|

市場調查報告書

商品編碼

1755329

金融雲市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Finance Cloud Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

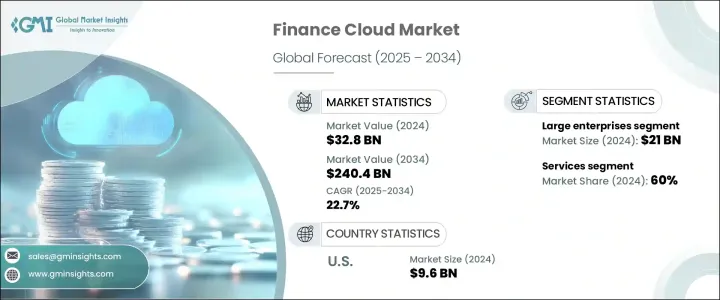

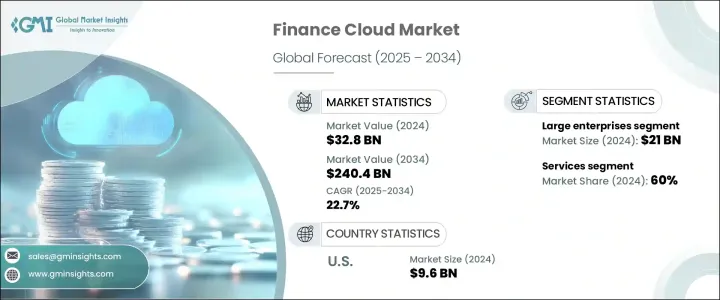

2024年,全球金融雲市場規模達328億美元,預計2034年將以22.7%的複合年成長率成長,達到2,404億美元。銀行、保險、投資管理和其他金融領域對數位轉型的需求日益成長,推動了這一成長。企業紛紛轉向基於雲端的金融解決方案,以提高營運效率、確保合規性並提升客戶體驗。自動化、人工智慧 (AI) 和高級分析技術的整合,透過實現即時決策和主動風險管理,徹底改變了財務工作流程。

財務雲端平台為最佳化財務營運奠定了基礎,包括自動化會計、即時財務報告以及與企業資源規劃 (ERP) 和客戶關係管理 (CRM) 系統的順暢連接。加密、多因素身份驗證和基於區塊鏈的交易驗證等增強的安全協議可保護敏感的財務訊息,並有助於滿足嚴格的監管要求。用於現金流預測的預測分析、用於交易處理的機器人流程自動化 (RPA) 以及用於互動式儀表板的擴增實境 (AR) 等創新技術正在加速市場應用。這些技術進步使企業能夠在競爭激烈的環境中提供差異化的金融產品,提高準確性並增強業務敏捷性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 328億美元 |

| 預測值 | 2404億美元 |

| 複合年成長率 | 22.7% |

2024年,大型企業市場規模達210億美元。這些企業憑藉著雄厚的IT預算和部署可擴展、全面雲端基礎架構的能力,佔據領先地位。這些企業使用財務雲端系統來簡化全球財務流程,確保合規性,並整合不同業務部門的服務。集中式雲端平台能夠統一執行策略,並在部門之間有效協調,從而實現跨區域的標準化流程和強大的安全性。

2024年,服務業佔據了60%的市場佔有率,這得益於諮詢、實施、支援和託管服務需求的不斷成長。隨著金融機構向雲端原生系統遷移,它們嚴重依賴專業服務提供者來確保平穩過渡、整合並遵守監管標準。這些服務透過幫助機構客製化平台、管理工作負載、維護正常運作時間並保障安全,從而最佳化雲端效能。持續的支援和託管服務使組織能夠專注於核心功能,而將基礎設施管理交由外部處理。金融法規的複雜性、網路安全風險以及持續的數位轉型,提升了專業雲端服務對大型企業和中小企業的策略重要性。

2024年,美國金融雲市場規模達96億美元,預計2034年將以24%的複合年成長率成長。美國強大的IT基礎設施、大型金融機構的佈局以及對雲端技術的早期採用推動了這一成長。強大的監管環境和充滿活力的金融科技生態系統加速了銀行、保險和投資領域對雲端技術的採用。美國的金融公司利用雲端平台對遺留系統進行現代化改造,加強網路安全,並提供無縫的數位體驗。與Google、微軟和亞馬遜等領先雲端服務供應商的合作也為此轉型提供了支持。

全球金融雲端產業的主要參與者包括 Salesforce、IBM、戴爾、甲骨文、凱捷、Acumatica、印孚瑟斯、亞馬遜、微軟和谷歌。為了鞏固市場地位,金融雲領域的公司專注於持續創新並擴展其技術產品。他們投資開發人工智慧和自動化驅動的解決方案,以提高效率和合規性。與金融機構和雲端服務供應商建立策略聯盟和合作夥伴關係有助於加速採用並擴大其覆蓋範圍。公司優先考慮增強安全功能和監管合規能力,以滿足行業標準。此外,許多公司正在透過在地化服務和資料中心擴展其全球業務,以符合區域法規並降低延遲。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 管理客戶資料和財務

