|

市場調查報告書

商品編碼

1766166

包裝與捆紮機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Wrapping and Bundling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

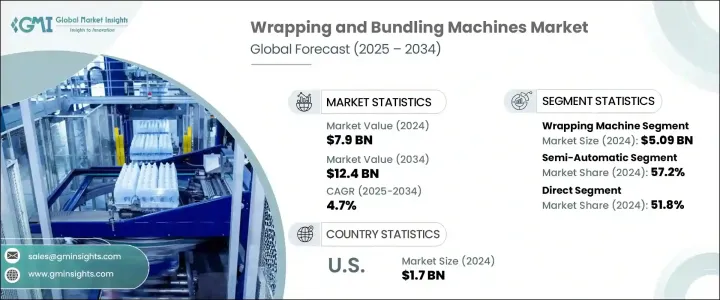

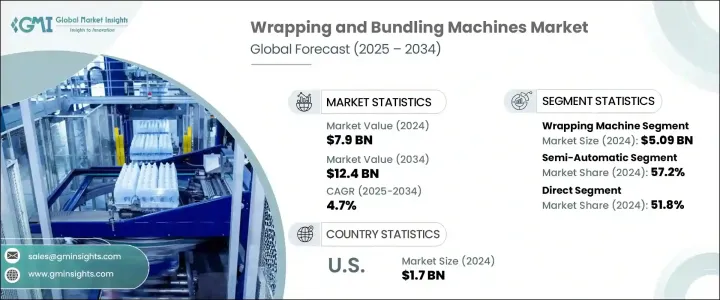

2024 年全球包裝和捆紮機市場價值為 79 億美元,預計到 2034 年將以 4.7% 的複合年成長率成長至 124 億美元。各行各業對自動化的日益重視是推動該市場成長的主要動力之一。隨著企業致力於提高營運效率、減少人力並確保包裝一致性,對這些機器的需求持續成長。高產量產業越來越依賴自動化系統來簡化營運、降低錯誤率並最佳化長期成本。這些機器不僅加快了包裝過程,而且還最大限度地減少了停機時間,同時解決了勞動力短缺和工資壓力問題。隨著勞動力挑戰的加劇以及對精簡、無錯誤包裝的需求,自動化成為維持生產力的關鍵策略。

現代包裝和捆紮系統也整合了感測器、數據驅動監控以及與企業級軟體相容等智慧技術。這些功能透過即時維護警報、精準控制和分析驅動的營運來提高效率。這種技術的應用正從已開發市場蔓延到發展中市場,這些市場的製造業升級與國家成長議程相符。隨著製造商應對不斷變化的合規性和衛生法規,先進的包裝設備日益被視為一項策略性投資,以實現長期韌性和成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 79億美元 |

| 預測值 | 124億美元 |

| 複合年成長率 | 4.7% |

2024年,包裝機市場規模達50.9億美元,預計2025年至2034年的複合年成長率將達到5.4%。包裝系統憑藉其靈活性、廣泛的應用範圍和易於自動化的特點,其受歡迎程度遠遠超過捆紮設備。這些機器對於維護產品狀態至關重要,尤其對於運輸過程中容易變質或損壞的物品。從小型設備到大型製造工廠,包裝解決方案能夠適應各種形狀、尺寸和包裝膜的產品,適用於各種生產環境。其可擴展性和適應性是支撐其市場主導地位的關鍵因素。

半自動機器佔了57.2%的市場佔有率,預計到2034年將以5.8%的複合年成長率成長。這個細分市場吸引了那些尋求經濟高效、可靠地從手動流程轉型的企業。這些機器在經濟實惠、功能強大和易用性之間實現了完美平衡。它們所需的資本投入更少,操作員培訓也更少,同時比手動系統具有更高的一致性。由於半自動機器能夠適應不斷變化的產品線和中小批量生產,因此常用於處理多種包裝形式的企業。它們在自動化需求適中的行業中廣泛應用,使其成為邁向全面自動化的重要橋樑。

美國包裝和捆紮機市場規模預計在2024年達到17億美元,預計2025年至2034年的複合年成長率為6.1%。該地區的成長得益於包裝作業向高效自動化系統的轉變。隨著企業尋求營運現代化,美國製造商正在投資升級的高速設備,以滿足安全法規和智慧製造原則的要求。美國先進的基礎設施和數位技術的整合進一步鞏固了其在全球市場的領導地位。

