|

市場調查報告書

商品編碼

1766191

OTC 連續血糖監測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測OTC Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

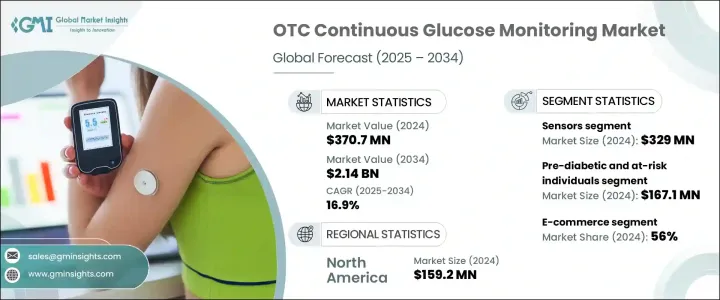

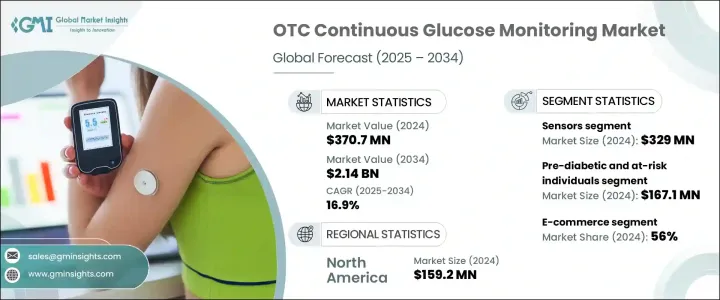

2024 年全球非處方連續血糖監測市場規模為 3.707 億美元,預計到 2034 年將以 16.9% 的複合年成長率成長,達到 21.4 億美元。非處方連續血糖監測 (OTC CGM) 無需處方即可購買,不僅在糖尿病管理中發揮越來越重要的作用,而且在更廣泛的健康監測應用中也發揮著越來越重要的作用。這些設備使消費者能夠即時追蹤血糖水平,從而幫助他們就飲食、運動和整體健康狀況做出明智的決定。隨著對個人健康資訊的需求不斷成長,這些系統正被用於預防性醫療保健和個人化營養。隨著感測器技術、緊湊設計、更長的穿戴式性以及與智慧型手機和人工智慧平台的無縫整合的進步,OTC CGM 正變得更加方便用戶使用,並被更廣泛的受眾所接受。

製造商和數位平台正日益攜手合作,以提升消費者的整體產品體驗。透過整合高級分析技術並提供個人化的生活方式指導,這些合作正在為用戶創造更具吸引力、更注重價值的體驗。消費者現在可以即時獲得健康洞察,了解日常飲食習慣如何影響血糖水平和整體健康狀況。這種個人化回饋不僅限於監測血糖水平,還擴展到製定切實可行的健康目標,例如最佳化飲食、運動和睡眠模式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.707億美元 |

| 預測值 | 21.4億美元 |

| 複合年成長率 | 16.9% |

感測器領域佔最大佔有率,2024 年價值 3.29 億美元。人們對緊湊、舒適、易用的穿戴式設備的日益青睞,推動了更多創新感測器的開發。這些感測器如今採用了石墨烯、軟性聚合物和可拉伸電子元件等先進材料,以提高舒適度和測量精度。這些感測器與穿戴式裝置和智慧型手機的整合,實現了即時連接和資料傳輸,從而提升了用戶體驗,並拓寬了連續血糖監測 (CGM) 的使用範圍。

2024年,電商領域佔了56%的市場。這一成長源自於消費者行為的轉變,注重健康的消費者更傾向於在線上購買健康設備,從而繞過傳統的零售和臨床管道。電商平台讓消費者能夠直接購買非處方動態血糖監測(OTC CGM),從而在數位化健康旅程中擁有更大的自主權。這種直接面對消費者的方式也使品牌能夠更有效地與客戶互動,透過線上管道提供個人化的教育和支援。

預計到 2034 年,美國非處方連續血糖監測市場規模將達到 11 億美元。人們對預防性保健的興趣日益濃厚,尤其是在非糖尿病族群中,這推動了這項需求。人們擴大使用 CGM 來最佳化飲食、運動和代謝性能。美國食品藥物管理局 (FDA) 的監管進展,包括對非處方連續血糖監測 (OTC CGM) 的批准,進一步促進了這些設備的廣泛應用。連續血糖監測 (CGM) 與智慧型手機和健康應用程式的整合也增強了消費者對自我管理的信心,使用戶能夠無縫監測血糖水平並獲得個人化的健康建議。這一趨勢得益於美國數位健康工具的廣泛採用,消費者擴大尋求個人化的健康資料。

OTC 連續血糖監測市場的主要參與者包括雅培實驗室、Dexcom、January AI、Levels Health、Limbo (Vitals in View)、Nutrisense、三諾生物、Ultrahuman Healthcare、Veri 和 Zoe。為了加強在 OTC 連續血糖監測市場的地位,各公司採取了多種策略。首先,他們專注於增強感測器背後的技術,整合軟性聚合物和可拉伸電子產品等尖端材料,以提高舒適度和準確性。許多公司也與數位健康平台建立策略合作夥伴關係,為消費者提供附加服務,例如人工智慧分析和個人化指導。此外,許多製造商正在接受向電子商務的轉變,這使他們能夠直接透過線上管道接觸更廣泛的消費者群體。透過投資使用者友善的設計、提供教育資源和簡化購買流程,這些公司旨在提高產品採用率並建立強大的客戶忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費者對代謝健康和保健的興趣日益濃厚