- 對詐欺檢測和預防的需求增加

- 增強商業智慧和策略規劃的需求日益成長

- 增強財務規劃與分析

- 產業陷阱與挑戰

- 資料隱私和安全問題

- 與現有遺留系統的整合可能很複雜

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 服務

- 解決方案

第6章:市場估計與預測:依企業規模,2021 - 2034 年

- 主要趨勢

- 大型企業

- 中小企業

第7章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 民眾

- 混合

- 私人的

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 銀行業

- 保險

- 投資管理

- 其他

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 客戶關係管理

- 財富管理

- 資產管理

- 帳號管理

- 收益管理

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Acumatica

- Amazon

- Aryaka

- Capgemini

- Cisco

- Dell

- Google LLC

- Hewlett Packard

- IBM

- Infosys

- Microsoft

- Oracle

- Rapidscale

- Sage

- Salesforce

- ServiceNow

- Tata Consultancy

- Unit4

- Wipro

- Workday

- Yardi

The Global Finance Cloud Market was valued at USD 32.8 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 240.4 billion by 2034. The growth is driven by the rising demand for digital transformation within banking, insurance, investment management, and other financial sectors. Companies shift to cloud-based finance solutions to boost operational efficiency, maintain compliance with regulations, and enhance customer experience. Integrating automation, artificial intelligence (AI), and advanced analytics transform financial workflows by enabling real-time decision-making and proactive risk management.

Finance cloud platforms provide a foundation for optimized financial operations, including automated accounting, real-time financial reporting, and smooth connectivity with enterprise resource planning (ERP) and customer relationship management (CRM) systems. Enhanced security protocols such as encryption, multi-factor authentication, and blockchain-enabled transaction verification protect sensitive financial information and help meet stringent regulatory requirements. Innovations like predictive analytics for cash flow forecasting, robotic process automation (RPA) for transaction handling, and augmented reality (AR) for interactive dashboards accelerate market adoption. These technological advancements allow organizations to differentiate their financial offerings, improve accuracy, and increase business agility in a highly competitive environment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.8 Billion |

| Forecast Value | $240.4 Billion |

| CAGR | 22.7% |

The large enterprises segment was valued at USD 21 billion in 2024. Their leadership stems from substantial IT budgets and the ability to deploy scalable, comprehensive cloud infrastructures. These organizations use finance cloud systems to streamline global financial processes, ensure regulatory compliance, and integrate services across diverse business units. Centralized cloud platforms enable consistent enforcement of policies and efficient coordination between departments, delivering standardized processes and robust security across regions.

The services segment held a 60% share in 2024, driven by the increasing need for consulting, implementation, support, and managed services. As financial institutions migrate to cloud-native systems, they depend heavily on specialized service providers to ensure smooth transitions, integration, and adherence to regulatory standards. These services optimize cloud performance by helping institutions customize platforms, manage workloads, and maintain uptime while upholding security. Continuous support and managed services free organizations to focus on core functions while infrastructure management is handled externally. The complexity of financial regulations, cybersecurity risks, and ongoing digital transformation has elevated the strategic importance of specialized cloud services for large corporations and SMEs.

U.S. Finance Cloud Market was valued at USD 9.6 billion in 2024 and is expected to grow at a CAGR of 24% through 2034. The country's robust IT infrastructure, presence of major financial institutions, and early adoption of cloud technologies fuel this growth. A strong regulatory environment along with a dynamic fintech ecosystem accelerates cloud adoption across banking, insurance, and investment sectors. Financial firms in the U.S. leverage cloud platforms to modernize legacy systems, strengthen cybersecurity, and deliver seamless digital experiences. Partnerships with leading cloud service providers like Google LLC, Microsoft, and Amazon support this transition.

Key players in the Global Finance Cloud Industry include Salesforce, IBM, Dell, Oracle, Capgemini, Acumatica, Infosys, Amazon, Microsoft, and Google LLC. To strengthen their market presence, companies in the finance cloud sector focus on continuous innovation and expanding their technology offerings. They invest in developing AI-driven and automation-powered solutions to enhance efficiency and compliance. Strategic alliances and partnerships with financial institutions and cloud providers help accelerate adoption and broaden their reach. Firms prioritize enhancing security features and regulatory compliance capabilities to meet industry standards. Additionally, many are scaling their global footprint through localized services and data centers to cater to regional regulations and reduce latency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Managing customer data and financials

- 3.7.1.2 Increased demand for fraud detection and prevention

- 3.7.1.3 Rising need to enhance business intelligence and strategic planning

- 3.7.1.4 Enhanced financial planning and analysis

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Data privacy and security concerns

- 3.7.2.2 Integration with the existing legacy systems can be complex

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Services

- 5.3 Solution

Chapter 6 Market Estimates & Forecast, By Enterprise size, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Large enterprises

- 6.3 SME

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Public

- 7.3 Hybrid

- 7.4 Private

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Banking

- 8.3 Insurance

- 8.4 Investment management

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Customer relationship management

- 9.3 Wealth management

- 9.4 Asset management

- 9.5 Account management

- 9.6 Revenue management

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acumatica

- 11.2 Amazon

- 11.3 Aryaka

- 11.4 Capgemini

- 11.5 Cisco

- 11.6 Dell

- 11.7 Google LLC

- 11.8 Hewlett Packard

- 11.9 IBM

- 11.10 Infosys

- 11.11 Microsoft

- 11.12 Oracle

- 11.13 Rapidscale

- 11.14 Sage

- 11.15 Salesforce

- 11.16 ServiceNow

- 11.17 Tata Consultancy

- 11.18 Unit4

- 11.19 Wipro

- 11.20 Workday

- 11.21 Yardi