的複合年成長率成長。導電聚合物複合材料(尤其是聚合物-金屬和聚合物-碳複合材料)的使用日益增多,由於其增強的機械性能和導電性,正在推動需求成長。據報道,碳基複合材料的年需求量增加了20%,這主要得益於汽車和儲能產業的應用。這些複合材料的強度來自其聚合物基質和導電填料,從而為下一代應用創造了用途廣泛的材料。

德國導電聚合物(PEDOT、PANI)市場在2024年佔據了相當大的佔有率,這得益於其高度重視永續聚合物複合材料與尖端製造製程的融合。綠色生產的推動與嚴格的環境政策一致。該地區導電聚合物的進口量年均成長12%,主要是為了滿足汽車和航太製造商日益成長的需求。這凸顯了當地產業正在轉向先進的環保材料,以符合歐盟永續發展的要求。

主導全球導電聚合物(PEDOT、PANI)市場的關鍵參與者包括賀利氏控股和西格瑪奧德里奇(隸屬於其母公司默克集團),這兩家公司都擁有強大的產品組合和穩固的市場影響力,為行業持續擴張做出了巨大貢獻。在導電聚合物市場營運的公司正專注於創新、垂直整合和區域擴張相結合的方式,以鞏固其市場地位。領先的公司正在投資研發,以改善聚合物加工方法、提高電氣性能並開發符合不斷發展的工業標準的複合材料。與最終用途產業(尤其是電子、汽車和儲能領域)的合作使公司能夠共同開發特定應用的材料。企業也正在加強其全球分銷管道並確保原料獲取,以減少供應鏈的脆弱性。永續性是另一個重要的策略支柱,一些公司正在開發可回收聚合物並實施綠色製造技術。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供主要國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 聚(3,4-乙撐二氧噻吩)(PEDOT)

- 聚苯胺(PANI)

- 聚吡咯(PPy)

- 聚噻吩(PTh)

- 其他導電聚合物

第6章:市場估計與預測:依傳導機制,2021 - 2034 年

- 主要趨勢

- 固有導電聚合物(ICP)

- 導電聚合物複合材料(CPC)

- 聚合物-碳複合材料

- 聚合物金屬複合材料

- 其他複合材料

- 有機混合離子電子導體(OMIEC)

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 防靜電包裝

- 電容器

- 電池

- 感應器

- 有機發光二極體 (OLED)

- 太陽能電池

- 執行器

- 電致變色裝置

- 電磁干擾(EMI)屏蔽

- 印刷電路板(PCB)

- 超級電容器

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 電子和半導體

- 能源

- 醫療保健和生物醫學

- 汽車

- 航太與國防

- 紡織品和穿戴式設備

- 工業的

- 包裝

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Agfa-Gevaert NV

- Celanese Corporation

- Merck KGaA

- Solvay SA

- 3M Company

- SABIC

- Covestro AG

- Henkel AG & Co. KGaA

- Heraeus Holding GmbH

- PolyOne Corporation (Avient Corporation)

- Rieke Metals, LLC

- RTP Company

- Lubrizol Corporation

- Asbury Carbons

- Sigma-Aldrich Corporation (Merck Group)

- Panipol Oy

- Polyone Corporation

- Premix Group

- Hyperion Catalysis International

- Ormecon GmbH

The Global Conductive Polymers (PEDOT, PANI) Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 9.3 billion by 2034. Market expansion is closely tied to infrastructure development, government spending, and broader industrial output, which continue to act as macroeconomic growth catalysts. The steady rise in global manufacturing and urbanization contributes to a robust demand curve for conductive materials. These trends align with international industry reports and illustrate how global demand, while influenced by data and projections, is also shaped by broader economic shifts. The continued progress in processing technologies has lowered production costs and boosted efficiency, driving market competitiveness.

At the same time, environmental policy regulations have prompted cleaner production practices and recycling across supply chains. This transition is creating new opportunities for sustainable growth. The rising middle class in emerging markets adds further momentum, boosting demand for electronics, transportation, and energy storage solutions-all key end-user sectors. While supply chain challenges persist globally, adaptive frameworks, automation, and technical innovation are enabling the market to grow steadily throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 billion |

| Forecast Value | $9.3 billion |

| CAGR | 6% |

The polyaniline (PANI) segment generated notable revenues in 2024 due to its adaptable conductivity and resilience under varying environmental conditions. The polymer has seen approximately 10% annual growth in demand from corrosion protection and sensor-based applications, driven by increased activity across industrial and transportation sectors. Looking ahead, the market is expected to maintain this upward trend as demand accelerates. Other polymer types still face constraints due to complex processing challenges and limited scalability. This points to a need for innovation to improve compatibility, integration, and structural stability in large-scale use.

