|

市場調查報告書

商品編碼

1766203

熱轉印印表機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Thermal Transfer Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

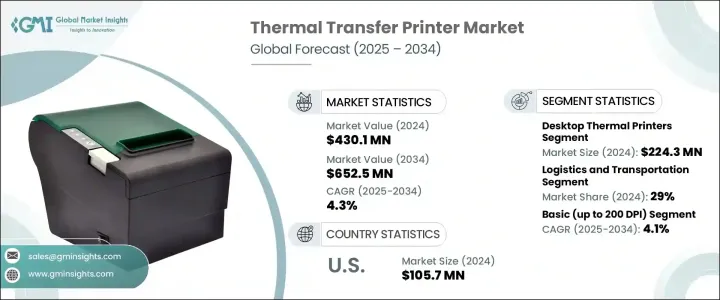

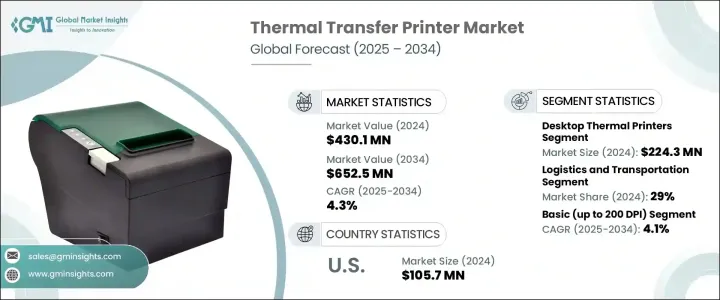

2024 年全球熱轉印印表機市場規模為 4.301 億美元,預計到 2034 年將以 4.3% 的複合年成長率成長,達到 6.525 億美元。這一成長得益於對可靠、持久標籤解決方案日益成長的需求以及印刷技術的持續進步。隨著企業優先考慮高效率的標籤系統,對智慧熱轉印印表機的需求也不斷攀升。雲端列印、行動連線和無線設定等最新創新正在提高可用性並推動其更廣泛的應用。新興的熱激活無墨列印方法也正在重塑市場,因為它們無需使用傳統的墨水。同時,向永續發展的轉變正在推動環保色帶替代品的開發,以減少對生態的影響。製造商正在積極投資更環保的選擇,使用可再生、可生物分解的材料來取代石油基塑膠,以符合更廣泛的企業責任目標。

這些趨勢不僅提升了功能性,也使熱敏列印技術與環境法規和不斷變化的客戶期望一致。製造商如今更加重視永續產品開發,推出可生物分解的色帶、可回收零件和節能列印系統。為了因應更嚴格的合規標準,企業正在整合低排放技術並採用更環保的生產流程,以減少碳足跡。同時,使用者對印表機的要求不僅僅是效能,他們想要的是智慧、連網且環保的設備。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.301億美元 |

| 預測值 | 6.525億美元 |

| 複合年成長率 | 4.3% |

桌上型熱感式印表機市場在2024年創造了2.243億美元的市場規模,預計複合年成長率為4.1%。其日益普及的趨勢得益於其緊湊的設計、無線相容性和方便用戶使用的功能。這類印表機廣泛應用於醫療保健、物流和零售等行業,能夠支援高效營運,同時最佳化空間利用。企業更青睞能夠處理多種介質類型和尺寸、提高工作流程靈活性並最大程度減少設備佔用空間的多功能解決方案。

物流和運輸業在2024年佔據29%的市場佔有率,預計到2034年將以4.7%的複合年成長率成長。這些行業嚴重依賴熱轉印印表機來製作耐用、可掃描的標籤,用於追蹤和運輸。高解析度、持久耐用的標籤對於供應鏈管理至關重要,因為它們能夠承受環境壓力和頻繁搬運。行動列印功能也越來越受歡迎,可以在配送過程中和配送點按需製作標籤。這種便攜性提高了整個物流工作流程的準確性和速度,支援即時庫存控制和無縫營運。

