|

市場調查報告書

商品編碼

1755336

商用蒸汽鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Steam Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

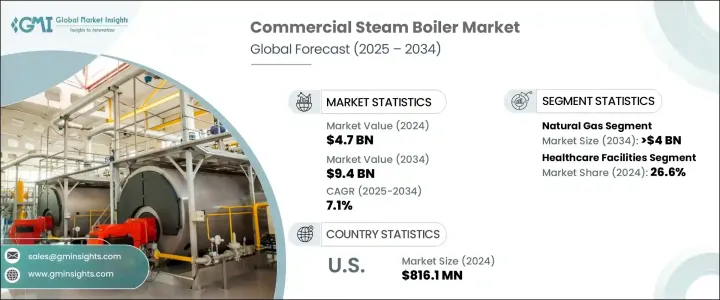

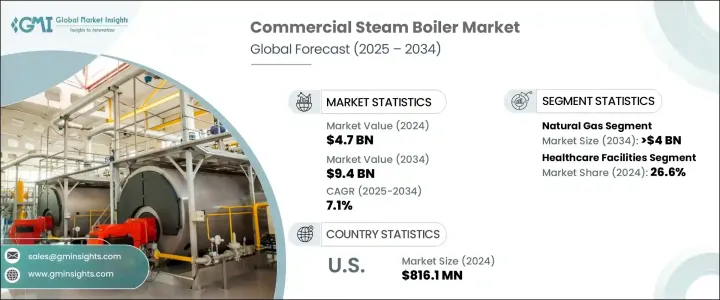

2024 年全球商用蒸汽鍋爐市場價值為 47 億美元,預計到 2034 年將以 7.1% 的複合年成長率成長至 94 億美元。商業基礎設施(如商業機構、零售環境和醫療設施)的投資不斷增加,在推動現代蒸汽鍋爐系統的採用方面發揮重要作用。這些系統因其支援節能運作和增強暖氣性能的能力而越來越受到青睞。該行業也受益於向環保供暖解決方案的廣泛轉變。政府和私人利益相關者正在積極推廣更清潔的燃料替代品,鼓勵從傳統的煤炭和石油動力系統過渡到更永續的燃氣和電力鍋爐。這些措施旨在減少整體碳排放,同時遵守國際氣候承諾。

此外,物聯網監控系統等智慧技術與商用蒸汽鍋爐的整合,正在提高營運可視性並增強能源最佳化。這些進步使用戶能夠更好地管理效能、減少能源浪費並延長正常運行時間,而這些正是在關鍵任務環境中保持連續性的關鍵因素。監管機構對清潔排放日益成長的壓力也影響買家的偏好。遵守ASME和EN等嚴格的能源標準,正在鼓勵人們用下一代高效鍋爐取代過時的型號。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 47億美元 |

| 預測值 | 94億美元 |

| 複合年成長率 | 7.1% |

政府機構為升級公共基礎設施供暖系統提供的激勵措施,進一步加快了其應用步伐。以學校、醫療中心和政府大樓為重點的現代化項目,正在促進高效蒸汽鍋爐系統的更廣泛部署。隨著對模組化鍋爐解決方案優勢的認知不斷提高,越來越多的商業用戶開始採用更易於安裝和維護的可擴展裝置。這些模組化配置旨在高效處理波動的加熱負荷,並且維護時不會造成運行中斷,使其成為需要持續正常運作的設施的理想選擇。

市場按燃料類型細分為天然氣、石油、煤炭、電力和其他燃料。天然氣因其環境足跡小、能源性能卓越且營運成本相對較低,仍是最廣泛使用的燃料。預計到2034年,光是天然氣領域的市場價值就將超過40億美元。天然氣管道基礎設施的快速擴張和液化天然氣(LNG)供應的日益普及,是提高燃氣蒸汽鍋爐在商業空間可行性的關鍵因素。這些系統具有卓越的熱效率和操作靈活性,使其成為各種建築類型的熱門選擇。

從應用角度來看,該市場涵蓋商業場所,例如醫療保健設施、辦公空間、住宿、零售環境、教育建築等。受醫療基礎設施持續發展的推動,醫療保健相關用途在2024年佔據了26.6%的市場。對可靠的蒸汽應用(包括滅菌、空間供暖和日常營運)的需求,正在推動診所、診斷實驗室和醫院的蒸汽安裝。