In 2024, the inherently conductive polymers (ICPs) segment stood at USD 2.3 billion and is anticipated to grow at a 6.1% CAGR through 2034. The rising use of conductive polymer composites-especially Polymer-Metal and Polymer-Carbon combinations-is driving demand due to their enhanced mechanical performance and conductivity. Annual demand for carbon-based composites has reportedly grown by 20%, largely fueled by adoption in the automotive and energy storage industries. These composites gain strength from both their polymer matrices and conductive fillers, creating highly versatile materials for next-gen applications.

Germany Conductive Polymers (PEDOT, PANI) Market held a sizeable share in 2024, due to its strong focus on integrating sustainable polymer composites alongside cutting-edge manufacturing practices. The push toward greener production is aligned with strict environmental policies. Imports of conductive polymers into the region have seen a 12% annual increase, largely to meet the rising demand from automotive and aerospace manufacturers. This highlights how local industries are shifting toward advanced, eco-friendly materials in compliance with EU sustainability mandates.

Key players dominating the Global Conductive Polymers (PEDOT, PANI) Market include Heraeus Holding and Sigma-Aldrich (operating under its parent group, Merck), both of which possess strong product portfolios and established market influence that contribute significantly to ongoing industry expansion. Companies operating in the conductive polymers market are focusing on a mix of innovation, vertical integration, and regional expansion to reinforce their market presence. Leading firms are investing in R&D to advance polymer processing methods, enhance electrical properties, and develop composites that meet evolving industrial standards. Partnerships with end-use industries-especially in electronics, automotive, and energy storage-allow companies to co-develop application-specific materials. Firms are also strengthening their global distribution channels and securing raw material access to reduce supply chain vulnerabilities. Sustainability is another major strategic pillar, with several companies developing recyclable polymers and implementing green manufacturing techniques.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Conduction mechanism

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Poly(3,4-ethylenedioxythiophene) (PEDOT)

- 5.2 Polyaniline (PANI)

- 5.3 Polypyrrole (PPy)

- 5.4 Polythiophene (PTh)

- 5.5 Other conductive polymers

Chapter 6 Market Estimates & Forecast, By Conduction Mechanism, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Inherently conductive polymers (ICPs)

- 6.3 Conductive polymer composites (CPCs)

- 6.3.1 Polymer-carbon composites

- 6.3.2 Polymer-metal composites

- 6.3.3 Other composites

- 6.4 Organic mixed ionic-electronic conductors (OMIECs)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Anti-static packaging

- 7.3 Capacitors

- 7.4 Batteries

- 7.5 Sensors

- 7.6 Organic light-emitting diodes (OLEDs)

- 7.7 Solar cells

- 7.8 Actuators

- 7.9 Electrochromic devices

- 7.10 Electromagnetic interference (EMI) shielding

- 7.11 Printed circuit boards (PCBs)

- 7.12 Supercapacitors

- 7.13 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electronics & semiconductor

- 8.3 Energy

- 8.4 Healthcare & biomedical

- 8.5 Automotive

- 8.6 Aerospace & defense

- 8.7 Textiles & wearables

- 8.8 Industrial

- 8.9 Packaging

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Agfa-Gevaert N.V.

- 10.2 Celanese Corporation

- 10.3 Merck KGaA

- 10.4 Solvay S.A.

- 10.5 3M Company

- 10.6 SABIC

- 10.7 Covestro AG

- 10.8 Henkel AG & Co. KGaA

- 10.9 Heraeus Holding GmbH

- 10.10 PolyOne Corporation (Avient Corporation)

- 10.11 Rieke Metals, LLC

- 10.12 RTP Company

- 10.13 Lubrizol Corporation

- 10.14 Asbury Carbons

- 10.15 Sigma-Aldrich Corporation (Merck Group)

- 10.16 Panipol Oy

- 10.17 Polyone Corporation

- 10.18 Premix Group

- 10.19 Hyperion Catalysis International

- 10.20 Ormecon GmbH