|

市場調查報告書

商品編碼

1766180

汽車量子點背光單元市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Quantum Dot Backlight Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

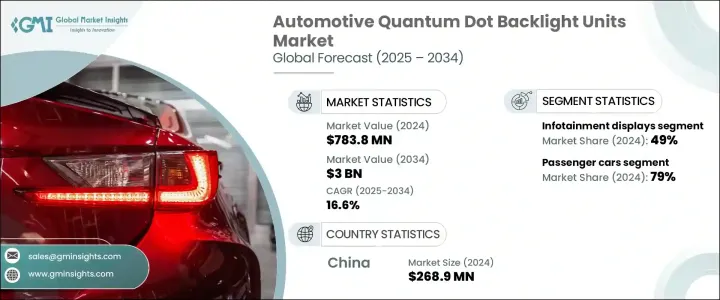

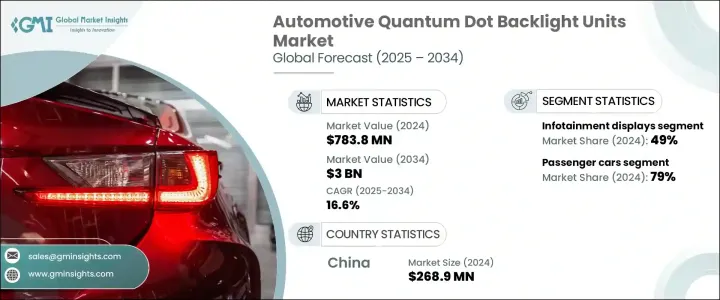

2024 年全球汽車量子點背光單元市場價值為 7.838 億美元,預計到 2034 年將以 16.6% 的複合年成長率成長,達到 30 億美元。這一成長是由消費者對沉浸式數位顯示器的期望不斷提高,以及車輛資訊娛樂和智慧駕駛艙系統的加速採用所推動的。隨著汽車內裝發展成為數位指揮中心,對提供卓越色彩保真度、更高對比度和增強亮度的顯示器的需求正在迅速成長。量子點 (QD) 背光單元正在成為提供這些先進視覺功能的核心組件。隨著對車載連接、即時駕駛資料和多媒體功能的需求不斷成長,QD 增強型螢幕可提供當今連網汽車所需的效能、效率和耐用性。

汽車製造商正在重新思考其座艙設計,轉向涵蓋資訊娛樂、儀表板和平視顯示器 (HUD) 的統一顯示平台。這項轉變有助於實現一致的使用者介面和精簡的製造流程。隨著模組化顯示系統在從電動和混合動力車型到高階自動駕駛平台等各個汽車領域日益普及,QD 背光單元正成為標配。其適應性、色彩精準度和節能性正在鞏固其在下一代數位汽車體驗中的地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.838億美元 |

| 預測值 | 30億美元 |

| 複合年成長率 | 16.6% |

到2024年,乘用車領域將佔據79%的市場佔有率,預計2025年至2034年的複合年成長率為18%。在這一領域,量子點(QD)背光單元透過提供更豐富的色彩還原、更高的亮度和更佳的能耗,正在徹底改變顯示性能。這些增強功能使其特別適用於需要在各種光照條件下表現良好的資訊娛樂系統、平視顯示器和數位駕駛儀錶板。由量子點增強膜(QDEF)驅動的高動態範圍(HDR)視覺效果帶來身臨其境的體驗,同時支援連網車輛系統的安全性和功能性。它們能夠無縫整合到基於LCD和曲面的顯示格式,使其成為現代駕駛艙佈局的理想選擇,尤其是在中檔到豪華電動車車型。量子點顯示器也符合汽車級耐久性標準,這對於長期車載部署至關重要。

資訊娛樂顯示器市場在2024年佔據49%的市場佔有率,預計到2034年將以15%的複合年成長率成長。對響應迅速、色彩鮮豔且細節豐富的座艙數位體驗的需求,推動了量子點(QD)在車載資訊娛樂系統中的整合。量子點背光單元增強了多媒體觀看體驗、導航清晰度和使用者介面的反應能力。玻璃上量子點(QD-on-Glass)和量子點顯示(QDEF)等技術可提供中控顯示器所需的寬色域、更快的更新率和高亮度。它們能夠在明亮的環境中保持影像質量,從而增強駕駛員和乘客的互動體驗。隨著使用者體驗成為競爭優勢,這些顯示器現已成為傳統汽車和電動車中控台系統不可或缺的一部分。

