|

市場調查報告書

商品編碼

1750617

持續血糖監測市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Continuous Glucose Monitoring Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

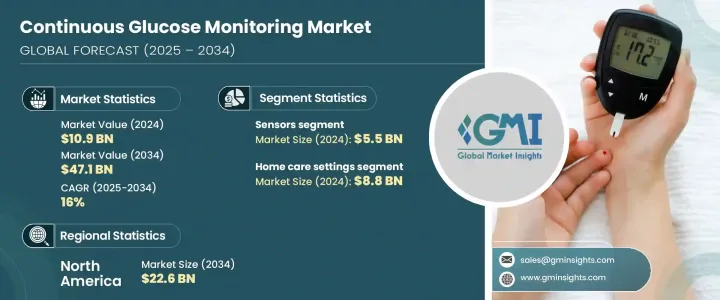

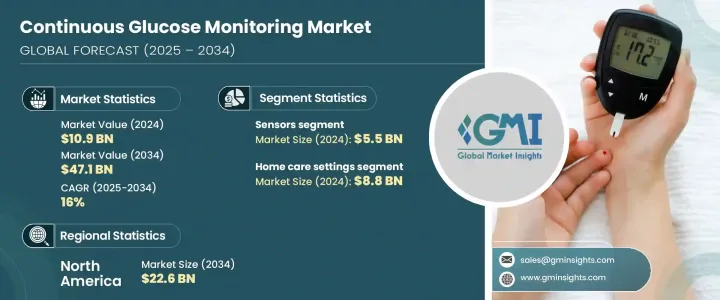

2024年,全球持續血糖監測市場規模達109億美元,預計到2034年將以16%的複合年成長率成長,達到471億美元,這主要得益於糖尿病患病率的上升以及對即時、方便用戶使用型監測技術的需求。 CGM系統能夠全天候追蹤血糖水平,在各種醫療保健領域越來越受歡迎。這些系統通常使用放置在皮下的微創感測器來監測間質血糖,並將資料傳輸到數位裝置以便於追蹤。

隨著糖尿病管理意識的不斷提升以及全球向預防保健的轉變,連續血糖監測 (CGM) 系統的普及率正在迅速提升。越來越多的患者和醫療保健專業人員選擇 CGM 解決方案,以更好地控制血糖、減少併發症並改善長期健康。即時持續監測血糖水平的能力,以及智慧警報和數據共享功能,正在透過為患者提供切實可行的洞察,徹底改變糖尿病護理。隨著全球醫療保健系統強調以患者為中心、以技術支援的解決方案,CGM 技術正逐漸成為現代糖尿病管理的基石。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 109億美元 |

| 預測值 | 471億美元 |

| 複合年成長率 | 16% |

感測器精度和功能的不斷提升,在CGM市場的轉型中發揮了關鍵作用。 2024年,感測器細分市場產值達到55億美元,預計到2034年將以16.1%的複合年成長率成長。生物感測器技術的進步使得更小、更精確的感測器成為可能,它們不僅可以監測血糖,還可以追蹤其他生物標記物,從而更全面地了解使用者的代謝健康狀況。更高的舒適度、更高的資料精度和更佳的穿戴式性促使用戶從傳統的血糖監測方法轉向CGM系統。

家庭護理已成為主要的應用領域,得益於這些系統提供的便利性,到2024年,其市場規模將達到88億美元,佔81%的市場佔有率。即時警報、與智慧型手機的整合以及與醫療保健專業人員輕鬆共享資料的功能,使CGM設備成為居家管理糖尿病患者的實用之選。此外,遠距照護的轉變進一步提高了CGM設備的採用率,消費者對減少對就診依賴的居家監控解決方案表現出強烈的偏好。

2024年,美國持續血糖監測市場規模達49億美元,這得益於糖尿病患者人數的不斷成長以及保險覆蓋範圍的擴大,從而提高了持續血糖監測系統的價格和可及性。此外,醫療保險政策的扶持和報銷範圍的擴大也使得CGM系統的應用範圍更加廣泛,包括老年人和低收入群體。同時,美國市場也受惠於穿戴式健康科技的持續創新,感測器體積更小、配戴更舒適,配戴時間更長,資料準確性也更高。

全球連續血糖監測市場的知名公司包括 Dexcom、美敦力、雅培實驗室、Senseonics、羅氏製藥、三諾生物、Med Trust、Medtrum Technologies、浙江凱立德、i-SENS 和 A. Menarini Diagnostics。為了提升市場佔有率,連續血糖監測 (CGM) 製造商投入研發資金,開發精度更高、尺寸更小、佩戴時間更長的下一代感測器。許多製造商正在與數位健康平台和行動應用程式開發商建立策略聯盟,以增強設備連接性和資料整合。其他製造商則透過區域合作夥伴關係和收購小型企業來擴大其全球影響力,以豐富產品組合併加快創新速度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球糖尿病患者人數不斷增加