美國熱轉印印表機市場佔83%的市場佔有率,2024年市場規模達1.057億美元。這一領先地位的形成得益於快節奏產業對耐用標籤解決方案日益成長的需求以及電子商務的快速發展。隨著直接面向客戶的訂單履行模式的興起,對列印的運輸標籤、條碼和包裝標識的需求也隨之增加,而熱轉印印表機能夠有效地列印這些標籤。美國企業正積極採用這些技術,以快速可靠的方式滿足大量生產需求。

為全球熱轉印印表機產業成長做出貢獻的主要公司包括 APS Group、Domino Printing、SATO America、Markem-Imaje、Linx Printing Technologies、Videojet Technologies、Weber Packaging Solutions、PrintJet、Brother、Hanin (HRPT)、Kite Packaging、DNP Group、Brady、Heller Group 和 TE。為了鞏固其在全球熱轉印印表機市場的地位,各公司正在執行以創新、客製化和永續性為中心的策略。他們正在開發具有基於雲端的列印、遠端存取和無縫移動整合功能的智慧印表機,以滿足精通技術的用戶的需求並提高操作便利性。主要參與者也正在推出可生物分解色帶等永續產品,以減少對環境的影響並吸引具有環保意識的買家。此外,製造商透過提供適用於不同行業應用的模組化緊湊設計來提高產品靈活性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按類型

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS 編碼 - 84433290)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 桌上型熱感式印表機

- 行動熱感式印表機

- 工業熱感式印表機

第6章:市場估計與預測:依彩色印刷能力,2021 - 2034 年

- 主要趨勢

- 單色

- 多色的

第7章:市場估計與預測:按列印速度,2021 - 2034 年

- 主要趨勢

- 慢速(最高 150 毫米/秒)

- 中(200 毫米/秒)

- 快速(300 毫米/秒)

- 超快(400 毫米/秒)

第8章:市場估計與預測:依印刷質量,2021 - 2034 年

- 主要趨勢

- 基本(最高 200 DPI)

- 半專業(高達 300 DPI)

- 專業(高達 600 DPI)

第9章:市場估計與預測:依用途,2021 - 2034 年

- 主要趨勢

- 卡片和徽章印表機

- 條碼

- 標籤

- 收據

- 標籤

- 腕帶

- 其他

第 10 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 製造業

- 物流和運輸

- 衛生保健

- 零售

- 政府

- 其他(酒店業等)

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- APS Group

- Brady

- Brother

- DNP Group

- Domino Printing

- Hanin (HRPT)

- Hellermann Tyton

- Kite Packaging

- Linx Printing Technologies

- Markem-Imaje

- PrintJet

- SATO America

- TE Connectivity

- Videojet Technologies

- Weber Packaging Solutions

The Global Thermal Transfer Printer Market was valued at USD 430.1 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 652.5 million by 2034. This growth is fueled by the rising need for reliable, long-lasting labeling solutions and continued advancements in printing technologies. As businesses prioritize efficient labeling systems, the demand for smart thermal transfer printers is climbing. Recent innovations such as cloud printing, mobile connectivity, and wireless setup are enhancing usability and driving wider adoption. Emerging heat-activated, inkless printing methods are also reshaping the market by eliminating traditional ink needs. Meanwhile, the shift toward sustainability is driving the development of environmentally friendly ribbon alternatives that reduce ecological impact. Manufacturers are actively investing in greener options using renewable, biodegradable materials to replace petroleum-based plastics, aligning with broader corporate responsibility goals.

These trends are not only improving functionality but also aligning thermal printing technology with environmental regulations and evolving customer expectations. Manufacturers are now placing greater emphasis on sustainable product development by introducing biodegradable ribbons, recyclable components, and energy-efficient printing systems. In response to stricter compliance standards, companies are integrating low-emission technologies and adopting greener production processes to reduce their carbon footprint. At the same time, users are demanding printers that offer more than just performance-they want smart, connected, and eco-conscious devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $430.1 Million |

| Forecast Value | $652.5 Million |

| CAGR | 4.3% |

The desktop thermal printers segment generated USD 224.3 million in 2024 and is forecast to grow at a 4.1% CAGR. Their increasing popularity is linked to compact designs, wireless compatibility, and user-friendly features. Widely adopted in sectors such as healthcare, logistics, and retail, these printers support efficient operations while optimizing space. Businesses prefer multifunctional solutions capable of handling multiple media types and sizes, improving workflow flexibility, and minimizing equipment footprint.