- 直接面對消費者 (DTC) 和訂閱模式的擴展

- 技術進步和人工智慧驅動的洞察力

- 預防性醫療保健和長壽趨勢的轉變

- 產業陷阱與挑戰

- 成本高且保險範圍有限

- 監管和資料隱私問題

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

- 2024 年按消費者類型分類的銷售量

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 透過感測器

- 按平台/應用

- 公司市場排名(按地區)

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組成部分,2021 年至 2034 年

- 主要趨勢

- 感應器

- 平台/應用程式

第6章:市場估計與預測:依消費者類型,2021 年至 2034 年

- 主要趨勢

- 非糖尿病健康愛好者

- 糖尿病前期及高危險群

- 其他消費者類型

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 世界其他地區

第9章:公司簡介

- Abbott Laboratories

- Dexcom

- January AI

- Levels Health

- Limbo (Vitals in View)

- Nutrisense

- Sinocare

- Ultrahuman Healthcare

- Veri

- Zoe

The Global OTC Continuous Glucose Monitoring Market was valued at USD 370.7 million in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 2.14 billion by 2034. OTC CGMs, which are available for purchase without a prescription, are playing an increasingly significant role not only in managing diabetes but also in broader health monitoring applications. These devices allow consumers to track their glucose levels in real-time, which empowers them to make informed decisions about their diet, exercise, and overall wellness. As the demand for personal health information grows, these systems are being embraced for preventive healthcare and personalized nutrition. With advancements in sensor technology, compact design, longer wearability, and seamless integration with smartphones and AI platforms, OTC CGMs are becoming more user-friendly and accessible to a wider audience.

Manufacturers and digital platforms are increasingly joining forces to improve the overall product experience for consumers. By integrating advanced analytics and offering personalized lifestyle coaching, these collaborations are creating a more engaging and value-driven experience for users. Consumers now have access to insights about their health in real-time, helping them understand how their daily choices impact their glucose levels and overall well-being. This personalized feedback is not just limited to monitoring glucose levels but extends to creating actionable health goals, such as optimizing diet, exercise, and sleep patterns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $370.7 Million |

| Forecast Value | $2.14 Billion |

| CAGR | 16.9% |

The sensor segment holds the largest share valued at USD 329 million in 2024. The increasing preference for compact, comfortable, and easy-to-use wearables is fueling the development of more innovative sensors. These sensors now incorporate advanced materials such as graphene, flexible polymers, and stretchable electronics to improve comfort and measurement accuracy. The integration of these sensors with wearables and smartphones allows real-time connectivity and data transfer, enhancing the user experience and broadening the scope of CGM usage.

The e-commerce segment held 56% share in 2024. This growth is driven by a shift in consumer behavior, where health-conscious individuals prefer purchasing wellness devices online, bypassing traditional retail and clinical settings. E-commerce platforms offer consumers direct access to OTC CGMs, providing greater autonomy over their digital health journey. This direct-to-consumer approach also enables brands to engage with customers more effectively, offering personalized education and support through online channels.

United States OTC Continuous Glucose Monitoring Market is projected to reach USD 1.1 billion by 2034. The rising interest in preventive health, particularly among non-diabetic individuals, is driving this demand. People are increasingly using CGMs to optimize their diet, exercise, and metabolic performance. Regulatory advancements by the FDA, including approvals for OTC CGMs, are further facilitating the widespread adoption of these devices. The integration of CGMs with smartphones and health apps is also boosting consumer confidence in self-management, enabling users to monitor their glucose levels seamlessly and gain personalized health insights. This trend is supported by the high adoption of digital health tools in the U.S., with consumers increasingly seeking personalized health data.

Key players in the OTC Continuous Glucose Monitoring Market include Abbott Laboratories, Dexcom, January AI, Levels Health, Limbo (Vitals in View), Nutrisense, Sinocare, Ultrahuman Healthcare, Veri, and Zoe. To strengthen their presence in the OTC continuous glucose monitoring market, companies have adopted several strategies. First, they are focusing on enhancing the technology behind their sensors, integrating cutting-edge materials like flexible polymers and stretchable electronics to improve comfort and accuracy. Many companies are also entering strategic partnerships with digital health platforms to provide consumers with additional services, such as AI-powered analytics and personalized coaching. Furthermore, the shift towards e-commerce is being embraced by many manufacturers, allowing them to reach a broader consumer base directly through online channels. By investing in user-friendly designs, providing educational resources, and streamlining the purchase process, these companies aim to increase product adoption and build strong customer loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer interest in metabolic health and wellness

- 3.2.1.2 Expansion of direct-to-consumer (DTC) and subscription models

- 3.2.1.3 Technological advancements and AI-powered insights

- 3.2.1.4 Shifts in preventive healthcare and longevity trends

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs and limited insurance coverage

- 3.2.2.2 Regulatory and data privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Rest of the World

- 3.5 Volume by consumer type, 2024

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By sensor

- 4.2.2 By platform/app

- 4.3 Company market ranking, by region

- 4.4 Company matrix analysis

- 4.5 Competitive analysis of major market players

- 4.6 Competitive positioning matrix

- 4.7 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Sensors

- 5.3 Platforms/Apps

Chapter 6 Market Estimates and Forecast, By Consumer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Non-diabetic health enthusiasts

- 6.3 Pre-diabetic and at-risk individuals

- 6.4 Other consumer types

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Rest of the World

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Dexcom

- 9.3 January AI

- 9.4 Levels Health

- 9.5 Limbo (Vitals in View)

- 9.6 Nutrisense

- 9.7 Sinocare

- 9.8 Ultrahuman Healthcare

- 9.9 Veri

- 9.10 Zoe