- 全球對連續監測設備的需求不斷成長

- 設備技術進步

- 政府加強提高人們對糖尿病的認知

- 產業陷阱與挑戰

- 與設備相關的高成本

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組成部分,2021 年至 2034 年

- 主要趨勢

- 發射器

- 感應器

- 接收器

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 居家照護環境

- 診斷中心和診所

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 荷蘭

- 瑞典

- 俄羅斯

- 丹麥

- 芬蘭

- 挪威

- 波蘭

- 瑞士

- 比利時

- 立陶宛

- 拉脫維亞

- 愛沙尼亞

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 台灣

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 科威特

- 卡達

第8章:公司簡介

- Abbott Laboratories

- A. Menarini Diagnostics

- Dexcom

- i-SENS

- F. Hoffmann-La Roche

- Med Trust

- Medtronic

- Medtrum Technologies

- Senseonics

- Sinocare

- Zhejiang POCTech

The Global Continuous Glucose Monitoring Market was valued at USD 10.9 billion in 2024 and is estimated to grow at a CAGR of 16% to reach USD 47.1 billion by 2034, driven by the increasing prevalence of diabetes and the demand for real-time, user-friendly monitoring technologies. CGM systems, which allow round-the-clock tracking of glucose levels, are gaining traction across various healthcare settings. These systems typically use a minimally invasive sensor placed beneath the skin to monitor interstitial glucose, transmitting the data to digital devices for easy tracking.

With rising awareness about diabetes management and the global shift toward preventive care, the adoption of continuous glucose monitoring (CGM) systems is accelerating rapidly. Both patients and healthcare professionals are increasingly turning to CGM solutions to enable better glycemic control, reduce complications, and improve long-term health outcomes. The ability to continuously monitor glucose levels in real time, along with smart alerts and data-sharing capabilities, is transforming diabetes care by empowering individuals with actionable insights. As healthcare systems worldwide emphasize patient-centered and tech-enabled solutions, CGM technology is emerging as a cornerstone of modern diabetes management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.9 Billion |

| Forecast Value | $47.1 Billion |

| CAGR | 16% |

The continuous improvements in sensor accuracy and functionality have played a key role in transforming the CGM market. In 2024, the sensors segment generated USD 5.5 billion and is expected to grow at a CAGR of 16.1% through 2034. Advancements in biosensor technology have enabled smaller, more precise sensors that not only monitor glucose but can also track other biomarkers, offering a broader view of the user's metabolic health. Increased comfort, enhanced data precision, and better wearability prompt users to transition from traditional glucose monitoring methods to CGM systems.

Home care has emerged as a primary application area, contributing USD 8.8 billion and holding an 81% share in 2024, fueled by the convenience these systems offer. Real-time alerts, integration with smartphones, and the ability to easily share data with healthcare professionals make CGM devices a practical choice for patients managing diabetes at home. In addition, shifts toward remote care have further increased adoption, with consumers showing a strong preference for at-home monitoring solutions that reduce dependence on clinical visits.

United States Continuous Glucose Monitoring Market accounted for USD 4.9 billion in 2024, driven by the rising number of people living with diabetes and greater insurance coverage that has improved the affordability and accessibility of CGM systems. Supportive Medicare policies and reimbursement expansions have enabled broader patient adoption, including among seniors and low-income groups. At the same time, the U.S. market is benefiting from continuous innovation in wearable health tech, leading to smaller, more comfortable sensors with extended wear time and enhanced data accuracy.

Prominent companies in the Global Continuous Glucose Monitoring Market include Dexcom, Medtronic, Abbott Laboratories, Senseonics, F. Hoffmann-La Roche, Sinocare, Med Trust, Medtrum Technologies, Zhejiang POCTech, i-SENS, and A. Menarini Diagnostics. To enhance market presence, CGM manufacturers invest in R&D to develop next-generation sensors with improved accuracy, smaller sizes, and longer wear times. Many are forming strategic alliances with digital health platforms and mobile app developers to enhance device connectivity and data integration. Others are expanding their global footprint through regional partnerships and acquiring smaller firms to diversify product portfolios and speed up innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of people suffering from diabetes across the world

- 3.2.1.2 Rise in demand for continuous monitoring devices globally

- 3.2.1.3 Technological advancements in devices

- 3.2.1.4 Increasing government initiatives to generate awareness regarding diabetes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost related to devices

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to Consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Transmitters

- 5.3 Sensors

- 5.4 Receivers

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Home care settings

- 6.4 Diagnostic centres and clinics

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.3.7 Sweden

- 7.3.8 Russia

- 7.3.9 Denmark

- 7.3.10 Finland

- 7.3.11 Norway

- 7.3.12 Poland

- 7.3.13 Switzerland

- 7.3.14 Belgium

- 7.3.15 Lithuania

- 7.3.16 Latvia

- 7.3.17 Estonia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Taiwan

- 7.4.7 Indonesia

- 7.4.8 Vietnam

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Colombia

- 7.5.5 Chile

- 7.5.6 Peru

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Israel

- 7.6.5 Kuwait

- 7.6.6 Qatar

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 A. Menarini Diagnostics

- 8.3 Dexcom

- 8.4 i-SENS

- 8.5 F. Hoffmann-La Roche

- 8.6 Med Trust

- 8.7 Medtronic

- 8.8 Medtrum Technologies

- 8.9 Senseonics

- 8.10 Sinocare

- 8.11 Zhejiang POCTech