The logistics and transportation segment represented a 29% share in 2024 and is projected to grow at a 4.7% CAGR through 2034. These industries rely heavily on thermal transfer printers to create durable, scannable labels for tracking and shipping. High-resolution, long-lasting labels are critical for supply chain management, as they withstand environmental stress and constant handling. Mobile printing capabilities are also gaining popularity, enabling on-demand label production during deliveries and at distribution points. This portability enhances accuracy and speed across logistics workflows, supporting real-time inventory control and seamless operations.

United States Thermal Transfer Printer Market held an 83% share and generated USD 105.7 million in 2024. This leadership position is driven by the growing need for durable labeling solutions in fast-paced industries and the rapid development of e-commerce. With the rise in direct-to-customer fulfillment, there's a higher requirement for printed shipping labels, barcodes, and packaging identifiers, all of which are produced efficiently with thermal transfer printers. U.S. companies are embracing these technologies to meet high-volume demands with speed and reliability.

Leading players contributing to the growth of the Global Thermal Transfer Printer Industry include APS Group, Domino Printing, SATO America, Markem-Imaje, Linx Printing Technologies, Videojet Technologies, Weber Packaging Solutions, PrintJet, Brother, Hanin (HRPT), Kite Packaging, DNP Group, Brady, Hellermann Tyton, and TE Connectivity. To solidify their positions in the global thermal transfer printer market, companies are executing strategies centered on innovation, customization, and sustainability. They are developing smart printers with cloud-based printing, remote access, and seamless mobile integration to cater to tech-savvy users and boost operational convenience. Key players are also launching sustainable products like biodegradable ribbons to reduce environmental impact and appeal to eco-conscious buyers. Additionally, manufacturers are enhancing product flexibility by offering modular, compact designs suitable for varied industry applications.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Color printing capability

- 2.2.4 Print speed

- 2.2.5 Print quality

- 2.2.6 Usage

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code – 84433290)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Desktop thermal printers

- 5.3 Mobile thermal printers

- 5.4 Industrial thermal printers

Chapter 6 Market Estimates & Forecast, By Color Printing Capability, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Single color

- 6.3 Multi color

Chapter 7 Market Estimates & Forecast, By Print Speed, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Slow (Up to 150 mm/sec)

- 7.3 Medium (200 mm/sec)

- 7.4 Fast (300 mm/sec)

- 7.5 Ultra-fast (400 mm/sec)

Chapter 8 Market Estimates & Forecast, By Print Quality, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Basic (up to 200 DPI)

- 8.3 Semiprofessional (up to 300 DPI)

- 8.4 Professional (up to 600 DPI)

Chapter 9 Market Estimates & Forecast, By Usage, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Card and badge printers

- 9.3 Barcodes

- 9.4 Labels

- 9.5 Receipts

- 9.6 Tags

- 9.7 Wristbands

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Manufacturing

- 10.3 Logistics and transportation

- 10.4 Healthcare

- 10.5 Retail

- 10.6 Government

- 10.7 Others (hospitality etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 APS Group

- 13.2 Brady

- 13.3 Brother

- 13.4 DNP Group

- 13.5 Domino Printing

- 13.6 Hanin (HRPT)

- 13.7 Hellermann Tyton

- 13.8 Kite Packaging

- 13.9 Linx Printing Technologies

- 13.10 Markem-Imaje

- 13.11 PrintJet

- 13.12 SATO America

- 13.13 TE Connectivity

- 13.14 Videojet Technologies

- 13.15 Weber Packaging Solutions