|

市場調查報告書

商品編碼

1755370

衛生紙市場機會、成長動力、產業趨勢分析及2025-2034年預測Hygienic Paper Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

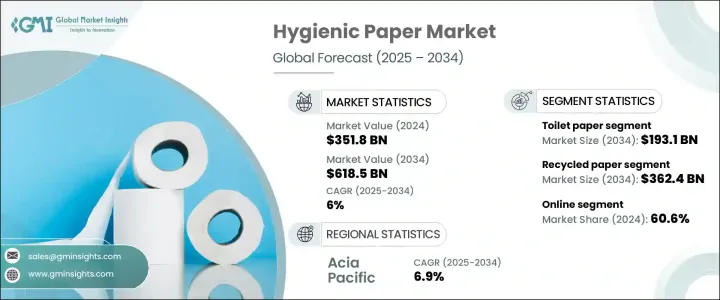

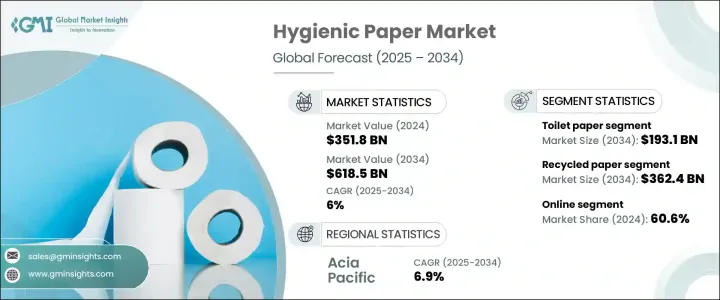

2024年,全球衛生紙市場規模達3,518億美元,預計到2034年將以6%的複合年成長率成長,達到6,185億美元。市場強勁的成長軌跡主要得益於消費者對環保產品的偏好日益成長、衛生標準不斷提高以及環保意識的不斷增強。如今,消費者越來越意識到自身對生態環境的影響,並積極尋求符合綠色價值的永續替代方案。這種行為轉變推動了再生衛生紙需求的激增,尤其是在消費者越來越重視安全和環保的情況下。隨著個人和社區衛生習慣的不斷改進,大眾對全球健康議題的關注也促使紙巾、濕紙巾和其他衛生相關產品的廣泛普及。

這種行為轉變正受到更廣泛的永續發展文化運動的強化,而這種文化運動深受環境教育和廣泛媒體通報的影響。企業正在透過重新設計產品和供應鏈來體現這些價值觀,確保自身在快速變化的市場中保持競爭力。永續創新和企業責任如今已成為競爭策略的核心。各國政府也發揮重要作用,制定了更嚴格的環境政策,並提供激勵措施來鼓勵永續生產。這些法規,加上消費者的期望和技術進步,正在推動環保產品的開發,這些產品既符合衛生標準,又不損害環境完整性。先進材料和永續製程的使用使得生產既高效又環保的衛生紙成為可能,為全球市場創造了長期成長潛力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3518億美元 |

| 預測值 | 6185億美元 |

| 複合年成長率 | 6% |

衛生紙市場按類型細分為衛生紙、面紙、紙巾、餐巾紙、濕紙巾以及其他類型,其中包括廚房紙和醫用用紙。其中,衛生紙在2024年佔據主導地位,創造了1,040億美元的收入,預計到2034年將達到1931億美元。其在家庭、企業和公共衛生間的廣泛使用確保了穩定的需求。與其他衛生紙產品不同,衛生紙具有不可替代性,且消費量在不同人群和地區之間保持穩定。在許多發展中國家,城市人口的成長和現代衛生設施的普及進一步刺激了其使用量。大量購買習慣也有助於其成為衛生紙領域的主要產品。

就來源而言,市場分為原生紙漿和再生紙。 2024年,再生紙佔據主導地位,市值達2,031億美元,預計2034年將攀升至3,624億美元。由於消費者和企業越來越傾向於環保產品,再生紙領域將繼續保持領先地位。再生衛生紙不僅可以最大限度地減少浪費,還具有成本優勢,對製造商和買家都具有吸引力。回收製程的改進顯著提高了產品質量,彌合了性能與永續性之間的差距。相較之下,原生紙漿雖然為高階產品提供了高階品質,但其提取方法耗費資源,會對環境產生負面影響。隨著永續發展在全球日益受到關注,這些因素使得再生紙成為更可行的選擇。

