|

市場調查報告書

商品編碼

1665293

包裝機市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Overwrapping Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

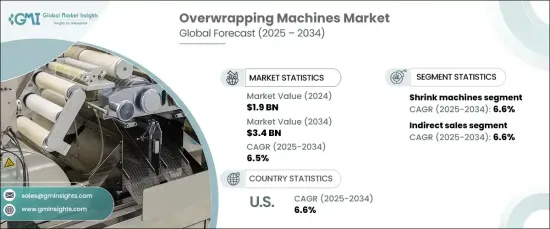

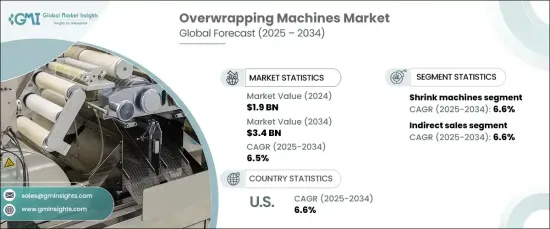

2024 年全球包裝機市場價值為 19 億美元,預計 2025 年至 2034 年期間將以 6.5% 的強勁複合年成長率成長。包裝機正在不斷發展,以支援可生物分解薄膜和再生紙等環保材料,以滿足日益成長的消費者偏好和日益嚴格的環境法規。隨著越來越多的行業採用永續包裝解決方案,市場預計將大幅成長。

包裝機市場依產品類型分類,包括收縮機、拉筋、水平流動機、流動包裝機、托盤包裝機等。 2024 年,收縮機領域佔市場最大佔有率,為 42.5%。預計未來十年該領域的複合年成長率為 6.6%。收縮機廣泛應用於食品飲料、藥品、消費品等產業。他們利用收縮膜包裹產品並加熱,使薄膜緊密貼合產品的形狀,這有助於延長保存期限,同時透過透明包裝保持產品的可見度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 6.5% |

此外,包裝機市場依配銷通路分為直接銷售和間接銷售。 2024 年,間接銷售部門以 65.5% 的佔有率佔據市場主導地位,預計到 2034 年將以 6.6% 的複合年成長率成長。這些中介機構對於了解複雜的區域法規以及為食品、藥品和化妝品等行業提供專業知識也很有價值。

在美國,包裝機市場佔有 73% 的主導佔有率,在預測期內以 6.6% 的複合年成長率穩步成長。美國對自動化包裝解決方案表現出強勁的需求,特別是在食品、醫藥和消費品等關鍵領域。隨著企業擴大整合物聯網技術來提高機器效率並減少停機時間,人們越來越關注能夠處理永續材料的機器。儘管市場具有成長潛力,但小型企業經常面臨與設備成本高和持續維護相關的挑戰。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對永續包裝解決方案的需求不斷成長

- 自動化和智慧技術的進步

- 電子商務產業的擴張

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 包裝標準的監管挑戰

- 成長動力

- 成長潛力分析

- 技術概覽

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 收縮機

- 伸展機

- 水平式流水機

- 流動包裝機

- 托盤纏繞機

第 6 章:市場估計與預測:按材料,2021 – 2034 年

- 主要趨勢

- 塑膠

- 紙

- 複合材料

第 7 章:市場估計與預測:按自動化,2021 年至 2034 年

- 主要趨勢

- 手動包裝機

- 半自動包裝機

- 全自動包裝機

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 藥品

- 化學品

- 消費品

- 其他

第 9 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接銷售

- 間接銷售

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 11 章:公司簡介

- Aetna Group SpA

- CAM Packaging Systems Ltd.

- Coesia SpA

- FUJI CORPORATION

- GEA Group AG

- Harpak-ULMA Packaging, LLC

- Haver & Boecker OHG

- IMA Industria Machine Automatiche SpA

- Ishida Co., Ltd.

- Krones AG

- Marchesini Group SpA

- Omori Machinery Co., Ltd.

- ProMach, Inc.

- Robert Bosch GmbH

- SACMI IMOLA SC

The Global Overwrapping Machines Market was valued at USD 1.9 billion in 2024 and is projected to grow at a robust CAGR of 6.5% from 2025 to 2034. As businesses and consumers alike become more conscious of environmental sustainability, packaging practices are undergoing a significant transformation. Overwrapping machines are evolving to support eco-friendly materials such as biodegradable films and recycled paper, aligning with growing consumer preferences and increasingly stringent environmental regulations. With more industries adopting sustainable packaging solutions, the market is expected to experience substantial growth.

The overwrapping machines market is categorized by product type, including shrink machines, stretch machines, horizontal flow machines, flow wrap machines, pallet wrap machines, and others. In 2024, the shrink machines segment accounted for the largest share of the market, holding 42.5%. This segment is forecasted to grow at a CAGR of 6.6% over the coming decade. Shrink machines are widely used in industries such as food and beverages, pharmaceuticals, and consumer goods. They utilize shrink film to wrap products and apply heat, tightly conforming the film to the product's shape, which helps extend shelf life while maintaining product visibility through clear packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 6.5% |

In addition, the overwrapping machines market is divided by distribution channel into direct and indirect sales. In 2024, the indirect sales segment led the market with a 65.5% share and is expected to grow at a CAGR of 6.6% through 2034. This segment relies on intermediaries such as distributors, agents, and resellers, allowing manufacturers to extend their reach to broader markets without maintaining a direct presence. These intermediaries are also valuable for navigating complex regional regulations and providing specialized expertise for industries like food, pharmaceuticals, and cosmetics.

In the U.S., the overwrapping machines market holds a dominant share of 73%, growing at a steady CAGR of 6.6% through the forecast period. The U.S. has shown strong demand for automated packaging solutions, particularly in key sectors like food, pharmaceuticals, and consumer goods. As businesses increasingly integrate IoT technology to enhance machine efficiency and reduce downtime, there is a growing focus on machines that can handle sustainable materials. Despite the market's growth potential, smaller businesses often face challenges related to the high costs of equipment and ongoing maintenance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for sustainable packaging solutions

- 3.6.1.2 Advancements in automation and smart technologies

- 3.6.1.3 Expansion of the e-commerce industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment and maintenance costs

- 3.6.2.2 Regulatory challenges in packaging standards

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shrink machine

- 5.3 Stretch machine

- 5.4 Horizontal flow machine

- 5.5 Flow wrap machine

- 5.6 Pallet wrap machine

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper

- 6.4 Composite materials

Chapter 7 Market Estimates & Forecast, By Automation, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual overwrapping machines

- 7.3 Semi-automatic overwrapping machines

- 7.4 Fully automatic overwrapping machines

Chapter 8 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Chemicals

- 8.5 Consumer goods

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aetna Group S.p.A.

- 11.2 CAM Packaging Systems Ltd.

- 11.3 Coesia S.p.A.

- 11.4 FUJI CORPORATION

- 11.5 GEA Group AG

- 11.6 Harpak-ULMA Packaging, LLC

- 11.7 Haver & Boecker OHG

- 11.8 I.M.A. Industria Machine Automatiche S.p.A.

- 11.9 Ishida Co., Ltd.

- 11.10 Krones AG

- 11.11 Marchesini Group S.p.A.

- 11.12 Omori Machinery Co., Ltd.

- 11.13 ProMach, Inc.

- 11.14 Robert Bosch GmbH

- 11.15 SACMI IMOLA S.C.