美國商用蒸汽鍋爐市場穩定成長,2024年將達到8.161億美元,高於2022年的7.274億美元和2023年的7.719億美元。這一成長趨勢反映了國家大力推行清潔能源計畫的政策,以及加強對商用鍋爐開發的投資。此外,旨在透過採用低氮氧化物燃燒器和更先進的燃燒方法來減少排放的監管要求也進一步刺激了市場需求。

預計到2034年,北美商用蒸汽鍋爐市場的複合年成長率將超過6.5%。醫療保健相關基礎設施的持續發展,加上政府推動的商業建築擴建和現代化改造,正在為蒸汽鍋爐的普及創造有利的市場環境。支持性政策框架和清晰的監管體系預計將促進該行業的長期成長。

商用蒸汽鍋爐市場的主要參與者包括史密斯休斯公司 (Smith Hughes Company)、富爾頓 (Fulton)、LAARS 供暖系統、Cleaver-Brooks、York-Shipley、Lochinvar、Clayton Industries、博世工業公司 (Bosch Industriekessel)、Precision Boilers、巴布科克·威爾科克斯 (Bcock & Wilcoeller)、巴布科克·威爾科克斯、巴布科克·威爾科克斯 (Bcock & Wilcoeller)、巴布科克·威爾科克斯、巴布科克·威爾科克斯 (Bcock & Wilcoeller)、巴布科克·威爾科克斯、巴布科克·威爾科克斯 (Bcock & Wilcoeller)、巴布科克·威爾科克斯 (Bcock & Wilcoeller)、 Manufacturing)、Hoval、Burnham Commercial、WM Technologies、哥倫比亞暖氣產品公司 (Columbia Heating Products)、Superior Boiler、Vapor Power International、費羅力 (FERROLI)、威仕曼 (VIESSMANN) 和派克鍋爐 (PARKER BOILER)。這些公司專注於創新、能源效率和產品可靠性,以保持競爭優勢,並滿足各商業領域不斷變化的客戶需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:按燃料,2021 - 2034

- 主要趨勢

- 天然氣

- 油

- 煤炭

- 電的

- 其他

第6章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 0.3 - 2.5 百萬英熱單位/小時

- > 2.5 - 10 百萬英熱單位/小時

- > 10 - 50 百萬英熱單位/小時

- > 50 - 100 百萬英熱單位/小時

- > 100 - 250 百萬英熱單位/小時

第7章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 冷凝

- 無凝結

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 辦公室

- 醫療保健設施

- 教育機構

- 住宿

- 零售店

- 其他

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第10章:公司簡介

- Babcock & Wilcox

- Bosch Industriekessel

- Burnham Commercial

- Clayton Industries

- Cleaver-Brooks

- Columbia Heating Products

- FERROLI

- Fulton

- Hoval

- LAARS Heating Systems

- Lochinvar

- PARKER BOILER

- Precision Boilers

- Sellers Manufacturing

- Smith Hughes Company

- Superior Boiler

- Vapor Power International

- VIESSMANN

- WM Technologies

- York-Shipley

The Global Commercial Steam Boiler Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 9.4 billion by 2034. Rising investments in commercial infrastructure, such as business establishments, retail environments, and medical facilities, are playing a significant role in driving the adoption of modern steam boiler systems. These systems are increasingly favored for their ability to support energy-efficient operations and enhanced heating performance. The industry is also benefiting from a widespread shift toward eco-friendly heating solutions. Governments and private stakeholders are actively promoting cleaner fuel alternatives by encouraging a transition from traditional coal and oil-powered systems to more sustainable gas and electric boilers. These initiatives are aimed at reducing overall carbon emissions while aligning with international climate commitments.