塑造這一市場的頂尖公司包括利樂拉伐集團 (Tetra Laval Group)、阿德爾菲集團 (Adelphi Group)、羅博帕克 (Robopac)、星德科科技 (Syntegon Technology)、石田 (Ishida)、伍爾夫泰克國際 (Wulftec International)、大森機械 (Omori Machine)、克朗斯 (Kignron) 工業集團Group)、Coesia、Lantech、Multivac、Optima 包裝集團 (Optima Packaging Group)、nVenia 和 Nichrome 包裝解決方案 (Nichrome Packaging Solutions)。為了鞏固市場地位,製造商正專注於技術創新和智慧自動化。他們正在開發具有物聯網功能、模組化設計以及與數位工廠系統相容的機器,以提升客戶價值。許多公司正在實現本地化生產,以降低供應鏈風險並改善服務交付。產品多樣化和針對特定行業的客製化解決方案也在推動長期合作夥伴關係的建立。策略性併購正在幫助企業擴大地域覆蓋範圍和產品組合。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 包裝自動化需求不斷成長

- 電子商務和物流的成長

- 食品飲料和製藥業的成長

- 永續性和環保包裝趨勢

- 技術進步

- 產業陷阱與挑戰

- 初期投資高

- 維護複雜且停機風險

- 機會

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 透過機器

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 貿易統計(HS編碼842240)

- 主要進口國

- 主要出口國

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- Industry structure and concentration

- Competitive intensity assessment

- 公司市佔率分析

- 競爭定位矩陣

- 產品定位

- 性價比定位

- 地理分佈

- 創新能力

- 戰略儀表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- 未來競爭前景

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 包裝機

- 拉伸包裝

- 收縮包裝

- 其他機器

- 捆紮機

- 收縮捆紮機

- 薄膜捆紮機

- 捆紮機

- 袖套捆紮機

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 自動的

- 半自動

第7章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 塑膠薄膜

- 可生物分解薄膜

- 紙質包裝

- 瓦楞紙板

第8章:市場估計與預測:依包裝類型,2021 - 2034 年

- 主要趨勢

- 初級包裝

- 二次包裝

- 三級包裝

第9章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 個人護理和化妝品

- 消費性電子產品

- 紡織品

- 物流與倉儲

- 化學品

- 工業品

- 其他

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Adelphi Group

- Coesia

- Ishida

- Krones

- Lantech

- Multivac

- Nichrome Packaging Solutions

- nVenia

- Omori Machinery

- Optima Packaging Group

- Robopac

- Signode Industrial Group

- Syntegon Technology

- Tetra Laval Group

- Wulftec International

The Global Wrapping and Bundling Machines Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 12.4 billion by 2034. The rising focus on automation across various industries is one of the major drivers behind this market growth. As companies aim to boost operational efficiency, cut back on manual labor, and ensure packaging consistency, demand for these machines continues to grow. Industries dealing with high production volumes increasingly rely on automated systems to streamline operations, reduce error rates, and optimize long-term costs. These machines not only speed up the packaging process but also minimize downtime while addressing workforce shortages and wage pressures. With rising labor challenges and the need for streamlined, error-free packaging, automation becomes a key strategy for sustained productivity.

Modern wrapping and bundling systems are also integrating intelligent technologies such as sensors, data-driven monitoring, and compatibility with enterprise-level software. These features improve efficiency through real-time maintenance alerts, precision control, and analytics-driven operations. Adoption is spreading from developed to developing markets, where manufacturing upgrades are aligning with national growth agendas. As manufacturers deal with evolving compliance and hygiene regulations, advanced packaging equipment is increasingly seen as a strategic investment for long-term resilience and growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $12.4 Billion |

| CAGR | 4.7% |

The wrapping machine segment generated USD 5.09 billion in 2024 and is anticipated to grow at a CAGR of 5.4% from 2025 to 2034. Wrapping systems are outperforming bundling units in popularity due to their flexibility, broad application range, and ease of automation. These machines are essential for maintaining product condition, especially for items prone to spoilage or damage during transport. From small setups to large manufacturing plants, wrapping solutions can accommodate diverse product shapes, sizes, and packaging films, making them suitable for a wide array of production environments. Their scalability and adaptability are key factors supporting their market dominance.