衛生紙市場的通路包括線上和線下平台。 2024年,線上銷售額約佔市場佔有率的60.6%,預計到2034年將以6.5%的複合年成長率成長。由於消費者對便利、快速和非接觸式購物的偏好轉變,數位平台已佔據主導地位。電子商務讓價格比較變得便捷,產品種類豐富,以及基於訂閱的購買方式,既適合個人消費者,也適合企業消費者。此外,許多製造商正在透過增強線上體驗來強化其直接面對消費者的策略,從而使數位管道更具吸引力。

從區域來看,亞太地區在2024年佔據了全球衛生紙市場的顯著佔有率,預計在預測期內將以6.9%的最高複合年成長率成長。在該地區,光是中國在2024年的貢獻就超過780億美元,預計到2034年將達到1,587億美元。都市化進程加快、生活水準提高以及可支配所得的增加是推動需求的關鍵因素。隨著衛生和環保意識的增強,該地區消費者越來越青睞高品質的品牌紙品。製造商也積極投資區域生產和分銷基礎設施,以滿足日益成長的需求。

衛生紙產業的領導者正專注於永續發展、產品創新和高效的供應鏈管理,以保持競爭力。主要參與者正在根據全球環境趨勢和不斷變化的消費者期望調整其業務策略,以保持市場佔有率並實現長期成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 供應商概況

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 衝擊力

- 成長動力

- 消費者對環保產品的偏好日益增加

- 提高衛生標準

- 人們對環境議題的認知不斷提高,並轉向永續實踐

- 產業陷阱與挑戰

- 造紙所需的能源密集型工藝

- 原料成本與供應鏈問題

- 成長動力

- 成長潛力分析

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- Industry structure and concentration

- Competitive intensity assessment

- Company market share analysis

- Competitive positioning matrix

- Product positioning

- Price-performance positioning

- Geographic presence

- Innovation capabilities

- 戰略儀表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- Future competitive outlook

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 衛生紙

- 單層

- 雙層

- 其他(三層等)

- 面紙

- 紙巾

- 捲毛巾

- 折疊毛巾

- 其他(中心拉毛巾等)

- 餐巾

- 濕紙巾

- 其他(藥用紙、廚房用紙等)

第6章:市場估計與預測:依來源,2021-2034

- 主要趨勢

- 原生紙漿

- 再生紙

第7章:市場估計與預測:按價格,2021-2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 家庭

- 商業的

- HoReCa

- 公司的

- 衛生保健

- 其他(水療中心、機構等)

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市/大賣場

- 專賣店

- 其他(個別店舖等)

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- APP

- Cascades

- Essity

- Georgia-Pacific

- Hengan

- Kimberly-Clark

- Mondi

- Nine Dragons Paper

- Oji

- Paperlinx

- Procter & Gamble

- Sofidel

- Suzano

- Vinda

- Wausau Paper

The Global Hygienic Paper Market was valued at USD 351.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 618.5 billion by 2034. The market's strong growth trajectory is largely driven by rising consumer preference for eco-friendly products, heightened hygiene standards, and growing environmental consciousness. Shoppers today are increasingly aware of their ecological impact and actively seek sustainable alternatives that align with green values. This shift in behavior has fueled a surge in demand for recycled hygienic paper, especially as consumers place a premium on safety and environmental protection. Public concern over global health issues has also contributed to the widespread adoption of tissues, wipes, and other hygiene-related products as both individual and community hygiene practices continue to evolve.

This behavioral transition is being reinforced by a broader cultural movement toward sustainability, heavily influenced by environmental education and widespread media coverage. Businesses are responding by redesigning products and supply chains to reflect these values, ensuring they stay relevant in a rapidly changing market. Sustainable innovation and corporate responsibility are now central to competitive strategies. Governments are also playing a role by enacting stricter environmental policies while offering incentives to encourage sustainable manufacturing. These regulations, coupled with consumer expectations and technological improvements, are leading to the development of eco-conscious products that meet hygiene standards without compromising environmental integrity. The use of advanced materials and sustainable processes has made it feasible to produce hygienic paper that is both effective and environmentally responsible, creating long-term growth potential for the global market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $351.8 Billion |

| Forecast Value | $618.5 Billion |

| CAGR | 6% |

The hygienic paper market is segmented by type into toilet paper, facial tissues, paper towels, napkins, wet wipes, and others, which include kitchen and medicinal paper. Among these, toilet paper held the dominant share in 2024, generating USD 104 billion in revenue, and is projected to reach USD 193.1 billion by 2034. Its widespread usage in homes, businesses, and public restrooms ensures steady demand. Unlike other hygienic paper products, toilet paper is non-substitutable and consumed consistently across demographics and geographies. In many developing nations, growing urban populations and access to modern sanitation have further fueled usage. Bulk purchasing habits also contribute to the product's reliability as a staple in the hygiene paper segment.