Moreover, the integration of smart technologies such as IoT monitoring systems into commercial steam boilers is improving operational visibility and enhancing energy optimization. These advancements are enabling users to better manage performance, reduce energy waste, and improve uptime, key factors in maintaining continuity in mission-critical environments. Increasing pressure from regulatory agencies for cleaner emissions is also influencing buyer preferences. Compliance with stringent energy standards such as those set by ASME and EN is encouraging the replacement of outdated models with next-generation high-efficiency boilers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $9.4 Billion |

| CAGR | 7.1% |

Incentives provided by government bodies for upgrading heating systems in public infrastructure are further accelerating the pace of adoption. Modernization projects focused on schools, medical centers, and government buildings are facilitating broader deployment of efficient steam boiler systems. With increased awareness about the benefits of modular boiler solutions, more commercial users are adopting scalable units that are easier to install and maintain. These modular configurations are designed to handle fluctuating heating loads efficiently and can be serviced without causing operational disruptions-making them ideal for facilities that demand constant uptime.

The market is segmented by fuel type into natural gas, oil, coal, electric, and others. Natural gas continues to be the most widely adopted fuel due to its reduced environmental footprint, superior energy performance, and relatively lower operational expenses. The natural gas segment alone is projected to surpass USD 4 billion in market value by 2034. The rapid expansion of gas pipeline infrastructure and increasing access to liquefied natural gas (LNG) are contributing factors that enhance the viability of gas-powered steam boilers in commercial spaces. These systems offer superior thermal efficiency and flexibility in operations, making them a popular choice for a variety of building types.

When assessed by application, the market includes commercial establishments such as healthcare facilities, office spaces, lodging, retail environments, educational buildings, and others. Healthcare-related usage held a 26.6% share of the market in 2024, driven by continuous developments in medical infrastructure. The demand for reliable steam-based applications, including sterilization, space heating, and daily operations, is fueling installations in clinics, diagnostic labs, and hospitals.

In the United States, the commercial steam boiler market experienced steady growth, reaching USD 816.1 million in 2024, up from USD 727.4 million in 2022 and USD 771.9 million in 2023. This growth trend reflects strong national policies focused on clean energy initiatives and increased investments in commercial development. Demand is further supported by evolving regulatory requirements aimed at reducing emissions through the adoption of low-NOx burners and more advanced combustion methods.

Across North America, the commercial steam boiler market is forecast to grow at a CAGR of over 6.5% through 2034. Continuous development in healthcare-related infrastructure, in combination with government-driven efforts to expand and modernize commercial buildings, is shaping a favorable landscape for steam boiler adoption. Supportive policy frameworks and regulatory clarity are expected to contribute to long-term industry growth.

Key participants in the commercial steam boiler market include Smith Hughes Company, Fulton, LAARS Heating Systems, Cleaver-Brooks, York-Shipley, Lochinvar, Clayton Industries, Bosch Industriekessel, Precision Boilers, Babcock & Wilcox, Sellers Manufacturing, Hoval, Burnham Commercial, WM Technologies, Columbia Heating Products, Superior Boiler, Vapor Power International, FERROLI, VIESSMANN, and PARKER BOILER. These companies are focusing on innovation, energy efficiency, and product reliability to maintain their competitive edge and meet evolving customer demands across commercial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market scope & definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Electric

- 5.6 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 8.1 Key trends

- 8.2 Offices

- 8.3 Healthcare facilities

- 8.4 Educational institutions

- 8.5 Lodgings

- 8.6 Retail stores

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (Units, MMBTU/hr & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 France

- 9.3.2 UK

- 9.3.3 Poland

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Austria

- 9.3.7 Germany

- 9.3.8 Sweden

- 9.3.9 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Philippines

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.4.6 Australia

- 9.4.7 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 Iran

- 9.5.3 UAE

- 9.5.4 Nigeria

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Argentina

- 9.6.2 Chile

- 9.6.3 Brazil

Chapter 10 Company Profiles

- 10.1 Babcock & Wilcox

- 10.2 Bosch Industriekessel

- 10.3 Burnham Commercial

- 10.4 Clayton Industries

- 10.5 Cleaver-Brooks

- 10.6 Columbia Heating Products

- 10.7 FERROLI

- 10.8 Fulton

- 10.9 Hoval

- 10.10 LAARS Heating Systems

- 10.11 Lochinvar

- 10.12 PARKER BOILER

- 10.13 Precision Boilers

- 10.14 Sellers Manufacturing

- 10.15 Smith Hughes Company

- 10.16 Superior Boiler

- 10.17 Vapor Power International

- 10.18 VIESSMANN

- 10.19 WM Technologies

- 10.20 York-Shipley