中國汽車量子點背光模組市場佔63%的市場佔有率,2024年市場規模達2.689億美元,這得益於中國汽車的大規模生產和對高科技車載顯示器的強勁需求。隨著智慧座艙技術的擴展,中國汽車市場正迅速轉向量子點增強系統,用於數位儀錶板、ADAS視覺化和車載娛樂系統。政府推出的支援技術開發、在地化生產和智慧出行的政策進一步增強了量子點顯示器的應用勢頭。對高階數位座艙解決方案的需求正在推動量子點顯示器的整合,尤其是在日益成長的電動車和混合動力汽車領域,這些領域擴大將高階顯示技術作為標配。

積極影響全球汽車量子點背光單元市場的關鍵參與者包括三星顯示、京東方科技集團、夏普、Kyulux、友達光電股份有限公司 (AUO)、Nanosys、華星光電 (CSOT)、索尼、群創光電和 LG Display。為了鞏固市場地位,汽車量子點背光單元領域的公司正專注於產品創新、策略聯盟和產能擴張。各公司正大力投資研發,以提高 QD 技術的效率和耐用性,同時降低生產成本。與汽車原始設備製造商 (OEM) 和一級供應商的合作,使得先進的 QD 系統能夠及早整合到新的汽車平台中。一些參與者也致力於垂直整合的生產模式,以確保供應鏈的穩定性和性能的一致性。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 對高解析度顯示器的需求不斷成長

- 資訊娛樂系統整合度不斷提升

- 高級駕駛輔助系統 (ADAS) 的採用日益增多

- 量子點材料的技術進步

- 產業陷阱與挑戰

- 量子點顯示器成本高

- 鎘基量子點的毒性問題

- 市場機會

- 整合到自動駕駛和半自動駕駛汽車中

- 售後市場顯示器升級日益增多

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 成本細分分析

- 軟體開發和授權成本

- 部署和整合成本

- 維護和支援成本

- 網路安全與合規成本

- 培訓和變更管理成本

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 用例

- 最佳情況

- 消費者行為與採用趨勢

- 使用者體驗和介面趨勢

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 資訊娛樂顯示器

- 儀表板

- 抬頭顯示器 (HUD)

- 後座娛樂系統

- 高級駕駛輔助系統 (ADAS) 顯示器

第7章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 量子點增強膜 (QDEF) 背光

- 玻璃量子點(QDOG)

- 量子點LED(QD-LED)

- 量子點彩色濾光片(QDCF)

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AU Optronics Corp. (AUO)

- BOE Technology Group

- CSOT (China Star Optoelectronics Technology)

- Helio Display Materials

- Innolux Corporation

- Kyulux

- LG Display

- Luminit LLC

- Nanoco Group

- Nanosys

- Noctiluca

- OSRAM Continental

- PixelDisplay

- QD Laser

- Quantum Solutions

- Samsung Display

- Sharp Corporation

- Sony Corporation

- Toray Industries

- Visionox

The Global Automotive Quantum Dot Backlight Units Market was valued at USD 783.8 million in 2024 and is estimated to grow at a CAGR of 16.6% to reach USD 3 billion by 2034. This growth is driven by rising consumer expectations for immersive digital displays and the accelerating adoption of infotainment and smart cockpit systems in vehicles. As automotive interiors evolve into digital command centers, the need for displays that deliver superior color fidelity, higher contrast ratios, and enhanced brightness is growing rapidly. Quantum dot (QD) backlight units are emerging as core components for delivering these advanced visual capabilities. With demand increasing for in-vehicle connectivity, real-time driving data, and multimedia functions, QD-enhanced screens offer the performance, efficiency, and durability required by today's connected vehicles.

Automakers are rethinking their cabin designs, moving toward unified display platforms that encompass infotainment, clusters, and head-up displays (HUDs). This shift supports a consistent user interface and streamlined manufacturing. As modular display systems gain traction across vehicle segments-from electric and hybrid models to high-end autonomous platforms-QD backlight units are becoming a standard feature. Their adaptability, color precision, and energy savings are reinforcing their position in the next generation of digital automotive experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $783.8 Million |

| Forecast Value | $3 Billion |

| CAGR | 16.6% |

By 2024, the passenger vehicles segment held a 79% share and is predicted to grow at a CAGR of 18% from 2025 to 2034. Within this segment, QD backlight units are transforming display performance by delivering richer color reproduction, elevated brightness, and improved energy use. These enhancements make them especially suitable for infotainment, head-up displays, and digital driver dashboards that need to perform well under variable lighting conditions. High-dynamic-range (HDR) visuals powered by Quantum Dot Enhancement Films (QDEF) bring an immersive experience while supporting safety and functionality in connected vehicle systems. Their seamless integration into LCD-based and curved display formats makes them ideal for modern cockpit layouts, particularly within mid-range to luxury EV models. QD displays also meet automotive-grade durability standards, which are essential for long-term in-vehicle deployment.