The semi-automatic machines segment held a 57.2% share and are projected to grow at a CAGR of 5.8% through 2034. This segment appeals to businesses looking for a cost-effective, reliable transition from manual processes. These machines strike a perfect balance between affordability, functionality, and ease of use. They require less capital investment and minimal operator training while offering improved consistency over manual systems. Because of their adaptability to changing product lines and small-to-medium batch sizes, semi-automatic machines are commonly used in companies handling multiple packaging formats. Their widespread use in sectors with moderate automation needs makes them a vital bridge toward full automation adoption.

United States Wrapping and Bundling Machines Market with USD 1.7 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Growth in this region is fueled by the shift toward high-efficiency automated systems across packaging operations. As businesses look to modernize operations, U.S.-based manufacturers are investing in upgraded, high-speed equipment aligned with safety regulations and smart manufacturing principles. The country's advanced infrastructure and integration of digital technologies further enhance its leadership position in the global landscape.

Top companies shaping this market include Tetra Laval Group, Adelphi Group, Robopac, Syntegon Technology, Ishida, Wulftec International, Omori Machinery, Krones, Signode Industrial Group, Coesia, Lantech, Multivac, Optima Packaging Group, nVenia, and Nichrome Packaging Solutions. To strengthen their market position, manufacturers are focusing on technological innovation and smart automation. They are developing machines with IoT capabilities, modular designs, and compatibility with digital factory systems to increase customer value. Many firms are localizing production to reduce supply chain risks and improve service delivery. Product diversification and customized solutions for specific industries are also driving long-term partnerships. Strategic mergers and acquisitions are helping companies expand their geographic reach and portfolio offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine

- 2.2.3 Mode of operation

- 2.2.4 Material

- 2.2.5 Packaging type

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automation in packaging

- 3.2.1.2 Growth in e-commerce and logistics

- 3.2.1.3 Food & beverage and pharma industry growth

- 3.2.1.4 Sustainability and eco-friendly packaging trends

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Complex maintenance and downtime risk

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Machine

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 842240)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.3.1 Product positioning

- 4.3.2 Price-performance positioning

- 4.3.3 Geographic presence

- 4.3.4 Innovation capabilities

- 4.4 Strategic dashboard

- 4.4.1 Competitive benchmarking

- 4.4.1.1 Manufacturing capabilities

- 4.4.1.2 Product portfolio strength

- 4.4.1.3 Distribution network

- 4.4.1.4 R&D investments

- 4.4.2 Strategic initiatives assessment

- 4.4.3 SWOT analysis of key players

- 4.4.1 Competitive benchmarking

- 4.5 Future competitive outlook

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Wrapping machine

- 5.2.1 Stretch wrapping

- 5.2.2 Shrink wrapping

- 5.2.3 Other machines

- 5.3 Bundling machine

- 5.3.1 Shrink bundling machines

- 5.3.2 Film bundling machines

- 5.3.3 Strap bundling machines

- 5.3.4 Sleeve bundling machines

Chapter 6 Market Estimates & Forecast, By Mode of operation, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic films

- 7.3 Biodegradable films

- 7.4 Paper-based wraps

- 7.5 Corrugated cardboard

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Primary packaging

- 8.3 Secondary packaging

- 8.4 Tertiary packaging

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Personal care & cosmetics

- 9.5 Consumer electronics

- 9.6 Textiles

- 9.7 Logistics & warehousing

- 9.8 Chemicals

- 9.9 Industrial goods

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Adelphi Group

- 12.2 Coesia

- 12.3 Ishida

- 12.4 Krones

- 12.5 Lantech

- 12.6 Multivac

- 12.7 Nichrome Packaging Solutions

- 12.8 nVenia

- 12.9 Omori Machinery

- 12.10 Optima Packaging Group

- 12.11 Robopac

- 12.12 Signode Industrial Group

- 12.13 Syntegon Technology

- 12.14 Tetra Laval Group

- 12.15 Wulftec International