In terms of sources, the market is categorized into virgin pulp and recycled paper. In 2024, recycled paper dominated with a market value of USD 203.1 billion and is expected to climb to USD 362.4 billion by 2034. This segment continues to lead due to the increasing consumer and business preference for environmentally safe options. Recycled hygienic paper not only minimizes waste but also offers cost advantages, making it attractive for both manufacturers and buyers. Improvements in recycling processes have significantly enhanced product quality, bridging the gap between performance and sustainability. In contrast, virgin pulp, while offering high-end quality for premium products, involves resource-intensive extraction methods that negatively impact the environment. These factors make recycled paper the more viable option as sustainability gains traction globally.

Distribution channels in the hygienic paper market include online and offline platforms. In 2024, online sales accounted for approximately 60.6% of the market and are expected to grow at a CAGR of 6.5% through 2034. Digital platforms have gained dominance due to shifting consumer preferences for convenient, fast, and contactless shopping. E-commerce enables easy price comparison, access to a wide product range, and subscription-based purchasing, which suits both individuals and corporate buyers. Moreover, many manufacturers are strengthening their direct-to-consumer strategies through enhanced online experiences, making digital channels even more appealing.

Regionally, Asia Pacific captured a significant share of the global hygienic paper market in 2024 and is projected to grow at the highest CAGR of 6.9% during the forecast period. Within this region, China alone contributed over USD 78 billion in 2024 and is on track to reach USD 158.7 billion by 2034. Rising urbanization, improved living standards, and increasing disposable income are key factors boosting demand. With heightened awareness around hygiene and eco-friendly practices, consumers in the region are embracing high-quality and branded paper products. Manufacturers are also responding with investments in regional production and distribution infrastructure to support this growing demand.

Leading companies in the hygienic paper industry are focusing on sustainability, product innovation, and efficient supply chain management to remain competitive. Key players are aligning their business strategies with global environmental trends and evolving consumer expectations to maintain market share and achieve long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Supplier Landscape

- 3.1.3 Profit margin analysis

- 3.1.4 Disruptions

- 3.1.5 Future outlook

- 3.1.6 Manufacturers

- 3.1.7 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer preference for eco-friendly products

- 3.2.1.2 Increased Hygiene Standard

- 3.2.1.3 Growing awareness of environmental issues and a shift towards sustainable practices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Energy-intensive processes required for paper production

- 3.2.2.2 Raw material costs and supply chain issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Consumer buying behavior analysis

- 3.4.1 Demographic trends

- 3.4.2 Factors affecting buying decision

- 3.4.3 Consumer product adoption

- 3.4.4 Preferred distribution channel

- 3.4.5 Preferred price range

- 3.5 Regulatory landscape

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.1.3 Company market share analysis

- 4.1.4 Competitive positioning matrix

- 4.1.4.1 Product positioning

- 4.1.4.2 Price-performance positioning

- 4.1.4.3 Geographic presence

- 4.1.4.4 Innovation capabilities

- 4.1.5 Strategic dashboard

- 4.1.5.1 Competitive benchmarking

- 4.1.5.1.1 Manufacturing capabilities

- 4.1.5.1.2 Product portfolio strength

- 4.1.5.1.3 Distribution network

- 4.1.5.1.4 R&D investments

- 4.1.5.2 Strategic initiatives assessment

- 4.1.5.3 SWOT analysis of key players

- 4.1.5.4 Future competitive outlook

- 4.1.5.1 Competitive benchmarking

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Toilet paper

- 5.2.1 Single ply

- 5.2.2 Double ply

- 5.2.3 Others (Triple ply, etc.)

- 5.3 Facial tissues

- 5.4 Paper towels

- 5.4.1 Roll towels

- 5.4.2 Folded towels

- 5.4.3 Others (Center-pull towels, etc.)

- 5.5 Napkins

- 5.6 Wet wipes

- 5.7 Others (medicinal paper, kitchen paper, etc.)

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Virgin pulp

- 6.3 Recycled paper

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Household

- 8.3 Commercial

- 8.3.1 HoReCa

- 8.3.2 Corporate

- 8.3.3 Healthcare

- 8.3.4 Others (Spa, Institutional, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Supermarket/hypermarket

- 9.3.2 Specialty stores

- 9.3.3 Others (Individual stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 APP

- 11.2 Cascades

- 11.3 Essity

- 11.4 Georgia-Pacific

- 11.5 Hengan

- 11.6 Kimberly-Clark

- 11.7 Mondi

- 11.8 Nine Dragons Paper

- 11.9 Oji

- 11.10 Paperlinx

- 11.11 Procter & Gamble

- 11.12 Sofidel

- 11.13 Suzano

- 11.14 Vinda

- 11.15 Wausau Paper