The infotainment displays segment held a 49% share in 2024 and is expected to grow at 15% CAGR through 2034. The demand for responsive, vibrant, and highly detailed in-cabin digital experiences is pushing QD integration within vehicle infotainment systems. QD backlight units enhance multimedia viewing, navigation clarity, and user interface responsiveness. Technologies such as QD-on-Glass and QDEF deliver wide color gamuts, faster refresh rates, and high brightness levels necessary for central control displays. Their ability to retain image quality in bright ambient environments enhances the interactive experience for both drivers and passengers. With user experience becoming a competitive differentiator, these displays are now integral to center-stack systems across both conventional and electric vehicles.

China Automotive Quantum Dot Backlight Units Market held a 63% share and generated USD 268.9 million in 2024, propelled by its large-scale vehicle production and strong demand for high-tech automotive displays. With the expansion of intelligent cockpit technologies, China's automotive market is rapidly shifting toward QD-enhanced systems for digital clusters, ADAS visualization, and in-car entertainment. Public policies supporting tech development, localized manufacturing, and smart mobility have further strengthened the momentum behind QD adoption. The push for high-end digital cockpit solutions is driving the integration of QD displays, especially in the growing electric and hybrid vehicle segments, which are increasingly adopting premium display technologies as standard features.

Key players actively shaping the Global Automotive Quantum Dot Backlight Units Market include Samsung Display, BOE Technology Group, Sharp, Kyulux, AU Optronics Corp. (AUO), Nanosys, CSOT (China Star Optoelectronics Technology), Sony, Innolux, and LG Display. To strengthen their market presence, companies in the automotive quantum dot backlight unit space are focusing on product innovation, strategic alliances, and capacity expansion. Firms are investing heavily in R&D to enhance the efficiency and durability of QD technologies while reducing production costs. Partnerships with automotive OEMs and Tier-1 suppliers are allowing for early integration of advanced QD systems into new vehicle platforms. Several players are also working on vertically integrated production models to ensure supply chain stability and performance consistency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Application

- 2.2.4 Technology

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for high-resolution displays

- 3.2.1.2 Rising integration of infotainment systems

- 3.2.1.3 Growing adoption of Advanced Driver Assistance Systems (ADAS)

- 3.2.1.4 Technological advancements in quantum dot materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of quantum dot displays

- 3.2.2.2 Toxicity concerns with cadmium-based QDs

- 3.2.3 Market opportunities

- 3.2.3.1 Integration in autonomous and semi-autonomous vehicles

- 3.2.3.2 Growing aftermarket display upgrades

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

- 3.13 Consumer behaviour & adoption trends

- 3.14 User experience & interface trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Infotainment displays

- 6.3 Instrument clusters

- 6.4 Head-Up Displays (HUDs)

- 6.5 Rear-seat entertainment systems

- 6.6 Advanced Driver Assistance System (ADAS) displays

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Quantum Dot Enhancement Film (QDEF) backlights

- 7.3 Quantum Dot on Glass (QDOG)

- 7.4 Quantum Dot on LED (QD-LED)

- 7.5 Quantum Dot Color Filters (QDCF)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AU Optronics Corp. (AUO)

- 10.2 BOE Technology Group

- 10.3 CSOT (China Star Optoelectronics Technology)

- 10.4 Helio Display Materials

- 10.5 Innolux Corporation

- 10.6 Kyulux

- 10.7 LG Display

- 10.8 Luminit LLC

- 10.9 Nanoco Group

- 10.10 Nanosys

- 10.11 Noctiluca

- 10.12 OSRAM Continental

- 10.13 PixelDisplay

- 10.14 QD Laser

- 10.15 Quantum Solutions

- 10.16 Samsung Display

- 10.17 Sharp Corporation

- 10.18 Sony Corporation

- 10.19 Toray Industries

- 10.20 Visionox